Vaca Muerta is coming of age [GGP]

Vaca Muerta, Argentina’s giant shale formation, has pushed its nose into the international LNG market once before and now looks set to do so again, but on a larger scale and on a more permanent basis. Its expansion will be supported by regulatory changes introduced by free market advocate, Argentine President Javier Milei, but amid the uncertain outcome of the economic ‘shock therapy’ being delivered to the country as a whole.

Milei is attempting to stabilise the economy through a twin process of fiscal reform and rebuilding the balance sheet of the central bank. Despite some early successes, the shock therapy has thrown the country into recession. Milei lacks a Congressional majority and his political survival will likely depend on his ability to bring Argentina back from the brink of economic collapse.

Others have tried and failed before. Declining living standards, increased poverty and income inequality will take a political toll. For the moment, though, Argentineans appear to accept the president’s message that the situation will get worse before it gets better.

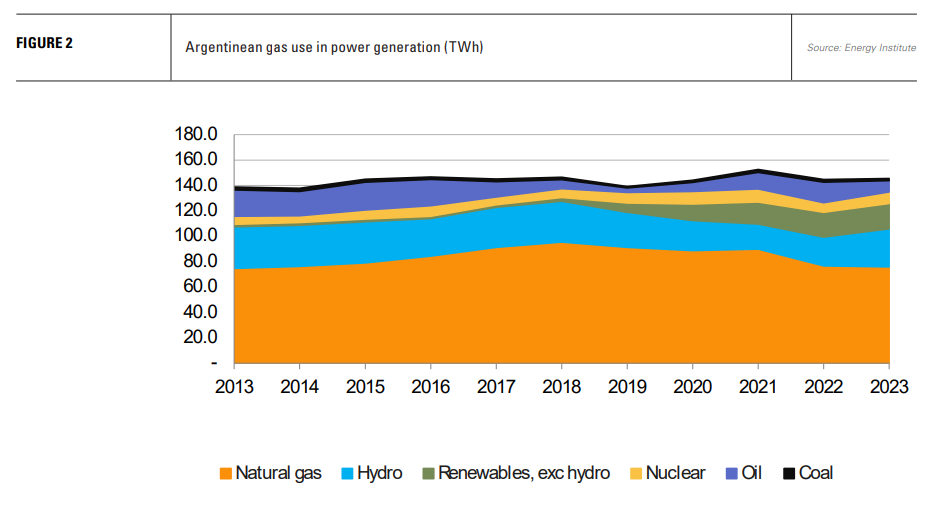

Within this fragile context, Vaca Muerta is one of the country’s bright spots, playing a key role in sustaining the domestic energy economy and, with further development, offering the potential for both regional pipeline and LNG exports.

Once bitten, but ambition undiminished

Back in 2019, state oil and gas company YPF exported its first cargo of Argentinean LNG using Tango FLNG, contracted for ten years from Exmar. However, only five cargoes were exported before a combination of the COVID pandemic and surging winter gas demand curtailed available feedstock gas, resulting in the early termination of the charter agreement.

Tango FLNG left its berth at Bahia Blanca on November 1, 2019 and Argentina’s LNG export ambitions appeared to have come to an abrupt end.

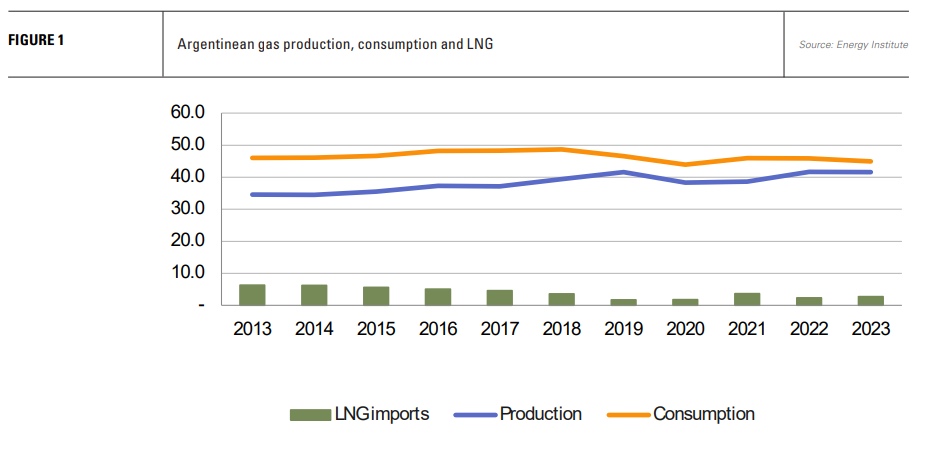

However, oil and gas production from Vaca Muerta has continued to rise and LNG exports are again seen as a primary means of monetising an expected surplus of gas in coming years.

The country’s renewed ambitions took a significant step forward in July, when Pan American Energy Group (PAEG) signed a 20-year deal with Golar LNG for the supply of an FLNG vessel to Argentina, starting in 2027.

PAEG was created in 2017 from the assets of Pan American Energy and Axion Energy, with Bridas Group and UK oil major BP each holding 50%. In addition to oil and gas, PAEG has built wind farms in Argentina and Brazil and, last year, acquired lithium exploration blocks in northwestern Argentina.

This time round it will be a private energy group which leads Argentina’s LNG charge, but alongside new plans hatched by YPF in conjunction with Malaysia’s state oil and gas company Petronas.

Securing a vessel

Golar LNG has three FLNG vessels … almost, and four customers.

The Hilli Episeyo was the first LNG carrier to be converted to FLNG in 2017. It has been cited as a potential candidate for Argentina as its contract with UK-based Perenco, offshore Cameroon, ends in July 2026. Golar’s second operational vessel, Golar Gimi, arrived in January offshore Mauritania/Senegal and is under contract with BP until 2044.

The third vessel is the 2004-built Fuji LNG, an LNG Carrier, which is a conversion project, subject to a final investment decision, although long-lead items for its conversion are already being built, according to Golar LNG. The company announced a project development agreement with the Nigerian National Petroleum Company in June for an FLNG vessel to work offshore Nigeria. Under the agreement, the two partners expect a final investment decision by the end of this year, targeting first gas by 2027.

If the Hilli Episeyo were redeployed to Argentina, and Fuji LNG to Nigeria, this could leave Perenco, which started a five-well drilling campaign on the Kita Eden field offshore Cameroon in February, without an FLNG vessel from July 2026. Interestingly, Perenco was reported to have bought a nearly 10% stake in Golar LNG in June via an investment affiliate.

YPF renews its LNG plans

Meanwhile, YPF has not given up on LNG exports. The company has teamed up with Petronas, which has built and operates two FLNG vessels in Malaysia. In April, Petronas announced the start to construction of a third FLNG vessel for use in Malaysian waters, which is expected to be complete in 2027. Partnering with the company therefore brings to YPF not just a capital partner, but operational experience and design capabilities, as well as relationships with ship builders.

According to YPF, a final investment decision on the Argentinean project, which will include upstream gas production, dedicated pipeline infrastructure and LNG production, is expected in 2025. In 2023, the two companies signed a land lease deal at the port of Bahia Blanca to carry out feasibility studies. The first stage envisages 1-2mn t/yr FLNG capacity by 2027, potentially rising to 15-20mn t/yr in the early 2030s.

Vaca Muerta production

Vaca Muerta’s growth has been slow in comparison with its US shale counterparts. The challenges remain substantial and span labour issues, rig availability and takeaway pipeline capacity to the bigger problems presented by Argentina’s volatile economic and political situation.

Yet it is notable that the oil majors have stayed the course and remain, along with YPF, major investors in the shale play, reflecting its long-term potential. In addition to YPF and other Argentinean oil and gas companies, Shell, Chevron, ExxonMobil and TotalEnergies have all steadily been growing their production in the area.

According to the Oil & Gas Journal, at the end of 2023, companies operating on Vaca Muerta reached a record 14,722 fracture stages, up 17.6% from 2022, with predictions of 18,000 this year. In February, gas production from Neuquen province, in which most of Vaca Muerta is located, hit a record 89.4mn m3/d, up 8.6% year on year. Oil production reached a record 381,570 b/d, a 17.6% year-on-year gain.

Reform bill sets new pathway

The timing of PAEG’s announcement is unlikely to have been accidental. Reform of oil and gas sector regulation is expected to boost investment significantly, putting Vaca Muerta on a path towards reaching its full potential.

The president’s ‘Ley de Bases’ reform bill was passed in July, although of more than 600 proposed articles, only 238 were accepted. It is nonetheless an important victory for Milei and the articles passed create a much more attractive investment environment for oil and gas activities in the country.

The reforms will see an end to government price setting and a phasing out of producer subsidies. In addition, the domestic market will no longer be prioritised over exports, providing security for export projects.

In particular, the industry has welcomed passage of the Incentive Regime for Large Investments (RIGI). This provides extensive tax benefits for new large investments, including the tax-free import of construction materials and a specific exchange rate regime. The incentives and benefits will come with long-term guarantees. It also allows disputes to be resolved by international arbitration rather than local courts. Investments of more than $1bn which position Argentina as an exporter will attract additional benefits and incentives. This should benefit LNG exports, as well as mining and lithium production.

In anticipation of the changes, mid-stream company TGS has already proposed a major expansion of the Nestor Kirchner pipeline, which evacuates gas from Vaca Muerta. Existing upgrades are expected to increase capacity from the current 11bn m3/yr to 21bn m3/yr. TGS’ latest proposal would take capacity to 35bn m3/yr. The company said that if a tender was awarded by November, the key component of the pipeline expansion, the Vaca Muerta duct capacity expansion, could be operational in mid-2026.

A tender for a separate project, the planned second phase extension of the Nestor Kirchner pipeline, is expected to be issued later this year.

Expectations are high that the new regulatory environment will prove a game changer for the slow burn shale play. Techint Group CEO, Paolo Rocca, said earlier this year that Vaca Muerta had the capacity to quintuple its current oil output within six to seven years, if investment conditions are conducive. Consultants Rystad Energy last year forecast 1 million b/d by 2030, absent investment impediments.

Such scenarios would mean a huge increase in associated gas production. Vaca Muerta would likely behave like US shale formations with liquids production providing the economic basis for expansion and gas production growing fast, but with little price sensitivity. This would drive down domestic gas prices and provide a reliable feedstock for exports, either pipeline or as LNG.

In this respect, the price connection with the oil market should not be discounted. OPEC will have another passenger riding on the back of its attempts to manage the oil market. It is not just domestic reversals which could unseat Argentina’s oil and gas plans; the international price of oil remains a key variable.