US gas producers struggle to meet demand [Gas in Transition]

Natural gas demand is increasing globally and, as a result of the war in Ukraine and the resulting massive reduction in Russian gas exports, so is global demand for US LNG. But US shale gas producers are struggling to meet this demand, both domestically and for export. This winter and next are expected to be particularly difficult, especially for Europe, putting even further pressure on gas supplies.

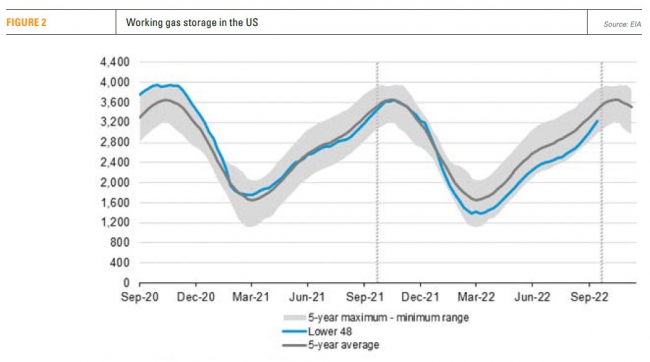

But there is a big question-mark as to whether US gas producers can respond. A drier and hotter than expected summer has left US gas inventories low, well below the seasonal average – the second-lowest for autumn for the last 12 years.

This has led to warnings to Europe not to rely on US LNG to rescue it if a harsh winter creates shortages and rationing of gas supplies.

Increasing gas demand

A dry and hot summer put massive pressure on US natural gas domestic demand this year. Cooling demand was the highest since 2018. A significant reduction in hydropower generation, combined with the retirement of many coal-fired power plants, put even further pressure on domestic gas demand.

According to the IEA, in California, this year drought is estimated to have cut hydro to just about 8% of total power generation, from a median of 15% in recent years.

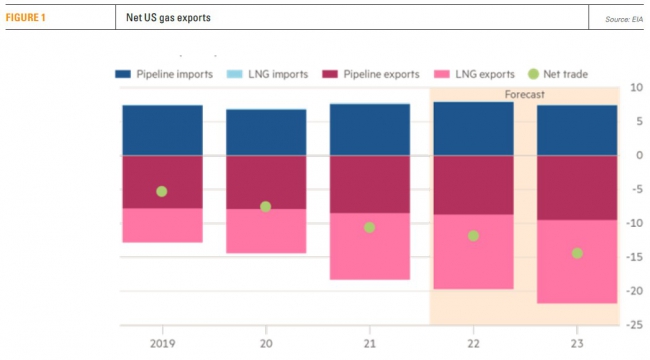

In addition, LNG exports have grown to about 12% of domestic gas production, up from 4% in 2019, and there is a push to increase these further. In fact, net exports by pipeline as well as LNG hit a record 377bn ft3 in March 2022, over three-times more than the 121bn ft3 in March 2019. This trend is expected to continue into 2023.

The combination of these factors meant that, despite increased production - up by around 4% in the second quarter of 2022 compared with the same period in 2021 - US gas inventories are being kept below the pre-pandemic average.

In response to these developments, by August Henry Hub prices jumped close to $10/mn Btu, in comparison to just over $2/mn Btu pre-pandemic and $3/mn Btu a year ago. Even though the price now is just under $7/mn Btu, given the looming shortages this is expected to rise significantly during the coming winter, putting increasing pressure on US LNG exports.

Signs that US natural gas production would have to accelerate significantly were evident as early as spring this year. But like in the rest of the oil and gas industry, investment in new oil and gas production in the US did not keep pace with growth in post-pandemic demand, contributing to the shortages that are being experienced now.

Confusing messages from the Biden Administration and the EU about the role of oil and gas long-term are keeping investments in new exploration and production low. Instead, the oil and gas companies are ploughing their massive profits into paying down debts, share buy-backs and returns to shareholders.

The outcome is that US working gas storage has been below the 5-year seasonal average almost all of this year, and there are no signs of recovering, despite the high gas prices (see figure 1).

Risk of backlash

With demand for gas continuing to increase globally, and US companies exporting LNG at record rates – and record prices and profits – availability of natural gas for US consumers is becoming tighter, impacting domestic gas and energy prices. This is risking a backlash.

In July a group of governors from New England wrote in a letter to US Energy Secretary Jennifer Granholm this summer saying “We appreciate that the [Joe] Biden administration has been working with European allies to expand fuel exports to Europe. A similar effort should be made for New England.” They added that high prices “will have significant implications for our region’s electric and natural gas customers and raises reliability concerns if the region suffers a severe winter.” Granholm responded by promising to address supply disruptions and high prices.

In July a group of governors from New England wrote in a letter to US Energy Secretary Jennifer Granholm this summer saying “We appreciate that the [Joe] Biden administration has been working with European allies to expand fuel exports to Europe. A similar effort should be made for New England.” They added that high prices “will have significant implications for our region’s electric and natural gas customers and raises reliability concerns if the region suffers a severe winter.” Granholm responded by promising to address supply disruptions and high prices.

Similar concerns were expressed by the Industrial Energy Consumers of America, which said in a regulatory filing that “LNG exports have already resulted in substantially increased inflation via higher natural gas and electric power prices”.

Earlier this year a group of Democratic US lawmakers urged the Biden administration to “limit US natural gas exports” while it examined the “impact on domestic energy prices”. Those calls will grow louder if, as expected, domestic energy prices increase further this winter.

Pretty strong stuff that could force diversion of US gas away from global LNG exports to supply increasing domestic demand.

On top of these developments, the FT reports that “US drillers are growing increasingly uneasy about potential recession, as surging costs and persistent shortages of equipment and workers signal a slowdown in the oil patch just as the world is depending on the US to keep energy markets well supplied.”

The US oil and gas industry is also facing backlash and resistance from climate and environmental campaigners and activists, with new gas pipeline projects facing innumerable approval and permitting obstacles, leading to major delays and cancellations of new projects. Combined with a new EPA proposal for GHG and methane emissions reporting, it is hitting pipelines hard, constraining future increases in gas supplies.

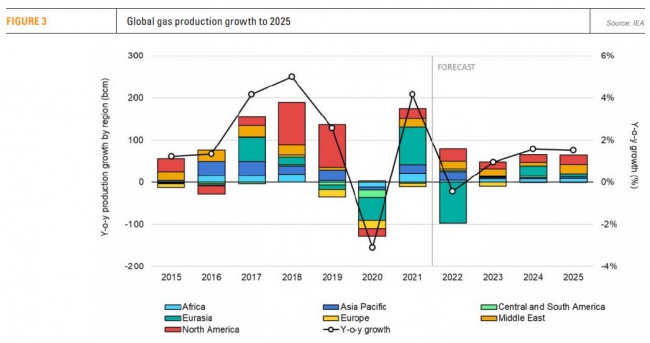

While all of this is happening, the IEA estimates that global gas production will slow down in 2022 (see figure 2), as the expected drop in Russian production resulting from lower demand and higher import diversification in Europe offsets increases from other regions.

The resulting gas market tightening could exacerbate gas supply shortages further this winter.

Impact on US LNG exports and Europe

Following the energy crisis, exacerbated by the Ukraine war, US LNG has become a lifeline for Europe as it struggles to replace the massive cut in Russian gas supplies.

Even though the US recognises the urgency to maintain global LNG exports, it is facing increasing challenges in continuing to do so. Nevertheless, it will find it politically difficult to intentionally cut LNG exports in response to the developing domestic situation. On the other hand, some degree of slowing down is not unlikely.

US drillers have been warning that they cannot increase oil and gas supplies in time to stop a winter energy crunch, in effect telling Europe “there is no bailout coming.” Given the problems they are facing, they will be unable to step-up supplies quickly enough to prevent winter shortages. US LNG is, in effect, close to reaching maximum capacity.

This is not good news for Europe that has been turning to LNG to replace the cut in Russian pipeline gas supplies.

In addition, a recent study by Rystad Energy, funded by the American Petroleum Institute and the International Association for Oil & Gas Producers, found that “US producers will remain the biggest LNG suppliers to European countries over the long term. But before the market rebalances, there will be a supply gap lasting until somewhere between 2023 and 2025,” with major implications on European industry costs and its ability to survive and remain profitable during this period.

Another limitation is that US LNG producers and traders will continue to sell their LNG on the spot market, to whoever pays the highest prices. Depending on Asian gas demand, this does not guarantee supplies to Europe.

Meanwhile, there are warnings of a cold and calm winter in Europe, which would hit renewable output and put additional pressure on gas demand. Therefore any slowing down of US LNG exports could have major consequences on the EU’s ability to cope. Especially as at the same time the EU is trying to phase-out Russian gas.