Repsol To Challenge Spain's Gas Natural

Repsol announced June 6 its 2018-20 Strategic Plan which treads deliberately on the toes of its former partner Gas Natural (GN) in its aims to move into Spain’s wholesale and retail energy markets, including power generation.

Between 2018 and 2020, it plans to invest €15bn ($17.5bn), of which 53% upstream and 45% downstream, including Gas & Power. The total will include €2.5bn on low-emission energy projects. The plan is self-financed on the basis of $50/barrel of Brent crude. Repsol said it will reduce CO2 emissions by 2.1mn mt by 2020, from 2016 levels, even though the company will grow.

In its downstream strategy, Repsol plans to “create a successful wholesale gas business” by leveraging its existing position as Spain’s largest industrial consumer. It sets itself two targets by 2025: to have a greater than 15% share of Spain’s wholesale gas market, but also to carve out a 5% Spanish retail gas and power market share that would equate to 2.5mn customers, in both cases competing against GN.

On the wholesale gas front, that marks quite a reversal from five years ago. Repsol slimmed down its wholesale gas portfolio in 2013, when it agreed to divest its international LNG business to Shell for $6.7bn. But Repsol's decision four months ago to sell its 20.072% stake in Spanish utility GN, which it held for almost 20 years, gives it now the opportunity to compete head on against GN.

GN last week announced its own restructuring in order to better focus on its strengths.

Another Repsol downstream strategy goal outlined June 6 is to build up a low-carbon generation portfolio – again setting itself up as a challenger to GN. Repsol said its aim is to develop 4.5 GW of generation capacity by 2025 with a mix of solar, wind, gas-fired power plants and other low-carbon technologies. It will also “diversify into emerging countries that yield higher returns,” an idea it may have borrowed from Eni and Total.

Repsol launches upstream drive

Spain's integrated oil and gas group also said it will grow its production by 8% to 750,000 barrels of oil equivalent/day in 2020, from 695,000 boe/d in 2017. Upstream will invest €7.9bn between now and 2020, it said, of which some 60% will go on growth projects and exploration. It will prioritise onshore and shallow-water projects.

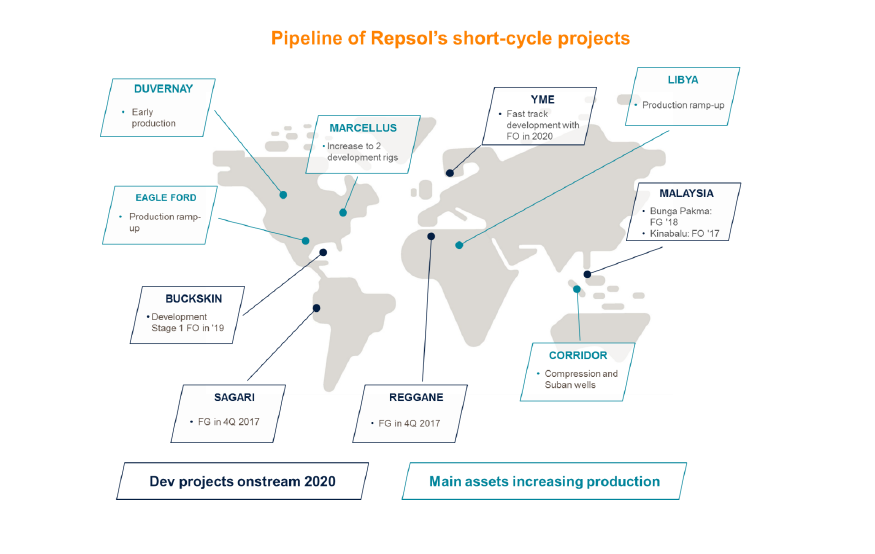

Primary investment will focus on organic growth of existing upstream assets not requiring major development that generate cash and increase production in the near term, it said (see map below).

In addition to such 'short-cycle' assets, Repsol said it has also identified five developments for "beyond 2020" that have a combined breakeven of $42/b: Alaska (US), Duvernay (Canada), Akacias (Colombia), plus Sagittario and Campos-33 (both Brazil).

Its upstream unit will furthermore launch a new efficiency and digitalisation program with more than 600 initiatives and the objective of achieving €1bn of additional free cash flow per year by 2020. An example of the latter is Repsol and Google Cloud’s agreement June 4 to optimise refinery management using big data and artificial intelligence.

Map credit: Repsol