Upstream Has to Cut to Survive: WoodMac

The oil and gas sector is back in survival mode as the oil price rout deepens and debt and equity markets have closed. This is likely to lead to more companies slashing dividend, according to a new report by Wood Mackenzie published March 19. Upstream mergers liquidity is also limited and "survival will rely on swift and deep cuts to investment," it said.

Since the week of March 9, more than a third of the companies Wood Mackenzie covers in its corporate service have cut capex by 30% but more work will be needed if low prices linger, it says.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

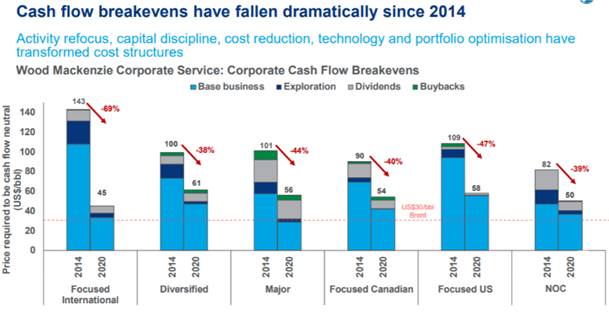

It said: “Deep spending cuts across the board are needed to achieve cash-flow neutrality at $35/barrel in 2020. We calculate an average spending cut of 57% will be required for our coverage if only upstream spend is targeted. A reduction of 41% would be needed across all spend categories, including dividends, to be cash flow neutral at $35/b.” At time of press, Brent crude was trading at $25.7/b.

Simple averages of companies in each segment. The base business breakeven is the price to cover up- and downstream spend, overheads and interest payments on debt. Based on current costs and development plans with no adjustment made for the collapse in price

Occidental, Apache and Kosmos had freed up a combined $2.5bn of capital through dividend cuts and more companies will follow suit, it said. The majors however can use their balance sheets to support current dividends but even there, buybacks will be suspended and some will re-introduce scrip dividends to preserve cash.

Looking further ahead, “balancing the books at $30/b in 2020 is possible for many companies. But tough decisions would be required, which would involve breaking promises to shareholders. Over $75bn in 2020 discretionary exploration and development capex and $80bn of shareholder distributions may have to be cut," the company said.