Prelude FLNG drives improvements in Shell results [Gas in Transition]

Shell’s 2022 results, announced last week, reported a stunning (and record) pre-tax profit of $42bn – rather more than double profits for 2021. Seven tenths of the up-step came from Shell’s integrated gas division, caused by 2022’s gas price spike (gas volumes actually fell by 5% from 2021). Shell’s Integrated gas division turned in only 14% of group sales but more than half of Shell’s profits. If we assume that more gas margin is lurking in the profits generated by Shell’s chemicals division (profits here jumped from $0.4bn to $4.5bn) then it is fair to conclude that in 2022, Shell was a giant gas company with an oil and chemicals business attached.

Prelude repeatedly spoiled Shell’s gas story in past years

Shell’s 2022 gas story has been a troubled one in the recent past. Quietly buried in the notes to the accounts (in the smallest of small print) lay the footprints of a gas drama starring the world’s largest man-made floating object – the Prelude Floating LNG (FLNG) plant.

Prelude has been a story of extremes ever since it was conceived. With two large gas fields, Prelude/Concerto and Ichthys, all but stranded 250 km offshore northwest Australia and 2,000 straight-line km from the nearest body of consumers in Perth, Shell had three choices – abandon the stranded reserves, build an onshore LNG train and loading terminal nearby, or place a floating LNG terminal above the field.

Stranded fields, stranded gas plant

The land-based option was unappealing. Once the fields were depleted the land-based plant would have to be written off (unless a major new field appeared nearby, which is unlikely). Producing at a rate of 7-8bn m3/year Prelude’s 85-bn m3 reserves would be depleted in around a dozen years. A 3.6mn mt/yr shoreside plant, plus a terminal, export pipeline from the field, a 1-mn mt/yr LPG and condensate processing plant and a production platform on the field, would come in at a combined $8bn. Depreciation alone over twelve years would come in at about $0.10/m3.

When the project was being analysed back around 2008 LNG was selling for about $0.25/m3 (around $7/mn Btu). After operating costs and resource costs (quoted at about $5bn or $0.06/m3), Shell would be left with a poor margin, if any at all. Clearly a land-based LNG plant was not attractive.

So build a moveable gas plant

A liquefaction train costs much the same whether built ashore or afloat. The train would certainly need a large platform but that is just a big floating hull – cheap in the scale of energy investments. The win would be that a floating plant could deploy to new fields after Prelude depletes, and to give it a working life of at least 25 years, and perhaps as long as 35. Three times the working life with costs perhaps 30% higher than a land-based plant must have looked like an attractive idea.

A $10bn spend with a 25 year life at 5bn m3/yr plus 1mn mt/yr of condensates and LPG generates a depreciation charge of only $0.06/m3 (depending on how one allocates the charge between liquids and gases). If Shell got lucky and the plant lasted 30 years depreciation would fall to around $0.05/m3.

The numbers said yes

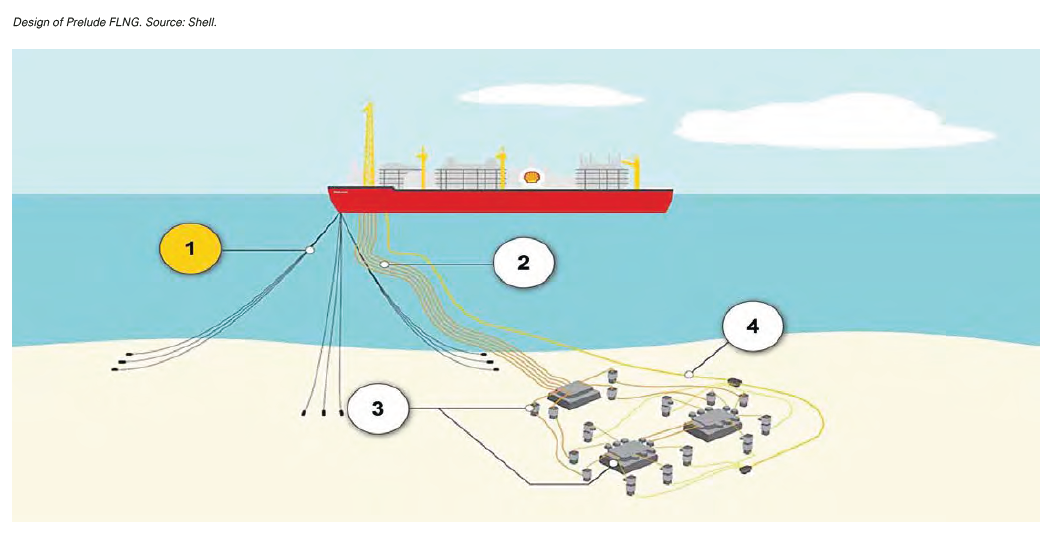

And so the plan was born to build the world’s largest floating object – the Prelude FLNG plant. The design was simple in concept. Fit 14 processing modules, each weighing about 5,000 mt, onto a 3.5 hectare deck. Add a 5,000-mt accommodation unit for 350 workers at the stern. At the bow add a rotating turret to accommodate the risers from Prelude’s subsea infrastructure. Inside the hull are insulated tanks to hold 220,000 m3 of LNG (about ten days’ production at 5bn m3/yr), with smaller tanks to hold associated LPG and condensate. Offload production weekly to a tanker through seven articulated loading arms amidships (four for LNG, the rest for condensate and LPG), and the job is done.

At her bow Prelude would be fitted with a 550-ft long flare tower for use in emergencies, and she would be moored to the seabed by a set of suction piles and 10,000 mt of steel chain cable. With her own power station and three small azipod thrusters to help her cope with bad weather, the sum of her parts came to 600,000 mt fully loaded. As Shell liked to point out during her build, that’s the equivalent of six US Navy aircraft carriers.

At her bow Prelude would be fitted with a 550-ft long flare tower for use in emergencies, and she would be moored to the seabed by a set of suction piles and 10,000 mt of steel chain cable. With her own power station and three small azipod thrusters to help her cope with bad weather, the sum of her parts came to 600,000 mt fully loaded. As Shell liked to point out during her build, that’s the equivalent of six US Navy aircraft carriers.

Prelude’s economics were also extreme. In theory she would produce 3.6mn mt/yr of LNG worth $1.3bn at $8/mn Btu, and about another $1bn of associated liquids. With an original planned capital cost of around $10bn (probably including subsea completion and tie-back of 14 risers and six umbilicals) and a life of 25 years, annual depreciation would cost only $400mn, annual payroll (300 crew aboard, another 300 ashore on leave) about $100mn, direct operating costs about $300mn, and depreciation of the field about $200mn/yr. That would leave a margin of something over $1bn/yr and a 10% return on capital. Gear up the investment with term debt and the ROC heads up to 20%.

The project as a whole would add roughly 1% to global LNG production, in a location convenient for LNG’s growth markets in Asia.

But reality found it hard to deliver the number

All good so far. But the outturn misfired on multiple fronts. First, the build came in substantially over budget. No one outside the senior levels of Shell knows exactly how much Prelude cost because Shell’s group numbers are large enough to hide the detailed cost within much larger lines in the accounts, but it is possible to infer Prelude’s true cost from later announcements by one of Shell’s partners in the deal, Inpex, and from occasional data-drops by Shell itself. We know, for example, that the design work alone ate up a reported 18mn person-hours at a cost of $1.5bn.

Within two years of Prelude’s startup in 2018, the owners were looking over their calculations with a jaundiced eye. As gas prices flatlined (pre-Ukraine war), with new LNG capacity galloping over the North American horizon, and with demand threatened by a growing orthodoxy on fossil fuels and global warming, Prelude’s shareholders booked major impairment charges to their investment.

Our own calculation (fraught with estimates) suggests that in 2019, Prelude looked like returning about 5% return on net capital invested, if it could get its utilisation up to something respectable. Shell’s average ROC is 16%, and its hurdle rate is probably a few points above that. In order to bring the carrying value into line with actual returns, the partners would need to write their investment down by around two thirds of capital invested. That is what happened at Inpex, as revealed by note to Inpex’s accounts.

Inpex revealed the scale of the pain, Shell echoes

In 2019 Inpex (with a 10% interest) declared an impairment charge of 129bn yen on its Prelude carrying value of 191bn yen. That carrying value implies that Inpex paid 320bn yen ($3bn) for its 10% Prelude interest, a number that likely included a 10%, in the Prelude and Ichthys fields. The implication of Inpex’s carrying value is that Prelude cost something around $20bn to build, excluding the carrying values of the fields and their subsea infrastructure.

In the same year Shell applied an unquantified impairment charge for its retained 67.5% interest in Prelude. This charge was contained within a larger impairment charge of either $10.7bn or $11.5bn (the amount depends on which of two notes in the accounts applies). Inpex impaired two thirds of its Prelude investment. If Shell did the same (likely, since the Prelude partners probably acquired a single impairment analysis) then potentially all of that $10.7-11.5bn might have been Prelude impairment, which would imply a pre-impairment carrying value of around $16bn, and a project cost of $23bn. A note in 2021’s accounts implies that no more than $9.2bn of the impairment charge came from Prelude. The same maths spins that up into a total Prelude cost of $21bn.

Reading between those lines we can see clear evidence that Prelude ran something like 100% over budget.

Low utilisation and gas prices lay at the heart of the problem

The reasons for an impairment charge in 2020 are not hard to find. Prelude struggled to reach its design utilisation right from startup. A cascade of accidents, outages, near-disasters and strikes constantly got in the way.

Indeed, it looks as if the longest production period without an interruption since commissioning in 2018 has been seven months. One source we have seen claims that Prelude has only been in actual production for a total of 18 of the 55 months since startup.

To add to utilisation woes, 2020 brought a painful dip in global gas demand and LNG prices as the world stood still for Covid. Shell’s average price achieved for gas fell by about a quarter.

Prelude’s impairment charge crashed Shell’s result for 2020, wiping out integrated gas’ profits completely (and then some), and contributing a material part of the group’s swing from $2 bn profit in 2019 to a $27bn loss in 2020.

But rescue was on the way

Like the rest of the gas world Shell’s investors had no inkling of what would happen to LNG prices in 2022. With gas prices spiralling following the European Commission’s effective banning of Russian gas in European markets, sales booked by integrated gas almost doubled, adding $25bn while moving 5% less actual gas.

Half of those sales flow from third-party gas traded rather than produced by Shell. In the traded segment it is likely that Shell’s margins moved by not much since purchase costs will have risen with sale prices. For Shell’s own production on the other hand (30mn mt of LNG = 38bn m3 of natural gas, plus 47bn m3 of un-liquefied gas) pre-tax profits leapt by $7bn, about $0.09/m3.

From Prelude’s perspective that price and margin uplift is highly material. Going back to our back-of-the-envelope calculations, at full utilisation, with a capital cost of $20bn, and with LNG at $20/mn Btu ($0.72/m3), Prelude’s pro forma pre-tax would come out at $2.5bn. Stretching useful life from 25 years to 30 nudges that up to around $3bn.

Utilisation is still a challenge

However, those are at full utilisation. Prelude’s operating problems have not yet gone away. 2022 saw a four-month shutdown because of failures in the on-board power plant, plus two months of strikes, and a fire on board to boot. Now, with the strike ended and operating skills growing with experience, Shell might expect to persuade its auditor to accept a forward utilisation number of maybe 90%. That $2.5bn prize is now firmly in sight.

Write down, write back

What that would mean for Shell is that an asset written down by two thirds in 2020 now needs to be written back up. A hurdle rate of 16% and pre-tax profits of $2.5bn implies a total project carrying value of $15bn, of which $10bn net would accrue to Shell.

If Shell’s original net investment of $14bn (67.5% of $21bn) was written down in 2020 by $9.3bn, to $4.7bn, a write-back to $10bn would appear as an adjustment in 2022’s announcement of somewhere north of $5bn.

And that is what Shell announced last week. In fact $6.1bn of write-backs were booked in the Integrated Gas division for 2022. It looks like most of that is Prelude, and that the Prelude roller-coaster accounted for nearly a third of Shell’s group profit uplift.

At last Prelude might pull its considerable weight

Looking forward, what does all that mean for Shell’s ongoing profit growth and the global LNG market? For the latter Prelude represents a shade under 1% of world LNG production – large for a single ship but not highly material.

Once Shell gets on top of its reliability Prelude should run at 95% utilisation. If Shell could get there (and frankly we see no real reason why not, it is just an LNG plant after all), and sustain $20/mn Btu, Prelude should turn in a reliable $2.5bn/yr net to Shell for a decade to come.

In its LNG global outlook briefing on February 16, Shell’s two executive vice presidents for gas displayed calm confidence for both LNG volumes and prices for the two decades ahead. Shell’s house outlook is that as early as 2030, LNG market changes will create a structural gap of some 140mn mt/yr (180bn m3) above present and planned global production.

Happily ever after

On the price side, while TTF prices peaked at $94/mn Btu in August 2022 many buyers, Asian ones in particular, were sheltered from price spikes by long term contracts. 80% of Asian volumes were bought on term contracts in 2022. As those contracts work their way out of the market and demand up-steps outpace supply up-steps the prospects for sustained high prices look fairly sound. At $30/mn Btu, Prelude would book over $4bn pre-tax.

In a market shaped like that, or close to it, Prelude’s pre-tax contribution might amount to as much as one tenth of Shell’s group profits alone (plus maybe a few more write-backs). Which would bring Shell back to where it probably expected to be when it signed off on Prelude’s original investment plan. It may have been a rocky road, but Shell’s Prelude bet may at least be about to pay off.