The Impact of Covid-19 on LNG Supplies

As market watchers search for clues as to how and when demand may recover, the coronavirus could actually bring forward and intensify longer-term tightening of the LNG market by creating conditions that do not favor additional investments in LNG projects.

Already, lockdowns have slowed construction on projects in the works and companies are delaying final investment decisions (FIDs) on potential LNG supply projects by several years. The global LNG market could face a supply shortfall in a few years, a scenario that seemed unlikely at the start of 2020 when proposed projects with 186 million tons of capacity were in the pipeline. The ability of the oil and gas industry to recover from the impacts of coronavirus will have a long-term effect on companies’ potential to secure the financing required for multibillion-dollar investments in LNG supply. In addition to the 359 million tons (MT) of existing global LNG supply, there is over 100 MT of supply under construction and expected online by 2025. Some 30 MT of that supply was expected over the next 18 months, but the timing now appears in doubt.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

These factors will create additional pressure on the LNG industry, which was already facing difficult questions, including how natural gas will fit into global efforts to reduce greenhouse gas emissions and ongoing trade relations between the US and China.

This piece explores the impacts of coronavirus on LNG investment and near- and longer-term fundamentals, with special attention given to the US market, which has surged in importance over the past decade because of the shale boom. It then examines how these factors will combine with longer-term issues the sector was facing, and concludes with a discussion of how countries seeking to boost LNG imports might pivot to take advantage of current market conditions and ensure investments in capacity to secure future volumes.

INVESTMENT WILL NOT RECOVER WITH PRICES

The impact of Covid-19 will hit the natural gas sector across multiple timeframes. With so much uncertainty about when and to what extent economies will reopen, it will take time before it is clear how much natural gas demand will be lost this year and possibly beyond. Clearly, there will be limited upside for contract and LNG prices this year. Most global liquefaction projects require a landed cost of around $6 per million British thermal units (MMBtu) or $60 per barrel of oil to breakeven, more than double current price levels. With existing LNG producers delivering cargoes below break-even costs, no new projects are going to make FID.

In Australia, Santos has delayed the $7 billion Barossa project, which was due to supply replacement gas for Darwin LNG. Expansion plans in Papua New Guinea have also been delayed as has a Train 7 for Nigeria LNG. ExxonMobil has put a hold on the Rovuma project in Mozambique, which was expected to make FID in the first half of this year.

In addition, ongoing construction of liquefaction terminals is being delayed, in part due to widespread lockdowns as well as financial considerations, which will impact new LNG supplies that were expected to come online this year and in 2021. Shell announced cuts to its workforce at the 14 million tons per year (MTPA) LNG Canada project and is trying to keep only essential personnel on-site. Other LNG projects could implement similar measures, especially as an LNG liquefaction train requires 7,000 to 11,000 workers during the peak construction period. It is worth noting that Total’s Mozambique LNG has been linked to two-thirds of all coronavirus cases in that country.

Covid-19 may provide international oil and gas companies (IOCs) with a good reason to delay construction a year or two on costly liquefaction projects out of an abundance of caution for workers’ safety. Many IOCs have announced CAPEX cuts of 20 percent or more, and LNG projects could be an attractive option for cutting costs.

If construction is also delayed in the United States it could hurt US LNG export growth, which had been expanding rapidly due to the boom in natural gas supplies. Construction was underway at six different LNG terminals on the US Gulf Coast when the pandemic hit. Freeport has just started commercial operation on a third train in May that needs to ramp up, while Elba Island has six smaller units due to start operations in mid-2020. Cameron LNG has a third train due to start in the third quarter (Table 1). All these expansions could now be delayed. US exports were expected to average 10 billion cubic feet per day (Bcf/d) next year, but that level may not be reached until 2022, which could reduce some of the supply overhang into 2021.

All of these factors are unlikely to be enough to counter the loss of demand this year and bring prices higher, but they may put a floor under spot LNG prices.

CARGO CANCELATIONS DO NOT ALWAYS EQUAL LOWER UTILIZATION

While delays in longer-term investments may eventually slow supply growth, structural issues make it difficult or even undesirable for companies to curtail supplies to quickly balance out the loss of global demand. All liquefaction plants are designed to run at high utilization rates and it is often extremely costly and inefficient to reduce rates. Design limitations restrict which plants can even ramp down. Some plants such as Cheniere’s plants at Corpus Christi and Sabine Pass utilize liquefaction technology (COP Cascade liquefaction) that allows utilization at rates as low as 20 percent. However, most US projects use the Air Products C3MR liquefaction technology that requires a high utilization rate.

Even using the more flexible liquefaction technology, the efficiency is so poor at rates below 95 percent that most plant operators do not advise running a plant at lower utilization for more than a couple days. Low-capacity operation usually only occurs in the event of another part of the plant malfunctioning, such as a turbine.

In the face of the market imbalance caused by the demand collapse and the inflexibility of supply, the LNG industry has been using shipping as a way of storing excess volumes, either by slowing shipping speeds, charting longer routes, or utilizing tankers as floating storage. Only when onshore and offshore storage reach maximum capacity and there is nowhere else for the LNG to go are producers likely to cut production.

A CLOSER LOOK AT THE US

US projects are often cited as the most likely to reduce utilization this year due to the more flexible nature of the contracts. US LNG exports are under long-term “take or cancel” contracts through the 2030s, for which producers receive fixed capacity fees even if buyers do not take the cargoes. US buyers have the option to not take contracted quantities given sufficient advanced notice to the seller and the payment of the cancellation fee. The fee is enough to cover the seller’s fixed and unavoidable costs. US terminals have buyers providing the ships and picking up cargoes (Free on Board) versus US suppliers delivering them to buyers (Delivered Ex-Ship). Companies like Cheniere then have the option to resell any canceled cargoes to their marketing arm, as they did in April when buyers canceled the right to two cargoes. As long as the cost of production of an LNG cargo is below the fixed capacity fee customers pay, there is still an incentive for US terminals to export cargoes. To date US export terminals have continued to operate at full utilization and any recent dips in utilization have been due to fog or maintenance and not market conditions.

Buyers have canceled the right to pick up 25 US cargoes in June, driven by the collapse of natural gas prices in Asia and Europe that has made it uneconomic to ship cargoes from the US to either destination. If those cargoes cannot be resold, it is possible that projects would take off a single train rather than reduce utilization across the plant. In the case of US projects with two trains, that would likely have to be prompted by half of all volumes over several months being canceled.

So far, no suppliers from the US or other countries have shown any interest in running below the maximum available capacity unless forced to because of a shortage of feedgas (e.g., Indonesia, Brunei, Egypt). With US natural gas production at 93 Bcf/d and US LNG exports at 8 Bcf/d, even the significant decline in gas production expected this year will have no impact on the volume available for US exports.

Existing projects may also seek to keep as much LNG on the market in the near term as possible to hamper the economics of additional trains in the midst of FID decisions, driving down competition and improving market conditions down the road.

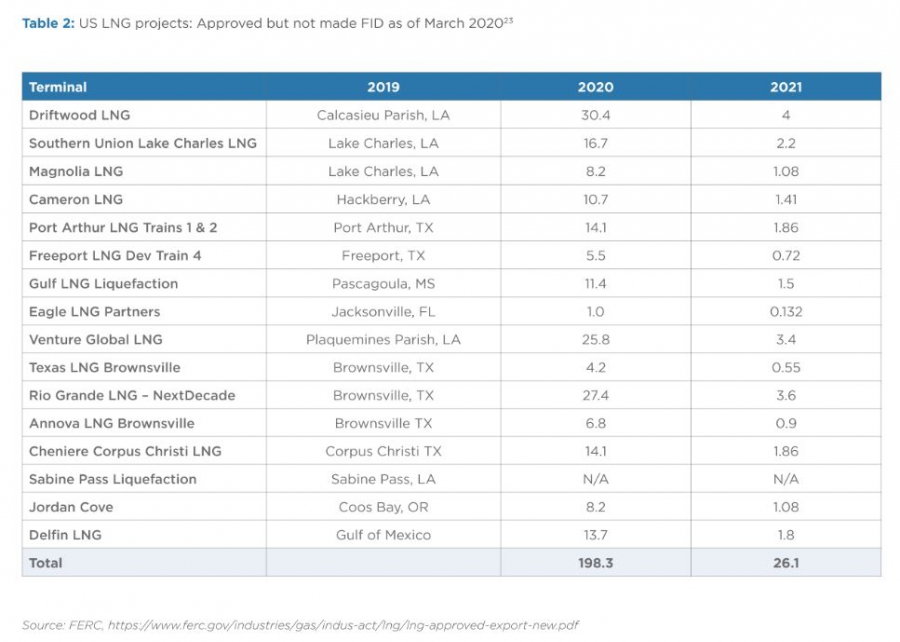

Sixteen US export projects and expansions representing nearly 200 million tons per annum (26 Bcf/d) of capacity have been approved by FERC and DOE but not yet made FID (Table 2). Only a fraction of those projects was ever expected to be built, but at the start of 2018 there were expectations that about 10 of them could reach FID, representing approximately 100 MT.

Already there are signs the timeline for the next wave of US LNG projects is in danger. Tellurian laid off 40 percent of its workforce in March, making an FID decision for the Driftwood LNG project unlikely this year. Shell pulled out of the Lake Charles export project in March, Sempra delayed FID on the Port Author LNG terminal, and Cheniere delayed FID on phase 3 expansion of Corpus Christi.

LNG projects were already under pressure from the US trade war with China that erupted in June 2018. A number of tentative agreements—heads of agreements or memorandums of understanding—with China were put on indefinite hold. China was the intended foundation buyer for many of these projects, sending them scrambling to find alternative long-term contracts to move forward.

Only two new US projects, Venture Global’s Calcasieu Pass and Ocean LNG’s Golden Pass (70 percent Qatargas, 30 percent Exxon Mobil), have reached FID since the start of 2018. Venture Global was able to offer fees low enough to entice buyers, while Ocean LNG has signed up all of the offtake of its project.

In addition, only two US expansions have made FID since 2018: train 3 of Corpus Christi and train 6 of Sabine Pass.

Demand for US cargoes may end up being higher as a result of additional spot buying by China as the giant economy begins to ramp up activity as it emerges from the coronavirus. But China may struggle to meet the targets for importing US energy set in the Phase 1 US-China trade deal ($18.5 billion over 2017 energy import levels for 2020) due to the fall in commodity prices. However, China may make a good faith effort to bring in additional US spot cargoes to avoid an escalation of tariffs, and in April China imported its first US cargo in 13 months.

Even if China begins to increase purchases of US spot cargoes this year, it is unlikely to sign long-term volumes from the US. China is not apt to make itself dependent on US gas imports for a 15–25-year period, especially when it may have concerns about the Trump administration’s position on trade from one week to the next, let alone what future administrations may do over two decades. No contract has been signed with a Chinese buyer since the trade war began in 2018, leaving several US export projects without a key foundation buyer. The lack of long-term commitments from Chinese buyers adds further doubt that a Phase 2 trade deal will be signed.

GLOBAL IMPACT WILL LAST FOR YEARS

Even if the oil price recovers, the experience of the LNG market this year—both in terms of demand destruction and lower prices—will weigh on developers and financiers of LNG supply for many years to come. Other factors could add to commercial concerns surrounding LNG projects.

Political strife is on the rise in Mozambique, where Islamist-militant attacks are up 300 percent so far in 2020. In March, militants attacked a town 38 miles from where Total’s Mozambique LNG project is being developed and where ExxonMobil’s project was due to be built.

The attacks on Saudi’s oil processing facilities in Abqaiq in September 2019 could also impact the proposed Qatargas expansion of 49 MTPA. Buyers that already have a sizable share of their imports from Qatar may be reluctant to purchase significantly more gas from the small nation between Iran and Saudi Arabia and prefer to diversify supply risk. While Abqaiq processes 5 percent of global crude production, Qatar supplies 22 percent (77 MT) of global LNG supply. Rather than increase capacity by another 63 percent, Qatar could end up scaling back expansion plans to a level closer to 100 MT rather than the planned level of 126 MT.

Risks to new projects are also coming from efforts to address greenhouse gas emissions. In recent years, offtake volumes have increasingly been signed up by portfolio players like Shell and Total. Future demand from European portfolio players such as BP is in question, however, given the carbon neutrality targets being proposed by those companies and the European Commission.

The decision by Shell in March 2020 to pull out of the Lake Charles project in the US may signal a decline in LNG investments by those IOCs. Without participation by the IOCs, much of the $80 billion of forecasted FIDs around the globe cannot take place.

The shift toward carbon neutrality may end up having a more significant impact on long-term LNG supply than any of the commercial or security risks outlined so far. It raises questions about the ability of LNG supply to keep up with projections of 700 MT of LNG demand by 2040.

As economies start to reopen after Covid-19 eases, LNG demand growth may return quickly due to the low price of both spot and oil-indexed contract prices and demand elasticity from the competitive price of gas with other fuels including coal. With supply growth harder hit by the impact of Covid-19, buyers will have to increasingly look to existing LNG supply to secure future long-term deliveries. There will be less LNG available for short-term and spot purchases at a time when more countries may wish to increase imports. While forecasters had expected the LNG market to remain well-supplied through 2025, it may actually move back into balance earlier.

A quicker rebalancing of the market could spur investment in smaller-scale onshore and floating LNG projects, which are cheaper and faster to bring online. But it seems unlikely that the industry will see another year like 2019 again, where 71 MTPA of supply reached FID.

RECOMMENDATIONS FOR LNG IMPORTERS

Changes in the LNG market will be significant for LNG importing countries if they can no longer rely on large portfolio players. Governments may have to step in more directly if they want volumes to grow beyond 2025, and become investors in liquefaction.

Japan’s commitment of $10 billion toward LNG infrastructure is the first step in this direction. With an average liquefaction train costing close to $8 billion (4 million tons at $2,000/ton), other governments are seeking to increase consumption of LNG will likely have to make similar commitments.

National oil companies can also take equity stakes in projects to spur development, as Chinese companies did with Australian LNG projects from 2009–2012 and again last year by taking a 20 percent stake in Arctic LNG 2.

Countries in Southeast and South Asia that are expected to make up 50 percent of future growth in LNG demand will need to adopt similar approaches to China and Japan if they want to have supplies available to meet demand.

Building import infrastructure alone is not enough to bring in LNG. Europe’s capacity has topped 150 MTPA since 2013, but until 2019 imports of LNG remained below 60 MT, as new LNG supply volumes were pulled to higher-priced markets in Asia. Without contracts in place, there is no guarantee that importing countries won't be outbid.

Until 2017 average contract lengths had been decling. However, that is beginning to reverse—now average contact lengths have moved back above 13 years. Longer contracts are a positive development for LNG investment, but importers of LNG need to provide more certainty that existing contracts will continue to be honored. Importers can facilitate this by honoring existing LNG contracts and not threatening to cancel or renegotiate contracts whenever prices move against them.

CONCLUSION

The impact of Covid-19 on LNG supply is going to last significantly longer than the impact on global LNG demand. While the LNG market will remain oversupplied this year and possibly longer, construction delays and the decline in final investment decisions could bring it back into balance sooner than buyers anticipate. Unless governments intend to take a more active role in LNG investment, buyers should sign up long-term contracts under current market conditions if they want to secure LNG supplies in the long term.

ACKNOWLEDGMENTS

I would like to thank Teddy Kott and my reviewers for their feedback and helpful insights, and Christina Nelson and Matthew Robinson for working so tirelessly in editing this paper. A special thank you to David Sandalow and Jonathan Elkind for their initial comments on my draft and for their support in general.

The views in this commentary represent those of the author. This work was made possible by support from the Center on Global Energy Policy. More information is available at http:// energypolicy.columbia.edu/about/mission.

Originally published by Columbia | SIPA.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

_f900x445_1588926409.JPG)