[NGW Magazine] Digitising the Business of Gas

Digitisation throughout the natural gas value chain can reduce costs and secure customers, but it can also pit producers against established utilities.

Digitisation, and the subsequent analysis of data, is helping achieve sharp cost reductions in upstream gas through improved operational efficiency and increased recovery rates. At the other end of the energy value chain, changing fuel buying patterns are leading oil and gas companies to digitise the customer experience, and in the UK, producers are developing an online gas and power retail presence – bringing them into direct competition with utilities.

Digitisation began some time ago in the oil and gas sector with 3-D seismic and advanced process controls for operations, but has only recently been fully embraced.

“Digital gas fields have been around for 20 years,” says Suraj Ramaprasad, Infosys Consulting’s global leader for energy/oil and gas. “Most oil companies had programs but take up was patchy at the time. Now prices are lower, forcing companies to cut costs, while the costs of enabling technologies – such as data processing, modern sensing equipment, storage and the internet – have dropped sharply, [so that while] 20 years ago, a strategic control room was required, now it can be done remotely on a PC.”

Digital technologies and advanced analytics can provide operators with clear, granular views, helping support better operational and strategic decision making. For example, digitisation can separately analyse production flow and conditions at each well, so that adjustments can be made to optimize output and better manage the reservoir.

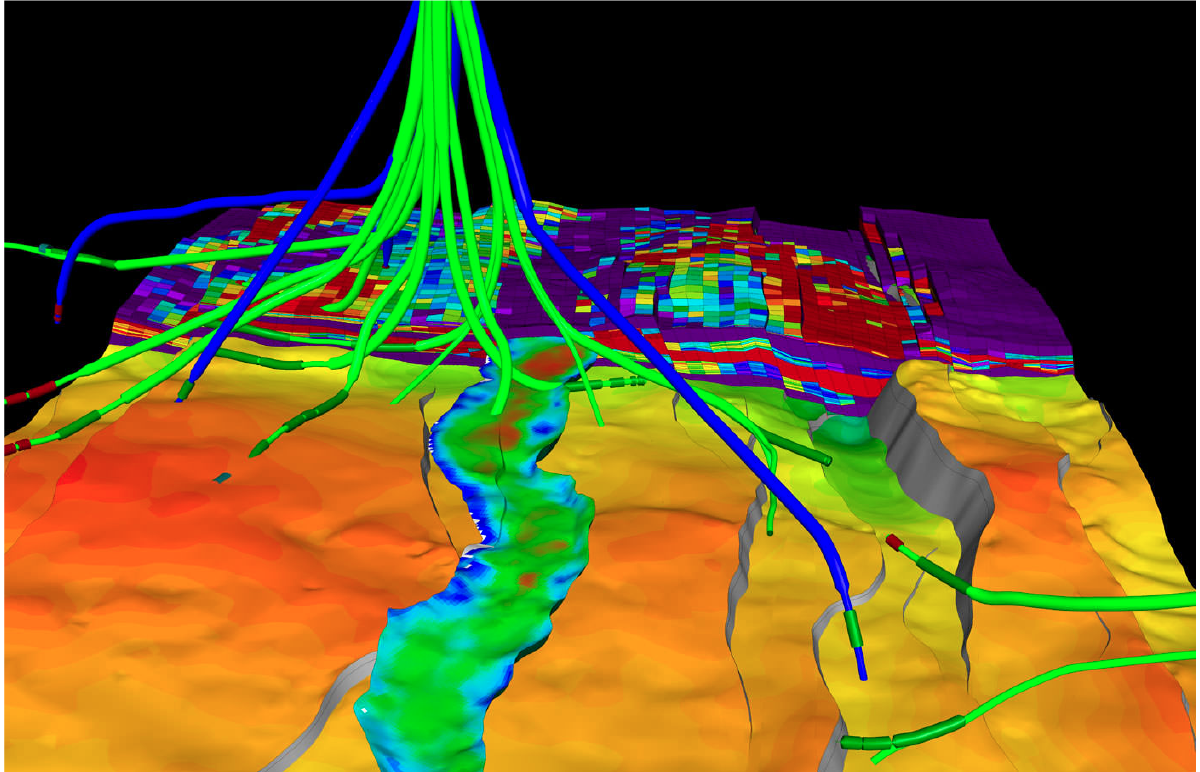

According to recent research by McKinsey & Company, integrating digital applications has allowed companies to increase their reservoir limits significantly, resulting in an average decrease of 20% in upstream per barrel capital expenditures. Some companies have also added a time dimension to 3-D seismic imaging, enabling them to better measure and predict fluid changes in reservoirs. McKinsey says this enhanced view of reservoirs typically increases the recovery rate by as much as 40%.

Example of 3D seismic data from the North Sea (Credit: Dynamic Graphics, Inc)

However, Phil Murray of Petrotechnics says collecting data from oil and gas installations is quite a messy and complicated process, as not all the parameters are clearly identifiable and laid out. He says information on the flows and pressures of a gas field and its wells is complex and variable, making it tricky to systematically digitise. Once the data is collected, it must be decided which bits are useful. This often amounts to no more than 10% of the total, which is then turned into intelligence with data analytics.

As well as using the available data to better manage production, virtual models can be generated from it, enabling testing and assessing of the lowest cost performance and development options.

“In drilling, non-productive time is a major metric – reducing idle hours using predictive analytics, by measuring various parameters associated with the well, can save millions across the drilling fleet,” Ramaprasad says.

Further operational and capital expenditure savings can be made from reducing manpower and associated equipment – such as living quarters and safety facilities - through greater remote operation and maintenance. Models and advanced sensors are also being used to predict maintenance, minimising the work that needs to be done and cutting unplanned outages.

Operational versus strategic digitisation

Murray says operational digitisation is being driven by opportunities to make quick savings on existing assets, where simple retrofitting of monitoring equipment can cut costs or enhance recovery with an immediate impact that pays back quickly. Most of the activity in the North Sea, for example, is of this type, with most of the new fully-fledged digital fields being developed elsewhere. Strategic digitisation, on the other hand, is more to provide a basis for intelligent autonomous operation at new platforms.

Ramaprasad says other digital areas that are gaining pace are virtual learning, where staff can be taught in offices how to operate equipment in remote locations.

“You can teach staff in offices by simulating in a non-remote location, and the cost of doing this is coming down quickly. It also avoids safety issues.”

He says visualisation of all sorts is advancing quickly, including in areas like supply chain management. “Flow through all storage points and pipelines can be visualised on a screen, with all monitoring done remotely…. It means operators can react to events much more quickly and so make better use of assets.”

Securing customers

Digitisation is also making itself felt at the downstream end of the gas value chain. According to Ramaprasad, the confluence of electricity and automotive fuels as the electric vehicle fleet expands means oil and gas companies are increasingly looking at setting up or acquiring electricity retailers. “Shell bought its first utility recently, which is an interesting trend. Several oil companies are working on projects to establish ‘Uber-like’ platforms to exchange electricity or any of their other fuel offerings, including diesel and natural gas. It would be a point where a customer could satisfy all their energy needs.”

Ramaprasad believes all major oil and gas companies currently have plans of some sort to improve consumer engagement and digitisation in retail business.

“The idea is to increase the level of personalisation, loyalty and product mix. To do this you have to engage online with the consumer – then make your proposition attractive enough to make it worth going to the retail outlet or fuel station.”

He says that oil and gas companies, especially integrated majors, are implementing digitisation strategies within their upstream and downstream business units separately, whereas utilities have more of a centralised approach.

“It’s very rare to have one chief CIO for a major – it’s normally one for each division - upstream, downstream…. Utilities, because they are smaller and more localised, can have one person overseeing a strategic approach, reporting to the CEO.”

The World Economic Forum recently estimated that the global value of a full digital transformation in the oil and gas sector would reach $1.6 trillion by 2030. Such substantial savings cannot be ignored by investors, and any company not looking at installing fully digitised systems will soon find they are unable to compete on a cost basis in today’s fast changing energy sector.

They may also find themselves falling behind in their ability to engage the customer in an increasingly complex multi-fuel retail sector.

Jeremy Bowden