South Korea plans to eliminate LNG use by 2050 [Gas in Transition]

South Korea’s Ministry of Trade, Industry and Energy (Motie) forecasts that gas demand will rise by 15% from 2020 to 2034. But the projected increase from 41.69mn mt to 47.97mn mt will in large part depend on low growth in electricity demand and the successful rollout of offshore wind generation. If gas-fired generation is higher than projected it is quite likely that total gas demand in 2034 could reach 52.53mn mt or more.

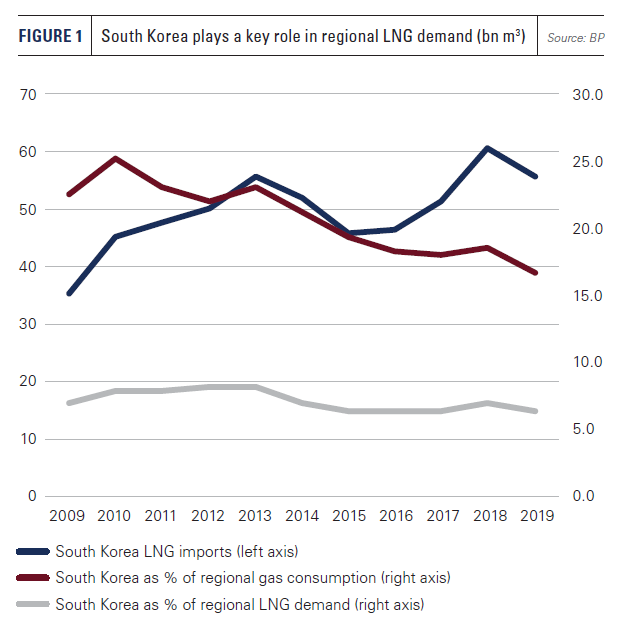

South Korea produces negligible amounts of gas and other fossil fuels, relying instead almost entirely on imports. It consumes only 6-7% of Asian gas, but accounts for a much larger share of the region’s internationally traded gas, which given the absence of piped gas imports, means LNG.

As a result of burgeoning Chinese imports, the country’s share of Asian LNG demand has fallen from the 25% or so recorded in 2010 (Figure 1). But it still accounted for 16.6% of total Asian LNG consumption in 2019, according to the BP Statistical Review of World Energy 2020.

Balanced energy supply

The limited potential for indigenous energy production has to date resulted in a balanced approach to energy supply, with a mix of resources being deployed to avoid excessive reliance on any particular fuel.

As a result, the shares of coal and nuclear in total primary energy supply have been relatively stable over the last three decades. The share of gas rose substantially in the 1990s and 2000s, but did so in tandem with the falling share of oil. In 2020, gas’ share of total primary energy supply stood at 18.6%, almost double the level in 2000, according to data from the Korea Energy Economics Institute (KEEI).

This increase was not for the most part down to more gas being used in final energy applications. Gas’s share of total final energy consumption has ranged from 9-12% over the past two decades, a relatively modest level by international standards.

This reflects the fact that the industrial sector still accounts for a high proportion of final energy use in South Korea. Industrial users accounted for 62% of final energy use in 2020, according to KEEI data, compared with 18% in the transport sector, 10% in the residential and 8% in the commercial sectors.

City gas use did increase rapidly in the 1990s and first half of the 2000s, but the rate of growth slowed after the mid-2000s. Consumption reached a high of almost 25mn tons oil equivalent (toe) in 2018, but fell to 23.1mn toe – 18.25mn mt of LNG – in 2020 as a result of the COVID-19 pandemic. Most of the gas was used in the residential and industrial sectors, according to KEEI.

Generation the key market

It is gas use in power generation that has grown most strongly over the past 20 years, and especially over the past decade. In 2000, the city gas sector accounted for 65% of all gas use compared with 30% used for power generation. But, by 2020, the city gas and power generation sectors accounted for 44% and 45%, respectively. In fact, 2020 was the first year electricity producers used more LNG than the city gas sector.

At the start of July 2021, South Korea hosted 41,170 MW of LNG-fired power plants, about a third of the country’s total generating fleet, according to the Korea Power Exchange’s Electric Power Statistics Information System. Most of the capacity comprised combined-cycle facilities, with a small amount of steam turbine plant. The other capacity included 35,780 MW of coal-fired plant, 23,250 MW of nuclear reactors, and more than 16,000 MW of solar plant.

The LNG-fired plants are primarily intended for mid-merit operation. However, actual LNG usage varies widely as a result of factors including unplanned nuclear outages, unanticipated changes in seasonal electricity demand, and the price of LNG relative to competing fuels.

For instance, LNG use was boosted in the first half of 2021 by the restricted operation of 28 coal-fired plants for environmental reasons. In addition, LNG use benefited from its low price relative to coal, since most South Korean LNG is purchased under long-term contracts based on lagged indexation to oil prices.

LNG demand was further supported in the second quarter of 2021 by the unplanned outage of several of the Korea Hydro and Nuclear Power Company’s nuclear reactors.

In April, scheduled maintenance work on 2,000 MW of capacity at Hanbit had to be extended, while 1,900 MW of capacity at the Hanul complex was closed temporarily because of incursions by marine organisms. In May, the 1,400-MW Shin Kori-4 reactor shut following a fire.

At that stage, seven reactors with 7,400 MW of capacity – a third of the country’s nuclear fleet – were offline for planned or unplanned reasons.

In large part because of the reduced nuclear and coal output LNG imports increased by 8.5% year on year to 20.03mn mt during January to May, according to customs data. In May, the state gas supplier Kogas saw its year-on-year sales to generators increase almost 80% to 1.168mn mt.

More LNG will be needed in the second half of 2021 because new government rules require Kogas to hold gas equivalent to nine days of demand from October, up from the current seven days. The new rule is intended to improve security of supply.

Long-term gas demand

While short-term events can cause significant shifts in near-term LNG demand, the underlying trend in future demand for the fuel will depend on how the government’s policies work out. And here the jury is very definitely out.

It is planned that city gas use will increase until at least the mid-2030s. The government envisages that the additional demand will arise largely from new applications, including the promotion of vehicles based on the use of hydrogen fuel cells. Motie has projected that city gas demand will grow by 1.73%/year to 27.09mn mt in 2034.

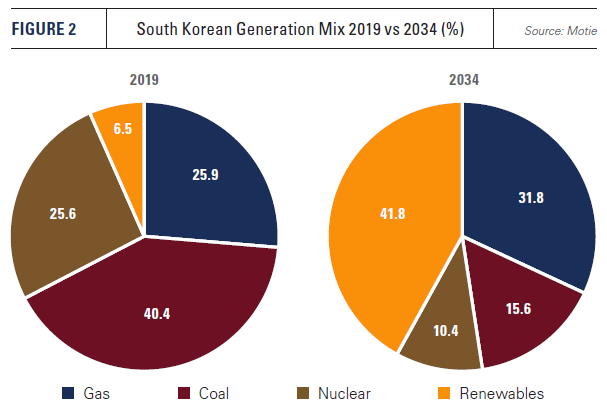

By contrast, gas use in power generation – the driver of growth in gas use over recent decades – is projected to increase by only 0.33%/year to 20.88mn mt in 2034 (Figure 2). This is despite the fact that the government has mandated that nuclear capacity will fall to 19,400 MW in 2034. It has also ordered the closure or conversion to LNG-firing of 30 of the 60 operational coal-fired plants by 2034. After an initial increase in capacity as seven plants currently being built are commissioned, the coal-fired fleet will fall to about 29,000 MW, with coal’s share of total generation output falling to about 30%.

It is envisaged that 24 coal-fired plants with some 12,700 MW of capacity will be converted to gas use. Combined with newly-commissioned generators, gas-fired capacity is projected to reach 59,100 MW in 2034 – an increase of 44% compared with the mid-2021 figure.

The very modest 0.33%/year increase in gas use in generation projected for the period to 2034 is partly based on the assumption that gas-fired generator efficiency will increase significantly. This is a reasonable assumption, given the newbuild and coal conversion plans. It is also assumed that many of the plants will operate only on peak load rather than at mid-merit as renewable capacity comes online. But this assumption is more questionable.

Counting on renewable capacity acceleration

Renewable energy capacity is projected to reach 77,800 MW in 2034, or about four times the current level. If the programme is successful, renewables would account for almost 42% of the 185,300 MW of total installed generating capacity.

This is a big ask, given that a significant part of the new renewable capacity is projected to comprise offshore wind farms. These have long lead times and need to be sourced from a sector whose supply chain capacities must grow substantially to meet burgeoning global demand.

The projects include an 8,200-MW complex off the southwest coast of the country, which is targeted for operation by 2030. They also include a series of innovative floating wind farms, including a huge 6-GW project offshore Ulsan at a cost of about $32bn, to be funded by both private and public capital. The country has a target of 12 GW of offshore wind by 2030, up from just 98 MW in 2020.

Building the new offshore capacity in the proposed timescale could prove problematic. This is especially so given that some of the wind farms are in areas where fishing rights are a thorny political issue. The government’s stated preference for the projects to be based on domestic technology may also prove difficult to achieve.

In addition, restraining the growth in gas-fired generation would require grid strengthening, extensions and the installation of flexible assets to accommodate the variability associated with an increasing amount of renewable output. And it assumes that the modest, and historically low, projected growth in electricity demand of 0.6%/year is not exceeded.

South Korea could well achieve its 2034 targets for lower coal and nuclear capacity, since the reductions are not that large. Building all the planned new renewable plants is likely to prove more difficult. And restraining gas use in power generation to little more than current levels may prove the most difficult task of all.

As gas effectively becomes the backstop fuel in the country’s power system, LNG demand in 2034 could well exceed not only the base case projection of 47.97mn mt, but also the high gas use forecast of 52.53mn mt.