US poised to become LNG market’s No.1 supplier [Gas in Transition]

US LNG exports have been on a stellar upward trend since 2016 when the first cargo left Sabine Pass.

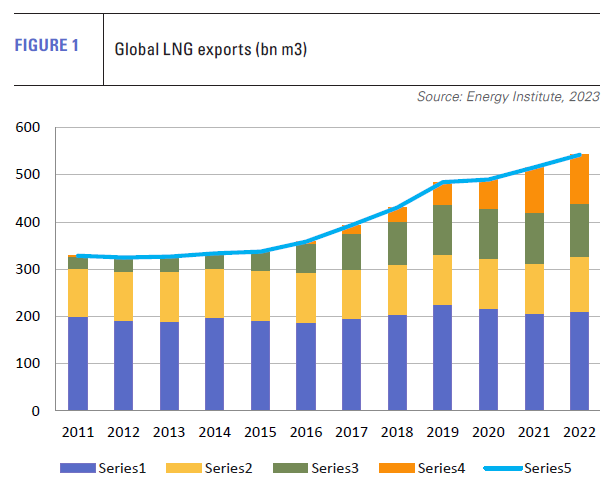

From close to zero in 2015, the country’s exports rose to 76.7mn t/yr in 2022, (see figure 1) making the US the third largest LNG exporter in the world after Qatar and Australia. Most significantly, the US has accounted for pretty much all of the supply-side growth in the global market since 2019, owing to production in both Qatar and Australia having reached plateaus.

Outside of the big three, LNG exports were lower in 2022 than in 2019, owing to a combination of supply interruptions and declining reserves.

There is plenty more to come from North America. In the first half of this year, US LNG exports ran at an annualised level of 88.2mn t/yr. Moreover, a new generation of US LNG plants are seeing final investment decisions (FID) move them to the construction phase.

The driving force behind these investments is an expected increase in demand from Asia, as developing economies in the region increase gas use as a means of reducing their dependence on coal, alongside the surge in European LNG consumption as a result of the war in Ukraine.

Europe has provided short-term demand, but it is mainly Asian buyers that have signed the long-term off-take agreements which are underpinning the expansion of US LNG capacity.

New plants under construction

There are currently five US LNG plants under construction, and they are all large. They are Golden Pass, which will add 18mn t/yr of capacity in 2024/25; Plaquemines stages 1 and 2 – 24mn t/yr later in 2024/25; Corpus Christi Stage 3 – 11.45mn t/yr in 2025; Port Arthur – 13.5mn t/yr in 2027; and Rio Grande – 17.6mn t/yr in 2027/28.

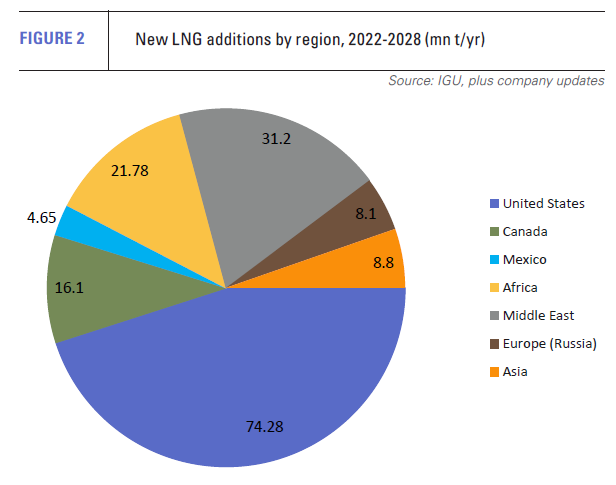

This means a total addition of 84.55mn t/yr, doubling US capacity in just five years (see figure2). It will raise significantly the proportion of US gas destined for export markets, increasing further the US domestic gas market’s exposure to international gas pricing.

And it’s all happening on the US Gulf Coast, which, in addition to the region’s existing LNG plants, means hurricane watching is going to become a major LNG market occupation. It will also increase Panama Canal transits as US LNG producers seek to establish a larger role in Asian markets.

Canada and Mexico secure west coast opportunity

However, the US has ceded to Canada and Mexico the west coast opportunity of significantly shorter transits to Asia. Attempts to get LNG plants up and running on the US west coast have failed. Mexico and Canada, in contrast, look likely to succeed with projects which will expand even further North America’s importance to the global LNG market.

LNG Canada is expected to be complete in 2025 with capacity of 14mn t/yr, while the more recently started Woodfibre LNG is expected online in 2027 with 2.1mn t/yr.

According to the US Energy Information Administration, the Canadian Energy Regulator has authorised a further 18 projects with combined capacity of 74mn t/yr, although the slow process of Canadian LNG development, coupled with the need for additional pipeline capacity to bring gas west to the coast, suggest development will not be quick.

Canadian government data shows a more modest but still substantial 47.6mn t/yr of new capacity with export licences – all on the west coast. LNG Canada’s two phases account for the majority of the planned new capacity (28mn t/yr).

Mexico similarly appears to have cracked the west coast nut with the Energia Costa Azul project in Baja California. This will have 3.25mn t/yr in the first phase, which is under construction, and potentially an additional 12mn t/yr in a second phase.

Other proposed west coast projects in Mexico, which have yet to reach an FID, could add more than 20.5mn t/yr capacity. All will use US gas as feedstock.

In addition, Mexico has two east coast LNG projects under construction which will add a combined 2.7mn t/yr to the increasingly busy Gulf Coast region.

As it stands the US will account for 45% of new capacity coming online worldwide in the next five years, Canada 9.8% and Mexico 2.8%, for a North American total of 57.6%. The US should therefore move into pole position in the rankings of LNG exporters, even taking into account the large-scale expansion of Qatari liquefaction capacity from its giant North Field expected in 2026/27.

North America’s share of new additions could be even larger, as LNG projects elsewhere include those with high degree of uncertainty regarding completion.

Mozambique’s onshore LNG travails continue

Take Africa, for example. The 12.88mn t/yr Mozambique project comprises the majority of a total 21.78mn t/yr capacity expected to be built in Africa over the next five years, but uncertainty continues to dog progress. Construction was stopped by operator TotalEnergies in 2021 as a result of militant activity in the Cabo Delgado region and a clear decision to restart, expected by the end of this year, has not arrived.

Although the security situation is reported to have improved, inflation has been high during the stoppage period and contractors are likely to be re-evaluating the viability of their contracts. TotalEnergies, meanwhile, will be keen to ensure that costs rise as little as possible.

In addition, in December, there were reports that Indonesia’s state oil and gas company Pertamina had cancelled its offtake agreement with Mozambique LNG for 1mn t/yr of LNG. As with supply-side cost inflation, the loss of a buyer may prompt a rethink of the project. If additional off-takers retreat, Mozambique LNG’s timeline will become ever more uncertain.

FIDs to expect in 2024

As the year closes, attention is turning to 2024. As ever, project developers have to look forward to the projected demand balance at the time their projects will be completed, which for most is now post-2028. Key factors in the calculation are the longevity of Europe’s current high demand for LNG, the expected increase in supply, primarily from the US and Qatar, and more broadly the impact of the energy transition on fossil fuel demand in general and natural gas in particular.

Yet despite the uncertainties, new FIDs are expected on a number of LNG projects both in North America and elsewhere.

Yet despite the uncertainties, new FIDs are expected on a number of LNG projects both in North America and elsewhere.

A likely first candidate is Pembina Pipeline Corp. and the Haisla Nation’s 50/50-owned Cedar LNG project on Canada’s west coast. An FID had been expected by the end of 2023, but has slipped into the first quarter of 2024. Pembina said in December that it was still finalising the project’s engineering, procurement, and construction agreement with US engineering company Black & Veatch and South Korea’s Samsung Heavy Industries. The project has a planned capacity of 3mn t/yr.

Meanwhile, in November, Diamond Gas International, a subsidiary of Japan’s Mitsubishi Corp., said it expects an FID to be taken in 2024 on the expansion of the US Cameron LNG project. Mitsubishi holds an 11.6% stake in Cameron LNG via a 70% interest in the Japan LNG Investment joint venture, which has a total 16.6% holding in the project.

The expansion would add 6.75mn t/yr new capacity to the facility’s existing 13.5mn t/yr. An FID will require an extension of the current export authorisation for additional capacity of May 2026. US energy company Sempra, which owns 50.2% of Cameron LNG, has also said to expect an FID in 2024.

Meanwhile, US company Energy Transfer appears to be closing in on an FID for its Lake Charles LNG project in Louisiana, possibly in the second quarter of 2024. However, the decision depends on gaining export approval from the US Department of Energy (DoE). The company was forced to file a new request in August after the DoE refused a second extension to the existing deadline to start exports by December 2028. The company has said the plant will take seven years to build.

In terms of offtake agreements, the company has made significant progress with a total of 7.9mn t/yr from six buyers, including China Gas, Gunvor, ENN, SK Gas, and Anglo-Dutch oil major Shell. Transfer Energy also has three non-binding heads of agreement for a further 3.6mn t/yr. However, this still falls some way short of the project’s planned 16.45mn t/yr capacity.

Another US project targeting FID in 2024 is Texas LNG, which has a planned capacity of 4mn t/yr. However, the timetable has slipped. The current timeline is to close project financing in 2024 and start construction later in the year with a target of first exports in late 2027 or early 2028.

Non-North American projects

Outside of the US, reports suggest Italy’s Eni could take an FID on a second floating LNG (FLNG) plant offshore Mozambique in 2024, following up on the success of its Coral South FLNG project. This started exporting in 2022 with a capacity of 3.4mn t/yr. When the Coral South project was first sanctioned it was not expected to come onstream until after the onshore Mozambique LNG, but time has shown the benefits of offshore development, even if the targeted capacities are lower. As a result, Eni may well decide that offshore is the way forward for LNG in Mozambique.

Likewise, TotalEnergies has said it is targeting an FID on its Papua LNG project in 2024. The project is expected to cost $12bn. TotalEnergies holds a 40.1% stake in the project, US major ExxonMobil 37.1% and Australia’s Santos 22.8%. The government of Papua New Guinea retains the right to increase its share of the project at the point of FID. The project has a planned capacity of 5.4mn t/yr and a start-up date of 2027/28.

Russian LNG remains a supply-side wild card

Significant uncertainty surrounds Russia’s plans for new LNG capacity, owing to the impact of sanctions and the exit of many foreign equipment and technology suppliers. Russia’s loss of many European markets for its pipeline gas has added urgency to the need to create new export outlets..png)

Moscow has given approval to gas and LNG producer Novatek for the large-scale Murmansk LNG project, construction of which could start in 2024. An FID on Novatek’s smaller 6mn t/yr Obsky LNG plant is also possible.

Murmansk LNG will use the same gravity-based platforms as for Novatek’s current Arctic LNG 2. The latter received its first platform, constructed outside Murmansk, this summer and the second is expected to be completed in 2024, freeing up space for a start on the structures for Murmansk LNG.

According to Novatek, the project will use technology provided by Russian manufacturers and its own liquefaction technology, which has not yet been deployed in LNG trains of the size envisaged for Murmansk LNG. The project has a planned capacity of 20.4mn t/yr from three 6.8mn t/yr trains with an ambitious start-up date of 2027 for the first train and 2029 for trains 2 and 3.

Arctic LNG 2 has faced delays as a result of sanctions, for example having to replace western made gas turbines with models from China. In September, the US announced new sanctions directed specifically at companies involved in Russia’s Arctic LNG developments.

The first train at Arctic LNG 2 is expected to be fully operational in 2024, but sanctions are likely to have had a greater impact on the ability to complete the project’s additional trains. Sanctions and the limitations of Russia’s domestic LNG supply chain suggest Russia’s ambitions will be delayed, making very uncertain its planned expansion of LNG capacity.