Norway to jumpstart German hydrogen transition

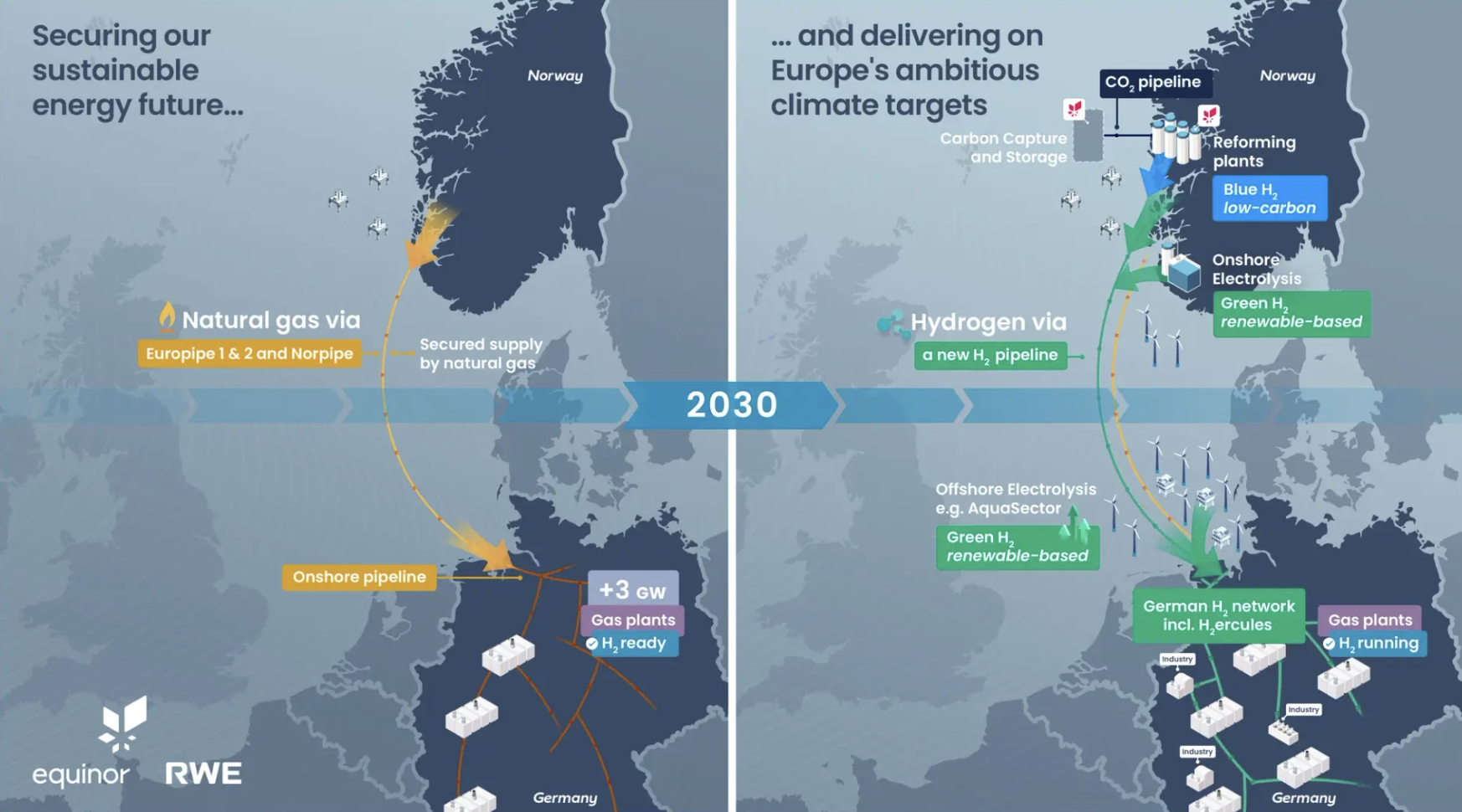

Norway and Germany's governments have agreed to cooperate on developing low-carbon technologies, while Norwegian state oil firm Equinor has signed an agreement with German utility RWE on building a pipeline to deliver blue and green hydrogen to Germany.

In a joint statement, Oslo and Berlin said they would expand heir cooperation in the fields of offshore wind power, hydrogen, battery technology and carbon capture and storage (CCS).

"The energy crisis has highlighted Norway's importance as a reliable supplier of gas to Europe, but it has also underscored the need to accelerate the transition to renewable energy," Norwegian prime minister Jonas Gahr Store commented. "Our collaborative efforts will help us to achieve our common goals of green industrialisation and lower emissions."

Equinor and RWE separately agreed to develop a hydrogen pipeline from Norway to Germany, as well as offshore hydrogen projects along its route. The two companies are working with Norwegian grid operator Gassco on a feasibility study for the pipeline.

The pair will also jointly invest in 3 GW of hydrogen-ready combined cycle gas turbine (CCGT) power capacity in Germany. Initially these plants will run on Norwegian gas, facilitating Germany's phase-out of coal-fired power while providing an alternative to Russian volumes. The hydrogen will arrive after 2030.

Norway has significant capacity to produce both blue hydrogen, thanks to its significant gas reserves, and green hydrogen, using its offshore wind potential. Equinor plans to develop 2 GW of blue hydrogen by the end of the decade, and expand this to 10 GW by 2038. The company said it could capture 95% of the CO2 when this hydrogen is produced.

"In order to make progress in the conversion from fossil fuels to hydrogen, there is an urgent need for a rapid ramp up of the hydrogen economy," RWE CEO Markus Krebber said in a statement. "Blue hydrogen in large quantities can be the start, with subsequent conversion into green hydrogen supply. This is exactly what we are driving forward with our partnership – providing the industries with significant quantities of hydrogen."

"The collaboration has the potential to develop Norway into a key supplier of hydrogen to Germany and Europe," Equinor CEO Anders Opedal added. "This is a unique opportunity to build a hydrogen industry in Norway where hydrogen also can be used as feedstock to domestic industries."

Norway also boasts significant carbon storage capacity. The government estimates that the Norwegian shelf could store the equivalent of 1,000 years of the country's emissions, and it is looking to offer up this capacity to its European neighbours.

The flagship CCS project in Norway is Northern Lights, which is being developed by Equinor, Shell and TotalEnergies. A final investment decision has been taken on Northern Lights' first phase, which will have a capacity of 1.5mn metric tons/year of CO2. It is expected to be enlarged to store up to 5-6mn mt/yr of CO2 under a second stage which is yet to be sanctioned.

Equinor and TotalEnergies signed the world's first commercial deal for CO2 transport and storage with Norwegian fertiliser group Yara in August.

Germany's energy transition strategy thus far has largely ignored CCS, in favour of renewables, hydrogen and increased electrification. CCS technology is currently prohibited in the country, although German economy minister Robert Habeck said on January 4 that Berlin was planning legislation next year to facilitate the deployment of CCS.

Habeck said there was no longer time to find alternatives to CCS in order to meet its climate targets.

"It's better to put the CO2 into the earth than into the atmosphere," he said.

Germany aims to cut its carbon emissions by 65% by 2030 from 1990 levels and bring them to net zero by 2045. As part of this plan, it is striving to completely phase out coal-fired power by 2038.

The country may need around 66 TWh of hydrogen by the end of this decade, according to the estimates of its energy agency DENA, and most of that is expected to be imported, either via pipeline or via LNG terminals that could be converted to receive the fuel. In October, the country received its first batch of blue hydrogen from the UAE. The 13mn mt cargo was in liquid ammonia form.

Domestically, the government has also earmarked €7bn ($7.4bn) for developing green hydrogen, but similar support is not available for blue hydrogen. It plans to produce 5 GW of green hydrogen by 2030, and expand this capacity to 10 GW by 2040.