Statoil: Paris Will Fail under 'Business as Usual'

The Paris COP21 climate agreement can be realised, but it requires new measures and much faster changes than we have seen so far, says a report published by Statoil June 9.

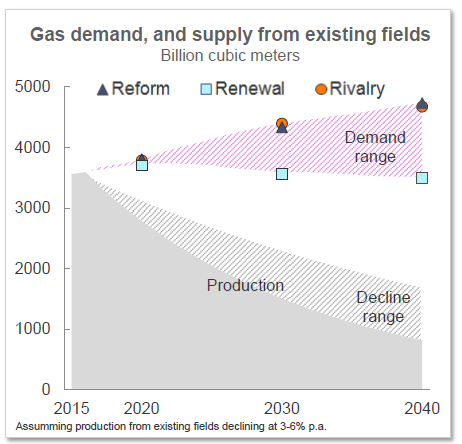

Energy Perspectives 2016 argues that towards 2040 the world will need a lot of renewable energy. Despite this, considerable investments in new production of oil and gas will be necessary to replace falling production from existing fields. “Even with a rapid increase in renewable energy, oil and gas demand will only be slightly lower than today’s level in 2040,” said Statoil chief economist Eirik Waerness. To meet the Paris agreement’s objectives, we need fast changes in the electricity sector and in private car transport, and a strong energy efficiency improvement in all sectors, he added.

Graphic credit: Statoil's Energy Perspectives 2016 report

Statoil CEO Eldar Saetre concurred: “Emissions must be reduced, while at the same time energy must be provided to a growing population where a rising number of people are finding their way out of poverty.” Statoil’s oil and gas production “has the lowest emission level in the world,” he added.

The report is based on three different scenarios: Reform, Renewal and Rivalry.

The Reform scenario in this year’s report is based on the national climate targets included in COP21, with some further restrictive measures, but the target of capping the global rise in temperatures at 2℃ is not attained in this scenario.

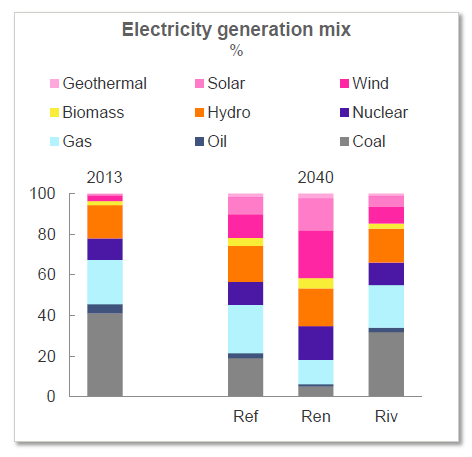

The most ambitious scenario is Renewal, which assumes that nine out of 10 new private cars sold in 2040 will be hybrids or electric cars. It also assumes a transformation in the electricity sector, where sun and wind will account for around 40% of the global electricity generation in 2040, compared with today’s 5%. Oil and gas demand will be somewhat lower than the current level.

The third scenario, Rivalry, is more impacted by geopolitical conflict and larger differences in the regional development, both with regard to economic and energy development.

Looking at gas out to 2020, the report sees global gas demand increasing by 1.4%/year under the Reform and Rivalry scenarios, but at a somewhat slower pace in Renewal. Norwegian gas production stays above 100bn m³/yr out to 2020, but Algeria struggles to raise output and curb domestic demand growth. The global LNG market remains depressed, while Statoil includes the US EIA forecast for US dry gas production from 750bn m³/yr in 2015 to around 820 bn m³/yr in 2020.

The divergences become wider out to 2040 for gas.

The Reform and Rivalry scenarios see continued healthy growth in demand. Global gas consumption increases from its current level close to 3,600bn m³/yr to over 4,700bn m³/yr by 2040 in Reform, so by 1.1%/year, and to a slightly lower level in Rivalry which portrays a more volatile world discouraging gas use in import-dependent regions. The share of gas in world primary energy demand increases from 22% in 2015 to around 24% in both scenarios.

Source: IEA (WEO 2015), Statoil (projections) -- Graphic credit: Statoil's Energy Perspectives 2016 report

In contrast, the Renewal scenario envisages almost global gas demand almost stable relative to today. Despite gas’s lower carbon footprint than oil and coal, it is only India, and for a period China – two emerging economies heavily reliant on coal – that use more gas in Renewal – compared with Reform. In all other regions, decarbonisation of generally more energy-efficient economies results in lower gas demand. By 2040, one in every three cubic metres consumed in the OECD region is lost in the Renewal, compared with the Reform scenario. Demand growth in emerging gas markets worldwide is just sufficient to compensate for losses in the mature markets of OECD and Russia/FSU.

“Beyond Yamal LNG, few Russian LNG projects move ahead in the scenarios; reasons include a well-supplied LNG market and Western sanctions,” the report says. “The Power of Siberia pipeline starts delivering gas around 2021, ramping up to annual exports of 38bn m³ during the decade. Moscow is eager to supply China with Western Siberian gas, but Beijing targets smaller volumes of Sakhalin gas for the North-eastern provinces of China. Projects targeting China are more likely to go ahead in the Rivalry scenario” -- ironically the one envisaging close political ties between the two.

Growth impulses for Russian gas production will come from China or supply into the LNG market, the report argues.

Mark Smedley