Supply security tops energy agenda [Gas in Transition]

As European gas prices, in particular, have soared this autumn, the Gas Exporting Countries Forum (GECF), a grouping of major gas producing countries, has been quick to point out the security provided by long-term contracts.

This goes against the trend of recent years. Data reported by GIIGNL, the International Group of LNG Importers, shows a steady increase in spot market purchases in the LNG market at the expense of long-term contracts. Spot volumes hit 35% of total LNG traded last year, compared with 27% in 2019. Moreover, long-term contracts for LNG have become shorter, more flexible and with a greater variety of pricing mechanisms offered, reducing the role of oil indexation in particular.

These changes reflect a broad shift in risk from buyers to sellers, about which the GECF is naturally concerned. However, the shift in risk is not simply about short-term market conditions, but structural changes in energy markets.

Short-term outlooks

The issue of long-term contracts will loom large in buyers’ thoughts amid today’s elevated spot pricing. However, the idea that traded LNG volumes will shift entirely to spot trade has always been misconceived. Long-term contracts are an essential part of the market, one which provides security for both buyers and sellers alike and a perhaps under-appreciated degree of flexibility.

In many cases, short-termism is the problem. Buyers worried about supply security today were happy to take advantage of the bargains on offer last year. At that point, maximising exposure to the spot market looked the best bet. Roll on 12 months and it is the sellers with spot cargoes who are making top dollar profits and the buyers who took a conservative position with low spot market exposure that are winning the employee of the year award.

The increase in risk borne by sellers may reverse temporarily, as a result of today’s high pricing, but is unlikely to do so on a large scale. This is because of long-term factors: importers’ greater price exposure within their own downstream markets, owing mainly to deregulation and price liberalisation, and the emergence of different risk mitigation options for both buyers and sellers as the LNG market continues to mature.

Matching supply and demand

LNG buyers face the fundamental problem that demand for gas in their own markets is usually highly seasonal and a function of unpredictable weather. Lock in too much LNG supply via long-term contracts and during a mild winter, buyers can find themselves with take-or-pay commitments, but demand low and storage bursting at the seams.

But if demand is high and long-term contract volumes insufficient, buyers have to enter the spot market, where they may pay much higher prices than normal, which they cannot pass through into downstream markets.

In countries where domestic gas prices are regulated and do not react quicky to movements in international pricing, in a tight market, buyers can face sudden, large losses.

In countries where domestic gas prices are regulated and do not react quicky to movements in international pricing, in a tight market, buyers can face sudden, large losses.

In deregulated markets, where competition is fierce, it can be equally hard to pass on higher costs. In markets with very insecure and price-sensitive domestic demand, buyers may prefer that spot purchases rather than long-term contract volumes dominate their purchasing strategy.

Others with more demand security may prefer less spot market exposure. LNG buyers typically adjust the level of spot exposure according to the level of flexible demand that they face.

Production profiles

But if buyers need flexibility, sellers generally do not. They want certainty. They have invested in billion-dollar assets that have fairly steady production profiles. Their best scenario is as much ‘up time’ as possible with demand matching or exceeding their supply capacity all year round. While they may occasionally make exceptional profits in a tight market, an LNG plant cannot operate much beyond its nameplate capacity. Consistency of demand is more important.

Moreover, LNG project developers need long-term contracts. This is because they provide revenue certainty and are key in the early stages of project development. If a seller can land long-term off-take agreements, they can raise finance for their project. For smaller developers, long-term offtake agreements are critical. Often only a small proportion of capacity will be left to the vagaries of the spot market.

Portfolio players

The response of the largest oil and gas companies to the shift in risk has been to build portfolios of production capacity and demand contracts, which enable them to protect against both production outages and swings in demand.

These large players can strike offtake agreements from their portfolio rather than a specific LNG project. Individual LNG projects face differing degrees of political and economic risk so a portfolio agreement as oppose to one direct with an LNG plant in a politically or economically unstable country, Yemen or Libya for example, carries less operational risk for the buyer.

The portfolio players are generally less dependent on long-term agreements as they can finance LNG projects in part or as a whole from their own balance sheets and earmark some equity production for their own downstream use. This generally allows them to support a higher level of exposure to the spot market. This has allowed them to offer more flexible contracts, for example with regard to duration, pricing and destination freedom.

Moreover, long-term contracts are not necessarily inflexible. They usually have minimum and maximum offtake levels, providing some volume flexibility or the ability to defer cargoes. If there are no destination restrictions, buyers have the option to resell unwanted cargoes on the spot market themselves. Pricing formulae also provide flexibility and, as the LNG market matures through the development of futures and derivatives, risk in the physical market can be offset by countervailing financial contracts.

|

GOG competition continued its rise in 2020 The International Gas Union’s (IGU) latest wholesale price survey shows that in 2020, what has been a more than decade long trend continued: gas-on-gas (GOG) competition, as opposed to oil indexation, increased by 1% to 49.3% of the surveyed market, which covered 98% of global gas consumption. The driving force behind this was another significant shift to GOG competition in LNG imports and away from oil price escalation, although this change was not uniform across all geographies. This shift has been evident in each of the last three years, according to the IGU data. Spot market LNG sales rose to 34.7% of total LNG imports in 2020. |

Oil indexation

The second issue highlighted by the GECF was oil indexation, to which the organisation reiterated its continued commitment. Oil indexation means linking the price of LNG in a long-term contract to that of oil, for example the international benchmark Brent crude contract. Oil price indexation is a resilient but declining feature of the LNG market and even GECF members have had to make major concessions in this area over the last decade.

Long-term contracts provide security for LNG buyers and sellers alike, but it is less clear that oil indexation remains as useful a tool as it once was. It is not an essential part of striking a long-term contract.

Oil indexation emerged as a way of pricing gas largely produced as a by-product of oil extraction – a linkage ironically reinforced more recently by the US’s shale boom. Downstream, gas was also competing with oil products, for example for heating, and to a far greater degree than today in electricity generation.

In 1990, at its peak, 1,364.7 TWh of electricity was generated from oil, but by last year this had fallen to just 758 TWh (Figure 1). Moreover, oil-fired generation has become much more geographically concentrated in areas not exposed to electricity market competition.

Europe generated just 46.3 TWh of power from oil last year, a fifth of the 1990 level, and oil-fired generation makes up a minimal amount of power supply in China, the world’s near-largest and certainly fastest-growing LNG market.

Even in LNG’s traditional markets – Japan, South Korea and Taiwan – oil-fired generation is in steady decline and likely to be the first victim of growing renewables output.

Oil indexation thus makes little sense to buyers as the price of LNG is determined by a volatile commodity, the value of which bears little relation to the markets into which they sell their gas. Moreover, as gas hubs and LNG futures become more liquid, much better aligned financial instruments are available to hedge exposures for both buyers and sellers alike.

Oil indexation thus makes little sense to buyers as the price of LNG is determined by a volatile commodity, the value of which bears little relation to the markets into which they sell their gas. Moreover, as gas hubs and LNG futures become more liquid, much better aligned financial instruments are available to hedge exposures for both buyers and sellers alike.

For the GECF, whom are also in large part, as major oil producers and exporters, members of OPEC, the attraction is that oil indexation provides an element of stability via OPEC. If OPEC can provide price stability through its policies, this will flow back into the gas market, providing predictable pricing conditions for measured investment decisions. Historically, the argument was than in the absence of liquid gas hubs and financial markets, this was the best way to price gas.

This, however, does nothing to address the market conditions buyers face, nor does it help them make use of gas and LNG markets’ growing financial sophistication.

Contract outlook

Today’s febrile market – not just record European gas prices but last year’s pricing doldrums – will prompt both buyers and sellers to rethink the balance of their exposure to the spot market. High prices indicate a lack of supply, which should increase buyers’ willingness to support new capacity through equity investments and long-term offtake agreements.

Producers and developers, for the moment, hold a stronger hand than last year. Long-term contracts could therefore see a revival as it provides benefits for buyers and sellers alike.

The question of oil indexation, however, is more opaque. There is a lack of common benefit.

The US has the largest pipeline of potential LNG developments and developers there have already shown a willingness to explore alternative pricing mechanisms, backed as they are by a liquid and sophisticated domestic gas market. Yes, they are hungry for the long-term contracts, but they are less likely to remove other elements of flexibility which make them attractive to potential buyers.

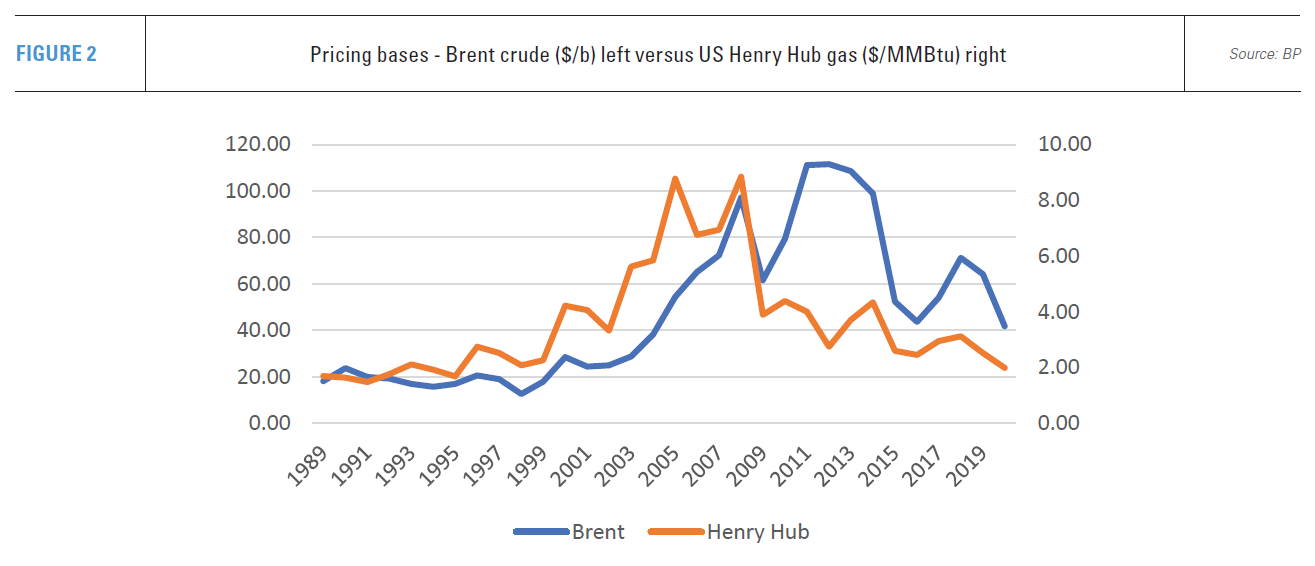

As a result, US LNG developers and portfolio players willing and able to take advantage of spot market exposure (Figure 2) are likely to prove significant counterweights to LNG producers seeking to use today’s tight market to land new long-term oil-indexed contracts.