[NGW Magazine] Baku: not just about oil

Azerbaijan is seeing its oil output decline as its major reserves enter the second half of their lives, but the country has already started on some giant downstream gas projects, including the value-added products sector.

Baku celebrated November 8 the two billionth metric ton (mt) of its theoretically extractable 2.6bn mt of reserves. With the approval of the BP-led Azeri-Chirag-Guneshli (ACG) contract to invest a further $40bn, it can look forward to another 500mn mt from those fields by 2050, and another 100mn mt will be produced from fields operated by state-run Socar.

Azerbaijan’s oil production is expected to plunge to 37.534mn mt next year, which is 2.2% lower than in 2017 which, in turn, was 6.5% lower than the 2016 figure. However, 2018 will be a milestone year for both the gas and downstream oil sectors, when the $6.1bn Star refinery in Turkey – 100% owned by Socar – with 10mn mt/yr capacity, is commissioned.

And the same year sees the first gas of Shah Deniz Stage 2 (SD2) flowing into Turkey’s Trans Anatolian Pipeline (Tanap), owned 58% by Azerbaijan, and two downstream gas plants becoming operational.

Upstream gas projects

Socar purchased the bankrupted AzMeCo methanol plant for $510mn last year, upgraded it and resumed production in April 2017, trading as the Socar Methanol Company. Next year, two new major plants – Socar Carbamide (urea) and Socar Polymer – will also become operational, using 1.3bn – 1.5bn m³/yr of gas as feedstock.

The $750mn Socar Polymer plant will produce 180,000 mt/yr of polypropylene and 120,000 mt/yr of high-density polyethylene in 2018, rising to 570,000 mt/yr in total by 2021. The Socar Carbamide project, which will also cost $500mn, will be commissioned at the same time. It will produce 438,000 mt/yr of ammonia and 730,000 mt/yr of urea.

Socar Methanol LLC CEO Elnur Mustafayev told NGW that Azerbaijan’s value-added products export is quite competitive in foreign markets despite the fact that the feedstock gas price is a fifth higher than it is in Iran, 41% higher than it is in Russia and 55% higher than it is in Saudi Arabia.

“We will produce 265,000 mt methanol in 2017, which will reach 600,000 mt/yr by 2020. Only 5% of the methanol is tended for domestic demand; the rest is for export, out of which approximately 40% to Turkey, and remaining to other Black sea and Mediterranean sea markets, Western Europe markets, as well as Caspian countries.

Socar successfully competes with other key methanol producers in all these markets mainly due to risk-based preventive maintenance, effective logistics and efficient cost management, he said, adding that in 2017, the year of acquisition of the methanol plant, Socar has exceeded natural gas supply by 10% over the production plan, which was crucial to display its commitment to support methanol production in the country.

The Baku-Tbilisi-Kars railway was also inaugurated October 30, paving the way for lower transport costs of commodities in those countries. Socar’s oil terminal in Kulevi, Georgia, can transship 800,000 mt/yr of methanol.

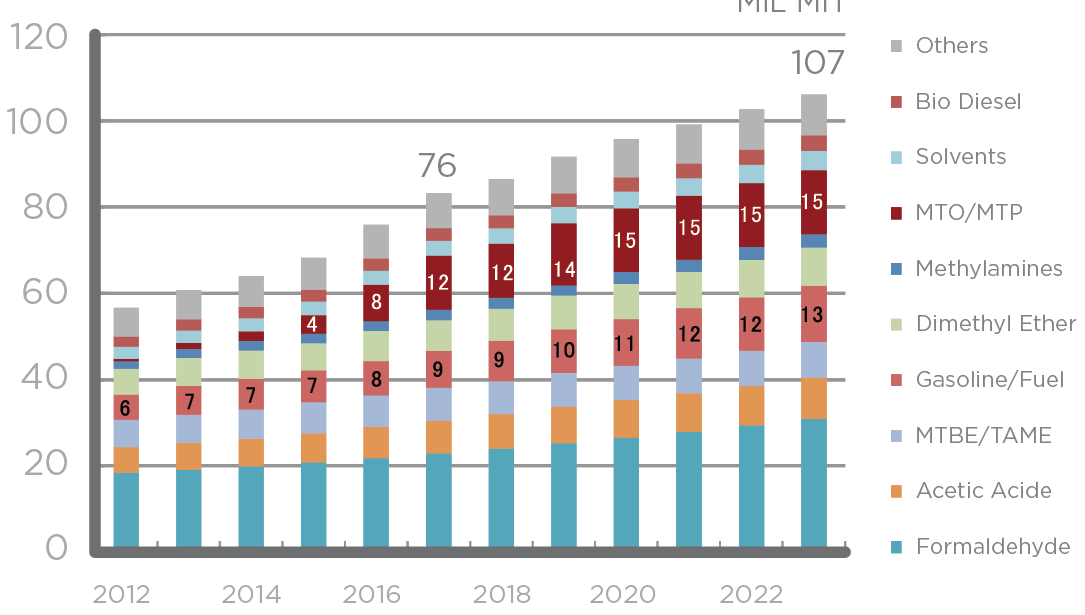

Worldwide Methanol Demand, by Final Use

Credit: Socar Methanol LLC

The global demand growth for methanol is quite high, having gone up by a tenth this year to 83mn mt compared with last year. Azerbaijan’s share in global methanol production will be 0.7% in 2017, he said.

Regarding gas demand for downstream projects and the current gas deficit in the country, and though SD2 gas is for export, gas production from other fields is expected to go up, in which case there is no worry about gas feedstock.

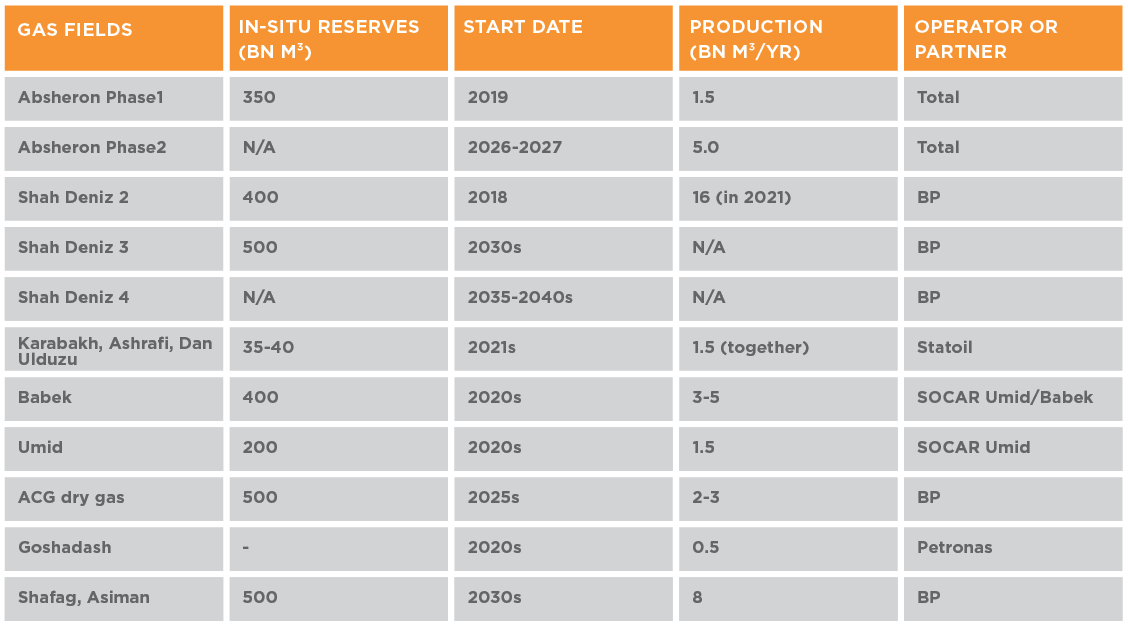

Azeri Gas Projects, Under Development and Planned

Source: Socar, industry sources

Azerbaijan is projected to increase gas production by 4.9% in 2018, after falling each year since 2015.

The country resumed production from Umid and Bulla Deniz recently and Total is preparing to start drilling by early 2018 to extract 1.5bn m³/yr from offshore Absheron.

Azerbaijan also revised the production-sharing contract for ACG, which will supply 42bn m³ to Socar free of charge by 2050. The dry gas layer of the field holds 200bn m³ and will become operational in two years’ time. Baku has also other gas fields, including Shah Deniz’s biggest phase, SD3.

Azerbaijan has extracted about 600bn m³ gas between 1928 and November 1, 2017. However, its fields hold further 2.6 trillion m³, Socar’s deputy vice-president for investment and marketing, Vitaliy Baylarbayov, told NGW magazine [Volume 2, Issue 12] in June, adding that it potentially can reach 3.45 trillion m³ in future.

First vice-president of Socar, Khoshbakht Yusifzade, said November 9 that the cumulative gas production in Azerbaijan will reach 2 trillion m³ in 2055.

Socar also has 51% stake in Petkim petrochemical holding in Turkey. The rest of Petkim’s stakes are in circulation on the Istanbul Stock Exchange.

According to the Turkish Public Disclosure Platform (PDP), the company’s net profits during the first nine months of this year amounted to TL 1.027bn ($265.2mn), almost double the same period last year. Petkim Holding had assets valued at TL 6.802bn as of October 1, 2017, compared with TL 6.269 bn in late 2016.

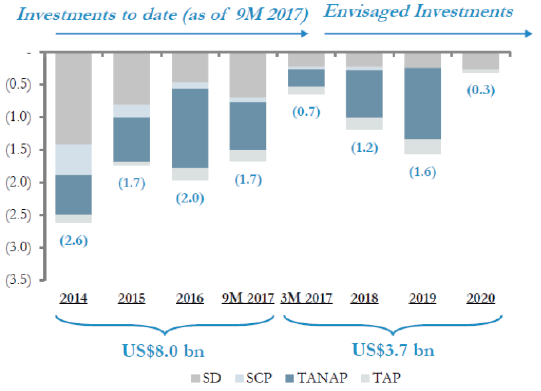

Azeri state SGCC’s investments in the Southern Gas Corridor

Source: Southern Gas Corridor Company (SGCC)

Petkim is the only petroleum chemical complex in Turkey and it is the biggest exporter in the Aegean region. It makes ethylene, polyethylene, polyvinyl chloride, polypropylene and other petrochemicals.

Shah Deniz second phase

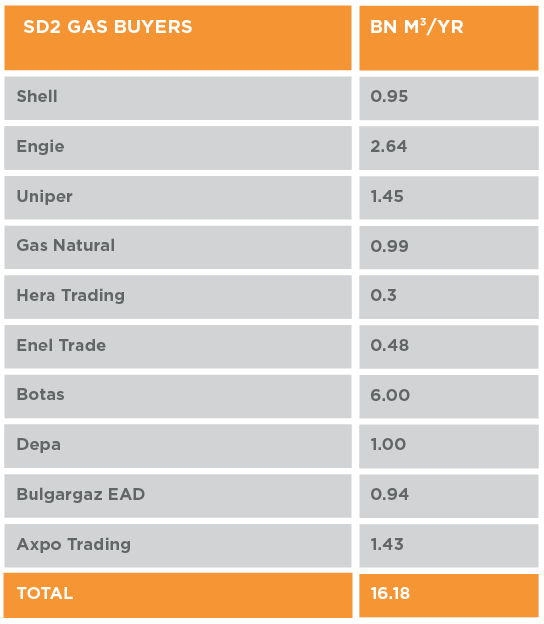

The country is preparing to start SD2 gas to Turkey in mid-2018, then the flow increases to 16.18bn m³/yr by early 2021, of which 10bn m³/yr goes to the EU.

Azerbaijan has invested $7.8bn in Southern Gas Corridor (SGC) as of September 30 and it is eyeing a further $3.7bn, mostly thanks to foreign loans, by the end of 2020, when the project becomes fully operational, the CEO SGC Company (SGCC) Afgan Isayev told NGW.

As of now, SD2 is 95.9%-complete, South Caucasus Pipeline extension (SCPX) nine-tenths complete, Tanap about four-fifths complete and Trans Adriatic Pipeline (TAP) around half-completed, he said.

Shah Deniz Phase 2 Gas Buyers

Source: Southern Gas Corridor Company (SGCC)

The European Bank for Reconstruction & Development (EBRD) signed a $500mn credit deal with SGCC October 18.

Azerbaijan established SGCC in 2014, the government owning directly 51% and state-run Socar owning the rest, as the vehicle that will consolidate, manage and finance the country’s interests in SD 1&2 and the three elements of the SGC: SCP and its expansion; Tanap and TAP. SGCC’s stake in the projects had been funded by equity injections from the ministry of economy and Socar for a total $2.4bn; another $2.5bn came from an issue of SGCC bonds to the state oil fund (Sofaz); there were direct loans from the International Bank of Reconstruction and Development and the Asian Infrastructure Investment Bank for $0.4bn and $0.6bn respectively; and inaugural eurobonds worth $2bn.

CNG, LNG plants

Apart from involvement in LNG projects in Malta and Cote d’Ivoire, Azerbaijan is also preparing for LNG and compressed natural gas (CNG) in its transport sector.

Finland’s Wartsila, which had launched two gas-fired power plants with a combined capacity of 800 MW in Azerbaijan, is developing another 385-MW plant. It is also persuading Baku to convert its shipping to LNG, the energy ministry told NGW.

Azerbaijan has 270 ships in the Caspian Sea, including 34 tankers. The ships consumed 49,200 mt of oil equivalent of diesel in 2016. The country also has been importing hundreds of CNG-fuelled buses since 2015 and it plans to provide CNG in all gas stations by the second half of 2018.

Its southern neighbour Iran is one of the world leaders in terms of its numbers of gas-fuelled vehicles (NGVs), which use 7.7bn m³/yr. Iran spent $3bn developing CNG plants and has used 54bn m³ since 2000.

About 3mn dual-fuel cars are on the road, and Iran plans to increase CNG demand to 12.7bn m³/yr by 2021.

Azerbaijan’s northern neighbour is also preparing to develop the NGV sector. The Russian giant Gazprom said that it and Israel’s Delek Drilling had signed a memorandum of understanding (MoU) October 2 relating to NGVs, including road, rail and marine transport. Russia has expertise in NGVs with some 145,000 on its roads.

Gazprom set up Gazprom Gazomotornoye Toplivo, a special-purpose company in 2012, in order to develop the NGV market, while the Israeli government’s Fuel Choices Initiative (IFCI) has worked since 2016 with Fiat Chrysler and its Dutch-registered UK partner CNH Industrial on NGVs.

Dalga Khatinoglu, Ilham Shaban & Goynur Shukurova