US upstream Lower 48 M&A deals on the rise as operators continue to consolidate and build upon core assets

There has been an increase in the number of mergers and acquisitions (M&A) made in the US Lower 48 upstream sector in 2021, which GlobalData notes is a sign that the oil & gas industry has begun to stabilize from the impacts of COVID-19.

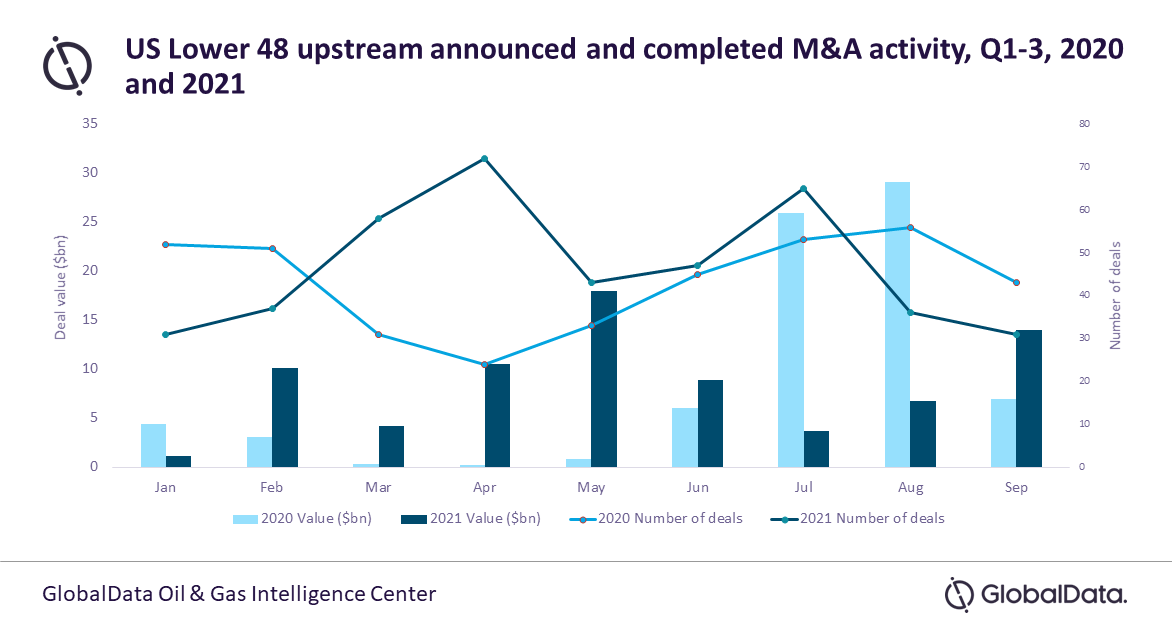

In its latest report, ‘Key Upstream M&A Deals in 2021’, the leading data and analytics company reveals that the total number of deals in the US upstream sector grew from 388* in 2020 to 420* in 2021. In terms of value, 2021 saw highs of around $18bn in May, and a total of around $77bn from January to September.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Justin Allen, Upstream Analyst at GlobalData, comments: “The M&A market has begun to see an increase in deal making throughout 2021, as companies continue to recover from the hardship of 2020 – which not only saw massive reductions in capital, expenditure and headcount, but record-low oil prices, bankruptcies and restructurings. However, the industry is still not quite back to pre-COVID-19 levels.

“If prices continue to stay where they are for the foreseeable future, it is likely that capital budgets will increase – especially in 2022. Rig activity has been consistently on the rise, and we can expect 1Q 2022 to also see upstream employment gains. At the same time, it is still difficult to forecast a full recovery, but Q1 2023 may be possible.”

The M&A market continues to see high volumes of company restructuring, consolidation and growth. Operators are budgeting their capital investments to focus more on core assets – either divesting non-core assets or acquiring more acreage through mergers or complete company buyouts.

Allen continues: “Some operators have decided to diversify their portfolios to include a mixture of crude oil and natural gas assets – hoping to be better prepared for future commodity pricing fluctuations. Others are trying to get control of their total greenhouse gas (GHG) emissions output, selling off assets to lower their emissions. One example of this is Shell’s announced sale of all its Permian (Delaware) Basin assets to ConocoPhillips for $9.5bn. Shell reported not only using this divestiture to consolidate and focus on its other core assets, but as way to also reduce its overall total GHG emissions.

“As pressure on operators to reduce their total GHG emissions output increases, some operators will lean towards divesting non-core assets, merge with other companies, or reduce footprint in certain areas in order to keep pace with the changing environmental scrutiny and regulations.”

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.