[NGW Magazine] Mozambique LNG Clears Some Hurdles

Since the giant gas discoveries were made earlier this decade, Mozambique has had to work hard to make the legal and regulatory framework fit for purpose. Now two of the three liquefaction and export projects are moving ahead.

Two of Mozambique's three natural gas development projects in Cabo Delgado in the north of the country are advancing, with one of them on track to start liquefaction by end-2022.

Italy’s Eni, US ExxonMobil and partners’ Coral South FLNG project is the most advanced, having taken final investment decision (FID) mid-2017 for its 3.4mn metric tons/yr (mt/yr) offshore floating liquefaction venture, estimated to cost $8bn.

Anadarko Petroleum, another US firm, leads the other partnership operating in Area 1 of the same basin and expects to take FID by March 2019, paving the way for $20bn to be invested in an onshore liquefaction plant able to produce an initial 12.88mn mt/yr LNG. A second ExxonMobil-Eni LNG development, taking gas from the offshore Mamba field on Area 4, would also liquefy its gas onshore. If Area 1 and Mamba onshore projects go ahead, their eventual capacity could reach 50mn mt/yr.

China, India and southeast Asia will be key markets for this estimated 180 trillion ft³ of gas.

In an update to parliament in Maputo May 16, mineral resources and energy minister Ernesto Max Tonela said the government was happy with the progress made so far, noting that the first steel for the construction of Coral South FLNG’s anchoring system had been cut in Singapore this March.

Completion of the platform construction is expected by the end of 2021 and is scheduled to be in Mozambican waters by end-1Q 2022, he said, "ready to extract the gas, transform it into a liquid state and export it to the whole world" in 4Q 2022. The minister has been in office for five months.

Eni is Area 4 operator, holding a 25% interest, partnered by ExxonMobil (25%) and Chinese state China National Petroleum Corp (CNPC, 20%), with the remaining 30% split equally between Mozambican state ENH, South Korean utility Kogas, and Portugal’s Galp Energia.

Under the terms of ExxonMobil’s $2.8bn farm-in completed in December 2017, it will lead development of the future onshore LNG facility for which FID has yet to be taken, whereas the floating LNG project already being developed – and offshore operations – will remain Eni-operated. The latter, Coral South FLNG, wrapped up its project financing in late 2017 and contracted in October 2016 to sell its full 3.4mn mt/yr output to BP for 20 years. Analysts said that as an aggregator BP could bid relatively low, being able to use its portfolio to absorb unexpected fluctuations in output from the plant.

Development concept of Area 4 South Coral project (Credit: Galp Energia)

In the Area 1 consortium, Anadarko has a 26.5% operating stake, while Mitsui of Japan has 20%, ENH 15%, Thai state PTT 8.5% and Indian concerns (OVL, Bharat Petroleum and Oil India) the other 30%.

As the Mozambican government moves to raise money to finance its own stakes in the Anadarko and Eni/ExxonMobil ventures, ENH in March appointed Lazard and Lion's Head Global Partners as advisers to help it raise $2bn. US-based Lazard will work with ENH on financing its share of the Anadarko project, while London-based Lion’s Head will work on the Eni/ExxonMobil project. "We need to put that in place: it's extremely urgent," ENH CEO Omar Mitha told Bloomberg late April.

Mozambique’s gross domestic product per person in 2016 was $382.1 – little more than a dollar a day – so it needs to lift its 29mn population out of poverty and accelerate its industrialisation.

In addition to creating some 5,000 jobs in the construction phase and about 1,000 jobs in the operational phase of both onshore LNG projects, the government estimates that 18% of the needed goods and services could be provided by local companies, and 23% by companies associated with Mozambicans. Also, the country expects to collect $78bn in taxes over the 25-year lifespan of the Eni-led Coral South FLNG and Anadarko-operated Mozambique LNG projects.

By early-May, Anadarko had agreed commercial terms and price for the sale of 5.1mn mt/yr of LNG from Area 1, more than half the 8.5mn mt/yr it requires to take FID.

“The FID on the Mozambique Area 1 project during this financial year is in our sights," Mitsui CEO Tatsuo Yasunaga told shareholders this May in Tokyo. The Japanese financial year runs to March 2019.

Mitsui’s 20% interest includes an option held by Japan’s state Jogmec (10%) that it is widely expected to exercise, then onsell; but Mitsui said it will keep at least 10% after FID.

Anadarko-led Mozambique LNG is on the market to raise between $14bn and $15bn to be spent on the venture and says it is confident that the project will be able to raise that amount. French bank Societe Generale, the project’s financial adviser, says it has already received interest for at least $12bn in direct lending plus cover from export credit agencies in South Africa, China, Italy and Japan.

Despite the absence yet of FID or project financing, Anadarko points to progress on the ground: it has built a two-lane road from the district headquarters at Palma to the proposed liquefaction site; built houses for 400 workers with those for a further 750 under construction; and resettled 1,500 affected people. The decision to build an airstrip will be taken by the end of June.

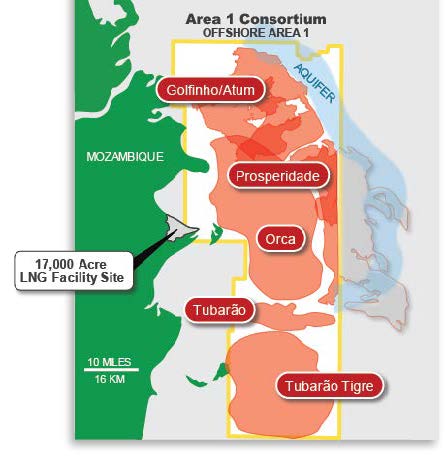

The Area 1 consortium will produce gas 40 km offshore Cabo Delgado, pipe it to the planned LNG plant at Afungi where it will be liquefied and shipped to Asia and other export markets.

Mozambique lacks infrastructure to consume much of its production, hence its being destined for export as LNG, but the government is keen to develop a local gas economy. It is seeking investment in power generation, liquid fuels (including gas-to-liquids) and fertiliser manufacturing. Privately though, gas resource holders say such projects will need to wait until the LNG ventures are up and making money. They are anxious for their carefully costed ventures not to suddenly have grandiose projects – such as a long-distance gas pipe to South Africa – grafted on. While there is progress on both the Area 1 and Mamba projects, one Mozambican publication Zitamar News cautioned May 17 that there is still much work to do including how much gas Area 4 will supply to the domestic market. There are also ongoing discussions between LNG producers and the domestic gas projects around shared infrastructure and access to the sea, it said.

Mozambique LNG project (Credit: Anadarko Petroleum)

Given ExxonMobil's progress in Area 4, there is potentially also an issue of how to sequence the two onshore LNG projects to avoid competition between the two for access to LNG markets and finance. Finally, contracts awarded under upstream regulator INP's fifth licensing round two years ago have still not been concluded, as some winners – including Norway’s Equinor (formerly Statoil) - walked away from the talks after failing to get clarity on Mozambique’s upstream terms.

Another possible point of concern are gun attacks blamed on Islamic militants that have occurred 80 km south of the project site. The first happened October 5, 2017, when 234 attackers were arrested. The second was on April 20 this year when one person was killed and 30 arrested. These, however, appear to not have unnerved investors.

Responding to claims that the assailants were Islamists, police spokesperson Inacio Dina on April 24 dismissed them as common criminals. Two days later however, defence minister Atanasio M'tumuke said they could be terrorist attacks that he declared must be contained.

Thulani Mpofu