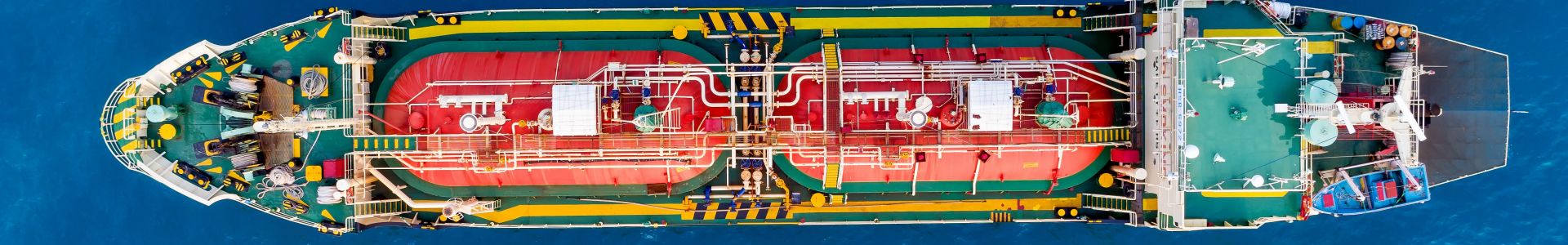

Nigeria licenses first floating LNG plant for export and domestic use

ABUJA, Sept 6 (Reuters) - Nigeria's oil regulator on Friday granted UTM Offshore Limited the first license to operate a floating liquefied natural gas plant, to tap flared gas from an ExxonMobil oil field in the Niger Delta.

Such plants are springing up on the continent as Africa seeks to tap its gas resources. Nigeria has more than 209 trillion cubic feet of gas reserves, but loses over $1 billion in annual revenue due to gas flaring, government estimates show.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

The 2.8 million tons per annum (MTPA) floating vessel owned by UTM will tap flared gas from ExxonMobil's Oil Mining Lease 104 (Yoho field) in offshore Akwa Ibom, in southern Nigeria.

Farouk Ahmed, head of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), said the plant's capacity had been upgraded from 1.2 MTPA to 2.8 MTPA due to growing LNG demand.

The engineering work will be completed in 2028, and production will roll out in the first quarter of 2029, UTM Offshore CEO Julius Rone said.

"This is just the engineering phase, and there are other variables. So it is not possible to give you the cost, but it is a multibillion dollar project."

The facility will deliver 500,000 metric tons of liquefied petroleum gas for domestic market, while the LNG will be exported, he noted.

Afreximbank provided $2.1 billion in financing the first phase of construction and committed for $3 billion for the second phase.

(Reporting by Camillus Eboh; Writing by Isaac Anyaogu; Editing by Richard Chang)