Technology focus: LNG expands shipping fuel market share, but will it be leapfrogged? [Gas in Transition]

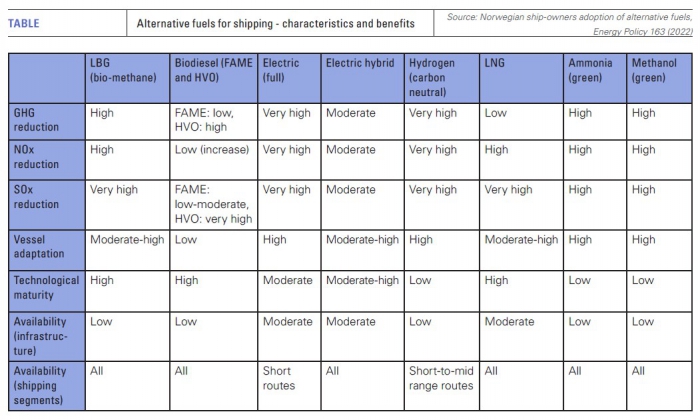

Neither high prices nor potential gas scarcity this winter in Europe will help LNG’s adoption as a shipping fuel. However, it remains the primary alternative to conventional fuels by some margin, offering an attractive combination of low emissions, infrastructural availability and operational experience.

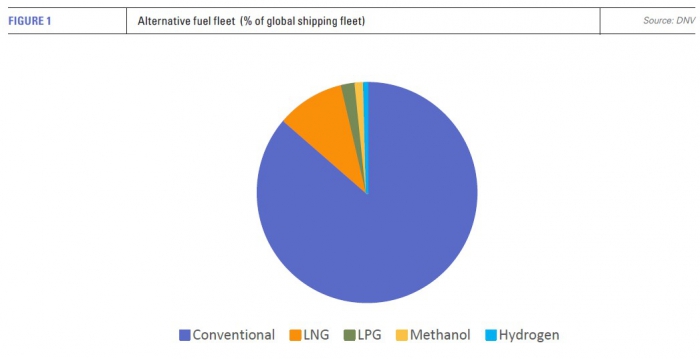

Only 0.41% of the global shipping fleet has adopted alternative shipping fuels so far, according to classification society DNV GL. LNG makes up the biggest segment at 0.34%. Future prospects are better.

Of orders placed for new ships, the share of alternative fuel use is 13.6%, with LNG extending its leadership role substantially to 9.96%. New contracts in 2022 show further evidence of accelerating change; the share of alternative fuels rises to 20.84%, and that of LNG to 14.94%.

In addition, the share attributed to LPG can largely be discounted. There is no adoption of the fuel outside the gas tankers segment, which includes LPG Carriers. In contrast, LNG adoption is visible at differing levels across 18 different vessel types, not including LNG Carriers.

However, methanol and hydrogen do show significant diversification. Based on ships in operation and on order, both span at least seven different vessel types. They are both early-stage fuels, with few ships in actual operation and limited infrastructural capacity in terms of refuelling.

For the moment, this leaves the LNG-fuelled fleet far out in front with the number of vessels in operation rising from 63 in 2015 to 323 in 2022. The order book suggests the number will increase to over 800 by 2026.

Strong growth is expected in key shipping segments with the number of LNG-fuelled containerships jumping from 40 to 171 by 2028, car carriers from around 10 to 102, with significant growth also evident in the crude oil tanker, chemical tanker, bulk carrier and cruise ship segments.

Electrification

The gains made by batteries as a means of shipping decarbonization have in fact been larger in number terms than LNG adoption, a development which would have come as a surprise to forecasters looking at the shipping world ten years ago. At 495, there are, in fact, more battery ships in operation than there are LNG-fuelled vessels, excluding LNGCs.

However, adoption is markedly different to LNG, being heavily concentrated in the car and passenger ferry segment – i.e. ships with defined, relatively short point-to-point routes -- and in the offshore supply ship segment. Penetration of long-haul applications is very limited.

In addition, only 23% of vessels in operation are pure electric. The bulk of the battery fleet is split between hybrid (51%) and plug-in hybrid (22%). Hybrid battery ships generally swap out one of three or four conventional generation sets for a battery, which delivers significant fuel and emissions savings, but falls far short of complete decarbonisation.

The order book for battery ships is also significantly smaller than for LNG, standing at 157 versus 516. Almost half of the new electric vessel orders are for ferries.

Methanol picks up steam

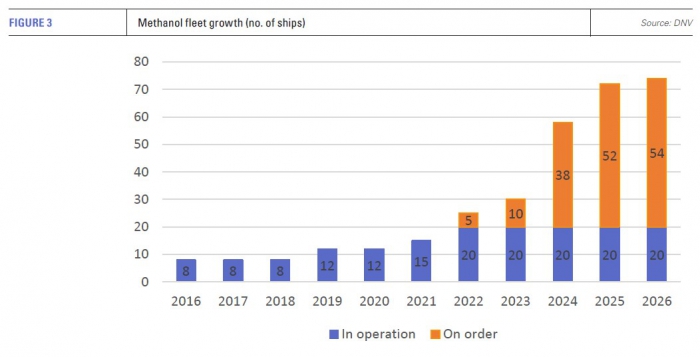

Methanol has really gained momentum over the last 18 months and in some of the shipping segments where LNG is strongest. Of the 64 methanol-fuelled ships on order, 47 are containerships, while in the oil/chemical tanker segment 18 methanol vessels are in operation and 7 on order.

The strategy adopted by one of the world’s largest shipping lines, Maersk, is instructive. Back in 2020, Maersk CEO Soren Skou said LNG was unlikely to play a large role as a transition fuel for the company, and that his objective was to move directly to a carbon neutral fuel, although at the time it was uncertain which fuel and when.

The answers appear to be now and methanol. On October 5, Maersk announced an order for six large ocean-going vessels with dual-fuel engines, which can run on green methanol or conventional diesel. They are to be built by South Korean shipbuilder Hyundai Heavy Industries and they bring the company’s methanol-ready vessel orders up to 19.

The answers appear to be now and methanol. On October 5, Maersk announced an order for six large ocean-going vessels with dual-fuel engines, which can run on green methanol or conventional diesel. They are to be built by South Korean shipbuilder Hyundai Heavy Industries and they bring the company’s methanol-ready vessel orders up to 19.

Maersk has a net-zero emissions goal for 2040 across its entire business. It has established a principle that it will order only newbuild vessels that can run on green fuels, pointing to a one-step fleet renewal programme without the use of transitional fuel technologies.

The six 17,000 TEU vessels are to be delivered by 2025. Maersk estimates the additional capital expenditure, benchmarked against conventional fuel capabilities, at about 8-12%. The six vessels are expected to save about 800,000 tons of CO2 emissions each year.

LNG early adopter

In contrast, CMA CGA, the world’s third largest container shipper by tonnage, has been a clear leader in terms of LNG, ordering a large number of newbuild LNG-fuelled ships to replenish its conventional fleet. However, in August, it too took the plunge into methanol, while continuing to pursue its LNG fleet conversion strategy. The company announced a major new order for ten LNG dual-fuel containerships and six methanol-fuelled vessels, the latter to be built in China by the Dalian Shipbuilding Industry Co. The vessels are to be delivered in 2025.

Highlighting its different approach, the company said “CMA CGM is accelerating its decarbonization trajectory by investing massively in gas and methanol fuels. The two sectors will be complementary for decarbonizing the shipping industry in the years to come.”

Methanol attraction broadens

Other shipping lines are also committing major capital to methanol-fuelled ships. X-Press Feeders late last year placed an order for 16 1,170 TEU dual-fuel newbuilds. China’s New Dayang Shipbuilding and Ningbo Xinle Shipbuilding Group will each build eight, with all the vessels expected to be in operation by the end of 2024 on European and Americas routes.

For long-term decarbonisation, X-Press Feeders is targeting ammonia, methanol and, more speculatively, a modular Molten Salt Reactor (MSR), both for propulsion and energy provision for the manufacture of green fuels.

This represents a long shot, but is indicative of the breadth of solutions ship owners are willing to consider in the search for low emissions shipping. MSRs were abandoned -- wrongly according to their proponents -- as a nuclear technology in the 1970s. Land-based Small Modular Reactors (SMRs), despite much increased interest in recent years, have also yet to be built. MSRs are thought to offer safer operation and less waste than conventional nuclear reactors.

According to X-Press Feeders and their partners Core Power (UK), a first prototype MSR is due to start trials in 2025.

Meanwhile, Greek shipowner Danaos Corp, placed orders earlier this year for two methanol-ready 7,100 TEU containerships from Dalian Shipbuilding and for four dual-fuel 7,200 TEU vessels from South Korea’s Daehan Shipbuilding for delivery in the first half of 2024.

Commenting on the decision, Danaos CEO John Coustas cited significantly elevated fuel prices in the future and the uncertainty of green fuel availability as reasons for investing in fuel efficient vessels which can later be modified for methanol use. The strategy, he said, would remove the risk of technological obsolescence and minimise fuel cost in the short term.

The cruise ship segment has also been an early adopter of LNG-powered vessels, but now seems to be broadening its technology choices.

MSC Group, for example, has ordered two new ships which will incorporate hydrogen fuel cells. Primary propulsion will be from LNG, but the fuel cells will be used to run with zero emissions while in port. In addition, Finnish shipbuilder Meyer Turku has started construction of the first methanol-ready cruise ship for TUI Cruises, while Viking Cruises expects to launch two new ships in 2024 and 2025, which will have hybrid power generation with hydrogen fuel cells.

LNG fuelling available now

According to Clarkson’s Research, as of October, 4.8% of the operational shipping sheet in terms of tonnage was capable of using alternative fuels, up from 2.3% in 2017, but that 43.8% of the new order book was alternative-fuel capable.

LNG still dominates in terms of alternative fuel choice, accounting for 38.9% of the new order book, compared with 2.2% LPG and 4.3% combined for methanol, ethane, biofuels, hydrogen or battery/hybrid propulsion.

Commenting on infrastructure, Clarkson’s shows LNG well ahead of the alternatives. Ports globally with LNG bunkering have increased from around 60 to 154 over the past five years and may reach 250 by 2026. About 171 ports, out of 6,000, have shore-side power, and over 1,700 vessels have either been fitted with or are scheduled to fit shore power connections.

As a result, LNG offers the most readily-available solution for reduced shipping emissions at scale, while most methanol-ready vessels continue to run on diesel, owing to the lack of methanol refuelling infrastructure. However, the growth of orders for methanol-fuelled ships suggests the necessary fuel supply chains will follow, and, as regulation of shipping emissions tightens further, ship owners will increasingly look towards zero rather than low carbon emissions solutions.