Tipping the global gas balance [Gas in Transition]

In its quarterly gas market report July 6, the Paris-based International Energy Agency (IEA) spoke of the return to pre-pandemic levels of global liquefaction capacity use. It further said: “In the absence of major project delays or unplanned outages, the risk of a structurally tight market appears limited before 2024 with the possible exception of short seasonal episodes.”

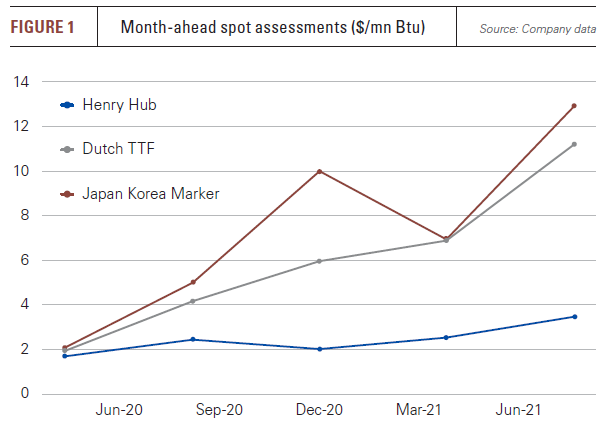

But spot prices for July and August delivery were so high in Asia, Europe and even Latin America in June and July this year that one could be forgiven for thinking that there is already not enough gas to go around.

Consultant Mike Fulwood, author of the International Gas Union (IGU)’s just-published annual review of wholesale gas prices, says that LNG supplies had been expected higher this year than last. But while US export terminals have been running at full capacity, there have been many minor problems at trains elsewhere that have wiped out any increase, he tells NGW. Meanwhile demand has been rising higher, with Europe at a ten-year high so far. “It does not take much to go from an over- to an under-supplied market,” he says.

The IGU’s analysis finds that imports into Europe last year were 81% priced competitively against gas (GOG), and only 19% were oil indexed (OPE). This is in marked contrast to 2005 when it was 91% OPE and only 7% GOG.

Gazprom’s adoption of hybrid pricing clauses which appear to offer the best of both worlds, where the hub price forms a corridor around the oil indexed contracts, cloud the issue a little though, according to a former gas contract negotiator at one of the incumbents in the European gas market. But the pricing report shows that more and more, Gazprom is moving to the liquid northwest European hubs and abandoning hybrid models.

What a difference a year makes

In May last year prices reached fresh record lows in Europe, with front months in the UK (National Balancing Point gas hub) on occasion dipping below 10p/th ($1.20/mn Btu). The more heavily traded Dutch TTF benchmark was similar, reflecting extreme market weakness across the continent. US LNG capacity was shut in as exports would have lost money in Europe and Asia.

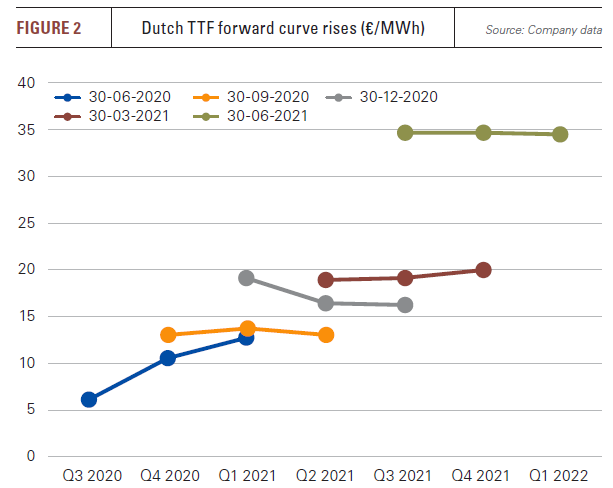

This summer, TTF prices have neared €40/MWh all the way out from day-ahead to the end of winter before dropping back in July to the still remarkable and almost uniform €34-€35/MWh range as of market close on July 12 (sees figures 1 and 2 for price trends over the past year). With such wide netbacks, US LNG tankers even sailed round South Africa to deliver cargoes to Asia.

LNG tanker reloads from Europe to Asia and slot cancellations in Italy have shown that some Asian utilities have been prepared to pay more than their European counterparts. Consultancy Timera Energy maintains that the stronger attraction of Asia and the lower proportion of both US and west African cargos heading towards Europe this year than last shows the market is tightening; while more LNG going to Europe instead of Asia would have signalled looser fundamentals.

The last time winter prices in Europe had approached these heights was in the summer of 2018, when the Beast from the East at the end of winter had finally drained storage. But in the event it proved to be a mild winter and Yamal LNG started up earlier than expected. Further, the Novatek-operated Yamal LNG terminal began shipping gas to Europe and prices halved.

The last time winter prices in Europe had approached these heights was in the summer of 2018, when the Beast from the East at the end of winter had finally drained storage. But in the event it proved to be a mild winter and Yamal LNG started up earlier than expected. Further, the Novatek-operated Yamal LNG terminal began shipping gas to Europe and prices halved.

There was also more Dutch gas then, as Groningen was allowed to produce more. For the coming gas year (October 2021-September 2022) production will be capped at 3.9bn m³, well below the mining regulatory agency SSM’s ‘safe maximum’ of 12bn m³/yr.

Fear and greed

There is a wide range of explanations for what indeed might prove only to a be “a short seasonal episode,” as the IEA puts it.

On the supply side, there is more Norwegian gas coming, as the Oseberg oilfield starts producing the gas that was injected. And in Algeria, the accident at the Skikda LNG terminal means more pipeline gas available for Europe until it is repaired.

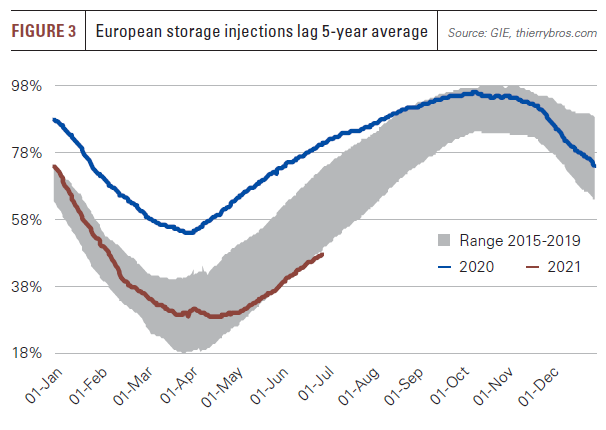

But on the demand side, Europe is concerned that it will have very little gas in store by the start of the winter heating season.

Interestingly, Italy and Spain, whose major buyers Naturgy, Enel, Eni and others have all renegotiated their long-term Algerian pipeline contracts, do have a high percentage of storage capacity filled this year compared with other parts of Europe as of July 10, according to data published by Gas Infrastructure Europe (GIE).

While the EU as a whole was 51% full, Algeria’s two pipeline importers were both around two-thirds full as of July 10 thanks to their access to this cheaper oil-indexed gas. Hungary and Poland were at similar percentages but those markets are less competitive.

Not only was the northwest European winter very long lasting well into May; it was also very much calmer than usual, meaning a lot more gas had to be used for power-generation than is normally the case.

Gas is still the main source of flexible power generation across parts of Europe, notably the UK. There is no seasonal battery storage anywhere and no amount of windfarm capacity will come to the rescue if the conditions are wrong. Wind was often below 10% of the generation mix while gas was often above 45% in the UK. Imports of French energy (heavily weighted towards nuclear power) were also running high.

The power market has also been ramping up, linked to the price of coal and now the very high carbon price in the EU – and since May the UK – emissions trading schemes. Depending on the efficiencies of the gas-fired and coal-fired plants at its disposal an operator can switch over to coal or gas depending on which makes a bigger margin after taking the carbon price into account. High carbon prices ought to incentivise combined-cycle gas turbines, the most efficient kind.

As a result of the competing calls for gas, injections (Figure 3) have been so slow that one analyst tells NGW that his company was expecting storage to be just 73%-78% full on average at the end of September and only 5% more than that range by the end of October.

This leaves consumers at the mercy of the weather. Even Gazprom’s storage facilities in Europe are barely injecting, the analyst says. Europe’s largest storage facility, Rehden in Germany, has only a few hundred million cubic metres of its 4bn m³ capacity taken; and in Austria, Haidach is about 15% full. This leaves Gazprom little flexibility for covering the Nord Stream 1 (NS1) maintenance period. Austria is 32% full, according to GIE.

Although the NS1 outage was publicised a long time in advance, rapidly rising prices have made it costlier to find alternative supplies, although NGW understands that Gazprom does have some contractual flexibility in its choice of delivery points during such maintenance periods.

This includes allowing its term customers to offtake gas from Rehden; taking gas from deliveries through Poland; and buying more gas at the hubs. In addition, customers have the choice of taking no gas during the maintenance period and offsetting that against their take-or-pay commitments.

There is another reason for the slow rate of restocking: much of the gas that went east into Ukraine as traders found a home for the low-priced hub gas last summer never left the country again for summer injection in the EU as some had expected it to.

Despite Ukraine’s favourable customs warehousing regime, the gas was sold in-country as the netbacks this year have been high and encouraged profit-taking.

Despite Ukraine’s favourable customs warehousing regime, the gas was sold in-country as the netbacks this year have been high and encouraged profit-taking.

Gazprom’s decision not to augment its capacity bookings through Ukraine, which are lower this year than last, has attracted much interest, although it did deliver close to record amounts in the first six months of the year. It has pipelines through Poland and under the Black Sea to Turkey, for instance, which are less controversial in Washington’s eyes.

There is the possibility that Gazprom is withholding gas to demonstrate the urgency of commissioning Nord Stream 2 (NS2): the first of the two 27.5bn m³/yr strands is ready for filling and the second almost is. Some analysts have discounted the idea that Gazprom is declining additional but interruptible capacity at the Russia-Ukraine border. There is no chance of being interrupted as only Gazprom can deliver gas there. And capacity it cannot access would not be paid for. “It is a red herring,” one analyst tells NGW. So the other argument is that it wants to show Europe what prices may be like without NS2.

China, Japan

There has been more injection into storage in Asia where that was practicable this summer; and where it is not, import terminal tanks were not being drained as much as was the case earlier, according to Fulwood. The JKM had reached $30/mn Btu in the winter, although very little LNG was traded as high as that, he says, and most LNG is tied to oil still. Traders would try to avoid repeating that mistake. But Fulwood stresses that most of the cargos would have traded at lower, oil-indexed prices.

China’s gas imports are growing particularly strongly, with domestic production, pipeline gas from Russia and central Asia and a mix of firm and spot LNG contracts to balance. Economic growth has been very high again this year, and according to consultancy Wood Mackenzie in a July 7 report, “an almost insatiable appetite for LNG has helped push Asian spot prices to an eight-year seasonal high in recent days.” High coal prices and lower than expected rainfall have also limited power supply. This pace of recovery is being felt across global energy markets but these power shortages are starting to slow industrial output.

With industrial production remaining robust throughout the country, “we expect steady growth in power demand. With higher temperatures also driving increased electricity consumption, the provinces of Hunan, Shandong and Zhejiang are all facing potential power shortages this summer,” WoodMac said.

“This is good news for gas-fired generators, but the situation for coal-fired power is unlikely to improve significantly. It's worth pointing out that industrial sectors using natural gas and other energy sources have not been impacted. Fuel costs have of course risen considerably but supply availability has remained steady,” it said.

FTI’s Madeline Jowdy tells NGW that China has the right geology for underground gas storage but it is a tightly regulated gas market: Beijing has only recently introduced TPA for pipelines and even if there is a forward curve that sends storage investment signals, it is not clear what the commercial incentives might be, she says.

And in Japan, fearing the worst, major utility Jera has drawn up measures to address supply and demand. With the energy ministry warning that this summer could be the tightest for power supply in several years, Jera is looking at ways to minimise outages in Q2 and it has set up an electricity supply-demand measures subcommittee.

Jera had completed checks of priority equipment at power plants in readiness for the expected extremes in the Tokyo and Chubu areas. It has also adjusted “fuel procurement and delivery schedules to ensure appropriate inventory levels” and prepared for higher power output, in co-operation with the grid operators, it said.

“The environment for thermal power generation is extremely difficult given uncertainty in the electricity supply and demand outlook caused by increased renewable energy, a tightening supply and demand balance in the fuel market, and an increased risk of failure at ageing power generation facilities,” it said.

Future LNG projects

Looking a little ahead, on the supply side, there is the Venture Global Calcasieu plant in the US Gulf due to start in Q4 2021 – and trading activity and vessel chartering around that event is cited as evidence that it will happen. The following quarter, Sabine Pass Train 6 should also come online. Later on are the US Golden Pass and the LNG Canada liquefaction projects and, it is hoped, Mozambique LNG.

Asia has long been the brightest ray of hope for LNG project operators hoping to get their financing over the line, with Chinese entities notably playing a role in the Russian Arctic through a mix of debt and equity.

As well as China, smaller countries also represent collectively sizeable demand. Indian and Thai importers for example are invested in the TotalEnergies-operated Mozambique LNG project, where work is in suspension for the foreseeable future. They might need to look elsewhere.

According to Jowdy, the cancellation of Mozambique LNG would be bad for the country’s economic development prospects but it could displace demand for capacity elsewhere, including US Gulf coast projects.

“But today's very high spot prices are not going to encourage buyers to sign up for long-term contracts. If they did not buy at $7/mn Btu they certainly are not going to buy at $12-14, and developers do not like these prices either as they only put people off. It is still a buyer's market for LNG – and there is unspoken-for LNG that has had FID in Canada and the US Gulf,” she explains.

Elsewhere, in terms of markets both Vietnam and Indonesia are promising, as diesel is too expensive for power generation.

But as small-scale LNG evolves, there is less need of mega-projects upstream. Gas may be collected, liquefied and trucked from wells that are otherwise stranded, or emitting methane, for $3/mn Btu, says one consultant active in Indonesia. A lot of associated gas is flared there and the government is selling this at $0.35/mn Btu to state-backed entities, the analyst says.

Pakistan, where gas production is lagging demand, and Vietnam have also been keen to move away from diesel. They are importing LNG and while the World Bank is not supportive of fossil fuel projects, these countries can still expect aid from pragmatic international finance institutions who can see gas as better than coal or diesel, even if it is not zero carbon, the analyst says.

The other major LNG importer Japan is still deciding on its energy mix. Jowdy says that there is huge opposition to nuclear ten years after Fukushima, reducing the likelihood of restarting more than one or two additional nuclear reactors. But the country has imported several cargoes of different energy carriers such as ammonia and hydrogen from different countries experimentally.

According to Jowdy, renewable energy is not going to be more than an add-on for Asian energy demand. Gas is going to grow with their economies: countries like the Philippines, Pakistan and Bangladesh will ideally replace coal with LNG. Decarbonising in Asia is not going to reach the scale of the Netherlands or Germany, but it is still a threat it is still going to create uncertainty for Asian LNG outlook.