Project spotlight: Cedar LNG [Gas in Transition]

Getting LNG projects up and running in Canada has proved challenging, particularly when set against the inevitable comparison with the US. To date, only one major project has seen a final investment decision (FID) and started construction – Shell’s large-scale 14mn tonnes/year LNG Canada project, which is moving towards its first exports in 2025.

In its mid-summer update, LNG Canada reported that the facility was 85% complete and that progress was being made on its potential Phase 2 expansion.

However, LNG Canada’s sole journey could change later this year with an FID on Cedar LNG slated for the fourth quarter and first exports expected in 2027. In addition, Woodfibre LNG, a unit of Pacific Energy, said it plans to start construction work on its 2.1mn t/yr facility in September, although no formal FID has been taken.

Cedar LNG

Although much smaller than LNG Canada at a proposed 3mn t/yr, Cedar LNG is touted as the new model for Canadian LNG development. It is the first to be majority owned (50.1%) by an indigenous community, the Haisla Nation. Canada’s Pembina Pipeline holds the remaining stake in the project.

Cedar LNG also aims to produce some of the lowest carbon LNG in the world and, in line with provincial climate targets for the oil and gas industry, reach net zero by 2030.

Both facets of the project’s development – low carbon emissions and its unique First Nation leadership – have attained equal importance with its economic viability.

Short transit routes

The project benefits from one of the shortest routes to key Asian markets, being one to 15 days closer to general Asia Pacific markets than other west coast ports such as Vancouver or Los Angeles.

Neither city has LNG export facilities, making the company’s comparison somewhat moot, but when set against US Gulf Coast LNG, which has to transit the Panama Canal to emerge much further south in the Pacific Ocean, Cedar LNG’s advantageous geographical position is clear.

It is also better positioned for the major LNG markets of north Asia than both potential Mexican west coast LNG projects and Russia’s Arctic LNG exports. Like the latter, Cedar LNG will benefit from a relatively cold climate, which reduces liquefaction costs, even if Canada’s Pacific coast is milder than the rest of the country. Cedar LNG also has an ice-free, deepwater channel for its LNG carriers to transit, travelling through Douglas Channel to the Hecate Strait.

Upstream gas supply and transit

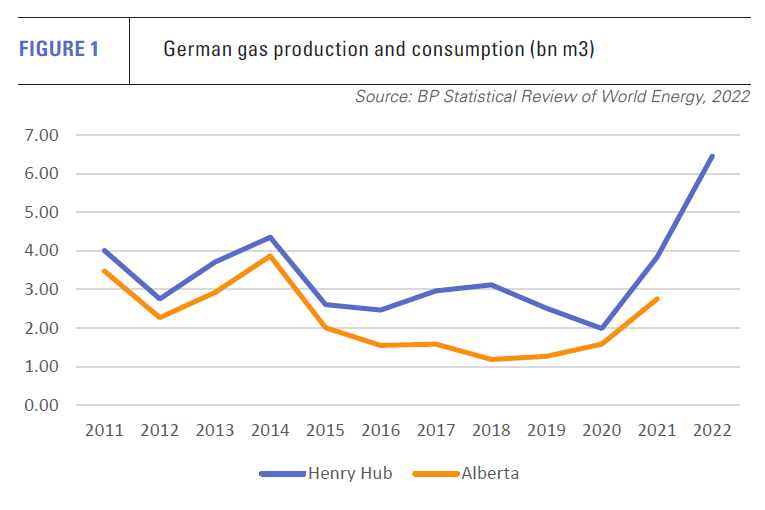

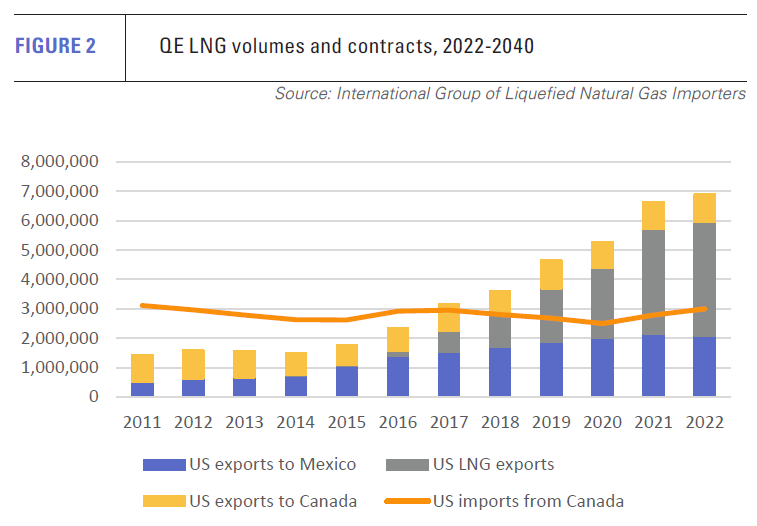

Feed gas will be sourced from British Columbia and Alberta with the bulk coming from the prolific Montney shale play. In recent years, Canadian gas prices have been significantly lower than US Henry Hub, averaging $2.75/mn Btu in Alberta in 2021 versus $3.84/mn Btu in the US (see figure 1). The price discount reflects the growth of US domestic gas supply and Canada’s lack of outlets for its own production beyond the US market (see figure 2), something which the development of LNG capacity may change.

US Gulf Coast producers benefit from the low cost of gas production in the region’s shale plays, but also have to contend with competition from seemingly ever-increasing US gas exports to Mexico. In June, these hit a new record at 6.8bn ft3/d on average as hot weather pushed up Mexican demand for electricity generation. US gas exports to Mexico are forecast to continue growing as Mexico expands its domestic gas network and more cross-border transmission capacity is put in place.

Back up north, feed gas will be supplied to Cedar LNG via an 8.5-km connection to the under construction Coastal GasLink Pipeline (CGL), which was reported to be 89.4% complete as of July. Like Cedar LNG, the pipeline has actively engaged First Nations, gaining support from the 20 indigenous communities along the project corridor.

The pipeline is being built by TC Energy, which has signed option agreements to sell a 10% equity interest in the pipeline to indigenous groups, 16 of which have formed CGL First Nations Limited Partnership and the FN CGL Pipeline Limited Partnership for the purpose. The options can be exercised once the pipeline is in service, subject to normal approvals and consents, including that of LNG Canada, which will also receive its feed gas via CGL.

More than 630 km of pipeline has been installed running from near Dawson Creek to Kitimat on Canada’s west coast, out of a total 670 km. The pipeline will have initial capacity of 2.1bn ft3/d, with potential for 5bn ft3/d with the addition of more compression.

Offtake MoUs in place, but firm deals lacking

The cost of CGL has risen significantly since initial projections were made and is now put at C$14.5bn ($10.7bn), up from C$11.2bn in 2022, itself a huge jump from the previously estimated C$6.6bn.

The level of inflation may raise concerns about transit costs, but, in March, Cedar LNG announced a memorandum of understanding (MoU) with Montney producer ARC Resources on a liquefaction agreement, which would account for 1.5mn t/yr of the plant’s capacity, equivalent to gas supply of 200mn ft3/d over 20 years.

The level of inflation may raise concerns about transit costs, but, in March, Cedar LNG announced a memorandum of understanding (MoU) with Montney producer ARC Resources on a liquefaction agreement, which would account for 1.5mn t/yr of the plant’s capacity, equivalent to gas supply of 200mn ft3/d over 20 years.

ARC Resources will own the gas through each stage of the value chain and undertake marketing of the LNG. It will also supply gas to LNG Canada via CGL under a supply agreement signed in 2021 for 150mn ft3/d. The agreement between ARC and Cedar LNG appears, in effect, to be a tolling agreement with ARC taking on the risk between upstream, transit and liquefaction costs on the one hand and the market price for LNG in Asia on the other.

ARC Resources says it wants to increase its exposure to international gas pricing, quoting the Platts JKM, which assesses the price of spot LNG cargoes in the Asia-Pacific area.

But what about the other half of Cedar LNG’s capacity?

To get the financing in place for development, LNG projects typically need offtake agreements covering close to 100% of nameplate capacity. At the time of the ARC Resources MoU, Cedar LNG said it was continuing commercial discussions with investment grade counterparties for additional long-term offtake commitments. In August, the company said it had signed non-binding MoUs for additional LNG offtake, covering the facility’s full capacity.

Positive news for the project, but non-binding MoUs still need to be firmed up, if they are to pass muster with the banks.

An FID on the project is currently expected in the fourth quarter of this year. Q4 is slightly later than expected, but a decision to engage in a second front-end engineering and design phase (FEED) last year has meant a delay, according to the company, while the new study catches up with the first FEED study awarded to Black & Veatch and Samsung Heavy Industries in February 2022.

Low-carbon LNG

Cedar LNG is emerging into an ever-evolving regulatory framework when it comes to the environment. In March, the BC government released a new energy action framework, which requires all proposed LNG projects to pass an emissions test with a “credible” plan to be net zero carbon by 2030.

This is a test which Cedar LNG appears to have passed. It gained its environmental assessment certificate from the British Columbia Environmental Assessment Office (EAO) in March. This commits it to taking all possible measures currently available to reduce its greenhouse (GHG) gas emissions to the lowest possible level, while working towards net zero emissions by 2030.

The environmental certificate comes with 16 legally enforceable conditions, which Cedar LNG must follow over the lifetime of the project, according to the BC government. This includes a GHG reduction plan that addresses provincial emissions reductions targets and schedules.

Under a substitution agreement, the BC EAO carried out the assessment on behalf of the federal government, eliminating the duplication of two assessments for a single project.

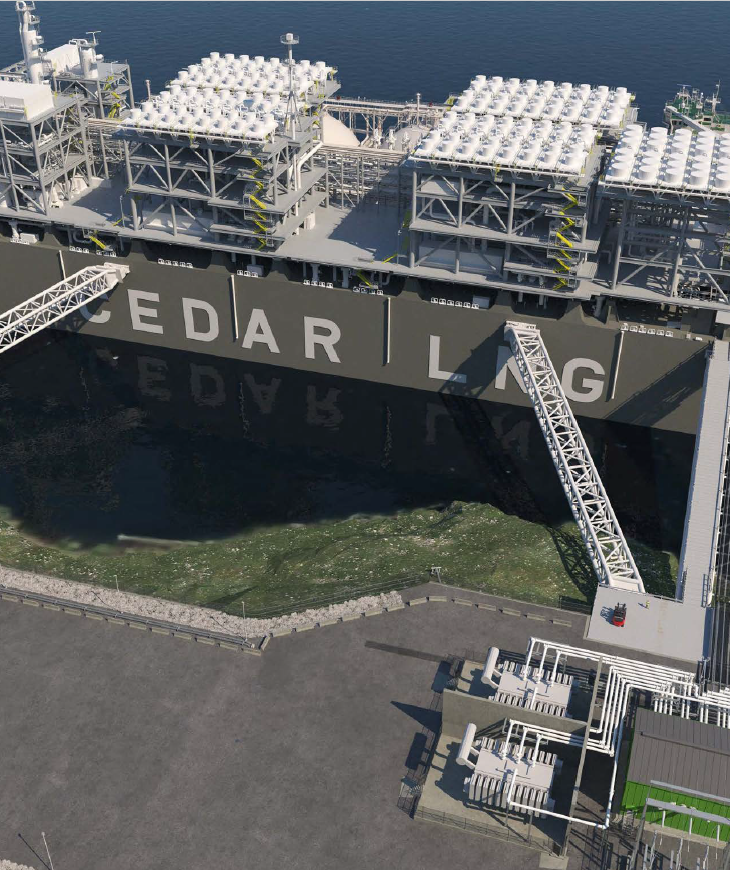

Central to the project’s low carbon ambitions is the use of electric drive trains supplied by renewable energy provided by power utility BC Hydro. An 8.5-km, 287-kV transmission line will run from BC Hydro’s Minette substation to the offshore, floating liquefaction facility and marine terminal.

The floating LNG facility will be permanently moored and consist of gas receiving and treatment units, LNG trains, air cooling systems, a flare system and LNG storage tanks with capacity of up to 250,000 m3, in addition to other necessary infrastructure. It is expected that up to 50 LNG Carriers will berth and load during the course of a year, escorted by tugs.

The floating LNG facility will be permanently moored and consist of gas receiving and treatment units, LNG trains, air cooling systems, a flare system and LNG storage tanks with capacity of up to 250,000 m3, in addition to other necessary infrastructure. It is expected that up to 50 LNG Carriers will berth and load during the course of a year, escorted by tugs.

According to the environmental approval, annual net GHG emissions during project operation are estimated at 251,000 t of CO2 equivalent with the GHG emissions intensity put at 0.08 tonnes of CO2 equivalent/t of LNG produced. Annual upstream emissions are estimated at 959-975,000 t of CO2 equivalent.

This certainly puts the project on a firm low carbon basis compared with the industry average, but achieving net zero by 2030 is likely to require further emissions abatement or offsets.