The economics of blue hydrogen [Gas In Transition]

Nils Rokke, executive VP for Sustainability at Norwegian research conglomerate SINTEF, recently contributed an article to Forbes about hydrogen production. The title, Blue Hydrogen Isn’t the Climate Enemy, It’s Part of the Solution, nicely captures the bottom line of the article. It’s a sentiment with which I heartily concur.

Production of blue hydrogen is far more controversial than it ought to be. Christopher Jackson famously resigned his position as chair of the UK Hydrogen & Fuel Cell Association (UK HFCA), in protest over the organisation’s support for blue hydrogen. He believed that blue hydrogen “is at best an expensive distraction, and at worst a lock-in for continued fossil fuel use that guarantees we will fail to meet our decarbonisation goals”.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Another objection, couched in what appear to be objective economic terms, is that as production of hydrogen by electrolysis ramps up, the capital cost of electrolysis equipment will drop quickly. Once the capital cost issue is resolved, an abundance of “nearly free” electricity from surplus wind and solar will quickly reduce the cost of green hydrogen. Companies that choose to invest in blue hydrogen production may therefore find themselves holding stranded assets. Blue hydrogen will become uncompetitive, and the companies will never recoup their investment. The International Renewable Energy Agency, IRENA, made that argument in a recent report titled Geopolitics of the Energy Transformation: The Hydrogen Factor.

In a previous article, I wrote about why I think IRENA’s forecast is highly unlikely. That article focused mainly on the high energy cost of electrolysis and related carbon footprint issues. Taking power from the grid for electrolysis before the grid has been fully decarbonized is counterproductive – it increases net carbon emissions. At the same time, use of dedicated renewables for electrolysis carries an opportunity cost by forgoing the reduction in carbon emissions that the renewables dedicated to energy-intensive hydrogen production could have produced had they been applied to the grid. I touched lightly on the other side of the equation – the model IRENA assumed for the costs of blue hydrogen production – but didn’t go into detail. I’d like to do that here.

The economics of blue hydrogen will be as dynamic as those of green hydrogen. An argument that green hydrogen will become cheaper when it is produced at scale, but blue hydrogen won’t, is fundamentally flawed. To get a definitive take on this issue, I contacted energy researcher Schalk Cloete. Dr. Cloete is a research scientist in process technology at SINTEF, and an expert on techno-economic assessment of process technology options. What follows is an edited transcript of our Q&A email exchanges.

RA: In a paper still out for peer review titled Maximising the Techno-Economic Performance of Steam Methane Reforming for Near-Term Blue Hydrogen Production, you and your co-authors chose as a baseline for comparisons a more or less standard steam methane reforming (SMR) process train configuration. It was modified to include a CO2 capture stage downstream of the low temperature shift reactor immediately upstream of the PSA hydrogen purification stage. Is that the configuration you believe most likely to be adopted for retrofitting carbon capture capacity to existing SMR facilities in the near future?

SC: It depends on several factors. The first question is whether we are fixated on near-100% CO2 avoidance. This pre-combustion configuration is economically compelling up to about 80% CO2 capture (a cost of €35/metric ton of CO2 avoided) because it captures CO2 from a pressurised stream where the CO2 is present at a high partial pressure. Even though we show it's possible to reach near-100% CO2 capture via PSA off-gas recycling, capturing the final 20% of CO2 in this way is about 4x more costly. Second, removing CO2 from the syngas before the PSA will affect the operation of the PSA and the downstream burners in the reformer furnace. It should be possible to operate these units at new set points, but there might be some extra costs or penalties involved. However, for new plants happy to capture only 80% of CO2, this is an economically attractive solution using off-the-shelf technologies. When CO2 taxes become high enough later during the plant lifetime, a post-combustion CO2 capture solution can be retrofitted to capture the remaining 20% of CO2.

RA: How does the performance of that baseline model compare to that of Howarth and Jacobson’s model in their harshly negative critique of blue hydrogen?

SC: That is quite an unfortunate paper. I won't go into the details here, but rather point to aquick and simple rebuttal by a well-respected collaborator on LinkedIn. The largest source of emissions in that study came from extreme fugitive emissions assumptions, but the direct CO2 emissions from their over-simplified hand calculations were also almost 3x higher than those of the standard blue H2 process with 78% CO2 capture resulting from our complete process simulation in Aspen Plus.

RA: You also looked at a variation on the baseline model that incorporated heat exchangers to better manage waste heat. How did those changes affect cost and performance?

SC: Tighter heat integration could reduce the costs and increase the efficiency by about 6%. This incremental gain is delivered by recovering more of the latent heat in the steam that must be condensed out before the PSA.

RA: A third configuration you evaluated used ohmic resistance in place of fuel combustion to supply enthalpy for the reforming reaction. That eliminates any flue gas and flue gas emissions from the furnace holding the fired tube reactors, at the cost of using electricity instead of fuel for the heat source. The results are interesting. Copied below are four charts from your paper that summarise them. Can you walk us through these to show how the electrified SMR model compared to the first two models in your analysis?

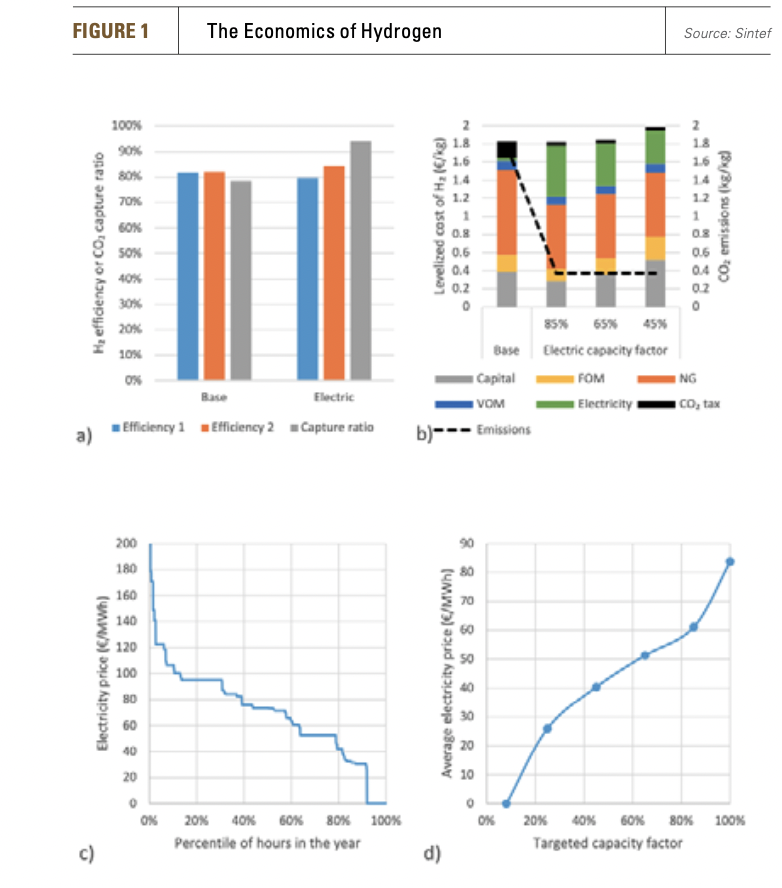

SC: The CO2 emissions in the conventional configuration originate mainly from unconverted CH4 and CO that cannot be captured by the CO2 absorption unit and then get sent to the reformer furnace to be combusted, releasing CO2. When we do electrical reforming, we can increase the reforming temperature to convert more CH4 and recycle most of the PSA off-gas with some remaining CH4 and CO back to the reformer, thus boosting the CO2 capture ratio from 78% to 94% in figure 1. For the economics in figure 2, the higher cost of electricity is cancelled out by the lower capital costs and CO2 tax burden (we assumed €100/mt) enabled by the electric reformer.

We also looked at the effect of operating the plant at a lower utilisation rate only when cheap electricity is available. Figure 4 shows how the average electricity price decreases if the plant can run for fewer hours of the year, consuming only the cheapest electricity and shutting down during the most expensive hours shown in figure 3. However, ramping down means that the capital of the plant is underutilised, making the levelized cost of capital higher. Figure 2 shows that this capital cost increase outweighed the cost reduction from cheaper electricity. Thus, an electrified reformer plant would need a fairly constant supply of relatively cheap low-carbon electricity to be attractive, potentially ramping down only during a few days in the year when electricity is at its most costly.

We also looked at the effect of operating the plant at a lower utilisation rate only when cheap electricity is available. Figure 4 shows how the average electricity price decreases if the plant can run for fewer hours of the year, consuming only the cheapest electricity and shutting down during the most expensive hours shown in figure 3. However, ramping down means that the capital of the plant is underutilised, making the levelized cost of capital higher. Figure 2 shows that this capital cost increase outweighed the cost reduction from cheaper electricity. Thus, an electrified reformer plant would need a fairly constant supply of relatively cheap low-carbon electricity to be attractive, potentially ramping down only during a few days in the year when electricity is at its most costly.

RA: So, let’s see if I’ve got this right. With the price model you used for gas, electricity, and carbon emissions, the cost of hydrogen for electrified SMR came out a wash with the base process when the capacity factor for electricity was 85%. The cost for the larger amount of electricity was offset by savings from the smaller amount of natural gas consumed, and from lower carbon emissions. Dropping to a CF for electricity of 65% only raised the cost of hydrogen by about 2%. The rise in capital and fixed operating costs associated with the lower CF were neary balanced by the lower cost of electricity at the lower CF. Right so far?

SC: Yes.

RA: So it looks like higher natural gas prices and higher prices on carbon emissions would tend to favour the electrified SMR option, while lower gas prices and lower prices on carbon emissions would favour the base process. Is that right?

SC: Yes, together with a high CO2 price, it would be about the ratio of electricity to natural gas price. However, natural gas is normally an important factor in setting electricity market prices, so this ratio would not vary freely. Also, the electricity prices we used come from a long-term simulation of a highly optimised decarbonised grid shared between Norway and Germany. If this would be done today, there would be substantial indirect emissions from electricity consumption in most markets. In the near-term, the electrified reformer concept could be interesting in selected markets like Norway with its hydro-rich grid, but then we should honestly consider the opportunity costs of not using that limited supply of reliable clean electricity for other purposes.

RA: One final point on electrified SMR before we move on to some of the more advanced methods for blue hydrogen production that you’ve studied. Your model for electricity pricing doesn’t appear to include any feedback effects for electrified SMR on the electricity market itself. But an electrified SMR plant capable of throttling its operation according to the availability of electricity could function as a “virtual battery” for the power grid. In economic terms, it would seem to have a positive externality in facilitating integration of higher levels of wind and solar resources and reducing the need for peaking units. Does that sound reasonable, and do you think it would (or should) affect the economic evaluation of the option?

SC: At best, the electrified reformer plant can ramp down during hours when electricity is scarce to reduce some of the pressure on the grid. Electrolyzers (green H2) are better for running at a low capacity factor to utilise electricity in times of excess. There would also be additional operating costs involved in frequently ramping all the units integrated in this chemical plant as well as the downstream CO2 handling infrastructure that we did not consider in our study. Thus, I would not put too much weight on added grid benefits beyond the natural market benefit the plant receives from not consuming electricity during the most expensive hours. Another counterbalancing factor is that hydrogen prices would probably be correlated with electricity prices as storing hydrogen is not free, thus reducing the average value at which the plant can sell its product if it concentrates production in hours with lower electricity prices.

RA: OK, I see that. Now let’s look beyond near term SMR conversions and consider what might lie further down the road. I know you and others have studied a number of possibilities. Two that particularly impressed me with their potential are membrane assisted autothermal reforming (MA-ATR), and gas switching reforming (GSR). You have an article about MA-ATR in the International Journal of Hydrogen Energy (here), and one that I found really intriguing about flexible power generation and hydrogen production using GSR in Energy (here).

Taking MA-ATR first, you concluded that it could have an effective H2 production efficiency of >80% with 100% CO2 capture. How would the 100% CO2 capture be achieved?

SC: The MA-ATR concept intensifies the reformer, water-gas shift, and PSA into a single unit that converts CH4 fully to CO2 in a single line. Thus, all the carbon in the CH4 is produced as CO2 in the outlet gas from the MA-ATR, ready for transport and storage after water is condensed out.

RA: You also wrote that the simplicity of the MA-ATR reactor “can allow for rapid scale-up and commercialization”. What’s your assessment of how quickly the first MA-ATR process trains could be brought online, and what would the cost of the produced hydrogen likely be?

SC: Due to the process intensification mentioned above and the relatively low operating temperature of MA-ATR, processes based on this concept are attractively simple. However, the long-term (months to years) performance and stability of the membranes remains to be demonstrated. Once such a demonstration is successfully completed, the process simplicity mentioned above can yield rapid process scale-up, probably at a CO2 avoidance cost below $20/mt.

RA: Wow! $20/mt is an impressively low price for carbon avoidance. That’s encouraging. Now for the last option we’ll cover here, let’s take a quick look at the GSR process. It’s a novel approach, probably not familiar to many. A good high level overview of the process can be found here for readers who are interested. Also, the economics of GSR for blue hydrogen are spelled out inthis paper that you and Lion Hirth published two years ago in Energy. You found that GSR had good synergistic potential to integrate with variable renewables. Can you explain why that is, and what you see as the bottom line for GSR technology in the future?

RA: Wow! $20/mt is an impressively low price for carbon avoidance. That’s encouraging. Now for the last option we’ll cover here, let’s take a quick look at the GSR process. It’s a novel approach, probably not familiar to many. A good high level overview of the process can be found here for readers who are interested. Also, the economics of GSR for blue hydrogen are spelled out inthis paper that you and Lion Hirth published two years ago in Energy. You found that GSR had good synergistic potential to integrate with variable renewables. Can you explain why that is, and what you see as the bottom line for GSR technology in the future?

SC: Yes, GSR is another interesting option that can yield similar economics to MA-ATR with a process closely resembling a conventional steam methane reforming plant. We did an economic assessment for a standalone GSR-H2 planthere, finding CO2 avoidance costs as low as $15 / ton with 96% CO2 capture. In this case, it is the long-term performance and stability of the oxygen carrier material and downstream high-temperature gas switching valves that remain to be demonstrated before scale-up.

Regarding the flexible plant, it works by operating the GSR-H2 plant at steady output and either exporting H2 to the market (when electricity prices are low) or combusting it in a power cycle (when electricity prices are high). These modes of operation allow most of the plant (and the downstream CO2 transport and storage infrastructure) to operate constantly at maximum output, while the electricity output ramps to balance wind and solar. However, the paper you refer to gives an over-optimistic view of this flexibility by assuming negligible storage costs for hydrogen. Although hydrogen is much cheaper to store than electricity, its storage cost is still significant.

We dida more detailed study later showing that properly accounting for the costs of handling the intermittent fluxes of hydrogen that are produced when the plant alternates between power and hydrogen output brings a significant cost that cancels out some of the flexibility benefit. However, it can still be highly attractive in regions close to geological formations that are suitable for cheap underground hydrogen storage.

RA: Thank you so much, Dr. Cloete. We could go on, but I think that’s about as much Q&A as we have space for in this article. Your answers have been very enlightening for me. I hope they have been for our readers as well.

There are other options for efficient production of blue hydrogen that Dr. Cloete and I did not discuss, and other options for energy-efficient carbon capture beyond the mature MDEA scrubbing technology that Dr. Cloete’s studies assumed. MIT startup Verdox, for example, has developed a class of electrochemical carbon capture systems that hold the promise of more complete CO2 capture at a lower specific energy cost than current approaches. It may be that the capital cost will be lower as well. That remains to be proven, of course.

Whether or not Verdox manages to live up to its promise, I think the bottom line is clear. The field is bubbling with promising options and new technologies for lowering the cost of very low carbon production of hydrogen from fossil gas. If green hydrogen is to compete with it, it must aim at a moving target.

Eventually, of course, green will triumph. Fossil gas supplies will run out, and blue hydrogen production will be reduced to reforming biomethane for removing CO2 from the atmosphere. But that will be some time in the future. In the meantime, blue and green hydrogen are natural allies, not competitors. They complement one another. Here’s how:

Green hydrogen presently has a problem. Even if electrolysis equipment were free, green hydrogen could not be produced at scale. There is not enough carbon-free electricity in the world to produce more than token quantities of truly green hydrogen. Any carbon-free electricity that is produced is better employed to replace generation from unmitigated burning of fossil fuels. The payoff would be much larger. But in that case, how can the infrastructure for an eventual hydrogen economy get developed? Isn’t that a classic chicken and egg problem?

Blue hydrogen resolves the chicken and egg problem. Not only can it be scaled quickly, but from the start, it can contribute to reducing carbon emissions. It does not require that the world defer reductions in carbon emissions while clean energy resources are devoted to producing costly electrolytic hydrogen that will never return more than a fraction of the energy put into making it. Blue hydrogen will contribute to building the decarbonized energy grid that must exist before truly green hydrogen can be scaled.

About Nils Rokke

Nils Anders Rooke is executive vice president of sustainability at SINTEF and also serves as chairman of the European Energy Research Alliance. His areas of research are energy and climate strategies, renewable energy, CCS technologies and policies, hydrogen and climate mitigation.

About the author

Roger Arnold is a former physicist, aerospace engineer, and systems architect. He has worked at IBM, Boeing Aerospace, AT&T, and a number of electronics companies and startups in San Diego and Silicon Valley. Now retired, he pursues independent research and writing. His writings focus on climate, clean energy, and sustainability. He is especially interested in exploring how technologies interact and create opportunities for synergistic solutions to critical problems.