Baker & McKenzie Report on Shale Gas in Poland

1. INTRODUCTION

1.1 Industry background

Poland is a net oil and natural gas importer. It has a small, mostly state-owned oil industry that produces oil onshore from small fields and offshore in the Baltic Sea. Although it produces some natural gas, Poland satisfies majority of its gas demand by importing gas, around two thirds of which comes from the former Soviet Union countries via legacy pipelines. As the second largest coal producer in Europe, Poland's electricity sector is dominated by coal-fired power plants.

Poland is eager to develop its shale resources to replace expensive gas imports from Russia and other countries. Moreover, Poland looks to develop its shale resources in order to retire or convert its fleet of coal-fired generation plants.

Both Poland's infrastructure and public opinion largely support the country's development of its shale resources. However, its shale industry is still at an exploratory, pre-commercial phase with shale gas operations slowing following the discontinuance of some international oil companies' shale explorations in Poland. Possible investors in Poland's shale resources are carefully watching the government's draft law on shale gas exploration and extraction.

1.2 Legal framework

The Act on Mining and Geological Law of 9 June 2011 (Journal of Laws of 2011, No. 163, item 981, as amended) ("Act on Mining and Geological Law") is the main instrument currently governing the process of shale gas exploration and exploitation.

As stated above, the Polish Government is presently working on new regulations regarding shale gas, including tax issues ("Draft Regulations"). The first draft was prepared in March 2013, and the Draft Regulations are expected to come into force on 1 January 2015. The current regime will be amended as follows (subject to any changes made prior to enactment):

- The type of licence. The current regime of two separate licences will be replaced by a unitary prospecting and production licence. Companies with existing exploration licences will have to enter into a competitive tender to transfer these into the unitary prospecting and production licence;

- A new hydrocarbon tax regime.

1.3 Ownership of hydrocarbon resources

The State Treasury owns all hydrocarbon resources. Licensees from the Ministry of Environment are required to begin shale gas exploitation and exploration and to obtain a mining usufruct, which is secured via agreement concluded with State Treasury represented by the Ministry of Environment.

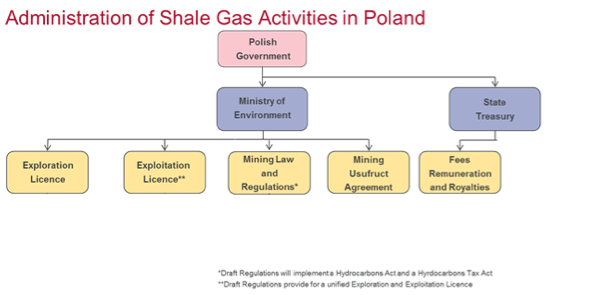

1.4 Administration

As shown in the schematic above, in Poland, the key regulators and players in the Oil & Gas sector are:

- Ministry of Environment (in Polish, Ministerstwo Środowiska ). The Ministry of Environment is the state ministry responsible for Oil, Gas and Mining in Poland. Its role consists of:

- preparing and implementing laws, regulations and policies for the energy and mining sector (the Polish Government is responsible for the initial creation of primary legislation and energy policy);

- granting licences for the exploration and exploitation of shale gas blocks;

- concluding mining usufruct agreements giving the right to explore or exploit underground natural resources to the exclusion of any other third parties; and

- managing and updating the databases on the exploration and exploitation of hydrocarbons, as well as the progress of any licence applications.

- State Treasury. The State Treasury maintains ownership of all significant hydrocarbon deposits in Poland. Under current legislation the State Treasury has no ownership in gas exploited. It does, however, receive fees, remuneration and royalties from the mining usufructuaries.

2 KEY LOCAL ASPECTS TO CONSIDER FOR A SHALE GAS PROJECT

2.1 Exploration term

To conduct oil and gas exploration in Poland, both an exploration concession and a mining usufruct agreement are needed. The exploration concession is granted by the Ministry of Environment, and gives the concession holder the right to conduct the relevant works. The mining usufruct agreement is concluded between the Ministry of Environment and the concession holder and gives the concession holder the right to use the deposit. For shale gas activities, both the exploration concession and the mining usufruct agreement can be awarded for a maximum term of 50 years. However, in practice, both are granted for a period of ten years.

2.2 Relinquishments

Specific terms and conditions of relinquishments (if any) are generally set out in the mining usufruct agreement.

2.3 Exploitation term

Oil and gas exploitation activities, like oil and gas exploration activities, require both an exploitation concession and a mining usufruct agreement. Again, for shale gas activities, both exploitation concession and mining usufruct agreement can be obtained for a maximum term of 50 years. As shale gas exploitation activities in Poland have not begun yet, there is no practice as regards the term for which the shale gas exploitation concessions and mining usufruct agreements will be issued.

There is in Poland a priority right, pursuant to which an entity, which has identified a mineral deposit, has, after:

- appropriately evidencing the deposit; and

- obtaining the decision approving the geological documentation of such deposit,

and within five years from obtaining such decision approving the geological documentation, priority over other entities to conclude a mining usufruct agreement over such deposit.

2.4 Delineation exploitation concession

In Poland, the area of the shale gas exploration concession may not exceed 1200 km2. There is no limit on the exploitation concession area, though it will be no larger than the exploration concession area of 1200 km2.

2.5 Water resources rights

The use of water is addressed by Polish law on a general basis without particular reference to shale gas activities. A water permit may be issued if the planned activity will not contravene the local water plans or the requirements of human health, the environment and cultural goods.

Generally, a water permit is issued by the starost (i.e. the head of local administrative division). However, depending on the purpose of issuing such a permit, it may be also granted by other authorities as, for example, the voivodeship marshal. The term of such permit depends on the type of water permit issued. Thus, in practice a water permit can be issued for a term shorter than the life of the mining usufruct/concession.

Under Polish law, a water permit for surface or underground water intake is not required if:

- the water intake does not exceed five m3 per day; or

- the intake is for the purpose of drilling or performing explosive boreholes with the use of water to drill mud for seismic tests.

2.6 Flaring

The Act on Mining and Geological Law, the Ministerial Ordinance on Environmental Impact Assessment 2008 and the Law on Environmental Protection 2001 address flaring in the context of shale gas activities. Gas that will not be marketed and exceeds operational requirements can be flared without obtaining consent from the Ministry of Environment.

3 OTHER LOCAL ASPECTS TO CONSIDER

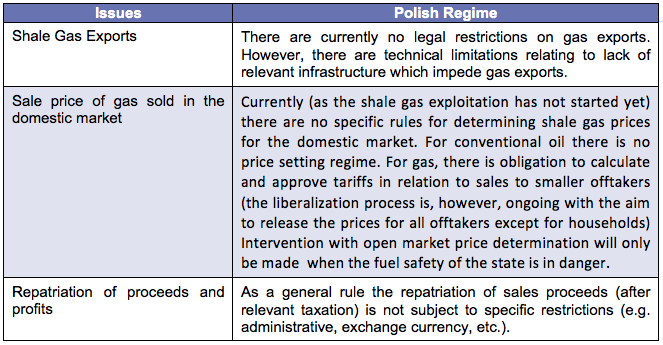

3.1 Domestic market obligations

Currently (as the shale gas exploitation has not started yet), there are no specific domestic market obligations regarding shale gas or for conventional hydrocarbons.

3.2 Fiscal regime and tax incentives

As part of the Draft Regulations, the Polish Government is working on new specific taxes on hydrocarbons (a special tax on hydrocarbons and a tax on exploitation of fossil fuels). The Polish Government is also planning to increase exploitation fees. However, these changes would only be introduced from 2015 to 2020 and have not yet been approved by the Parliament. Therefore, the final shape of those regulations is not known at the moment.

3.3 Third party and state access to infrastructure

The Polish Energy Law stipulates provisions which guarantee third party access to gas networks. This is based on the third party access rule which requires that third parties must be given access to transportation infrastructure when the third party meets the technical and economical requirements for connection to the system, concludes an agreement with the infrastructure owner and pays an interconnection fee. The fee is set in the tariff of the respective grid company, which is approved by Polish energy market regulator (URE).

4 MARKET UPDATE

4.1 Recent developments

A new bill to amend the Act on Mining and Geological Law has been proposed ("Bill"). This Bill amends the environmental impact assessment laws for shale gas. The Bill reduces the scope of the environmental impact assessment tests required for shale gas projects and upfront costs. The Bill also delays the requirement to obtain a decision on environmental conditions until a later stage in projects. As fracking is already taking place in Poland, the new Bill contains transitional provisions to deal with issues arising in relation to licences already granted.

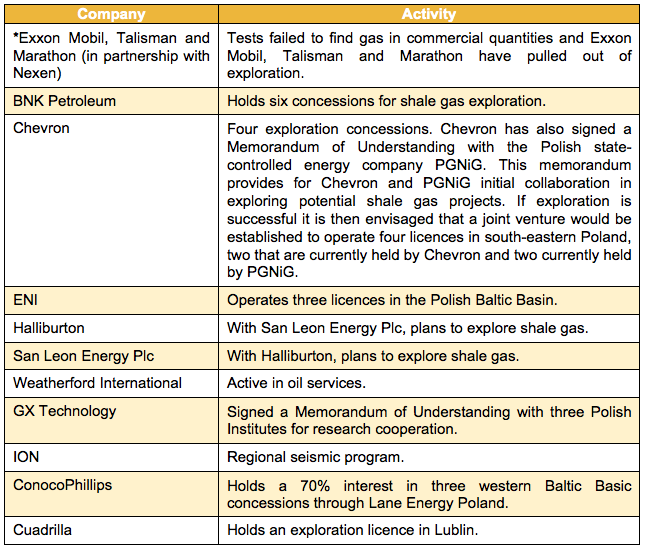

As of June 2013, there are 111 concessions for shale gas and two for tight gas, covering 88,000 km², with 43 exploration wells, of which nine carry out hydraulic fracturing and four have horizontal sections. However, in June 2012 Exxon Mobil pulled out of its exploration after tests failed to find gas in commercial quantities in the Lublin and Podlasie basins, followed by Talisman Energy and Marathon. Chevron and ENI are still actively exploring for shale gas in Poland.

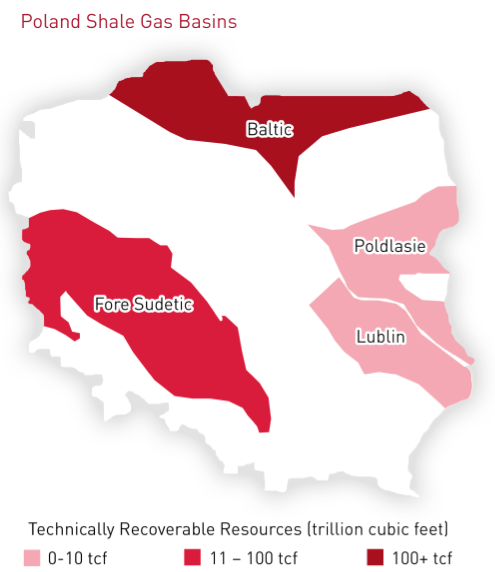

4.2 Key shale basins

The EIA identified the following basins as having technically recoverable shale gas resources in Poland:

4.3 Companies

The following companies are currently involved in shale gas operations in Poland:

Baker & McKenzie contacts:

Kamila Tarnacka Partner, Warsaw Kamila.Tarnacka@bakermckenzie.com

Malgorzata Kliczkowska-Iwaszkiewicz Associate, Warsaw Malgorzata.Kliczkowska@bakermckenzie.com

Oskar Waluskiewicz Associate, Warsaw Oskar.Waluskiewicz@bakermckenzie.com