Progress on gas flaring stalls [Gas In Transition]

Eliminating methane flaring would cut the world’s CO2 emissions by approximately 361mn metric tons, and its methane emissions by some 39mn mt of CO2 equivalent. And in many cases, it would provide significant additional energy supply – something that is highly sought after in today’s crisis. Yet progress has stalled over the past decade, according to a report published by the World Bank in early May, with global flaring volumes and flaring intensity seeing limited change during the period.

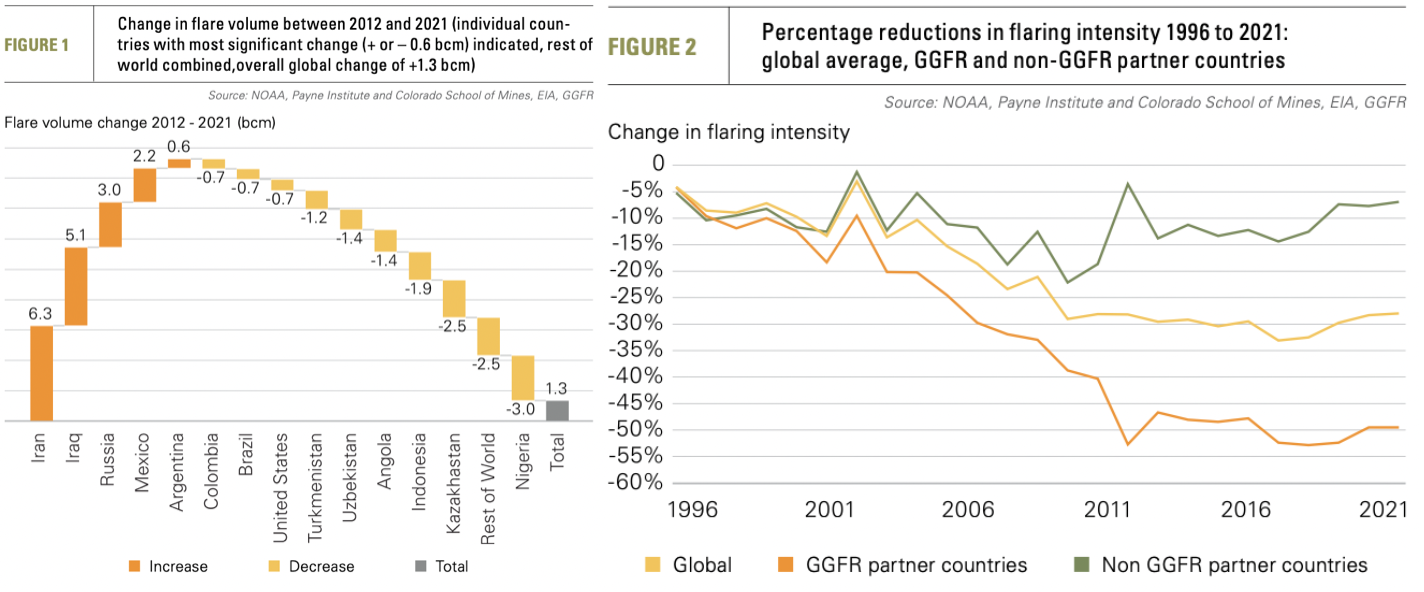

In contrast to early progress made in the late 1990s and 2000s, after satellites began observing methane emissions, flaring volumes have remained static over the last ten years, plateauing at around 144bn m3. This is enough gas to produce some 1,800 TWh of energy, equal to two-thirds of the EU’s net domestic power generation. Similarly, flaring intensity has stayed at around 27.5%.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

The World Bank’s report paints a frustrating picture. In 2012-2021, significant reductions in flaring achieved in countries including Nigeria (-3bn m3), Kazakhstan (-2.5bn m3) and Indonesia (-1.9bn m3) were overshadowed by larger increases in countries like Iran (+6.3bn m3), Iraq (+5.1bn m3) and Russia (+3bn m3). All told, the global amount of methane that was flared increased by 1.3 bcm (see figure 1).

The bank drew attention to some key success stories. One is Kazakhstan, ranked as the 18th biggest flarer, which reduced its flaring volume by 62% and its flaring intensity by 67% between 2012 and 2021. The US, in fourth place, cut its flaring volume by 8% and its intensity by 46%. This feat is all the more impressive considering the more than 50% expansion in the country’s oil production over the same period. Nigeria, the seventh top flarer, reduced volume by 31% and intensity by 10%.

There are just as many worrying cases, however. Mexico, in eighth position, flared 53% more methane last year than it did in 2012, while its intensity increased by a staggering 126%. Likewise Iraq, in second place, increased flaring by 41% over the period, as its intensity grew by 3%.

The report casts doubt on the effectiveness of the Global Gas Flaring Reduction Partnership (GGFR), the bank’s own initiative launched in 2002 to bring an end to routine flaring at oil production sites. While GGFR partner countries made substantial reductions in intensity during the 2000s, progress has languished over the past decade (see figure 2). It is also interesting to note that Russia, Iraq and Mexico, which all increased flaring volumes last year and are among the world’s top ten flarers, committed in 2016 to the World Bank’s Zero Routine Flaring by 2030 initiative.

The worst flaring offenders have largely remained the same over the past decade. Seven of the 10 biggest flarers – Russia, Iraq, Iran, the US, Venezuela, Algeria and Nigeria – have held this position consistently over the past decade. And the top 10 account for 75% of total flared volumes. In terms of intensity, the worst performers in recent years have been conflict-affected and insecure countries Syria, Yemen and Venezuela.

Solutions

The bank points to “a lack of political will and leadership in developing appropriate markets and infrastructure to recover and utilise the gas” as the main reason for stalled progress. On the other hand, while technology and innovation have an important role to play, the technology is already available to prevent most flared volumes. It also calls for effective regulation and strong enforcement. In its Global Flaring and Venting Regulations: A Comparative Review of Policies study, it notes a number of mechanisms that can be used to both penalise flaring and incentivise the use of the saved methane.

In the case of Kazakhstan, flaring of associated gas has been prohibited since the mid-2000s, with certain exceptions. Under its 2017 subsoil law, Kazakhstan requires operators to minimise flaring when drawing up new field development plans, and flaring measurements must be reported to the country’s energy ministry. Companies that violate the rules can face penalties. Astana also launched Asia’s first greenhouse gas emissions trading system in 2013, and in 2018, an online platform was created for monitoring, reporting and verifying these emissions.

Indonesia meanwhile limits flaring volumes to the equivalent of 3% of a field’s gas production, or no more than 5mn ft3/day over six months, 0.3% of a gas-processing facility’s intake and 0.8% of a refinery’s intake. However, neither country has an overarching target for achieving further reductions.

In Iran’s case, efforts to address flaring that have been primarily motivated by economic gain rather than climate benefit have been stifled by a lack of investment, due in large part to international sanctions. Meanwhile, most contracts for oil development in Iraq lack clauses for commercialising gas, and coupled with a lack of necessary infrastructure, that gas is often simply flared.

In Russia, the government has been trying to get its oil producers to utilise 95% of the associated petroleum gas they attract for years. But a lack of infrastructure in some regions, and the absence of significant fines, or incentives, has stunted progress. Crippling sanctions imposed in the wake of Moscow’s invasion of Ukraine will not help matters. In recent years Russian oil producers have sought to eliminate flaring to improve the environmental, social and governance (ESG) scores, to entice more international investment and increase their share prices. But with much of the international community now shunning investment in Russia anyway, this incentive no longer exists.

The World Bank notes that beyond the economic benefit, tackling flaring can strengthen the case for gas as a means of reducing energy sector emissions, directly by replacing coal and liquid fuels, and indirectly by serving as feedstock for low-carbon hydrogen. But stalled progress, should it continue, will undermine the climate case for gas, making policy-makers and investors think twice before committing to new projects. Evidently this is an area where bold promises need to be followed up by greater action.