[NGW Magazine] Peak natural gas demand

Most energy outlooks are quite comfortable talking about the possibility of peak oil but foresee gas demand continuing to grow in the period to 2050.

A few, though, such as DNV GL and Irena, forecast that natural gas demand will peak earlier than that. The continuously falling costs of renewables and advances in storage technology, including batteries, pose increasing challenges. Renewables are on the way to become cheaper than building coal and gas-fired power plants, even without subsidies.

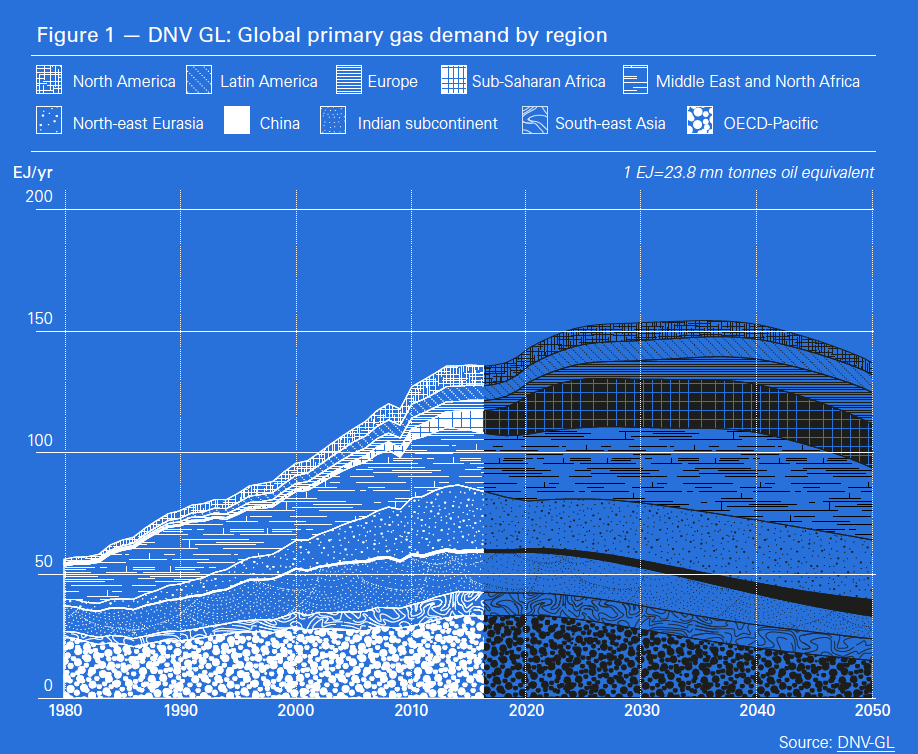

In its newest Energy Transition Outlook, released in September, DNV GL forecasts that global primary gas demand will peak by 2034 (Figure 1), as direct use of gas loses out to electricity. It forecasts that renewables will be taking an ever-increasing share of the electricity market, with gas demand falling back down to today’s levels by 2050.

DNV GL, though, warns that this requires the gas industry to remain cost-efficient if it is to stay competitive for the longer term. That will then ensure that gas decline, after it peaks by 2034, is slow and that it can still have a strong role alongside renewables in decarbonising the world energy system. Expensive gas will hasten renewables’ growth and could lead to faster decline. Increasingly, all fuels in the global energy mix will be competing on cost.

DNV GL also forecasts that, “driven by pervasive electrification, especially of transport, and by ongoing efficiency gains in other sectors, linked in many instances to digitalisation,” advances in energy efficiency will lead to “peaking of energy demand worldwide in the 2030s.” It concludes that a rapid energy transition will lead to “a very strong growth of solar and wind, initial growth in gas, and a decline in coal, oil and, eventually, gas, in that order,” but even then the world “would still exceed the 2 °C carbon budget.”

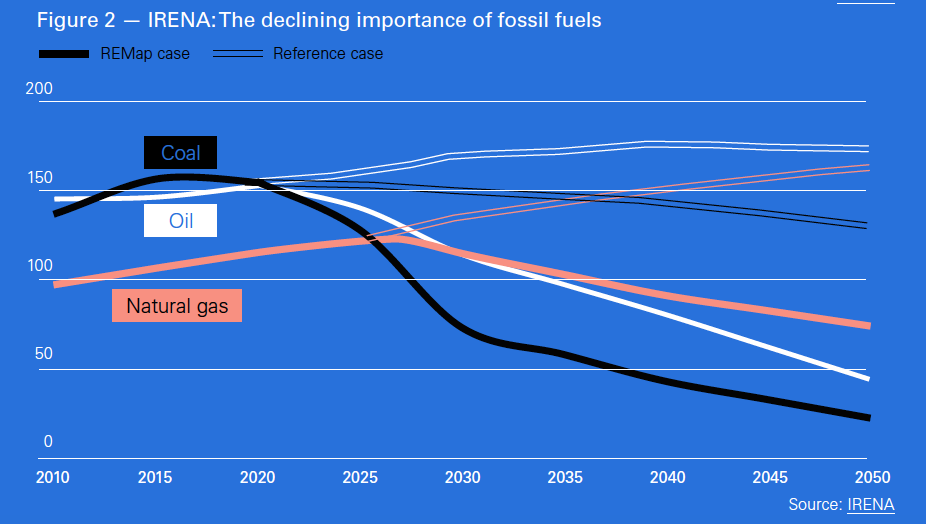

In its REmap case, which is based on the deployment of low-carbon technologies to achieve the Paris 2 °C goal, Irena forecasts that fossil fuel use for energy falls to one-third of today’s levels by 2050. Oil and coal would decline most, by 70% and 85% respectively. Natural gas use would peak around 2027 and then decline by 30% from present levels, but would be the largest source of fossil fuel by 2050 (Figure 2).

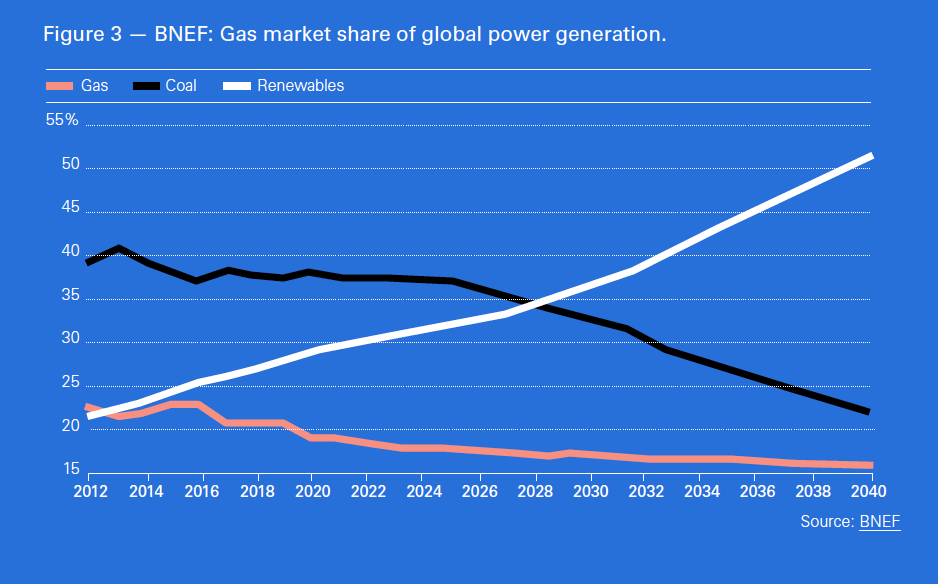

More recently, Bloomberg New Energy Finance (BNEF) forecasts in its New Energy Outlook, NEO-2018, published in June, that after peaking by the end of this decade, gas in power generation will decline from a 21% contribution to the power energy mix now to 15% by 2050 (Figure 3), displaced by renewables. According to BNEF, its future use will be mostly in peaker plants that provide power during periods of high demand, backing-up fast-growing renewable generation.

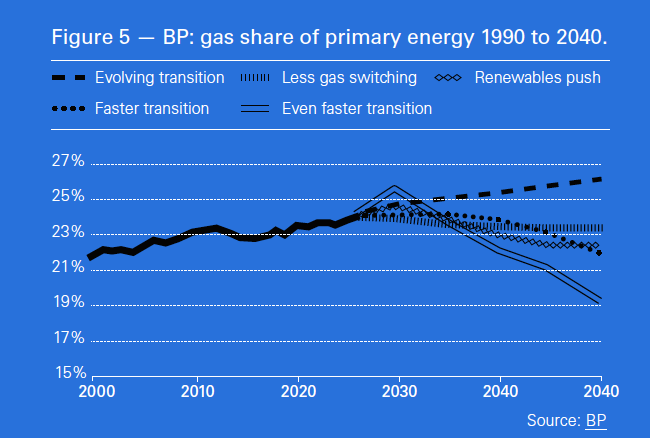

But even BP, in its Energy Outlook 2018, foresees a scenario under which gas demand peaks in the 2020s and declines below current levels. This could happen if the world were to enter an ‘even faster transition’ (EFT), needed to reduce carbon emissions from energy-use broadly consistent with the Paris climate goals (Figure 5). According to BP, this could be brought about by a sharp increase in carbon prices and implementation of climate polices to encourage greater energy efficiency and fuel switching – both issues are covered later in this article.

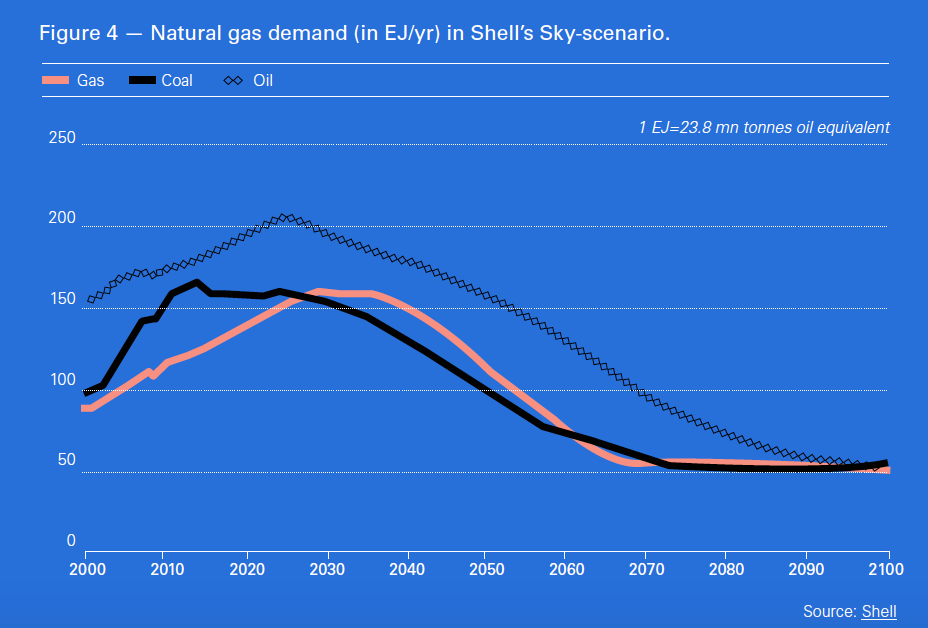

Shell also recognizes the unstoppable rise of renewables. Its CEO, Ben van Beurden, said that the energy transition is “fundamentally a force that cannot be stopped… It is both policy and public sentiment, but also technology that is driving it.” In its Sky-scenario, and similarly to Irena, Shell expects natural gas demand to peak by 2030 and to start declining in the 2040s to low levels beyond 2070 (Figure 4).

It would appear that even though the oil majors in their ‘base case’ scenarios expect natural gas demand to carry on increasing at least to 2050, they are hedging their bets. They are also considering scenarios that show possible conditions under which future natural gas demand may peak well before 2050.

Clearly the concept of ‘peak natural gas demand’ is not unthinkable and as such it merits further consideration.

As most major international oil companies (IOCs) are in the process of shifting future production to natural gas, often seen as a bridge between a fossil fuel past and a carbon-free future, this is an important issue.

With the inexorable advance of renewables, the world has entered an era of abundant energy. This is leading to low energy prices, a more competitive and cleaner energy market environment and increasing pressure on fossil fuels if they are to retain their dominance.

Increasingly cheaper renewables, combined with coal resilience because of low prices, are putting the future outlook for gas in doubt. BNEF’s CEO, Seb Henbest, warns: “Wind and solar are just getting too cheap, too fast" for gas to play a transitional role. High oil and gas prices, climate policies and increasing use of carbon pricing are other factors that may accelerate fuel mix switch, threatening the view that gas can be a bridge fuel.

Impact of climate policies

BP, in its Energy Outlook 2018, says the prospects for gas demand could be adversely affected, with both weaker or stronger environmental policies posing potential threats. Weaker policies could dampen the shift away from coal towards natural gas, while stronger policies could encourage greater gains in renewables and energy efficiency.

The share of gas in primary energy falls in all of these alternative scenarios, after reaching a peak, in contrast to the steady increase projected in the ‘evolving transition’ (ET) scenario (Figure 5). According to BP these policy “risks to gas demand are a key uncertainty” that might cause the gas share of primary energy consumption to plateau by mid-2020s to 2030s and then fall, “squeezed out by non-fossil fuels.”

In introducing the Energy Transition 2018 report, Remi Eriksen, group president and CEO DNV GL, said “There are many signs that the energy industry is on the brink of profound change. Globally, policy developments, despite some notable exceptions, continue to favour renewables technology. Last year, new renewable power capacity additions were more than double the new power capacity additions from fossil fuels. In capital markets, a reallocation of funds towards cleaner technology is underway.”

As DNV GL points out, only a few years ago policies to advance the energy transition were dominated by OECD countries. This is no longer the case. In terms of the pace of policies and implementation, China and India are now probably the most important regions in the world, to the extent that whatever they do in terms of energy policy and the use of gas, and the speed of their transition to renewable energy systems, will have a very large impact on the rest of the world.

With 2020 approaching, there is an expectation that climate pledges will be largely fulfilled and extended. This is increasing pressure on fossil fuels, as is the policy goal now in place in an increasing number of countries, of achieving near-zero emissions by 2050.

Seven countries have already adopted legally binding commitments to largely eliminate carbon emissions by 2050 - UK, Mexico, Denmark, Finland, France, Norway and Sweden - mostly in line with Paris climate targets, with the Netherlands and California about to join them. Germany has also specified similar targets in its Climate Action Plan 2050. Jointly these countries consume over 10% of global primary energy, and if this enthusiasm proves contagious, there could be major reductions in the consumption of fossil fuels.

Fossil fuels can retain a foothold through adoption of technologies to reduce emissions, such as massive implementation of carbon capture and storage schemes (CCS). Otherwise their future use could face extensive scaling-down.

Spencer Dale, chief economist of BP, and Bassam Fattouh, director of the Oxford Institute for Energy Studies, pointed this out in an article in August, saying that the combination of more ambitious climate policies, technology advances, efficiency improvements and changing social preferences have boosted the use of renewable energy and slowed down demand for fossil fuels.

Carbon pricing

Carbon pricing policies are designed to incentivise the deployment of renewable energy technologies and reduce emissions by increasing the comparative cost of higher-emission fuels and technologies.

The number of countries worldwide with carbon pricing policies in place at the end of 2017 stood at 64, up from 61 in 2016. As of April 2018, between a fifth and a quarter of global carbon emissions were covered by an explicit carbon price, up from 13% at the end of 2016. This was mainly due to the entry into force of China’s scheme. This is expected to gradually mature over the next few years and play a crucial role in emission reduction in China from 2020.

According to a new report from Carbon Tracker, carbon prices are set to rise even faster than previously anticipated in the EU. It forecasts that carbon prices could more than double to €40/metric ton (CO2 equivalent) between 2019 and 2023 and may reach €55/mt by 2030 if the European Commission legislates to align current emission targets with the Paris climate agreement. Prices have already increased from €4.38/mt in May 2017 to above €20/mt last month. By the end of the year, the price is expected to reach €25/mt.

This would accelerate the transition away from coal and lignite by making such power plants unprofitable. In the short to medium term this would certainly benefit natural gas demand, used to replace unprofitable coal and lignite.

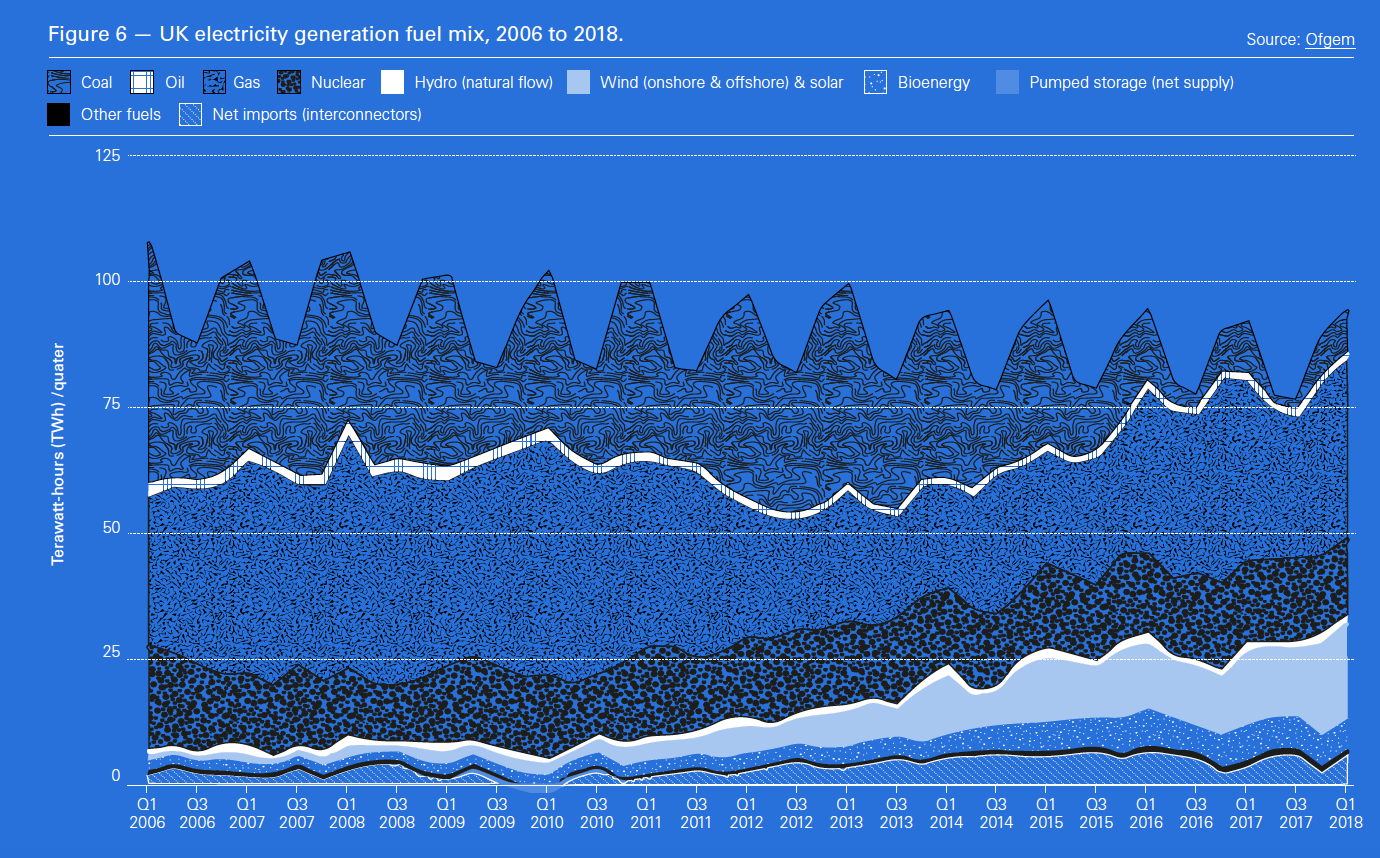

This is exactly what happened in the UK. A carbon floor price (CFP) was introduced in April 2013. It now stands at £18/mt and will remain at this level until 2020. This had a dramatic impact on cutting coal consumption which has been absent from the mix for days on end this year (Figure 6).

The introduction of CFP initially boosted gas consumption, from 70 bn m³ in 2014 to 81 bn m³ in 2016, but in 2017 it declined to 79 bn m³. Over the same period the share of renewables in power generation almost doubled from 15% in 2014 to 29.6% in 2017 and carbon emissions fell by a fifth.

By the end of 2017 UK’s carbon emissions were 38% below 1990 levels. In fact they are now at levels not seen since 1890. So, the UK is a good example of carbon pricing doing exactly what it has been designed for – benefiting renewables and emission reduction.

In the longer term, possibly beyond 2030, high carbon prices may impact natural gas demand, as forecast by BNEF in NEO-2018, especially if renewable cost reductions and cheaper electricity storage batteries carry on their present trend, as expected. This will be accelerated if gas prices remain high.

Gas prices in Europe and southeast Asia are already high and may increase further as winter approaches, impacting electricity prices. These are factors that contribute to implementation of greater energy efficiency measures and hastening renewables penetration at the expense of fossil fuels and may eventually lead to faster peaking of gas consumption if they persist.

Europe

In addition to changes to its Emissions Trading System (ETS) that are leading to higher carbon pricing, Europe has been setting up ambitious climate targets for the period 2020 to 2030. It has increased its carbon reduction target to 40% in comparison to 1990, energy efficiency to 32.5% and renewables uptake to 32%. About half the EU member states are pushing to raise these targets further, and in particular the carbon emissions reduction target to 55%. Once implemented, all these developments are bound to have an impact on future fossil fuel consumption.

Peak gas demand might have already happened. Despite increases over the last three years, gas consumption in Europe is still below 2010 levels. The International Energy Agency (IEA) expects European gas demand to be at the same level in 2040 as in 2020.

This may be the reason that has led the European majors Shell and Total into the retail energy market, sending important signals about their long-term direction in Europe. Both companies recognize the need to expand into the electricity supply chain, as the global energy market begins to transition to low-carbon, with a bigger role for renewable power, backed up with gas. Both the companies have big LNG positions.

Maarten Wetselaar, head of Shell’s ‘new energy strategy’, predicts the proportion of worldwide energy consumption met by electricity would increase from less than 20% today to about 50% in coming decades. He said: “Any piece of energy demand that can be electrified, needs to be electrified,” if international carbon reduction targets are to be met. “Electrification. . . is going to be the story of the next decades… We want to not just be part of it, we want to become a leader.”

Going further, Wetselaar said that the falling cost of wind and solar power, coupled with strengthening international commitments to decarbonisation, is turning renewables into a “normal, commercial, capitalist business rather than something driven by subsidies.”

BP, Eni and Equinor are also investing in renewables. The increasing investment by European majors in renewable power represents a hedge against the possibility of a more rapid transition, but it is also in response to increasing public and shareholder pressure.

China

China is the world’s largest consumer of energy, accounting for 23% of global primary energy in 2017. It has been the most important source of growth for global energy over the past 20 years.

In its NDC pledges under the Paris Agreement, China’s aims for 2030 are: to meet a fifth of its energy needs with non-fossil energy; to lower carbon intensity per unit of GDP by 60-65%; and for the country’s GHG emissions to peak around 2030. DNV GL forecasts that China will exceed these targets.

But as China transitions to a more sustainable pattern of growth, and its carbon trading scheme matures, its energy needs are changing.

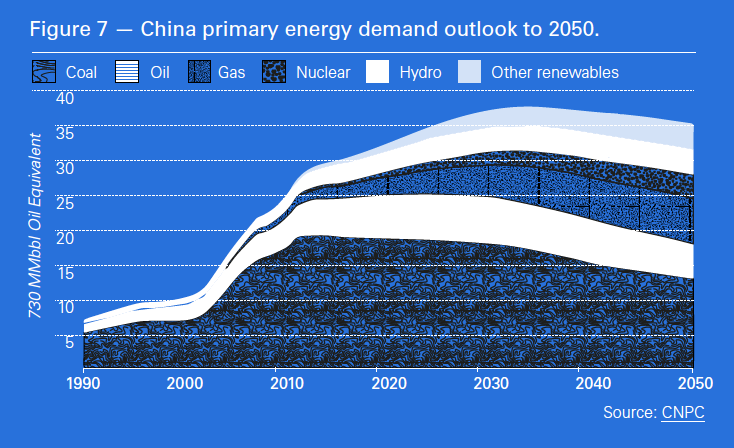

In a report published in February, China National Petroleum Corporation (CNPC) forecast primary energy demand will peak in the early 2030s and gradually decline beyond that. Natural gas is expected to peak in the early 2040s and plateau after that (Figure 7).

The forecast rapid growth in gas demand in the 2020s is driven by China’s decision to reduce coal-generated electricity in urban areas and replace it with gas-fired generation to reduce air pollution.

However, primary energy and gas demand are expected to slow-down beyond 2030 through efficiency improvements and as the Chinese economy transitions away from energy-intensive industrial sectors, such as steel and cement, towards less energy-intensive service and consumer-facing sectors.

Increasing use of renewables, hydro and nuclear in power generation in the period to 2050 will also impact gas demand.

Another factor impacting use of gas in China is that the decline in coal consumption is gradual and slow. Coal maintains a foothold, expected to remain the dominant fuel providing 38% of China’s primary energy even by 2050 (Figure 7), through the use of clean coal technology and CCS. This is driven by cost, security and reliability of supplies.

Much of the forecast growth in gas demand to 2030 is dependent on China adopting policies that favour gas rather than plentiful and cheaper coal in an attempt to improve major city air quality. China plans to more than double gas import capacity by 2025, with a goal to get as much as 10% of its energy from gas by 2020 and 15% by 2030, in comparison to 6.4% in 2016. But the switch from coal also requires gas prices to remain low. If these do not happen, gas demand could peak sooner.

However, as DNV GL points out, China imports much of its energy and raw materials, making energy security a key concern for the government. Developing more sources of domestic energy, and the technology to run renewables in particular, are two major elements of its strategy to reduce dependence on imports.

India

In India, keeping pace with growing energy and electricity demand, and meeting health, poverty, and education needs take priority over climate and environment. But worsening pollution and air quality in major cities is also becoming a serious concern.

In addition, energy security is also very important, favouring indigenous energy sources, such as renewables and coal, at the expense of imports, such as LNG.

BP, in its 2018 Energy Outlook, concludes that in contrast to China, the slowing in India’s energy demand growth in the 2040s will be less pronounced, underpinned by robust economic growth. As a result, after 2030 India is expected to emerge as the world’s largest growth market for energy.

Cost reductions in wind and solar are enabling India’s government to shift from plans for extensive coal power generation expansion to renewables. It is already becoming cheaper to build new onshore wind and solar power than run existing coal and gas plants. BP expects their contribution to India’s primary energy to increase from 2% in 2016 to 13% by 2040, and possibly more if current trends continue.

Natural gas plays only a small part in India’s primary energy, with only 6% in 2016. BP does not expect this to change significantly, growing to 7% by 2040.

Japan

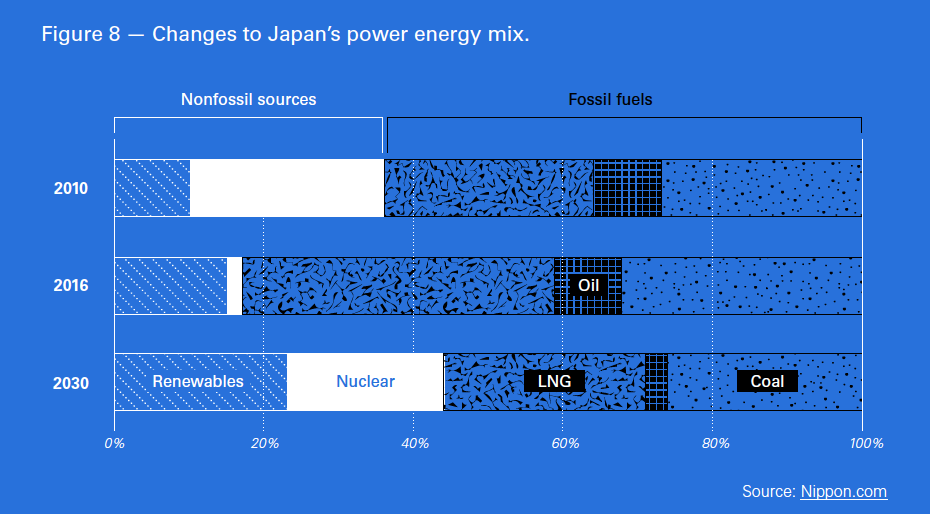

Japan’s 5th Strategic Energy Plan, published in July, expects primary energy consumption to remain flat over the period to 2030, with LNG and coal returning to pre-Fukushima levels, shifting more power generation to renewables (Figure 8). Nuclear still retains a very significant role.

LNG imports are expected to fall from 88.5mn mt/yr in 2015 to 62mn mt/yr by 2030, putting the LNG contribution to its power fuel mix down to 27%, significantly less than the 40% achieved in 2015.

US

In the US the shale boom has led to plentiful cheap gas supplies. This has helped gas displace coal as the primary fuel for power generation for the first time in 2017. The US is one of very few countries where gas has competed successfully with coal on economics. There is also the benefit that the shift from coal to gas and renewables played a big part in US emissions declining substantially over the last few years, by 12% between 2006 and 2016.

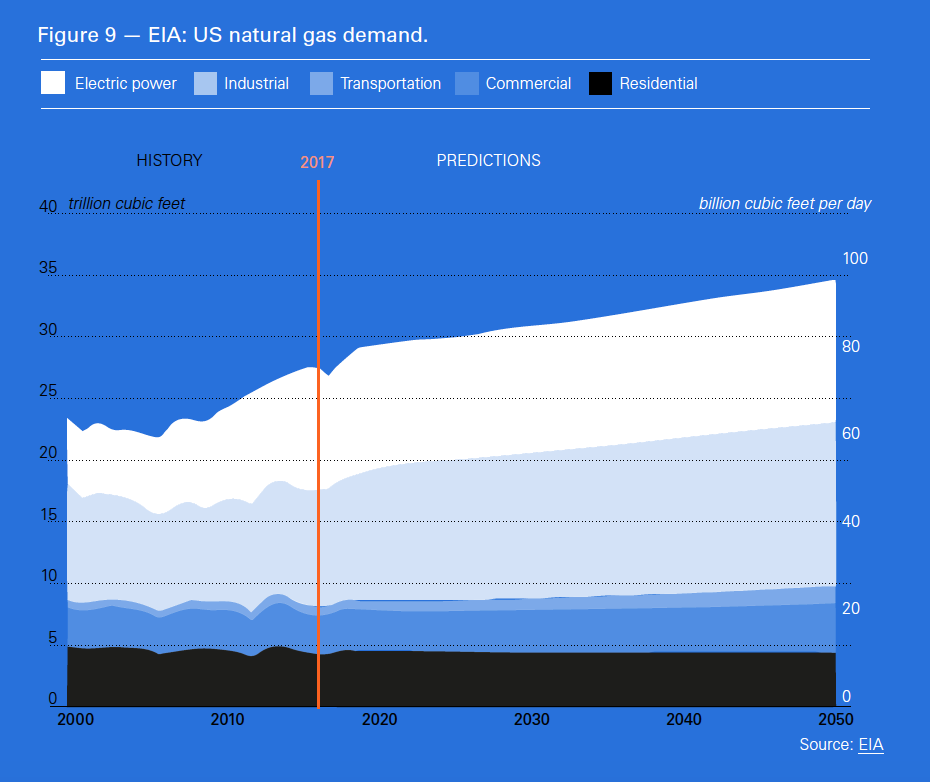

The IEA forecasts that US industry will drive gas demand to increase by 1.6% per year growth through to 2022 as it replaces crude oil as a raw material for petrochemicals.

These are the main reasons why the Energy Information Administration (EIA) expects US gas demand to continue increasing at least to 2050, bucking the trend in other major economies (Figure 9).

But as BNEF points out, as renewables and battery storage get cheaper they are challenging the use of gas in power generation, including the use of peaker plants.

Following Hawaii, California passed legislation at the end of August that would make it the first large US state to adopt almost completely carbon-free power generation by 2045. It already has a target to achieve 50% renewable generation by 2030. Being the world’s fifth largest economy, this could have serious implications on future gas demand. Other states, such as Massachusetts, New Jersey, New York and Washington DC, are about to follow suit. Such developments are likely to impact future fossil fuel demand even in the US.

Not all doom-and-gloom

The energy sector is changing fast, making long-term forecasts challenging. It is likely that in the longer-term natural gas demand will peak before 2050 and then decline over time. But it is not something that will happen suddenly, as Figures 1 to 7 show. In fact, most of these forecasts predict growth in global gas demand over the next twenty or so years, followed by gradual decline.

Shell, in its Sky-scenario, attributes this to the financial momentum of current investments in fossil fuels. “From 2018 to around 2030, there is clear recognition that the potential for dramatic short-term change in the energy system is limited, given the installed base of capital.”

In addition, renewables have great success penetrating the global power sector, but very limited success in other sectors, such as transport and industry, where displacing fossil fuels is proving to be much harder.

Demand for “oil companies’ traditional core products could have plenty of life left in it”, according to even Irena. It points out that “while renewable energy has made spectacular gains in power generation, in other sectors progress has been slower, and policy support is less advanced.” As a result, natural gas has a role to play in the longer term. Any decline will be gradual and can be managed – at least in the foreseeable future, but not forever.

As Dale and Fattouh point out in their article, “peak demand matters as it signifies a shift in perception from scarcity to abundance, which is already changing the behaviour of all players including oil [and gas] exporters.” They conclude: “Taking the ‘peak demand’ argument forward, it is generally thought that the world is on the brink of another energy transition, in which conventional sources such as oil [and gas] will eventually be substituted away in favour of low carbon sources.”

But it is important not to allow the uncertainty of ‘peak demand’ stifle investment in oil and gas projects prematurely, before renewables and efficiency improvements demonstrate they are able to fill the gap in global energy demand. This could result in energy supply shortfalls and price rises, creating a problem for the global economy.