Slow and unsteady loses the race [NGW Magazine]

Norwegian energy advisor DNV GL has released its Energy Transition Outlook 2019 (ETO2019), the third in the series, covering the period to 2050. The stark message is that things are not moving fast enough. “Even with the rapid changes in decarbonisation and energy intensity that DNV GL forecasts, CO2 emissions will still be at about half of today’s level in 2050,” to the extent that “the 1.5 °C carbon budget is exhausted in 2028.”

Without change, ETO2019 “points towards a 2.4 °C warming of the planet by the end of this century,” a level considered dangerous by the Intergovernmental Panel on Climate Change (IPCC).

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

DNV GL states that ETO2019 is its ‘best estimate’ of the energy future. The key highlights are:

-

Technology can deliver the COP21 1.5 °C target, but only with strongly enforced policies aimed at delivering strengthened nationally determined contributions (NDCs) under the Paris Agreement.

-

DNV-GL forecasts a technology-driven, rapid, energy transition, with the share of electricity in the final demand mix more than doubling by 2050 from today.

-

Half of passenger vehicles sold worldwide will be EVs by 2032

-

Oil will decline steeply after 2030, with half of all road vehicle sales expected to be electric by 2035.

-

Gas will continue to grow before leveling off at 29% of the energy mix by 2050.

-

But the transition is not fast enough, with global energy-related emissions peaking only by 2025. In fact emissions will not fall sufficiently by 2050 to bring global warming to well below 2 °C

-

Global energy use will peak by 2030, as energy efficiency gains outpace economic growth.

-

Electrification, powered by renewable sources, will be the biggest contributor to reduced energy intensity.

-

The transition will be affordable, as the world spends an ever-smaller share of GDP on energy, allowing for additional investment to further speed up the transition.

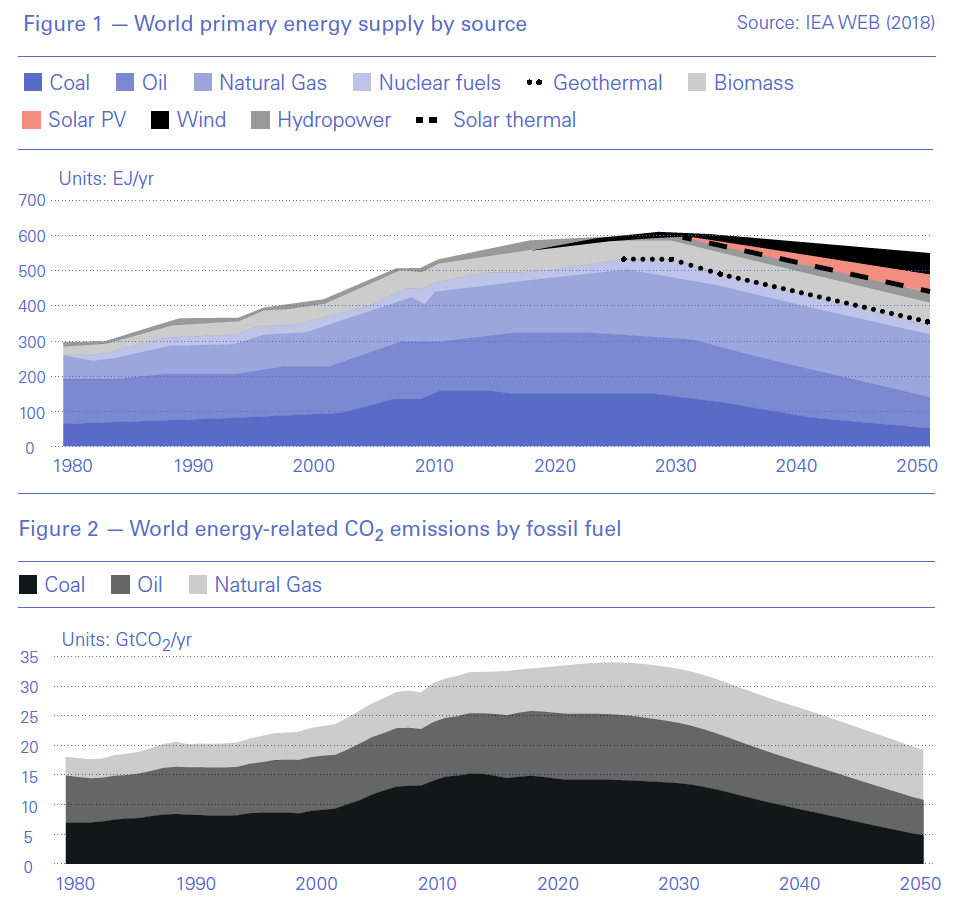

DNV-GL concludes that the world is approaching a future where less energy will be needed, even as the global population increases and the economy continues to grow. Large energy efficiency improvements in all sectors and accelerated electrification see primary energy supply peaking at 638 EJ in 2030 (Figure 1). DNV-GL forecasts that the fossil fuel share of the energy mix will decline from 81% today to 56% by 2050.

According to DNV GL natural gas and variable renewables will be the only energy sources for which demand will be higher in 2050 than today, but they must work together alongside greater uptake of carbon capture and storage (CCS) to secure a rapid energy transition.

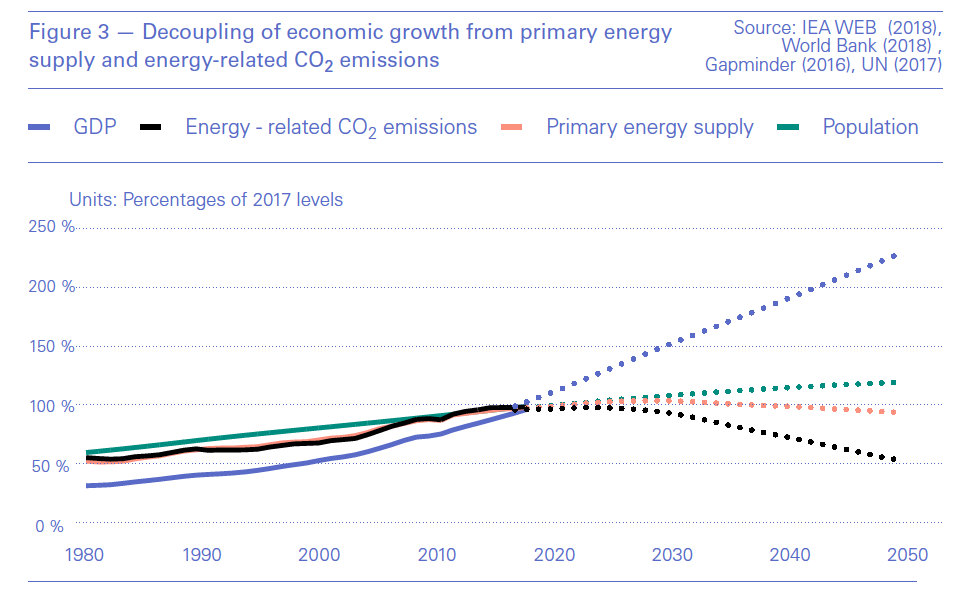

Delivering this energy mix by 2050 would lead to carbon emissions from fossil fuels peaking by 2025 (Figure 2) and declining thereafter to 1980s levels by 2050. But this will still not achieve Paris Agreement climate change targets, resulting in a 2.4 °C global warming by 2100.

DNV GL forecasts that the 1.5 °C carbon budget will be exhausted by 2028.

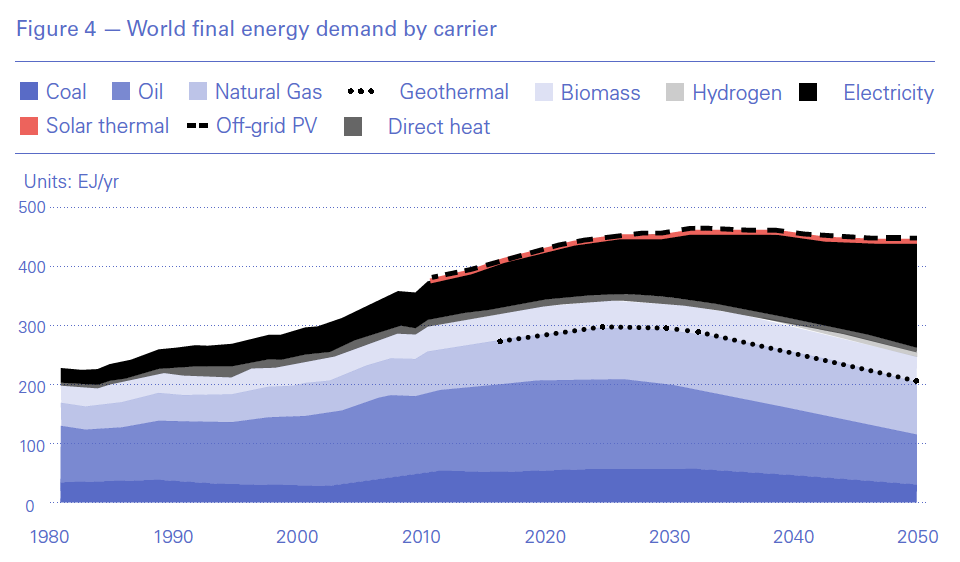

However, with the expectation that world population will increase by 2bn by 2050 and the aspiration of developing countries to improve living standards, it remains to be seen whether world primary energy demand will decline after 2030. DNV GL forecasts the decoupling of economic growth from primary energy supply and energy-related carbon emissions (Figure 3). According to ETO2019 this started in 2017. But this does not appear to be the case at present.

Nevertheless, the energy transition is picking up pace as the world is starting to wean itself off fossil fuels and move towards a net-zero carbon future. DNV GL states that “there will be a profound shift towards electrification and to generating that electricity from renewable sources.”

Electrification and renewables

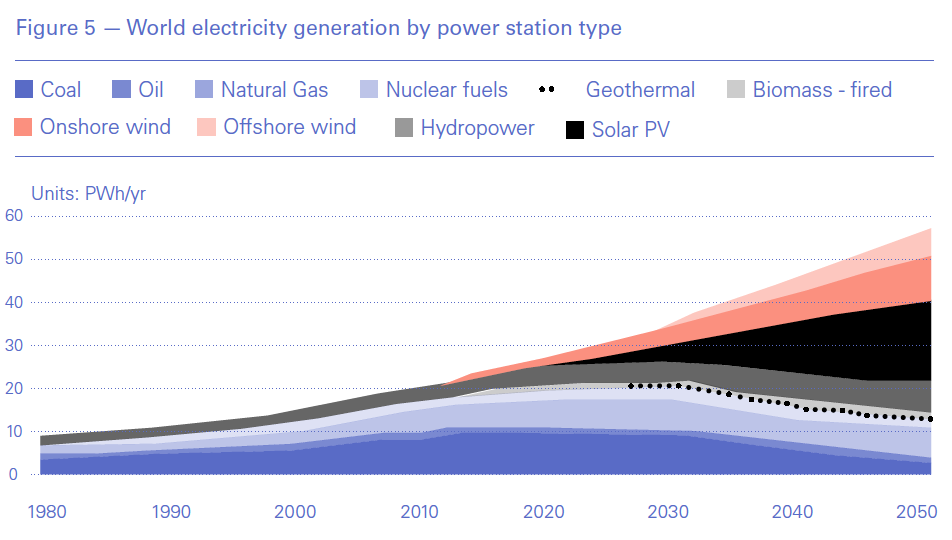

The key driver to DNV-GL’s Outlook is doubling of electrification from 19% of global final energy demand in 2017 to 40% by 2050 (Figure 4), replacing coal.

DNV-GL forecasts that by 2050 63% of the world’s electricity will be supplied by solar PV and wind, making it possible to achieve very large efficiency gains through a substantial reduction in heat losses. Global PV capacity will grow 30-fold from 2017 to 2050 to reach almost 12 TW. By 2050, greater China will have a 40% share of global installed PV capacity, followed by the Indian Subcontinent at 17%.

This will require system flexibility which will be achieved through a massive increase in global storage capacity from 0.65 TWh now to 31 TWh by 2050, mostly provided by batteries. The future grid will be a lot more complex, with digitalisation playing a key role.

A high penetration of variable renewables will also bring lower wind and solar PV prices, providing even stiffer competition to natural gas, keeping energy prices low.

Most of the increase in global electricity will come from solar PV (Figure 5), but also wind, with massive reductions in the use of coal. The contribution of fossil fuels to electricity generation will decline from about two-thirds now to about 20% by 2050.

However, natural gas will continue playing a major role in electricity production – providing a baseload role alongside variable renewables – reaching a peak by 2030 and remaining relatively flat in real terms to 2050.

This massive switch to renewables will result in major energy efficiency gains. One measure of this is the energy intensity of the global economy – expressed as units of energy per unit of GDP. For the last two decades, energy intensity has declined by 1.6%/yr. Over the next 30 years, energy intensity improvements will accelerate to 2.5%/yr, contributing to global primary energy demand peaking by 2030. This is quite ambitious, but DNV GL states that without such efficiency improvements, final energy demand globally would be about 70% higher by 2050, in comparison to its forecast demand.

Fossil fuel supply

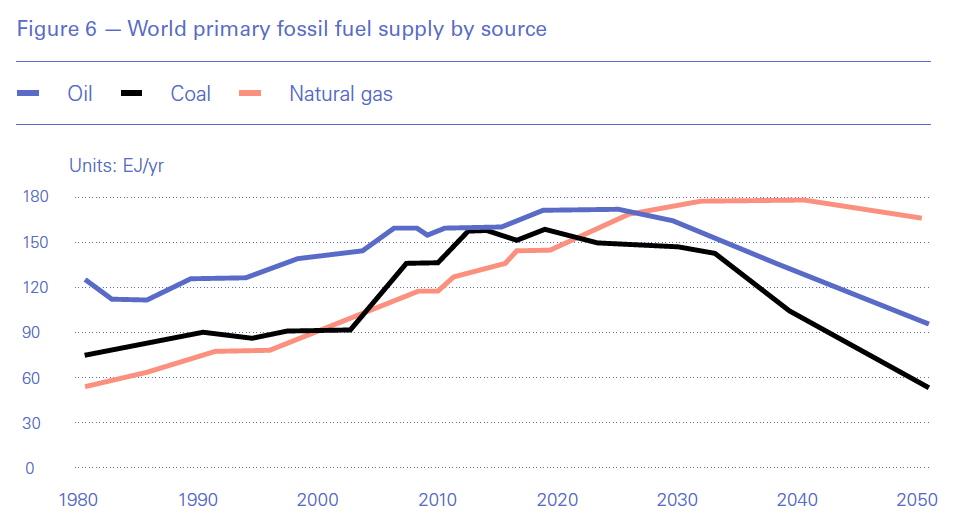

According to ETO2019, natural gas will continue holding “a major position as an energy source throughout the forecast period,” growing from 25% now to 29% in 2050 of global primary energy use (Figure 6). It takes over as the largest fossil fuel energy source in 2026.

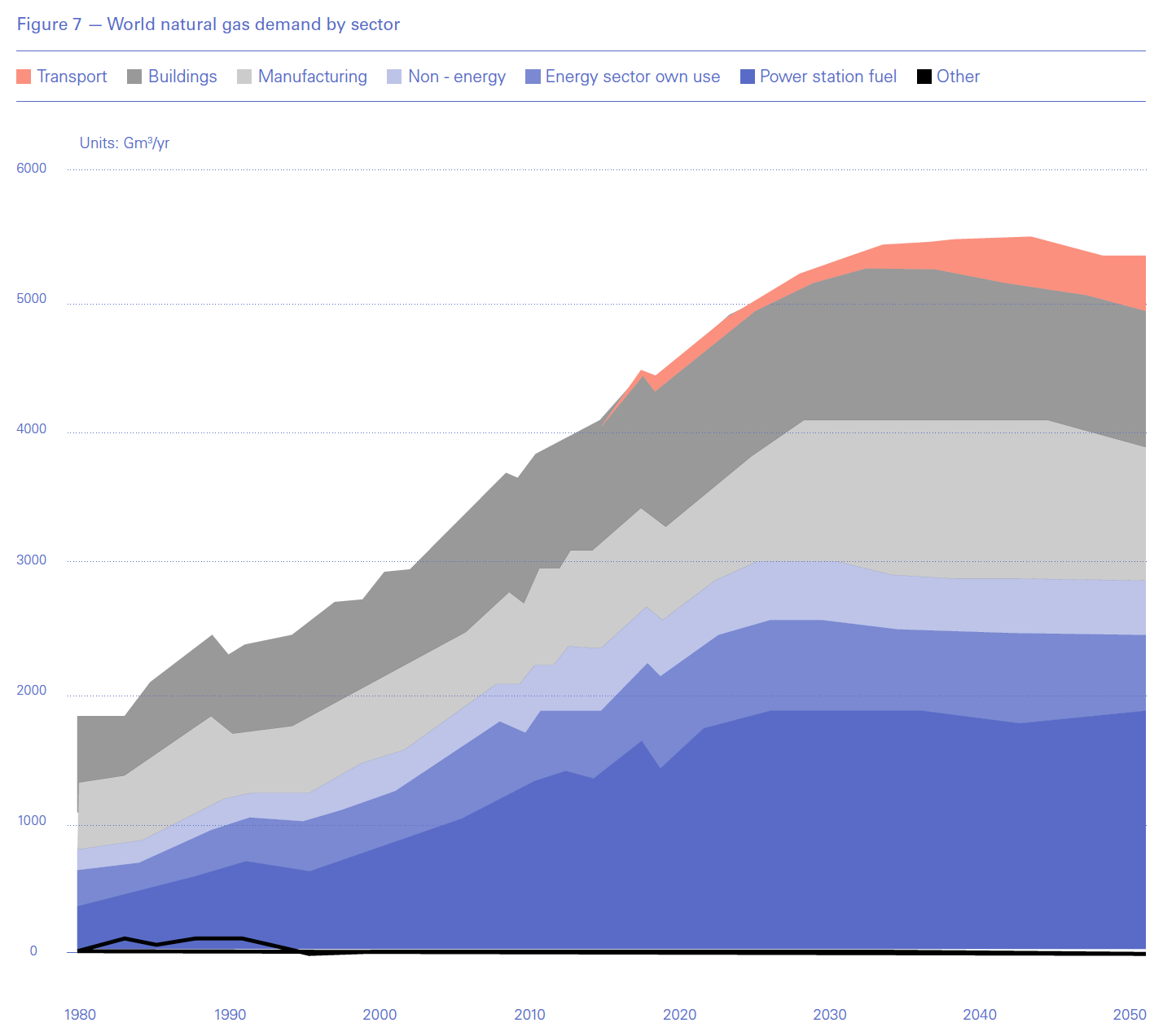

Natural gas production will increase from 4.6 trillion m³/yr to a peak of 5.5 trillion m³/yr by 2034 and thereafter will decline to about 5.15 trillion m³/yr by 2050, driven by the power, manufacturing – mostly petrochemicals – and buildings sectors (Figure 7). A major contribution to this will come from unconventional onshore gas, which will increase from 24% now to 34% of total production in 2050.

The use of LNG, though, will continue to grow at the expense of pipeline gas, driven by the simultaneous decline in costs and regional shifts in demand and supply. This growth will be fed by increasing gas deficits in China and Europe and strong North American gas surplus.

As the world pushes for more ambitious carbon emission reduction, aiming eventually for net-zero emissions by 2050, natural gas will need to be replaced or decarbonised. The three main methods to achieve this directly are biogases, hydrogen and CCS. Decarbonising gas will require gas networks to be much more flexible to handle hydrogen and biogases.

Based on global trading expectations, DNV-GL predicts that global LNG and liquid petroleum gas (LPG) trade will almost quadruple from 414mn mt/yr in 2019 to about 1.604bn mt/yr in 2050.

Oil use is forecast to peak by 2022 and then decline from 29% of world primary energy use today to 17% in 2050 – something not shared by other forecasts, such as by BP and the International Energy Agency (IEA). DNV GL attributes this decline to the rapid electrification of the world’s road transportation fleet.

Coal use peaked in 2014 and after a period of remaining relatively flat, it will decline rapidly after 2030. DNV GL states that “over the next decade we forecast a slow decline, with environmental concerns counter-balancing energy hunger in rising economies.” With security of supplies and trade war concerns in China, this remains to be seen.

The oil and gas industry is coming under greater pressure to demonstrate it can continue to deliver a secure and environmentally-sustainable supply of affordable energy. DNV GL forecasts that oil and gas will still meet 46% of world energy demand in 2050 compared with 54% in 2017 (Figure 1) – this makes decarbonisation of these fuels, as well as elimination of methane leakages, that much more important.

With the rate of depletion of oil and gas reserves from existing reservoirs estimated at 4% per year, this also means that new resources will need to be developed to meet new demand from growing economies – but low prices mean that cost control will remain critical. But operational improvements are getting more value from fields than before, slowing their declines and adding more reserves.

DNV GL’s forecast “emphasises that that there is no single pathway to a decarbonised energy mix. A combination of energy sources will still be needed throughout the forecast period.” But as prices become more competitive, producers will be increasing their focus on easier-to-access oil and gas resources – lower production costs and proximity to markets will become key. This means that the industry’s appetite for developing resources from challenging and frontier environments, such as deepwater, will be changing.

What can be done to hasten energy transition

DNV GL concludes – as many have before it – that there is no silver bullet: “If the world is to avoid dangerous warming, policies must be developed to tackle at least three fronts simultaneously: higher energy efficiency, more renewables, and industrial-scale CCS.”

Increasing public pressure, embodied by the global protests mid-September and the climate change discussions that followed at the UN, may contribute to hastening this. On the negative side, is inertia – the public’s reluctance to change its lifestyle and to pay more for less.

But DNV GL believes that the transition required to limit global temperature increase to 1.5 °C is affordable. Measured against world GDP growing by more than 130% to 2050, the energy expenditures increase is very small. It estimates that the share of world GDP devoted to energy will be cut in half, from 3.6% in 2017, to 1.9% by 2050 through the fall in spending on fossil fuels, and the rise of low-cost, efficient electrification.

ETO2019 estimates that the fossil upstream share of total expenditure, now at 68%, will almost halve to 38% by 2050. Gas operating expenditure will also fall by a quarter, but capital expenditure for gas falls much less sharply than it does for oil, which will shrink to less than a tenth from its peak in the 2020s.

But in real terms, DNV GL forecasts that the future energy system will be costlier than today’s. Annual global energy expenditure will increase by 22% from $4.5 trillion in 2017 to $5.5 trillion in 2050. However, in relative terms the energy expenditure increase is very small and becomes much more affordable when measured against world GDP growing by more than 130% to 2050.

Nevertheless, the rapid renewable buildup and grid expansion will be dependent on a successful shift in investments from fossil to renewable sources.

DNV GL estimates that more than $1.5 trillion needs to be invested each year on expanding power grids by 2030, including ultra-high voltage transmission networks and extensive demand-response solutions.

It believes the shift will occur in 2034 by which time non-fossil fuel capital expenditure will overtake fossil fuel.

In order to hasten energy transition, the world must start generating all its electricity from renewables, use less energy – with reductions of the order of 4.8%/yr – and capture carbon in enormous quantities. But none of these are realistic – not just in Europe, but even more so in Asia and Africa. Hence the conclusion that the world is heading towards a 2.4 °C warming by 2050 despite the declines in global primary energy consumption and energy-related carbon emissions (Figures 1 and 2).

Very high carbon prices would also force a faster transition, but it would be difficult to sell politically, bearing in mind what happened in France with the gilets jaunes. What the world needs is “extraordinary policy action” to tackle higher energy efficiency, more renewables and industrial-scale CCS faster and simultaneously. Remi Eriksen, group president and CEO of DNV-GL, said “We need to capitalise on the affordability of the energy transition and take extraordinary measures to create a sustainable future.”

May be the UN Climate Week meetings in New York in September and COP26 in Glasgow next year will lead to this, but it remains to be seen. On the other hand, as the impact of climate change becomes more visible, pressure on governments to act will increase over time.

Challenges

DNV GL stresses that it presents only one ‘most likely’ future, warning that “the coming decades to 2050 hold significant uncertainties for the planet, and the oil and gas industry. These uncertainties are notably in areas such as: future energy policies; emerging energy sources such as hydrogen; renewable energy integration with oil and gas production; human behaviour and reaction to policies; the pace of technological progress; and, trends in the pricing of existing and new technologies.” As Eriksen said “we need widespread policy supporting emerging technologies and continuing the support in the build-up phase to accelerate the energy transition.”

A key assumption in ETO2019 is that global primary energy demand will peak by 2030, driven by rapid electrification and increasing energy efficiency, particularly impacting oil and coal consumption. This is also supported by a report by Carbon Tracker in 2018 that states that the rapid growth of clean technologies is expected to cause fossil fuel demand to peak in the 2020s and most likely by 2023.

But it is at odds with this year’s BP Energy Outlook 2019 which – based on its ‘evolving scenario’ – forecasts that by 2040 global primary energy demand will grow by about a third, with about 74% coming from fossil fuels, driven by increasing population and improvements in living standards in Asia. The IEA came to similar conclusions in its 2018 World Energy Outlook (WEO2018). It forecasts that global primary energy will increase by about 27% by 2040, with fossil fuels providing 74% of it.

In its latest forecast the US Energy Industry Administration (EIA) predicts that global primary energy will increase even more, by 50% by 2050, led by growth in non-OECD countries and mostly by countries in Asia.

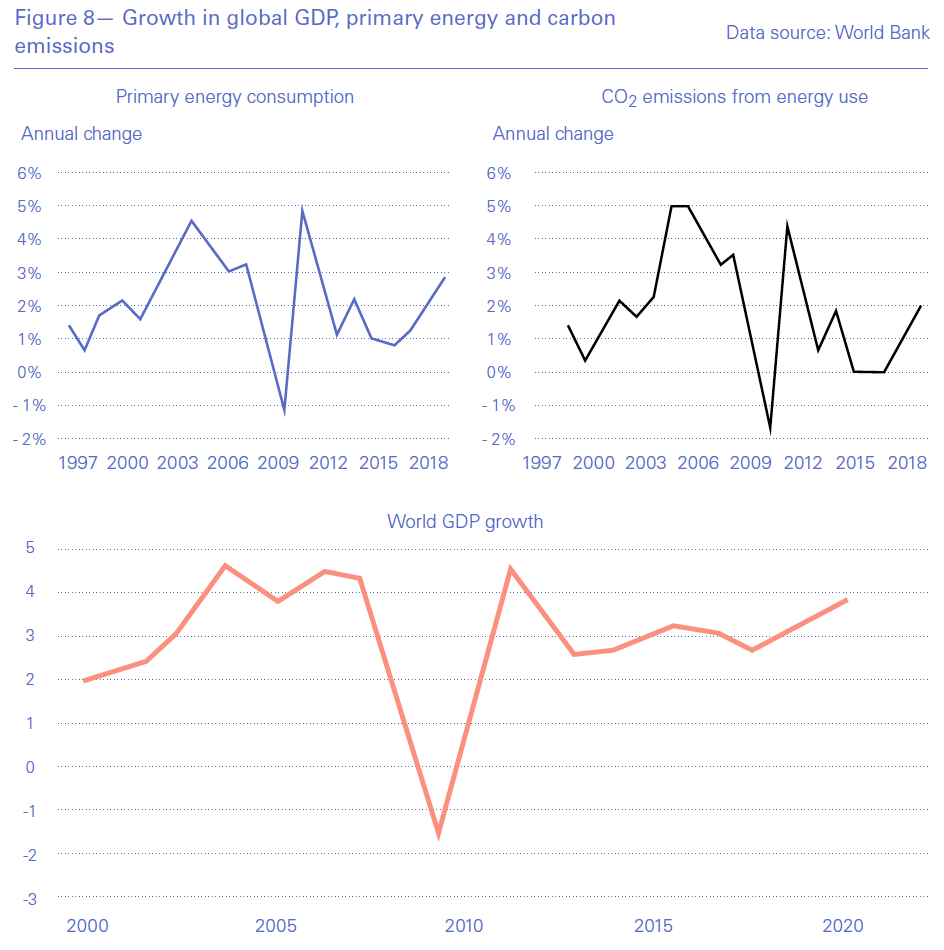

In addition, the growth in global GDP, primary energy consumption and carbon emissions still appear to be interlinked (Figure 8). Last year global primary energy demand grew by 2.9%, the fastest since 2010, and almost double the 1.5% average growth during the previous ten years, 2007 to 2017. At the same time, energy-related carbon emissions grew by 2.0%, the fastest since 2011.

Decoupling of world GDP, primary energy and carbon emissions growth still appears to be a distant prospect, especially given the forecasts by BP, IEA and EIA - but may be achieved in the longer-term through exceptional growth in renewables and energy efficiency.

Another challenge that emerges from ETO2019 is who will take up the required investment in the electricity system, and whether investors will be able to handle the increased risks emanating from very big and long-term investments in highly uncertain circumstances. DNV GL points out that there may be a need to socialise some of the risks. Paul Gardner, the lead author says: “In the end, I think it is likely that political and regulatory decisions will determine how fast the energy transition can go, more so than technology or costs.” The risk is that the pace of the transition will not be fast enough if no extra, aggressive, measures are taken.

Despite challenges, DNV GL believes that existing technology would be enough to contain global warming to the COP21 pledge of 1.5 °C, but only if the energy transition is backed by human behaviour, extraordinary and far-reaching policy action and strong enforcement of the policies set out in the Paris Agreement. As Ditlev Engel, chief executive DNV GL Energy, said: “Time is against us … governments, businesses and society as a whole need to change the prevailing mindset from ‘business-as-usual’ to ‘business-as-unusual’ to fast-track the energy transition.”