[NGW Magazine] Financing LNG in the new era

LNG projects used to be a one-way bet for the sponsors: now, with shorter contracts, rising competition and less certainty of project success, the banking sector is more cautious.

With supplies racing ahead of demand in an era of shorter-term contracts and relatively low prices that will probably last in the longer-term, securing liquefaction project finance has become a complex and challenging issue requiring a new financing architecture.

These and the wider issues associated with liquefaction project finance in a changing LNG market environment were the subjects of an interview with finance advisor at LNG consultancy Poten & Partners, Melanie Lovatt.

What types of funding are used for LNG export projects?

LNG export projects can be funded directly by their developers via either accrued cash or corporate credit lines. Or they can be funded using limited recourse project finance structures. Project finance is based on projected cash flows and is most commonly used when a sponsor would not be able to borrow enough money on a corporate basis or needs to protect itself from contingent liabilities in partnerships. Project finance involves the creation of special purpose vehicles, which in some cases are non-recourse to the sponsor.

The huge funding requirements for liquefaction projects, often running into many billions of dollars, means that the partners developing the project often have to provide guarantees for lenders during the construction phase because engineering, procurement and construction (EPC) contractors are not large enough to take on this risk. Therefore, with guarantees in place, most liquefaction project financings are limited-recourse rather than non-recourse.

What is the most common type and why? How successful is it?

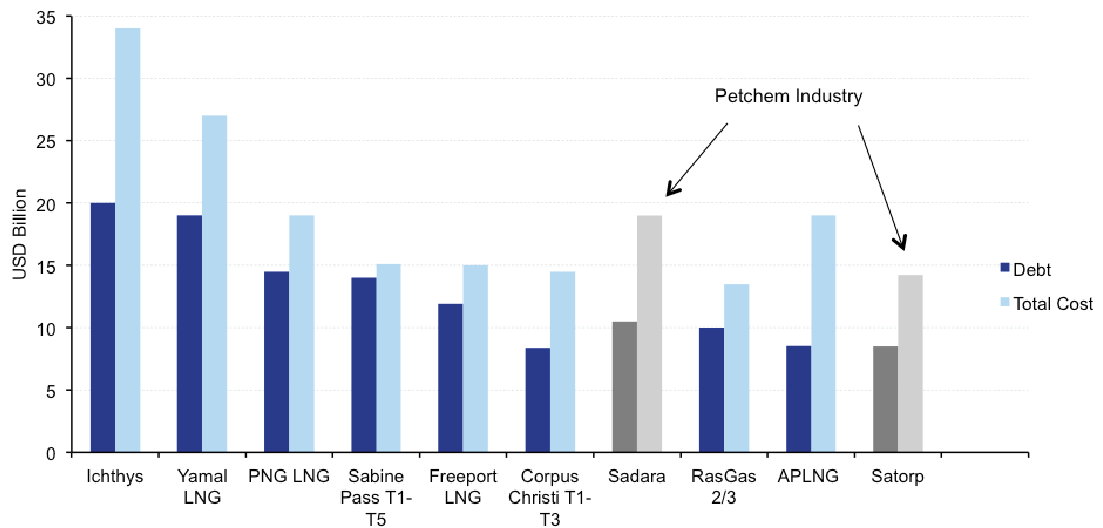

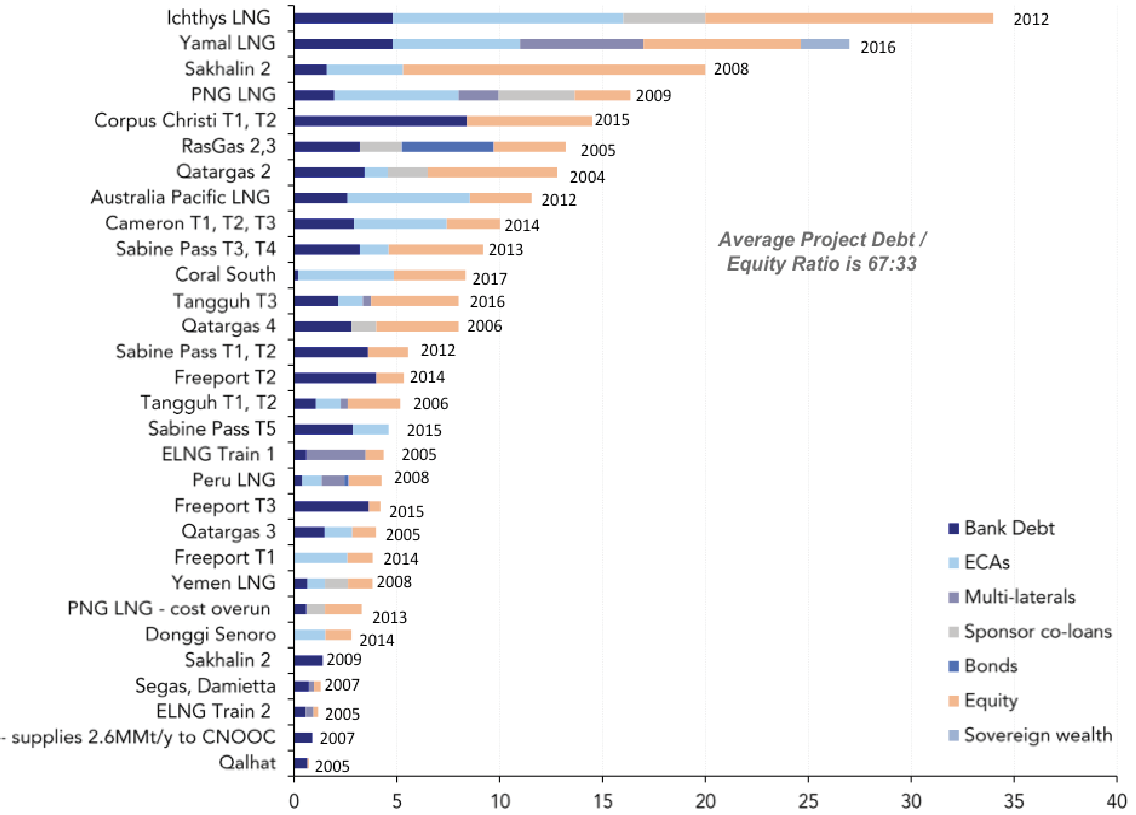

Project finance has been used for the majority of the world’s LNG export projects, although there are some notable exceptions, such as Australia’s 15.6mn mt/yr Gorgon LNG. With a price tag of around $54bn Gorgon is the biggest investment ever made in a single LNG project. Its developers – US majors ExxonMobil and Chevron, Anglo-Dutch major Shell and the Japanese utilities Osaka Gas, Tokyo Gas and Chubu Electric Power – used their own equity. The first LNG project to raise money using a project finance structure was Woodside’s North West Shelf in Australia, which completed its $1.4bn funding in 1980. Since then, project finance structures have allowed the LNG industry to raise billions of dollars per project. Over the last 10 years, LNG projects have occupied eight of the top ten positions in terms of cash raised across all sectors (Figure 1). The most recent to raise money using this type of structure is the Coral South floating liquefaction (FLNG) project in Mozambique. It secured agreements to receive $4.7bn of funding at the end of May this year.

Figure 1: Eight of the top 10 LNG project finance deals in last 10 years

NB: Total cost for Corpus Christi is $14.5bn, but that includes an extra $3.1bn debt that Cheniere did not use for the third train, because it did not sell sufficient production, and so is omitted. (Source: Poten LNG)

What underpins project funding and how has it evolved?

Until recently, liquefaction projects have been able to attract billions of dollars in funding because they are underpinned by long-term take-or-pay contracts with investment grade counterparties. These deals provide security not only for banks but also for other lenders. Stress-tested to break even at low gas prices and/or oil prices that allow them to ride out commodity downturns, the long-term contracts or long-term tolling deals that typify LNG projects allow debt servicing across the long horizons – stretching out 14-years in some cases – that are common in LNG project finance.

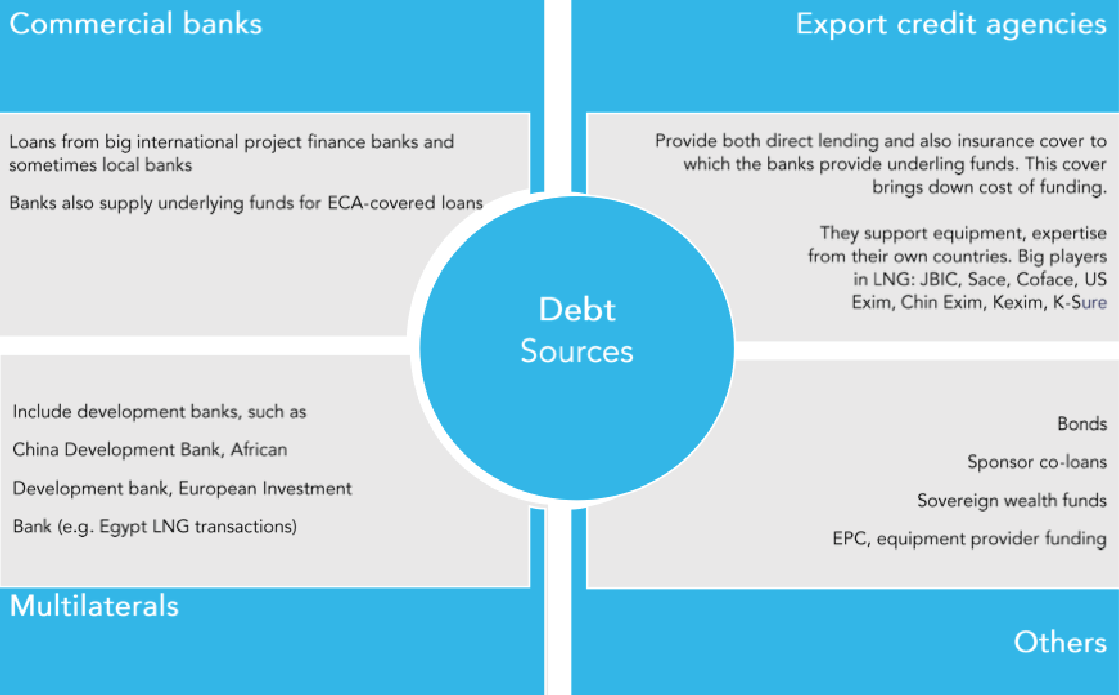

Figure 2: Project finance structure allows tapping of different pools of debt

Source: Poten LNG

Who are the contributors?

The main providers of debt funding to liquefaction project financings are commercial banks and export credit agencies (ECAs) (Figures 2 & 5). But they have also attracted debt from development banks, such as the European Investment Bank for the liquefaction projects in Egypt; bonds, as seen in Qatar’s RasGas trains 2 and 3 financings; and sovereign wealth funds, as seen in Russia’s $27bn financing for Yamal LNG.

Other providers of funding include project sponsors, usually gas majors, providing co-loans that are pari passu or on equal footing with bank debt.

An example is Ichthys LNG, the largest ever LNG project financing, at the end of 2012. Around $20bn of debt was raised for the $34bn project, with $4bn coming from co-loans from sponsors.

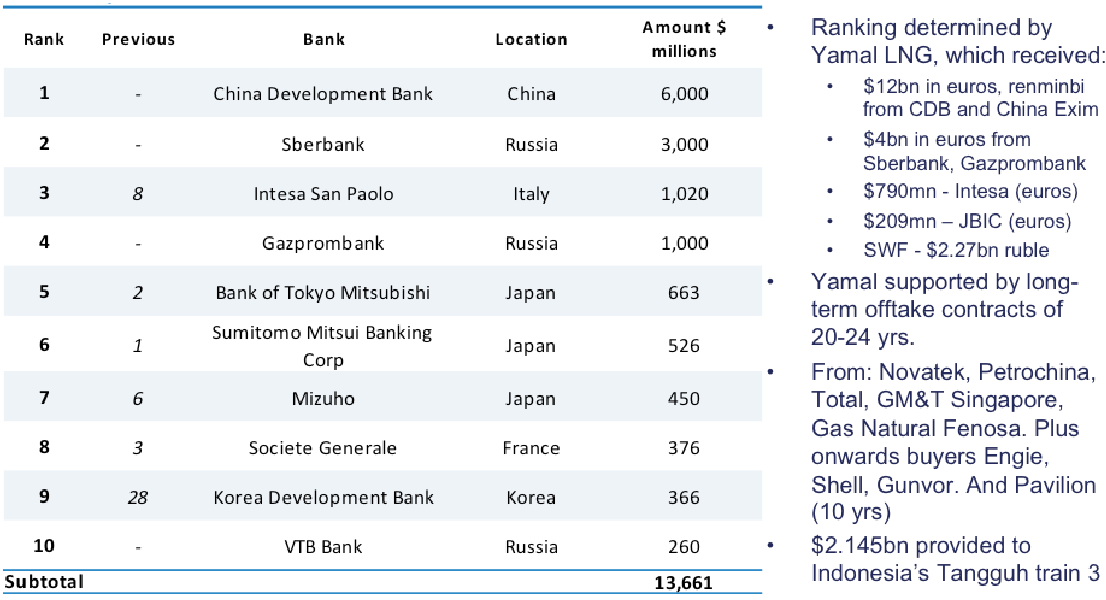

Poten ranks banks in terms of how much funding they provide to LNG project finance. For the 2017 ranking (Figure 3), based on 2016 transactions, the rankings were dominated by the banks, mostly Chinese and Russian, that provided huge loans to the $27bn Yamal LNG project. It attracted $19bn in debt. 2016 and 2015 rankings were dominated by Japanese and European banks, which came in as big debt providers on Corpus Christi, Sabine Pass, Cameron LNG and Freeport LNG in the US.

Contracting companies have also provided funding to projects, including GE on Cheniere’s Sabine Pass project in Louisiana and Freeport LNG in Texas. GE is also investing in two of the next wave projects: Tellurian’s Driftwood LNG project in Louisiana; and Next Decade’s Rio Grande LNG project in Texas.

Liquefaction companies have also attracted equity funding for their projects from infrastructure funds and via stock market offerings including issuing shares and also units in master limited partnerships, the latter being especially common in the US. Some of this is for early stage development before both final investment decision sanction and project finance agreements.

Figure 3: 2017 lender ranking – based on 2016 transactions

Source: Poten LNG

What are the challenges funding faces from changes in the structure of the LNG market?

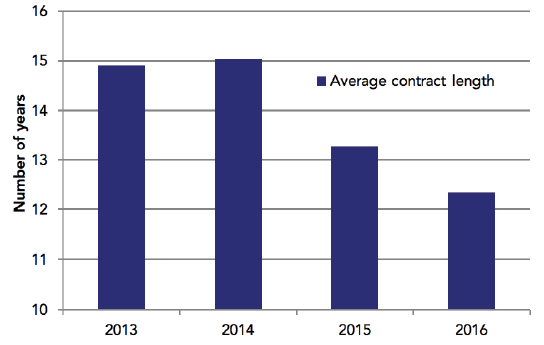

The LNG market continues to evolve from its relatively simple beginnings – when buyers signed up to long-term contracts and LNG cargoes went directly from the seller to the buyer – to one with greater flexibility, liquidity, complexity and shorter-term contracts (Figure 4).

Figure 4: Contract lengths are shrinking

Source: Poten LNG

This shift is a challenge for sponsors trying to finance liquefaction projects, because they are unable to rely on long-term contracts with investment-grade customers like they have in the past. Yet at the same time, the LNG market’s evolution is incomplete and it is not known whether the market can support liquefaction plants operating on a partial or full merchant basis.

New buyers have also entered the market and they may not be investment-grade or even rated at all by international agencies. Long-term take-or-pay contracts with investment-grade counterparties provide not only banks with security but also other lenders such as ECAs.

By contributor, banks and ECAs were dominant debt providers in LNG project financings completed in 2005-2017 (Figure 5). While ECAs will participate on a project in order to support construction, equipment, offtake and equity participation of their national companies, they will still perform extensive due diligence to assess the likelihood of being repaid, just as commercial banks do.

Figure 5: LNG project financing by contributor ($bn)

NB: 2007 – Tangguh – Fujian Tranche – supplies 2.6mn mt/yr to Cnooc (Source: Poten LNG)

How are industry participants and financiers likely to respond to these challenges?

The lower price environment and lack of customers has already forced sponsors to delay or cancel FIDs. In 2016 and thus far through 2017 there have been only two FIDs: Indonesia’s Tangguh train 3 last year; and Coral South FLNG this year.

The competition for customers is fierce and industry participants are responding by trying to reduce costs in order to offer the best prices and thereby attract offtakers or tolling counterparties.

US project sponsors, for example, are responding to the fundamental changes in the LNG market by seeking to offer incremental capacity and are planning to build trains smaller than those of about 5mn mt/y that were typical in the first wave of US projects.

Even the lower-48’s first producer, Cheniere, is planning a switch to mid-scale production at its Corpus Christi site in Texas. Bringing smaller trains online in a phased approach allows sponsors to reduce the amount of production or tolling capacity they have to sell and finance at each step, which could help in a buyers’ market where few customers are jumping in with big commitments.

The difficulties in signing up customers has prompted some sponsors to attempt to tweak the classic approach of the long-term offtake model. Tellurian has been offering different contract durations based on different pricing mechanisms, including fixed prices, to customers.

To reduce the debt it needs to raise, Tellurian is offering customers equity stakes in the project for $1,500/mt and is planning to retain between 7mn and 11mn mt/yr itself and act as the manager/operator. This would leave customers with ownership of 61% to 74% and Tellurian with the remaining 26% to 39%.

How has project finance adapted to complexities?

Thus far, sponsors and their advisors have managed to adapt project financing to complexities inherent in the LNG sector. For Australia Pacific LNG’s financing, lenders were concerned about upstream risk because coalbed methane-based feedstock requires that projects proceed with less certainty over the reserves than conventional projects.

Guarantees protected lenders from exposure to the upstream and similar guarantees were also provided for lenders in the financing of the sale of BG’s Queensland Curtis LNG pipeline infrastructure sale to APA, although neither Queensland Curtis nor the third other Australia CBM project, Gladstone LNG, used project finance structures to raise funding.

In Indonesia banks were faced with difficulty in taking title over the asset, so all the phases of Tangguh LNG’s financing of three trains have carried sponsor guarantees during repayment provided via trustee borrowing schemes. Completion guarantees from sponsors are also extensively used in LNG projects, as mentioned, to protect lenders.

Examples are Ichthys LNG, Papua New Guinea LNG, and Cameron LNG in the US. These are not released until lenders’ completion tests are met after a certain operating period. Lenders had the risk of FLNG technology mitigated on Coral South FLNG via completion guarantees. This is the first ever FLNG scheme to be project financed.

But the shift to shorter term contracts is the toughest challenge sponsors and their financial advisors will have to face when they are trying to raise money for their projects. Until now long term contracts with investment grade customers have been sacrosanct.

What is the impact of more volume moving into short and medium-term contracts?

It is possible that a project financing could go ahead with a mix of long- and shorter-term contracts and a mix of investment grade and sub-investment-grade buyers. But it is difficult to say where the sweet spot for this mix would lie and what percent of shorter-term contracts and sub-investment-grade buyers lenders would accept.

The amount of debt that can be raised for liquefaction project sponsors signing shorter-term contracts with sub-investment-grade buyers would fall because it increases a lender’s risk. This will reduce the achievable gearing level – debt-to-equity ratio. For liquefaction projects this has typically been around 70:30. The loan payback period, or tenor, could also be shortened as a result, so the loans do not extend beyond the period for which offtake is subject to a binding agreement.

But this would have implications for a sponsor’s profit margin and dividend payments. And deals perceived by the banks to be more risky will be priced higher, or may even be rejected.

What are the most pressing future challenges and how are these being faced?

Securing customers remains the most pressing challenge. With the recent market changes, there is going to be a clash between what customers want, in terms of LNG offtake or tolling services, and what financiers will find acceptable when they are looking to provide funds to a liquefaction project.

It remains to be seen what kind of changes banks, ECAs and other providers of funds will allow to the tried and tested method of using long-term offtake contracts to underpin project financings and what sorts of financing structures will emerge as a result.

Customers have a lot of choice now, in terms of pricing mechanisms, contract duration, flexibility clauses that allow diversion, or free-on-board (FOB) structures that allow the gas to go anywhere, rather than to a set destination. But for some that choice is causing some confusion and slowing their decision making processes, which means that liquefaction developers are unable to move ahead with their financings. LNG export project developers will try to find creative ways to finance and implement their schemes. But it is uncertain how far they can go with new approaches. And if customers wait too long, FIDs may prove elusive for the LNG providers. Customers may then be faced with a shortage because forecasts show LNG demand continuing to climb.

Another future challenge is the move by some financiers to stop providing funds to enable the production of hydrocarbons. To date some banks have put restrictions on financing for coal and certain types of oil financing. But in October BNP Paribas said it was pulling out of financing for projects based on oil and shale gas, as well as tar sands. This means that the French bank will not provide funds to the next wave of liquefaction projects in the US.

While this is only one bank, if others follow suit it would be more problematic for the LNG sector. Other types of financiers, such as pension funds, have exited fossil fuel financing, but there are still many funds, including infrastructure funds, that are investing in LNG.

Thank you very much.

Charles Ellinas