[Premium] MENA Could See Huge Gains from Sustainability: UN

As countries in the Middle East and North Africa look to build on new opportunities to grow their economies, a radical shift toward sustainable business strategies could unlock more than $637bn/yr by 2030, generating 12.4mn jobs across the region, argues a report released in Cairo December 4 by the UN Business & Sustainable Development Commission (BSDC).

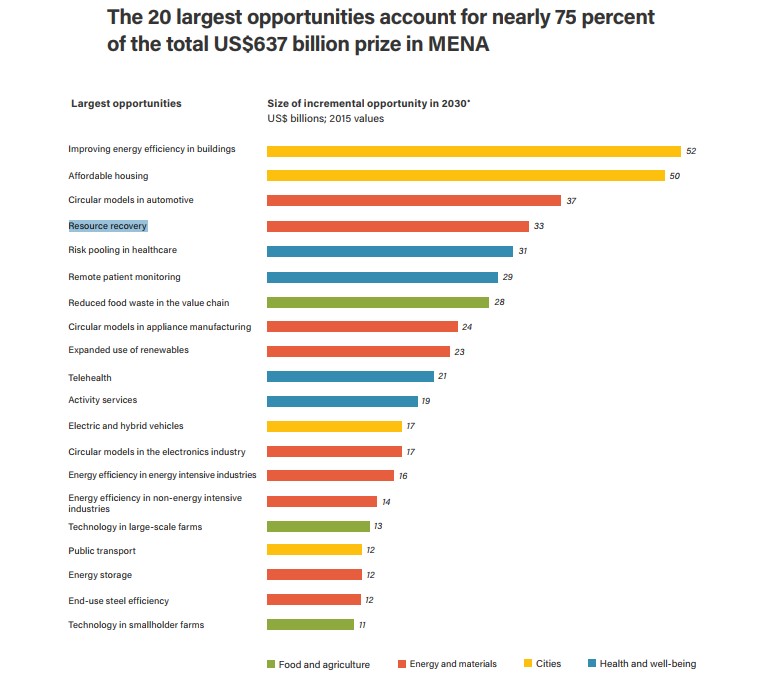

But if gas is a contributor for change, as inevitably it will be in Egypt thanks to the giant Zohr field expected onstream this month, it doesn't get much of a mention. 'Better Business, Better World MENA' breaks down its forecast $637bn/yr by 2030 in the 19 countries surveyed and across four key sectors: energy & materials: $229bn, cities $183bn, health $133bn, and food/agriculture $92bn (all annual by 2030).

It cites how oil-exporting countries in the region, including Saudi Arabia, Bahrain, Oman, Qatar and the UAE, have launched plans to diversify their economies away from fossil fuels as oil prices drop.

Of the energy and materials subtotal, renewables account for $23bn/yr by 2030, as countries across the region rethink their energy mix and searching for ‘greener’ alternatives, prompted by costly energy prices, increased climate risk, and rapid growth in energy demand. “Nearly every country has enough sunlight for a thriving solar industry,” the report notes.

The Saudi government plans to spend $109bn on solar energy infrastructure by 2040, it continues, while by 2020, Kuwait and Oman aim to get 10% of their energy from sustainable sources, Egypt aims to generate 20% of its power from renewable sources by 2022, and Morocco 52% of its energy from the same sources before 2030. The report cites specific instances in these last two countries of major solar projects, including one that cost $3.9bn at Ouarzazate, Morocco now starting in phases. It also expects energy storage to yield benefits amounting to $12bn/yr by 2030.

There’s little in the report about how investment in gas, as the least pollutive fossil fuel, might yield economic benefits. Indeed, the biggest chunks of the $229bn/yr energy & materials forecast economic benefit by 2030 are presented as coming from: circular models in the automotive industry ($37bn/yr); and resource recovery ($33bn) - see graphic below. The report estimates that over a quarter of the ‘cities $183bn/yr by 2030’ economic benefit will come from improved energy efficiency in buildings ($52bn), the biggest single 'incremental opportunity' identified.

The report includes Bahrain, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Syria, UAE and Yemen, plus Algeria, Egypt, Libya, Morocco, and Tunisia.

While certain countries from Morocco to the UAE are progressing clean energy investment, others like Yemen are either mired in war; or slowly emerging from its shadow, like Iraq. Former Yemeni president Ali Abdullah Saleh was killed in the capital Sana'a by Houthi gunmen to whom he had been allied on December 4, after making overtures for peace talks with the opposing Saudi-backed faction.

Saleh, deposed in 2012, was president when the 6.7mn mt/yr Yemen LNG plant was opened in 2009; it has been shut in by conflict for 32 months now and unable to earn revenue for the country. The World Bank earlier this year pointed out how decentralised solar projects would be an ideal first investment for regions of Yemen safe from conflict; but the country has a long way to go before such plans could be envisaged.

Yemen LNG celebrated its first cargo export November 7 2009, at a ceremony attended by Saleh (shown left of centre).