TC Energy in C$1bn equity deal with indigenous group

Energy infrastructure company TC Energy said July 30 it had reached a C$1bn equity interest purchase agreement with an indigenous-owned investment partnership for a 5.34% minority interest in TC Energy NGTL system and Foothills Pipeline assets (collectively the partnership assets).

The agreement is backed by the Alberta Indigenous Opportunities Corporation (AIOC) and was negotiated by a consortium committee representing specific indigenous communities across the western Canadian provinces of Alberta, BC and Saskatchewan. Including the partnership assets’ collective debt, the deal carries an enterprise value of about C$1.65bn.

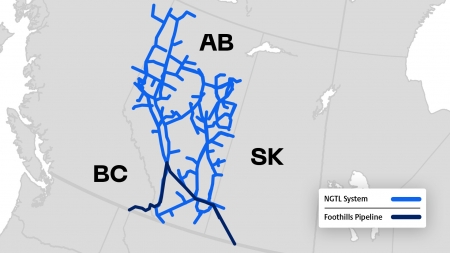

Under terms of the purchase agreement, 72 indigenous communities closest to the partnership assets will become equity owners in the highly integrated NGTL and Foothills pipeline networks which span some 25,000 kilometres in Alberta and parts of BC and Saskatchewan.

Together, the NGTL and Foothills systems connect about 80% of natural gas production in the Western Canadian Sedimentary Basin (WCSB) – one of the largest natural gas reserves in the world – to domestic and export markets. In 2023, WCSB production averaged just under 18bn ft3/day, according to data from the Canadian Association of Petroleum Producers.

“Indigenous ownership is the path to a more prosperous nation,” TC Energy CEO Francois Poirier said. “As owners, indigenous communities will have resources to invest for the future and greater economic sovereignty.”

This isn’t the first initiative by TC Energy to bring indigenous ownership into its operations. In 2022, it signed option agreements with two First Nations investment groups to sell a 10% interest in the Coastal GasLink (CGL) pipeline serving the LNG Canada natural gas liquefaction project on BC’s northern coast.

The AIOC will provide the indigenous communities with a C$1bn equity loan guarantee to support the newly formed indigenous-owned investment partnership. Once that loan guarantee is finalised, the communities will enter into definitive agreements as co-investors in the partnership assets.

“AIOC is proud to support this partnership with communities across Alberta, British Columbia and Saskatchewan with a C$1bn loan guarantee to facilitate this landmark investment,” AIOC CEO Chana Martineau said. “This transaction marks a profound step toward economic reconciliation, providing an unmatched opportunity for sustainable growth and prosperity for the participants.”

The consortium committee consists of members appointed by their respective communities to represent their interests throughout the partnership discussions. Together, the consortium, the AIOC and TC Energy shaped a partnership focused on a mutually-beneficial future within Canada’s resource economy.

“The consortium committee, tasked with negotiating this transaction, deserves notable credit for significantly improving the terms of this deal,” committee chair Chief Isaac Twinn of the Sawridge First Nation, said. “As a result, we anticipate that the indigenous investors will benefit from this partnership for some years to come.”

With the equity purchase agreement set, the consortium committee will present it to the participating communities for their review, with each community deciding on its own participation in the investment opportunity and commencing formal authorisation of their participation. The transaction and transaction size are not contingent on any given community, nor on all communities, electing to participate.

The transaction is expected to close in Q3 2024, subject to receipt of band council and settlement resolutions by participating communities and financing.