As Bulgaria moves to expand its grid, Russia keeps the Balkans guessing [NGW Magazine]

Gazprom completed the first string of offshore TurkStream (TS1) in April 2018, dedicated to supply 15.75bn m³/yr to Turkey’s domestic market from late next year; the second string, TS2, is to follow soon after.

The Netherlands-registered SouthStream Transport, responsible for the offshore section and terminals (Anapa in Russia and Kiyikoy in Turkey) told NGW that the second offshore string with the same capacity, dedicated to deliveries to Europe, would be completed in the coming months. “Both strings connect to Kiyikoy and deliveries from TS1 are expected to start by late 2019,” a spokesman said. Offshore engineering sources have also spoken of a landfall on Bulgaria’s Black Sea coast, which might not be for an offshoot of TS2.

But mystery surrounds the planned 180-km TS2 onshore section running from Kiyikoy to the border with Greece, to be built by a Gazprom/Botas joint venture; and further into the European markets.

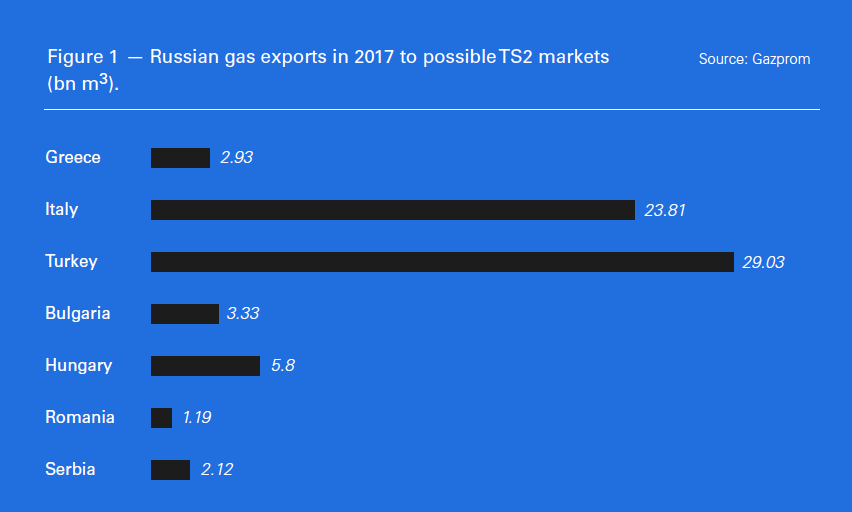

Greece expelled several Russian diplomats in May and relations between the two states have worsened. The Russian president Vladimir Putin said recently that Bulgaria can play a significant role in connecting its network to TS2 and transiting Russian gas to Europe. Analysts at Wood Mackenzie told NGW that Italy is likely to take Russian gas from Nord Stream and the possibility of TS2 expansion towards north (Bulgaria route) is higher.

A Bulgarian official told NGW that to build enough capacity to receive 15.75bn m³/yr TS2 gas would cost upwards of €2bn; or possibly even €4bn, given the age of the existing Trans-Balkan pipeline, now about 40 years old. Further investments are also needed for interconnectors and pipeline projects to transit gas to possible markets such as Romania, Moldova, Macedonia, Greece and the Balkans generally.

However, this will all be paid for through the standard, ship-or-pay contracts agreed during the final stage of the open season for incremental capacity, when binding prices are put on capacity.

Bulgartransgaz said November 8 that following the non-binding expressions of interest in the second stage, it has decided it is necessary to implement the development and expansion project, and it has submitted the documentation for the third and binding stage of the open season October 26 to the national energy and water regulator for approval. Phase 3 is planned to start and finish in December.

In the second phase, the interest shown was bi-directional across the border with Turkey, with most going from Turkey into Bulgaria. One major bidder in earlier rounds – in March of this year – indicated interest in shipping 567.4mn kWh/day (18bn m³/yr) for 20 years from 2019/20, with no interconnection point named; while another wanted 80mn kWh/d southwards at another border point. And another entity has – uniquely – expressed interest in taking 131.2mn kWh/d (about 4bn m³/yr) for the same period from the Black Sea at Varna. No other route details are given and these volumes are not backed by money. There is also interest in capacity into Serbia. There is no capacity bid for in the TransBalkan line, perhaps because it is already assumed to be Gazprom’s which might use it in reverse flow.

Bulgaria-Serbia link

Regardless of TS2, the construction of the Bulgaria-Serbia interconnector (1.8bn m³/yr) and the Bulgaria-Romania-Hungary-Austria (BRUA) project (1.75bn m³/yr by 2019 and 4bn m³/yr by 2022) are on track.

“The problem is that Russia doesn’t have any interest in investing in the needed infrastructures in the region, while the major markets, Hungary and Austria, are in the heart of Europe and they can receive gas easily from Germany (Nord Stream),” the Bulgarian official said.

In 2017, Bulgaria delivered 14bn m³ of Russian gas to Turkey and 2.93bn m³ to Greece, Gazprom’s statistics indicate. The official said that Bulgaria received only a little more than $200mn as transit fee. He said that if the investment issues are solved, Russian gas can reach Europe via TS2, but not before 2022.

Putin also announced earlier that Russia considers delivering TS2 gas to Italy, but the priority is Bulgaria and northern markets.

TAP working in Italy

Delivering gas to southern Italy is also feasible, either by building a second Greece-Italy offshore pipeline or expanding the planned TransAdriatic Pipeline (TAP) in the mid 2020s or even later. TAP’s first phase, at 10bn m³/yr, would start Azeri gas deliveries to Greece in 2020, then Albania and southern Italy.

Italy’s new government finally gave OK to TAP on October 27, Reuters reported. A week before that, the TAP consortium told NGW that construction of Italian section which would take 80% of Azeri gas deliveries would start soon. In an email November 8, TAP told NGW that it is progressively resuming works for the completion of the Italian section of the pipeline, after the summer break, and it is now carrying out activities aimed at making the construction sites and the offshore section fully operational, in line with all the authorisations that have been officially granted by the relevant authorities.

TAP said it is carrying out the steps required by the environmental monitoring project – which have also been approved by the relevant authorities – for all the activities it undertakes. TAP has all the necessary permits in place to carry out works that are being progressively resumed, it says; and out of the verifications of compliance, TAP has 32 out of the 39 needed for construction. The remaining seven, which relate to the offshore section to be built next spring, are being processed.

The second phase of TAP would double export volume, but it should find new consumers. For now, state-run Socar has a 1bn m³/yr gas sale agreement with Bulgaria and the construction work on the Interconnector Greece Bulgaria (IGB with 3bn m³/yr capacity) will start in the coming months in order to connect to TAP in time to deliver Azeri gas in 2020, even earlier than Italy’s Azeri gas intake. A source told NGW that Bulgarian prime minister Boyko Borissov will visit Baku in January 2019 to discuss the final stages of gas-related business.

About a half of Russia’s 194bn m³ of pipeline gas deliveries to the EU and Turkey went through Ukraine last year, but the transit contract will end in late 2019. Russia had first said it would extend the contract, but only for 10bn m³/yr, but now it is focusing on higher volumes and the sides are negotiating on the terms of new contract. Ukraine received about $3bn in 2017 as Russian gas transit fees.

It seems the alternative routes cannot replace Ukraine route physically for a couple of years; and if they did, the lack of gas in the east would pose significant problems to Ukraine’s pipeline operator. NS2 with 55bn m³/yr is also projected to be operational by late 2019, but it might slip; and it will take a while to fill up and begin commercial deliveries.

Russia is expecting to sell a record 205bn m³ by pipeline alone to the EU and Turkey this year; and further volumes for next years.