US Chevron to Buy Anadarko for $33bn (Update)

(Updates with analysts' comments)

US major Chevron has entered into a definitive agreement with fellow US producer Anadarko to buy all the outstanding shares for $33bn, or $65/share – a 34% premium to the April 11 closing price – in stock (75%) and cash (25%), it said April 12. It will also assume $15bn of debt.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

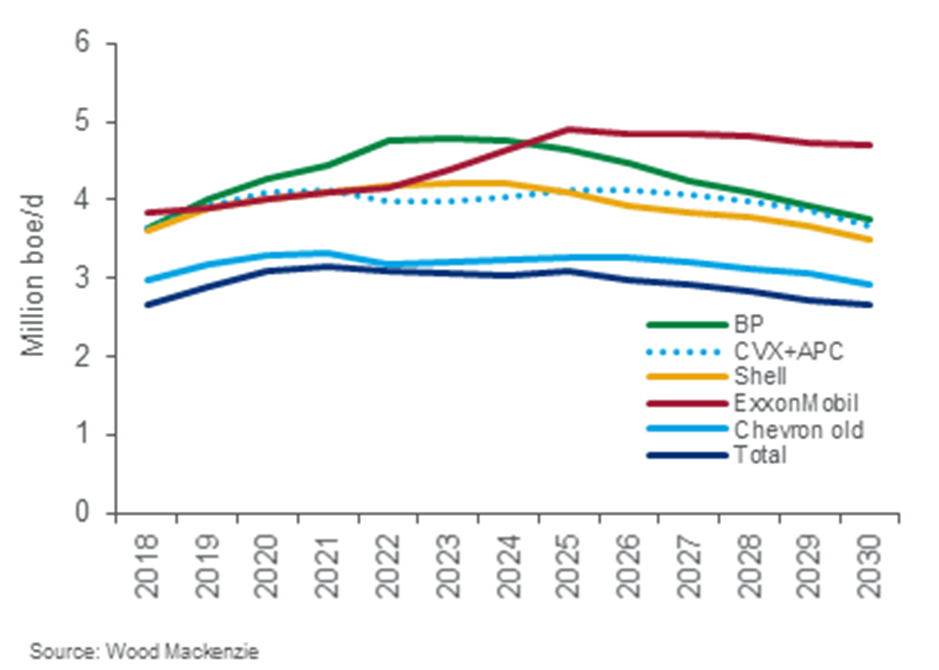

The new $48bn entity will become the largest privately owned producer after US ExxonMobil, as fourth-placed Chevron leap-frogs Shell and BP. The top four companies are now, says Wood Mackenzie, “in a league of their own.” It is the biggest such deal since Anglo-Dutch major Shell bought BG in 2015.

Supermajors: in a league of their own

Anadarko had been trading at $46.80/share the day before the announcement, and according to sources it had also considered a bid from Occidental at $70/share. However in the event it saw more value in being part of a major gas and oil producer.

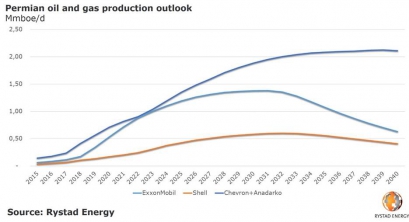

Owning Anadarko will significantly enhance Chevron’s already advantaged upstream portfolio and further strengthen its leading positions in large, attractive shale, deepwater and natural gas resource basins, Chevron said. It will be “by far the largest producer in the US Permian, which is the fastest-growing basin in the world, well ahead of ExxonMobil. By 2025 the merged entity will be able to produce as much 1.6mn barrels of oil/day from the Permian basin alone,” according to Rystad Energy.

Wood Mackenzie agreed, saying: “Chevron should truly outperform on cash flow and payback metrics for tight oil. It will acquire a “highly contiguous Delaware basin position in the Permian. Chevron ought to be able to do more with the acreage than Anadarko, which lagged behind in terms of well productivity. Chevron’s deepwater Gulf of Mexico position is also strengthened.” It also said Chevron had been “noticeably absent in the midstream rush of the past couple of years. It now takes a 55% stake in Western Gas, which goes a long way toward fixing that.”

Rystad Energy also sees Chevron attaining size in the US Gulf, “overtaking BP and Shell. Synergies are also apparent in east Africa, which is emerging as a vital region in the buoyant global market for liquefied natural gas (LNG). Chevron and Anadarko also have overlapping portfolios in Latin America.”

Rystad said: “Despite a 37% premium, we think the deal value price of $50bn is surprisingly good for Chevron. The implicit oil price in the deal is $60/barrel, while oil price today is $71/barrel. Adding synergies, we see a strong potential for value capture here.”

High on the list of priorities will be progressing the Mozambique LNG project, where Anadarko is operator. Chevron said: "Area 1 is a very cost-competitive and well-prepared greenfield project close to major markets." Wood Mackenzie said the deal would not have any near-term impact on the Mozambique LNG project, as Anadarko has indicated that FID is imminent. However, Mozambique offers attractive long-term growth and diversification opportunities for Chevron's LNG portfolio.” No doubt Chevron will have had access to the engineering contracts and the sales agreements before making its bid.

Chevron promised shareholders $2bn in synergies annually, the deal generating value within a year and plans to divest $15-20bn of assets between 2020 and 2022 to further reduce debt and return additional cash to shareholders, it said.

Anadarko shareholders will receive 0.3869 shares of Chevron and $16.25 in cash for each Anadarko share. Chevron will issue about 200mn shares of stock and pay about $8bn in cash.

“This transaction builds strength on strength for Chevron,” said Chevron’s CEO Michael Wirth. “The combination of Anadarko’s premier, high-quality assets with our advantaged portfolio strengthens our leading position in the Permian, builds on our deepwater Gulf of Mexico capabilities and will grow our LNG business. It creates attractive growth opportunities in areas that play to Chevron’s operational strengths and underscores our commitment to short-cycle, higher-return investments.

“This transaction will unlock significant value for shareholders, generating anticipated annual run-rate synergies of approximately $2bn and will be accretive to free cash flow and earnings one year after close,” Wirth concluded.

Anadarko CEO Al Walker said the strategic combination would form a "stronger and better company with world-class assets, people and opportunities."

As a result of higher expected free cash flow, Chevron plans to increase its share repurchase rate from $4bn to $5bn/yr upon closing the transaction.