The push to green US LNG exports [Gas in Transition]

Since about 2015 US LNG exports have been seeing a meteoric rise, reaching about 80mn metric tons/year by 2022, with 64% of this exported to Europe. Under its reference case – which is based on current trends and regulations – the US Energy Information Administration (EIA) expects the increase to continue to around 210mn mt/yr by the mid-2030s (see figure 1). But as exports of US LNG surge, so do concerns over its environmental impact..png)

With energy security at the forefront of most countries’ and industries’ energy concerns, the US LNG industry is well placed to benefit. As long as intermittency remains unsolved, renewables alone cannot provide the reliability, flexibility, resilience and industrial fuels the world needs. In addition, natural gas has a role in displacing coal in power generation. In this environment, US LNG exports can play a vital role in supporting global energy security. But realising this potential requires overcoming environmental concerns and especially methane emissions across the entire LNG value chain.

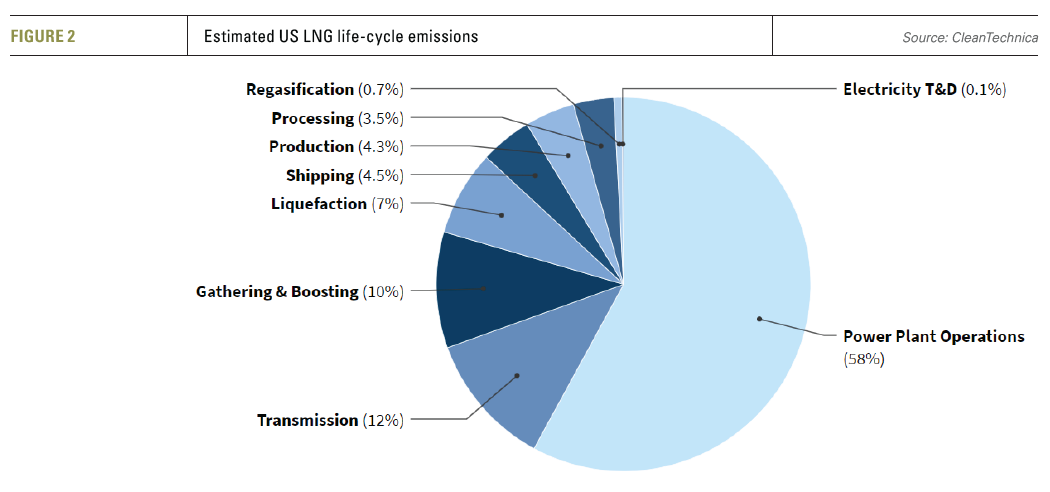

As a greenhouse gas (GHG), methane is over 80 times more potent than CO2 over a 25-year timeframe. LNG emits methane in every step of its value chain, from extraction to processing, liquefaction, storage and transportation. These are also the steps in which methane emissions are the most prevalent, collectively comprising close to 20% of lifecycle GHG emissions of an LNG-to-power project.

Estimated LNG life-cycle GHG emissions are shown in figure 2 for every step, based on US LNG transported from the Gulf Coast to Rotterdam. As expected, most emissions occur during power plant operations, but over 40% occur at the earlier stages up to regasification, mostly under US LNG producers’ and traders’ control.

Reducing methane emissions not only has become a priority, but it is also a prerequisite in ensuring the future of natural gas and LNG both in Europe and in the US.

In Europe, eliminating methane emissions has become a make-or-break issue in terms of achieving its ambitious climate change targets. In early May, the European Parliament (EP) approved new legislation with much tighter rules to reduce methane emissions that include stringent leak detection and repair (LDAR) requirements. These rules have been extended to apply to imports of oil and gas. From 2026, those importing oil and gas into the EU will have to prove that they are adhering to these requirements. However, gas and LNG imports from countries with comparable laws will be exempted.

In Europe, eliminating methane emissions has become a make-or-break issue in terms of achieving its ambitious climate change targets. In early May, the European Parliament (EP) approved new legislation with much tighter rules to reduce methane emissions that include stringent leak detection and repair (LDAR) requirements. These rules have been extended to apply to imports of oil and gas. From 2026, those importing oil and gas into the EU will have to prove that they are adhering to these requirements. However, gas and LNG imports from countries with comparable laws will be exempted.

Likewise, in the US the Inflation Reduction Act (IRA), approved by the US Senate in August 2022, includes a Methane Emissions Reduction Programme that, for the first time, has introduced a charge on methane emitted by oil and gas companies. In addition, in November 2022 the US Environmental Protection Agency (EPA) introduced a proposal requiring routine monitoring of all oil and gas well sites and facilities, for their entire life, and repair of all fugitive emissions. These also apply to LNG facilities.

On April 21, the US Department of Energy’s Office of Fossil Energy and Carbon Management issued a Full Suite of Action on LNG Exports and Methane Emissions Mitigation, aimed at bringing transparency and best practices to the US and global natural gas supply chains. It states “we are committed to doing everything we can to support the energy security and sustainability of our international allies and partners, while working to reduce emissions across LNG supply chains.”

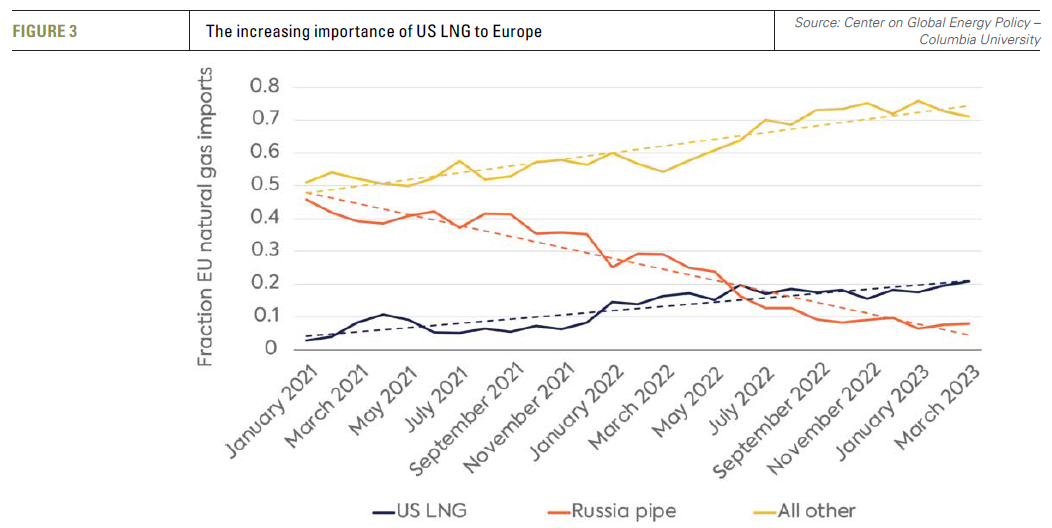

Given the increasing importance of LNG to both the US, as exporter, and the EU, as the consumer, (see figure 3), they are coordinating their actions through, for example, the EU-US Task Force on Energy Security. Its tasks include monitoring the energy security situation in the EU, deliveries of US LNG to Europe and reduction of methane emissions.

The importance of reducing methane emissions to the US LNG trade with Europe is highlighted in a report issued by the Task Force in April. It states that “the Task Force will help to implement EU and US efforts to reduce methane emissions, both in bilateral trade and at the global level” and that it “will further facilitate these efforts to reduce methane emissions and increase the liquidity of natural gas that minimises flaring, methane, and CO2 emissions across the value chain.”

With 90% of its natural gas imported, the EU is prioritising obtaining its LNG from “cleaner” sources. This became apparent as early as 2020, when Engie was asked by the French government to drop a US LNG import deal on the grounds that it was not “aligned with France’s environmental vision.” That is now considered to have been a “watershed moment signalling the importance of climate impacts in gas purchase decisions.”

Two years later, in 2022, Engie signed a 15-year supply deal with NextDecade for LNG from its proposed Rio Grande project in Texas. This is expected to produce a lower carbon-intensive LNG through carbon capture and storage (CCS) during the liquefaction process. NextDecade also intends to “source gas certified as low in methane intensity and leakage” — not just in the production segment but also “in the midstream and liquefaction segments, where standards are currently less developed.”

The US LNG sector will remain under significant pressure to curb emissions, especially of methane, as the industry looks to maintain its long-term prospects.

US LNG must tackle its methane emissions problem

A recent study has shown dramatic variations of methane emissions in the US natural gas sector. Another study published in the Proceedings of the National Academy of Sciences, suggests that methane emissions from the US oil and gas sector between 2010 and 2019 are 70% higher than EPA estimates. Several other studies produced similar results.

There have been reports of methane emissions from a number of LNG export terminals on the US Gulf Coast, often from flares that fail to combust completely, resulting in methane vented into the atmosphere. A peer-reviewed study, published in Science in September 2022, estimated that flares in many US oil and gas fields operate at only 91% efficiency. It stated that “this represents a fivefold increase in methane emissions above present assumptions and constitutes 4-10% of total US oil and gas methane emissions, highlighting a previously underappreciated methane source and mitigation opportunity.”

Lorne Stockman, research co-director at Oil Change International, author of one of the reports, said “our research shows that gas producers and LNG exporters cannot be trusted to clean up their methane emissions. This strengthens the case for rigorous regulation for gas certification programs that ensure the…accuracy of emissions reductions.” He recommended greater transparency and accountability for gas certification and governmental oversight to ensure accurate emissions reporting and reductions – something the new Biden administration regulations aim to address. He also urged the EU and other LNG importers to adopt “minimum criteria for documentation of methane emissions associated with gas [and LNG] imports.”

Such evidence shows how important EPA’s proposal “for the regulation of methane and volatile organic compounds from new facilities, as well as methane from existing oil and gas facilities” is.

With the Biden administration aiming to finalise the new rules and regulations before COP28 in November, it is hoped that they will usher in a new, forward-looking, mindset by the LNG industry to deal with its methane emission problem.

With EU imports of US LNG sky-rocketing, and with the coming of new EU and US regulations, the industry needs to accelerate such efforts. The availability of improved technology and stricter monitoring hopefully will reduce methane leakages and emissions to acceptable levels within this decade. As long as such emissions persist, they will continue to undercut the role of LNG as a cleaner fuel.

The future

The US’ LNG competitor Qatar is already ahead in the greening of its LNG supply chain. It has been engaged in reducing routine gas flaring since 2012. And more recently, its new North Field expansion project incorporates a CCS facility.

With global LNG demand expected to carry on rising into the 2040s, US LNG has a major role to play globally, but also in helping the EU advance its climate policy goals and diversify its LNG supply. But it requires credible and verifiable carbon and methane emission mitigation.

Stricter regulations and the introduction of a charge on methane emissions should incentivise US LNG producers and traders to reduce their methane emissions, as would carbon pricing in Europe.

It should also be remembered that with Europe’s – so far successful – drive to reduce use of unabated gas, it may not be a long-term market for US LNG exports. That market is Asia, where gas demand is expected to carry on increasing well into the 2040s. Asia has been Qatar’s traditional and biggest regional market. With Qatar greening its LNG and having a very low cost-base, it will be a formidable competitor that US LNG will need to match.

As an article published last year in Nature states, "that this must be accomplished against a background of increasing urgency of climate action underscores the importance of developing integrated policies that reduce emissions while improving global energy security and resilience."

Mitigating methane emissions is critical and urgent. The US and the EU appear to be taking measures to speed up the process. The success of these measures will be a major factor in greening US LNG exports, making them more sustainable, providing them with an advantage in global markets, particularly in Europe.