Shell recalibrates energy strategy [Gas in Transition]

At an investors’ gathering in New York on July 14, Shell CEO Wael Sawan, who took the company’s helm in September last year, presented an updated strategy. In effect, he announced a new, recalibrated strategy aimed at producing more oil and gas for longer.

“We are investing to provide the secure energy customers need today and for a long time to come, while transforming Shell to win in a low-carbon future…as we allocate capital to enhance shareholder distributions,” he said.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

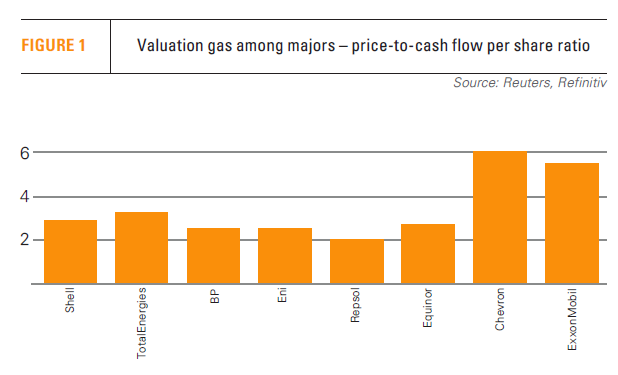

What is driving this is not just the massive profits of $40bn that Shell made on high oil and gas prices in 2022, but also a determination to increase value to underpin higher shareholder distributions and close the valuation gap with its US rivals, Chevron and ExxonMobil (see figure 1).

These are the key points of this new strategy:

- Higher shareholder distributions of 30-40% of cash flow from operating activities, compared with 20-30% previously, through a combination of dividends and share buybacks.

- Capital spending reduced to $22-25bn per year for 2024 and 2025.

- Annual operating cost structurally reduced by $2-3bn by end of 2025.

- Grow the company’s leading integrated gas business and maintain leadership in the global LNG market.

- Extend its advantaged position in upstream to achieve cash-flow longevity by stabilising liquids production to 2030.

In effect, this signalled an abandonment of the 2021 pledge to reduce production of “traditional fuels” by 55% through to 2030, including the company’s commitment to cut oil production by 1% to 2% each year in the 2020s.

In terms of lowering emissions and low-carbon investments, Shell pledged to:

- Continue the good progress it has made towards its target to become a net-zero emissions energy business by 2050, by reducing emissions from its operations, and from the fuels and other energy products it sells to customers.

- Achieve near-zero methane emissions by 2030 and to eliminate routine flaring from its upstream operations by 2025.

- Invest $10-15bn across 2023 to 2025 to support the development of low-carbon energy solutions including biofuels, hydrogen, electric vehicle charging and CCS.

Another reason why Shell believes it is on the right track was the overwhelming backing the company received from its shareholders at its AGM and the limited support for climate-related resolutions in 2023. This emboldened the company’s resolve to press ahead with the new strategy.

Driven by the developments over the last two years – the energy crisis and the invasion of Ukraine – the global energy pendulum has swung away from a single-minded focus on climate change, to balancing this by ensuring energy security. There is increasing and widespread recognition that it will take some time before renewable intermittency is tackled and renewables uptake starts making inroads into the ever-increasing need of non-OECD countries for more energy.

This was driven home by the Statistical Review of World Energy published by the Energy Institute in June. Trends for oil and gas, especially LNG, show global demand continuing to rise. This is also confirmed by the IEA and BP energy outlook projections, based on current trends and known policies. BP’s New Momentum scenario shows gas and LNG demand rising into the 2040s, driven by the growing economies of Asia.

The IEA warned that oil and gas supply must fall by more than 50% by 2030 in order to stay on track for net zero by 2050. But plainly that is not happening – energy transition is taking longer.

China has been signing long-term LNG contracts, running well past 2050, as have many LNG portfolio traders. So far in 2023, 45.25mn tonnes/year of long-term contracts have been signed. In response, the US is forging ahead with new LNG projects. The latest is NextDecade that has just announced that it is going ahead with the first phase of the 27mn t/yr Rio Grande LNG plant, the third liquefaction facility to be sanctioned this year in the US.

These are the reasons that major oil and gas companies, including Shell, are back to increasing capital investments in exploration and development. They fully intend to meet this rising global demand.

In response to this, Sawan said early July that such investments are needed, and that mandates to cut oil and gas before proven scalable and affordable alternatives are available would be “dangerous and irresponsible.” He said he was “of a firm view that the world will need oil and gas for a long time to come. As such, cutting oil and gas production is not healthy."

But even as it raises spending on oil and gas, Shell made it clear that it will continue to make major investments in renewable energy and low-carbon projects.

Acceleration in natural gas investments

The largest contributor to Shell’s record earnings in 2022 was the company’s integrated gas trading business, with a share of almost 40%. This was a factor behind Shell’s recalibrated energy strategy that makes it clear that natural gas and LNG are central to its future business. Shell is already one of the biggest players in the global LNG market and fully intends not only to maintain but also grow this market.

Shell is not the only one. Most majors plan to accelerate their natural gas and LNG investments. They are confident that this will be a growing market all the way to 2050. This is also what Shell’s 2023 LNG Outlook projects – that LNG demand will reach 650-700mn t/yr by 2040, from just over 400mn t in 2022.

Shell is not the only one. Most majors plan to accelerate their natural gas and LNG investments. They are confident that this will be a growing market all the way to 2050. This is also what Shell’s 2023 LNG Outlook projects – that LNG demand will reach 650-700mn t/yr by 2040, from just over 400mn t in 2022.

They are also responding to pressure from the majority of their shareholders to maximise their oil and gas profits, rather than commit further in lower-margin renewable energy businesses.

Natural gas has a strong and proven record in the drive to reduce emissions. It is also an abundant resource that supplements renewable intermittency and is still indispensable to all other energy sectors, not just electricity – that together comprise well over 80% of global primary energy demand – including industry and heating.

As Wael Sawan told investors in New York, “LNG will play an even bigger role in the energy system of the future than it plays today…LNG can be easily transported to places where it is needed most. And what’s more, on average, natural gas emits about 50% less carbon emissions than coal when used to produce electricity.”

Shell plans to increase investment in natural gas projects by about 25% in 2023, to $5bn – in itself a record for the company – and maintain it at this level through to 2025. Overall, the company plans to spend about $13bn annually on its upstream and integrated gas business through to 2030 to maintain oil and gas production at about 2.5mn barrels of oil equivalent/day, or more.

Ramifications

The high profits in 2022 led to increased investor pressure to focus on the most profitable businesses: gas. As Reuters reported, Shell’s updated strategy to shift back to oil and gas production also means paring back investments in renewables. In recent months, Shell scrapped several projects, including in offshore wind, hydrogen and biofuels, due to projections of weak returns. And mid-July it was reported that the company is “exploring options for its global renewable power operations, including a potential stake sale to outside investors, but also separating the business into a more independent unit.”

In addition, under internal restructuring, effective from July 1, Shell combined all renewables operations with oil refining and marketing operations, to form a new downstream and renewables directorate to be led by the current downstream director.

Wael Sawan said: “we will invest in the models that work – those with the highest returns that play to our strengths." He insisted that efforts to shift to low-carbon businesses cannot come at the expense of profits.

But not everybody is happy with these developments. Shell’s head of renewable generation announced early July that he is leaving the company. Activists and pro-climate shareholders are also unhappy. Church of England’s (CoE) Pension Fund announced that it will divest its holdings in Shell, saying that its “plans to align the company’s strategy regarding the goal of limiting global warming to 1.5 degrees Celsius are insufficient.” But given that CoE’s holdings amount to only £1.35mn, this can only be seen as a symbolic gesture.

Accusing Shell of backtracking from its previous commitments to cut oil and gas production, US climate envoy John Kerry said: "What we need are company chief executives, looking to the future and investing in that future and accelerating the transition to that future.” But neither Kerry nor other climate activists say how the world will get there in an orderly manner without major upheavals and more, costly, crises.  Decarbonisation is still key, but as Sawan said, until proven, scalable, reliable and affordable low-carbon energy becomes available to replace hydrocarbons, the world will need oil and gas. These are the realities driving the LNG growth.

Decarbonisation is still key, but as Sawan said, until proven, scalable, reliable and affordable low-carbon energy becomes available to replace hydrocarbons, the world will need oil and gas. These are the realities driving the LNG growth.

Nevertheless, Shell is committed to deliver more value with less emissions. In order to market natural gas as a clean alternative to coal, energy majors are working to cut methane releases. Shell joined the Oil and Gas Climate Initiative (OGCI) – which includes 12 of the world's largest oil and gas companies – last year, aiming to achieve near-zero methane emissions by 2030.

Earlier in the year there was talk of Shell leaving Europe and moving its base to New York. But Sawan quashed that. He said: “The transfer of the seat is not a priority for the next three years." Three years is not a long time. What happens after that remains to be seen.

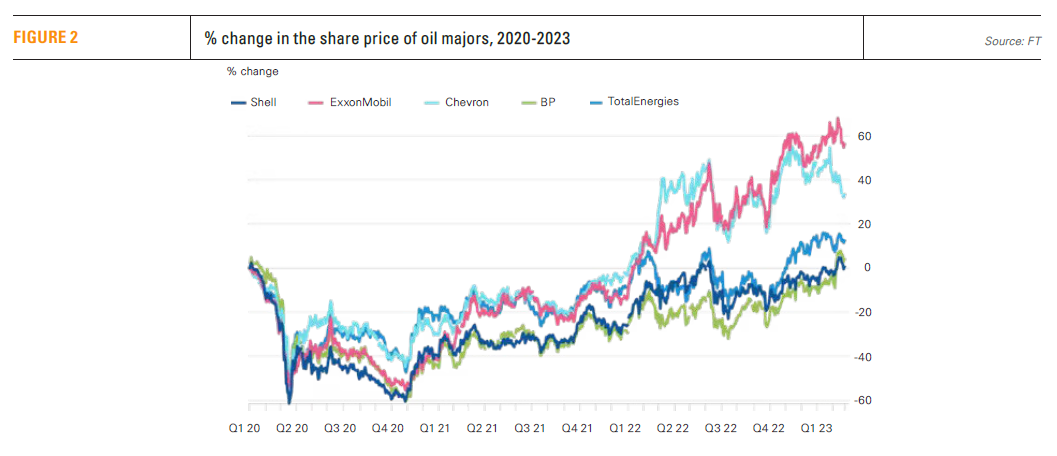

As the FT reported, “the motivation that led to the potential move remains: Sawan is concerned about the yawning valuation gap between Shell and US-listed rivals ExxonMobil and Chevron.” Shell’s shares have lagged behind its US rivals as oil prices recovered following the drop in 2020 (see figure 2). But in the month since the presentation in New York Shell’s share price has climbed over 6%.

Asked about what happens after the three years, Sawan’s response was: "I would never rule out anything that could create the right conditions for the company and its shareholders. Ultimately, I am in the service of shareholder value.” And that also means that he is “absolutely committed” to the company’s upstream business, with ruthless focus on its most profitable assets.