Pyrolysis: the most promising hydrogen production method? [Gas Transitions]

"Pyrolysis can be a cost-effective and scalable solution to hydrogen production,” according to a recent report from international energy consultancy Pöyry, commissioned by the German gas advocacy group Zukunft Erdgas. The study, Hydrogen from natural gas – the key to deep decarbonisation, is “the first European decarbonisation study to consider methane pyrolysis as a third hydrogen production method alongside steam methane reforming with CCS and electrolysis,” says Pöyry.

For the European (and international) gas industry, the possibilities of pyrolysis could become a very important matter. Consensus has emerged among energy specialists that “molecules” will be an indispensable part of the future low-carbon European energy system. Even Greenpeace in Germany has come to the conclusion that electrification alone will not be able to deliver a climate neutral energy system in a cost-effective and timely way. The question is what form these molecules will take.

Almost certainly the key part will be played hydrogen, but debate is still raging whether this will be mostly “green” hydrogen, made from renewable energy through electrolysis, or “blue” hydrogen, made from natural gas through steam methane reforming in combination with CCS. Although green hydrogen is preferred by the likes of Greenpeace, most experts believe that there is not enough renewable energy available to scale up production of hydrogen to the extent necessary for a timely transition.

Yet blue hydrogen, preferred by the gas industry as it will keep natural gas in the mix, also faces its challenges. The main disadvantage is that it requires carbon capture and storage (CCS), which is controversial in many countries, and which is feasible in any case only where there is storage for CO2 available, e.g. in empty gas fields. In other words, blue hydrogen offers a very uncertain path for natural gas going forward.

But now a third alternative has emerged: hydrogen made through pyrolysis. This, as described by Pöyry, is the decomposition of methane into hydrogen and solid carbon. (See box). As the carbon produced in this process is solid rather than gaseous, it requires no underground storage. On the contrary, it does not have to be stored at all: it can be used in existing industries, e.g. as carbon black in tyres, and in applications such as concrete and batteries.

In theory then pyrolysis seems to be an even more attractive option than blue hydrogen, which is why prominent gas companies, like Gazprom, are expressing great interest in the technology. John Williams, Senior Principal at Pöyry, specialised in natural gas and hydrogen, explains that Pöyry’s recent study, which came out in July 2019, builds on an earlier report, from May 2018, which had already concluded that a decarbonized energy future in Europe cannot be built on electrification alone. “But then pyrolysis came along and we decided to look into that as well,” says Williams. “So we did the calculations again, but now with pyrolysis included.”

What is methane pyrolysis?

From the Pöyry report Hydrogen from natural gas – the key to deep decarbonisation”, July 2019:

Methane pyrolysis (also known as methane splitting or thermal decarbonisation of natural gas) is an existing technology, which uses high temperatures to break down natural gas molecules (CH4) into hydrogen (2 H2) and solid carbon (C) products, such as carbon black or synthetic graphite. These solid carbon products should not be confused with soot or ‘black carbon’ which is the undesired by product of incomplete combustion.

Methane pyrolysis is already used commercially to produce carbon black with hydrogen as a by-product. (…) Different processes can be used in pyrolysis including thermal, catalytic and plasma based technologies. The energy required for the pyrolysis reaction can be provided by electricity (for example from renewables) or from the natural gas feedstock or the hydrogen produced as part of the process. (…)

The methane pyrolysis technology has been assessed against the existing hydrogen production technologies, such as, steam reforming and electrolysis in six different environmental impact categories according to the Life Cycle Analysis (LCA) methodology [ISO 14040, ISO 14044]. The results of that study showed that the use of methane pyrolysis based on liquid metal technology for hydrogen production has a comparable Global Warming Impact to hydrogen production from renewables.

Markets already exist for solid carbon, which therefore creates value that can offset the cost of the hydrogen production. Carbon black is used in the production of car tyres, providing reinforcement, and also as a pigment in plastics, inks and paints. Other uses for carbon black include as an Ultra Violet (UV) stabiliser in plastic pipes, and in electronics. Carbon black can be formed into pellets to make handling easier. Carbon black is non-toxic and will not leach or release any constituents to the groundwater if stored underground.

Another solid carbon product, synthetic graphite, can be used in lithium ion batteries as the anode. (…) Synthetic graphite can also be used in steel making as the electrode in electric arc furnaces, or as a refractory (heat resistant material) in furnaces and crucibles. Synthetic graphite can replace naturally occurring graphite, which is mined, 69% of it in China. The European Commission has identified the EU’s dependence on imported raw materials for batteries as a source for concern.

Other carbon products include graphene, carbon fibre and nanotube carbon. Carbon fibre is used as part of composite materials in applications such aerospace and cars, wind turbines and construction. Graphene, which is a special form of graphite, is a relatively new material, known for its high strength and conductivity. Potential applications include semi-conductors, batteries and electronics. Nanotube carbon is used in polymers, plastics and batteries. (…)

Although pyrolysis is still in its infancy, Pöyry is optimistic about its prospects. “We found that steam methane reforming (SMR) with CCS is still the cheapest method of producing hydrogen, but pyrolysis is likely to be cheaper than electrolysis, although all technologies still need to be scaled up.” This cost comparison does not even include possible revenues from carbon black. Williams: “It’s possible that the price will drop to very low levels if solid carbon is produced on a large scale, so we didn’t include this.”

Gas transmission network

But it does not have to be a question of either-or, says Williams. All three options could be part of a portfolio of hydrogen production technologies. “Without pyrolysis, there could be a limit on the amount of hydrogen available, either blue or green, since CCS and renewables both have their limitations. Pyrolysis would not replace these options, but would enlarge the market and could make it more cost-effective.”

He notes that the cost-effectiveness of the technologies also depends on the location in which they are employed. “Electrolysis may be most cost-effective in Southern Europe where there is a lot of sunshine, SMR plus CCS in countries around the North Sea that have empty gas fields, and pyrolysis in place where the possibilities of renewable energy and CCS are more limited.” The whole discussion around which type of hydrogen would be the cheapest is pretty academic in any case, notes Williams. “At this moment, all types of hydrogen production need to be scaled up.”

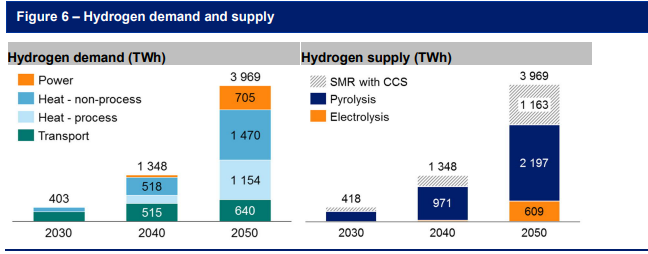

Nevertheless, in Pöyry’s new “Zero Carbon Hydrogen Pathway”, in which pyrolysis is included, hydrogen from pyrolysis comes out a winner, as can be seen in this chart:

Source: Pöyry, Hydrogen from natural gas – the key to deep decarbonisation”, July 2019. In the report the Zero Carbon Hydrogen Pathway is compared to an “All-Electric Pathway”.

One key advantage of pyrolysis, notes Williams, is that it can be produced near the demand source. “This mean the entire gas transmission network could be kept intact, including gas storages. Hydrogen would be used only in the distribution network, and in industry, which make adaptation of the system much easier and cheaper. Electrolysis, by contrast, requires transportation of hydrogen from centres with high renewable energy production to demand centres that could be hundreds of kilometres away. CCS also requires the building of new transport systems for the CO2.”

Continuing the use of the gas transmission networks would also make the transition easier, notes the report: “Whilst the gas transmission networks continue to carry natural gas, individual distribution networks can be converted to carry hydrogen in a phased and planned roll out. If the transmission grid were converted to hydrogen, all the connecting distribution grids and their customers would have to be ready to switch to hydrogen at the same time. Such an approach would place a severe strain on the supply chain (for example, the need for gas engineers to visit every home to make sure all appliances are capable of switching).”

A further advantage of continuing to use the gas transmission network, notes Williams, is that the gas wholesale markets could continue to operate in the same way as today. As the report notes, “instead of gas being used predominantly as an end use fuel, it would become mainly a feedstock for zero carbon hydrogen. As different companies (for example utilities, industrial users) could produce hydrogen there would continue to be many different buyers on the wholesale market, as there are today. The supply of natural gas would be largely unchanged. European buyers of natural gas would continue to benefit from the competition between indigenous production, pipeline imports and LNG as they do today.”

Thus, there would be “no need to wait for a deep and liquid traded hydrogen market to develop whilst grids are switching from hydrogen to natural gas, as consumers would still benefit from gas to gas competition. Nonetheless, competition between different hydrogen producers could still develop. For example, hydrogen from electrolysis could compete with that from natural gas in areas with access to renewables and either pyrolysis or SMR with CCS,” notes the report.

The report concludes that “pyrolysis becomes a key enabler of decarbonisation with hydrogen”. For this to happen, however, a hydrogen market needs to be developed in the first place, says Williams. This, he adds, “will require incentives from policymakers. If these are not forthcoming, the hydrogen market may not get off the ground at all.”

Innovation Award

Professor Alberto Abánades of the Polytechnic University of Madrid, a prominent researcher in the pyrolysis field, agrees with Williams that “all technologies are needed” in the drive for decarbonization. He does point out that there is a fundamental difference between pyrolysis and CCS: “With pyrolysis, carbon is re-used, so it becomes part of a closed circular system. This would make the production process part of the circular economy that we want to achieve in Europe.”

Abánades is optimistic about the uses that may be found for carbon black as well as for synthetic graphite, which can be made from solid carbon. “The widespread use of pyrolysis could lead to new markets for carbon being developed. Right now the market for solid carbon is limited. When you start producing it in huge quantities at low cost, you can open up new markets, for example in carbon bricks or carbon fibres, and in batteries.”

But even if the solid carbon is stored rather than re-used, it has an advantage over CO2-storage, notes Abánades. “When you store CO2 you have oxygen too. You have 44 grams of material. When you store solid carbon you have only 12 grams. And you can do this onshore, for instance in old coal mines.”

Abánades was involved in one of the most promising research projects involving pyrolysis, carried out by researchers from the Karlsruhe Institute of Technology (KIT) and the Institute for Advanced Sustainability Studies (IASS) in Potsdam in Germany. This group used a new approach in pyrolysis technology, based on liquid metals. They won three awards for their research, says Abánades, including most recently the Innovation Award of the German gas industry. (For more details on their approach and the award, see this article on NGVGlobal.com.)

“We found that traditional ways of pyrolysis worked in the lab, but not when they were scaled up. We spent some four years to produce a proof of concept based on liquid metals which we showed can be scaled up.”

But Abánades does not know exactly what next steps are being taken to make pyrolysis market-ready. “I did not get new funding to develop this further in Madrid, since the public funding agencies felt it is now more a question of market development instead of basic research. I know several companies are carrying out projects, in the U.S., Canada and Europe, but they tend to be somewhat secretive.”

So will pyrolysis be able to save the natural gas industry in a low-carbon future? “I’m not concerned with that,” says Abánades. “I am not from the gas industry. My aim is to come up with a solution for CO2 emissions. I think gas will be used for at least another thirty years. I don’t think we have a substitute. That’s why we have to come up with ways to decarbonize natural gas.”

How will the gas industry evolve in the low-carbon world of the future? Will natural gas be a bridge or a destination? Could it become the foundation of a global hydrogen economy, in combination with CCS? How big will “green” hydrogen and biogas become? What will be the role of LNG and bio-LNG in transport?

From his home country The Netherlands, a long-time gas exporting country that has recently embarked on an unprecedented transition away from gas, independent energy journalist, analyst and moderator Karel Beckman reports on the climate and technological challenges facing the gas industry.

As former editor-in-chief and founder of two international energy websites (Energy Post and European Energy Review) and former journalist at the premier Dutch financial newspaper Financieele Dagblad, Karel has earned a great reputation as being amongst the first to focus on energy transition trends and the connections between markets, policies and technologies. For Natural Gas World he will be reporting on the Dutch and wider International gas transition on a weekly basis.

Send your comments to karel.beckman@naturalgasworld.com