The 2022 EU gas market in numbers [Gas in Transition]

Statistics from the Joint Organisations' Data Initiative (JOGI) have just been released. As Lithuania and Romania have not yet provided all data, they have been omitted from demand. We are therefore looking at respectively EU-26 and EU-24 for production and consumption. But this is giving a good proxy for the EU as a whole.

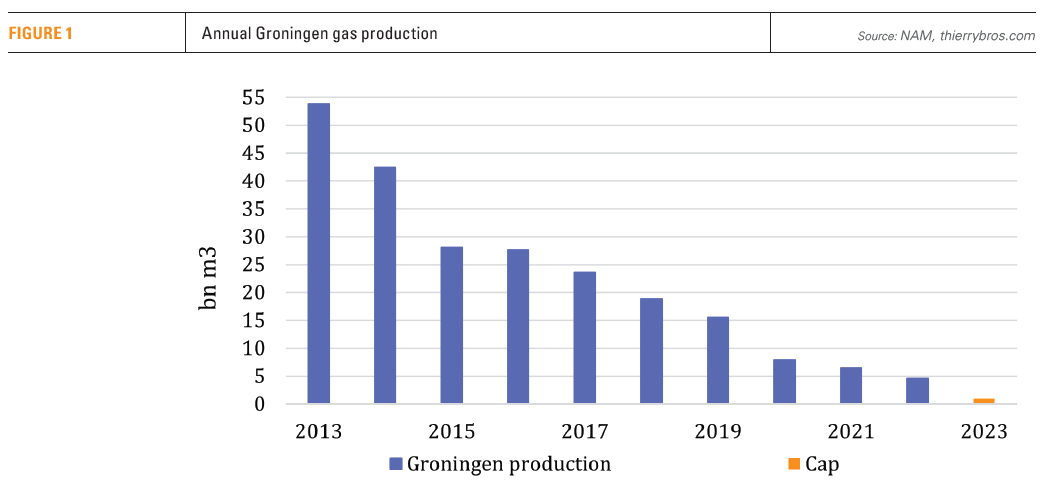

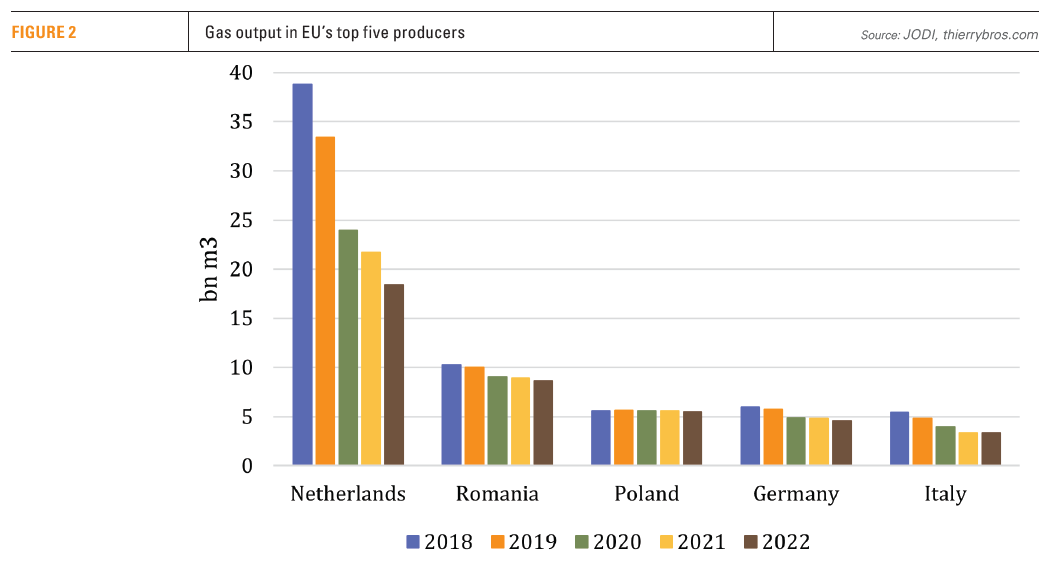

EU-26 gas production was again down by 8% in 2022, due to a drop of volumes mostly in the Netherlands (-3.3bn m3). The giant Groningen gas field alone accounted for 1.9bn m3 of this drop.

Groningen is expected to shut down in a couple of months, after years of its output being scaled down to avoid the risk of earthquakes. In 2023, the drop in Groningen production should again have a material impact on overall EU supply.

To help mitigate the drop in Russian pipe exports to Europe, neighbouring Norway and the UK increased their production by respectively 14% (+5.3bn m3) and 7% (+8.5bn m3).

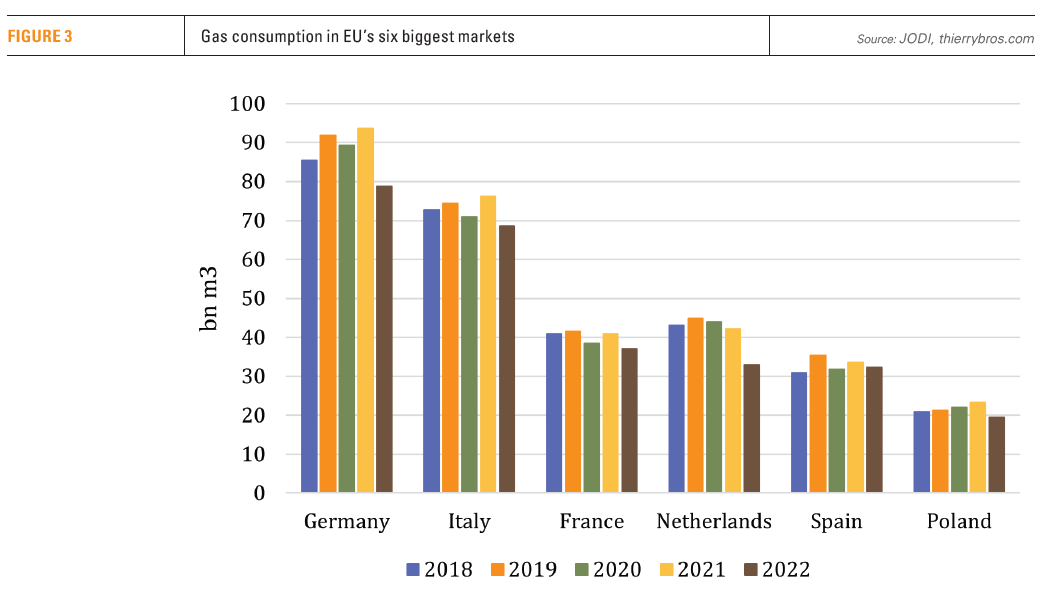

Overall EU-24 demand was down by a record 13% due the weaponization of gas by Russia that led to both record high prices and EU political interventions. At one end of the scale there was Finland, which saw a 47% decline in demand. On the other there was Malta, which saw consumption grow by 2%.

The previous record drop was witnessed in 2014, when consumption fell by 12%. Mild weather and demand reduction and destruction were behind the sharp fall last year. But this will not be the trend in the coming years. 2023 should likely see a small rebound due to lower prices.

As the Netherlands managed to reduce its demand much more than France (-22% vs -10%), for the first time the ranking of largest EU gas markets has changed. Now France has taken the third position, leaving the Netherlands in fourth place.

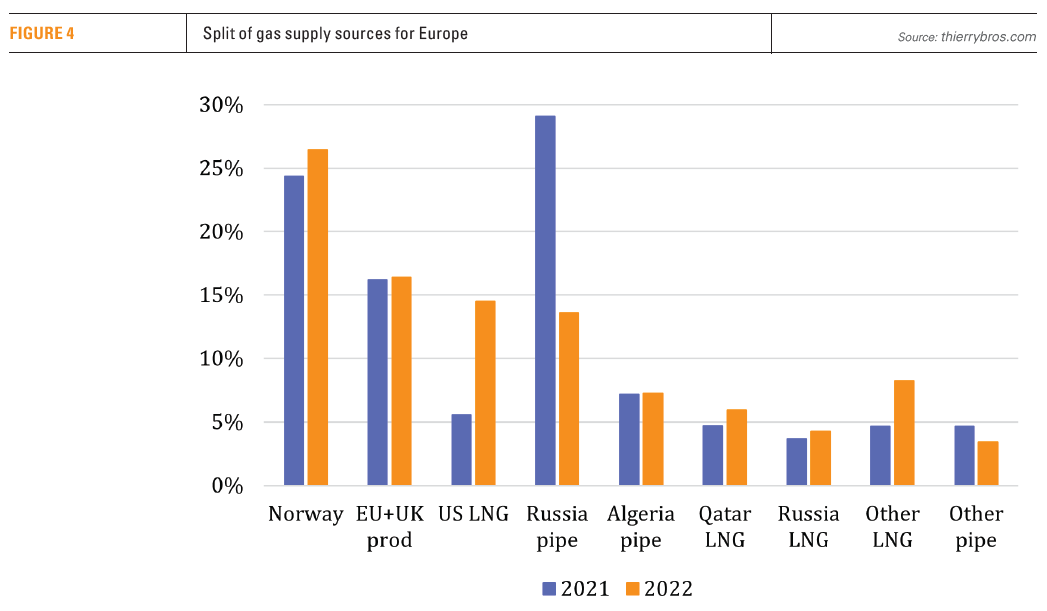

2022 has been an exceptional year, with the massive drop of Russian pipe exports mostly being mitigated by US LNG that has been rerouted away from Asia to Europe.

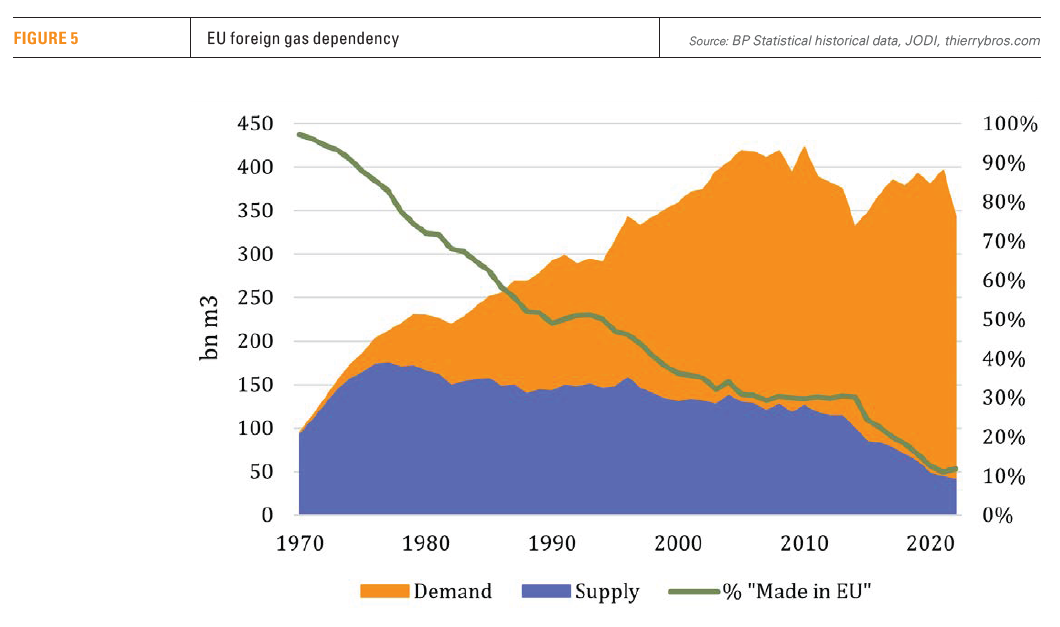

The EU foreign gas dependency factor reversed slightly in 2022 to 89% due to the massive drop in demand. But we should expect this percentage to increase in the coming years (at least due to the decline of domestic production). With high prices and little Russian pipe gas left, policymakers in Brussels and in member states should take heed of this and assess how to boost domestic production, particularly in Romania and Poland, and diversify supply by incentivising the top three foreign suppliers beyond Russia (Norway, US and Qatar) to invest massively in expanding their exports. This could be envisaged as a strategic partnership with the EU to increase security of supply while fostering the energy transition. That transition is currently reversing course. In 2022, 450 TWh of electricity was produced using fuels more polluting than gas. It would require an extra 90bn m3 of gas to replace these fuels.

About the author

Dr. Thierry Bros is a Professor at Sciences Po Paris and a contributor to Natural Gas World, an independent specialized website dedicated to global gas matter. Thierry is also a Senior Expert at Energy Delta Institute and a member of the EU-Russia Gas Advisory Council.

Thierry has 30 years experience in energy & climate, from policy side to trading floors.

Thierry Bros holds a Master of chemical engineering from ESPCI ParisTech and a PhD from Ecole Centrale Paris.