The Kremlin and the gas uncertainty principle [Gas in Transition]

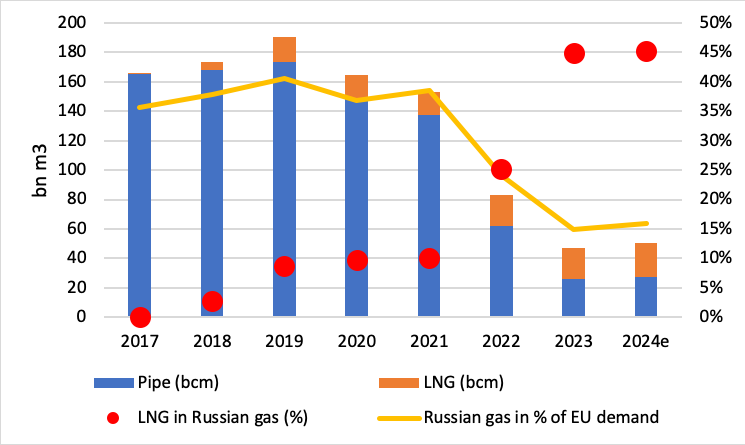

The ’uncertainty principle’ that Gazprom used in 2021 by unexpectedly tightening the EU gas market by not refilling its EU storage and stopping selling additional spot volumes can still be used again. After a 40% increase year/year in flow in January, Gazprom continues to push more gas to the EU in February (+30%). With more Russian LNG also coming to the EU (+7% in Jan-Feb 2024 versus Jan-Feb 2023), the share of Russian gas in EU demand should pick up above the 15% record low reached in 2023. This, at a time when markets are well supplied, is pushing European spot gas prices south. The Kremlin likes to remind everyone that: 1. only low cost gas projects (mostly in Russia) have a certainty of profit, 2. at a time the EU needs to reverse the processes of deindustrialisation and carbon leakage that have taken place over the last decades, cheap Russian gas cannot be sanctioned or embargoed and 3. the path of the energy transition depends on the cost competitiveness of green energies versus non-green ones. In short, the ‘uncertainty principle’ helps the Kremlin to remind the EU of its power. The only way to solve this geopolitical issue would be for the EU to effectively put in action its REPowerEU plan to phase out Russian gas well before the end of this decade. The 2024 Russian gas rebound so far this year is not the trend we should want to see, even if it helps solve the unbearable cost of the energy crisis.

By mastering its gas ‘uncertainty principle’, the Kremlin is not only playing a trick again but most importantly pushing the EU to either deliver its dogmatic green agenda at a cost (both economic and political) or stop setting impossible targets. With MEP elections looming, the EU Commission is unfortunately not in a strong position to fight back.

Russian gas flow to the EU

Sources: Entsog, thierrybros.com

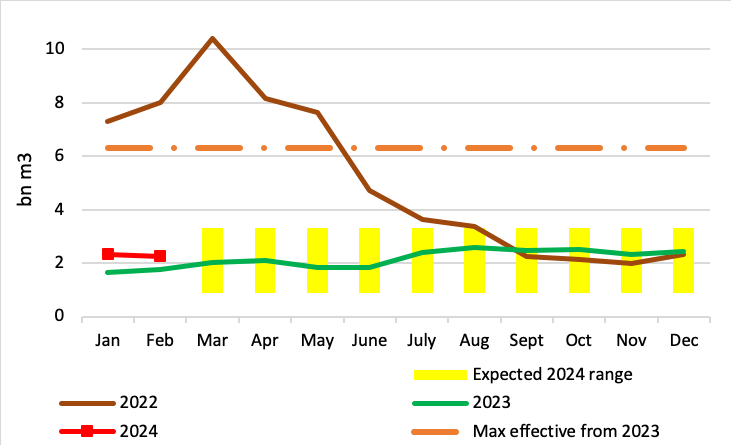

With 2.3bn m3 exported in February 2024 versus 1.7bn m3 exported in February 2023, for a six month in a row Gazprom’s exports to Europe are up year/year.

Gazprom's monthly gas exports to Europe

Sources: Entsog, thierrybros.com

We should see Russian pipe flows remain in the expected narrow range of 0.9-2.4bn m3/month and probably more around 2.3bn m3/m.

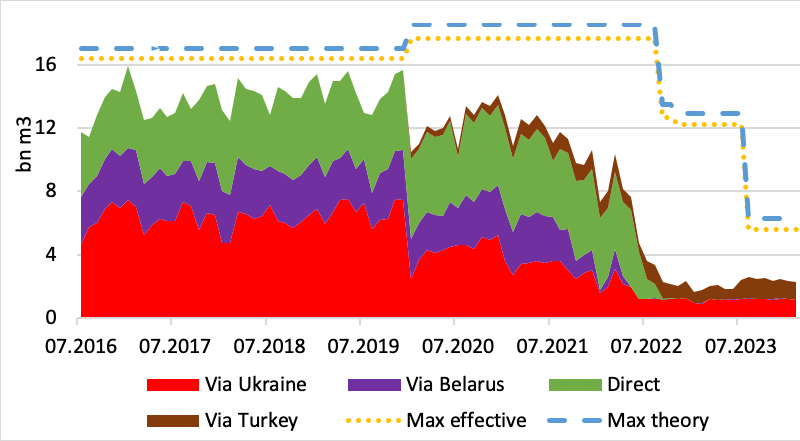

Split of Gazprom's monthly gas exports to Europe

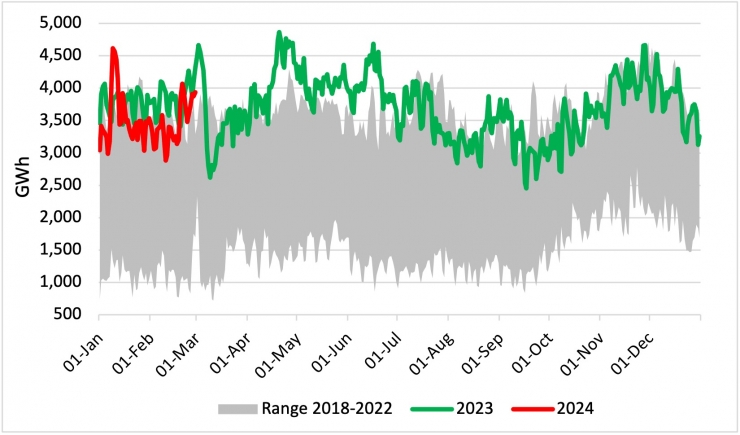

Since July 2023, LNG-send out is down year/year, as Asia is back on the LNG market with force, and EU storage facilities are so full for the time of year that extra LNG is not needed.

EU LNG send-out (excluding Malta)

Source: GIE, thierrybros.com

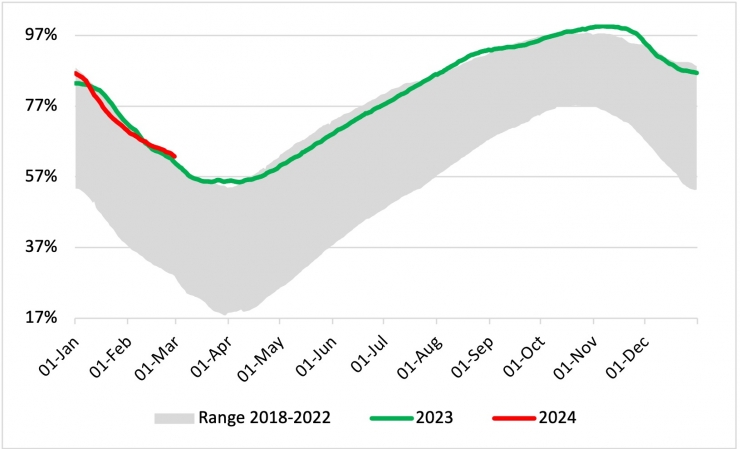

After moving on December 5 back within its historical range, EU gas storage volumes moved on January 9 below the level they were a year earlier due to a short-lived cold spell. But the return of mild winter and on-going anaemic industrial and power demand has pushed the 2024 storage curve back above 2023 records since February 10. With storage facilities 63% full at the end of February, we should end winter with a record high level of gas in stock.

Gazprom is a way weaker company than what it used to be, with both a market capitalisation that shrank from above $190bn in 2011 to $40bn and profitability in the red but, by mastering its ‘uncertainty principle’ the Kremlin could make the next few months very challenging for traders. Pushing more gas at a time it is not needed is not a sound producer practice but could be a very disturbing geopolitical one.

EU gas storage utilisation

Source: GIE, thierrybros.com

Dr. Thierry Bros

Energy Expert & Professor

March 1, 2024