Venezuela still a major bar to Trinidad's gas hopes [Global Gas Perspectives]

Trinidad & Tobago’s (T&T) gas production started to rise in earnest just before the turn of the millennium, transforming the government’s finances and the economy.

The first 3.0mn tonne/yr LNG train was completed in 1999. Two further 3.3mn t/yr trains started operations in 2002 and 2003, respectively, and a fourth 5.2mn t/yr train was added in 2005. In total, this provided the operating company, Atlantic LNG, with liquefaction capacity of 14.8mn t/yr.

UK majors Shell and BP are the main players. They have consolidated their ownership over time, with smaller shareholders exiting and state-owned oil and gas company NGC increasing its stake. According to Atlantic LNG, Trains 2 and 3 are owned 57.5% by Shell and 42.5% by BP. Train 4 is owned 51.11% by Shell, 37.78% by BP and 11.11% by NGC. Train 1 is owned 51% by Shell, 39% by BP and 10% by NGC.

The development of major gas fields resulted in large-scale exports of LNG and derived products such as ammonia and methanol, as well as facilitating the gasification of the economy, while other islands in the region remained dependent on relatively expensive oil products.

In 2022, T&T was the world’s top ammonia exporter with exports valued at US$3.5bn by the Observatory of Economic Complexity. Oil and gas sector revenue accruing to the central government amounted to TT$22.5bn (US$3.3bn), in comparison with TT$32 for non-oil and gas revenue.

Early production peak

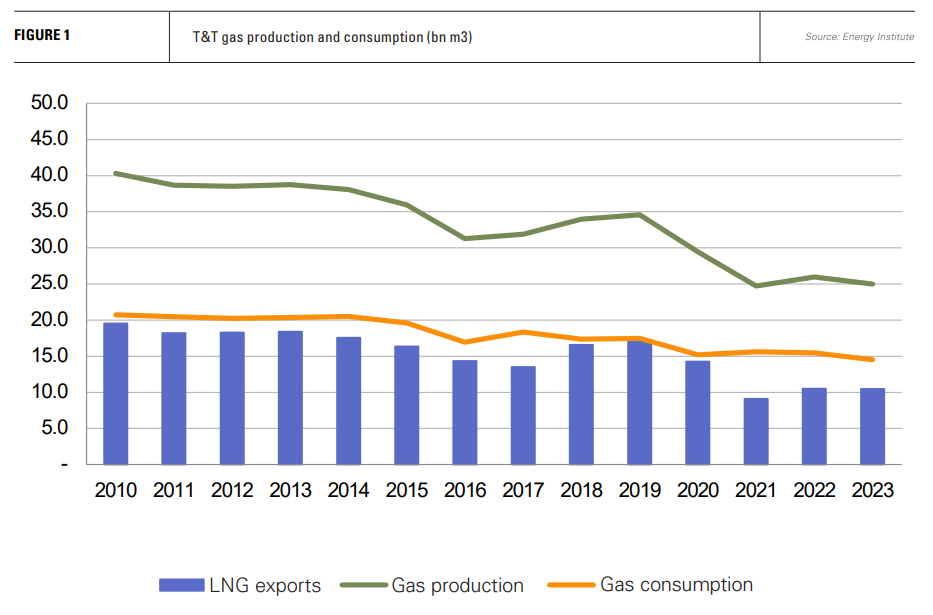

However, the expansion did not last long. Output peaked in 2010 at 40.3bn m3 of gas and 145,000 b/d oil oil, declining to 25bn m3 and 72,000 b/d by 2023. Falling gas supply saw both domestic consumption and LNG exports drop. The latter fell from 19.6bn m3 in 2010 to 10.5bn m3 last year, while domestic gas use declined from 20.7bn m3 to 14.5bn m3.

Atlantic LNG’s Train 1 was mothballed in December 2020. T&T’s LNG exports last year used only 52% of capacity, if all trains are included, or 65%, based on the three currently operational trains.

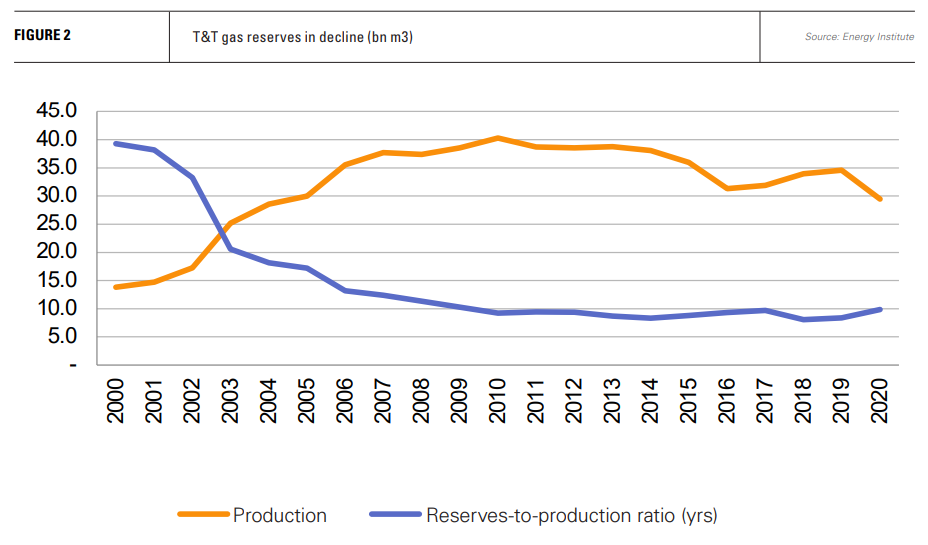

According to the most recent audit, carried out in 2022, T&T has less than 12 trillion ft3 of reserves remaining – a production-to-reserves ratio of just over 10 years.

Increasing gas production would allow fuller use of Atlantic LNG’s liquefaction capacity without the expense of newbuild LNG plant, and support the country’s ammonia and methanol exports, but development has been slow in large part because long-standing discoveries straddle the maritime border with Venezuela, which is under US sanctions.

Manatee investment decision

Operator Shell took a final investment decision on development of the Manatee gas field in July. Manatee lies in the prolific East Coast Marine Area and is the Trinidadian part of the Manatee-Loran field, which is shared with Venezuela. An agreement reached in 2019 between Venezuela and T&T allows each side to develop their portion of the field independently.

The combined field is estimated to hold 10.4 trillion ft3, equivalent to 239bn m3, of which 2.7 trillion ft3 lies in the Manatee area. The field is 100% owned by Shell.

Output from Manatee is expected to be about 6.2bn m3/yr (600mn ft3/d peak production), which will feed into Atlantic LNG and petrochemical production. First gas is expected from 2027. However, while this will underpin current supply levels, it is not sufficient to reverse the declines of the last 14 years.

US sanctions relief

The timing of the final investment decision, in early July this year, came just before elections in Venezuela, which were held at the end of the month.

In the run-up to the elections, the US softened its sanctions policy on Venezuela. In May, the US Treasury Department issued a two-year licence to BP and NGC to negotiate and develop the Cocuina-Manakin gas fields, which also straddle the maritime border with Venezuela. A similar licence issued to Shell in 2023 for development of the 4.2 trillion ft3 Dragon field, which lies wholly in Venezuelan waters, was extended to October 2025 and allows Venezuela to receive payment for its gas in cash. The field’s production would be piped to Trinidad via Shell’s Hibiscus field infrastructure in Trinidadian waters.

In addition, the US issued other licences for business with Venezuela to France’s Maurel & Prom, Spain’s Repsol and the Caribbean Island of Aruba.

Venezuela was also playing ball. BP was awarded an exploration and production licence by Caracas for the 1-trillion ft3 Cocuina-Manakin, making it operator of both sides of the field, simplifying development. As with Dragon, production would be tied back to Trinidad. Manakin, the Trinidadian portion of the field, holds two thirds of the total gas, and was discovered in 2000.

Meanwhile, NGC was awarded a 30-year licence to develop Dragon with Shell as operator in December 2023. In April, it was reported that Shell was seeking a long-term licence from the US before taking a final investment decision on the project.

The possibility that all of the Loran-Manatee gas could flow to Trinidad has also been floated, although Shell’s eight-well development plan for the moment targets only the Manatee portion of the field. The company may have been hedging its bets with its decision, eying significant potential upside from Loran, if the Maduro regime were to lose the election as forecasts suggested.

Stolen election

In the event, incumbent Nicolas Maduro was declared the election winner by the Venezuelan National Electoral Council. However, both the opposition and external observers, including the US, say the declaration was illegitimate. The electoral council has not published any detailed voting tallies to substantiate their decision. Washington has not recognised Maduro as the winner and, in September, placed sanctions on a number of Venezuelans, including members of the electoral commission and a judge who had issued an arrest warrant for the opposition leader Edmundo Gonzalez.

The US is also reviewing the possibility of revoking licences for oil companies still working in Venezuela following the election.

Had the election resulted in a change of government, the prospects for the development of cross-border gas fields would have been good. However, with the Maduro regime still clinging to power, Washington is now less likely to be supportive of their development, once again throwing into doubt Trinidad’s efforts to renew its gas supplies and secure long-term feedstock for its LNG and petrochemicals sectors.

The US, notably, only issued two-year licences, which is not long enough to bring the cross-border fields into production. On the positive side, the elections should not derail Shell’s development of Manatee.

Without Venezuelan gas, T&T will be even more dependent on reserves in its own waters. Australia’s Woodside has made some gas discoveries in the Calypso area estimated at about 3.2 trillion ft3 (90.6bn m3) of gas. Calypso lies wholly in T&T waters and therefore does not face the complications posed by US sanctions on Venezuela.

However, it is a technically challenging deepwater field, lying in waters of 2,100 metres about 220 km offshore. Woodside owns 70% with BP as a 30% minority partner. Pre-FEED engineering studies took place in first-half 2023. Negotiations on improved fiscal terms for the field’s development are ongoing, but if a deal can be reached, Calypso could potentially see gas production before those fields caught up in the politics of Venezuela and US sanctions.

LNG hub

A rejuvenation of gas supply for LNG in T&T would also support plans for small-scale LNG supply to other parts of the Caribbean, a market which T&T is losing out on to the US. Most Caribbean islands lack any domestic gas production and depend heavily on expensive, carbon heavy oil for power generation, typically using diesel and fuel oil for power generation.

Small-scale LNG deliveries on short haul routes would provide a cheaper, cleaner fuel. NGC signed a memorandum of understanding with a number of energy companies on developing small-scale LNG facilities to serve the wider Caribbean area in May 2023. Gas could potentially be sourced from upstream producers other than Shell and BP which are primarily focussed on Atlantic LNG.

The opportunity has not been lost on US producers, who have developed small-scale LNG infrastructure on the US Gulf Coast to supply consumers in the Caribbean Sea. US Energy Information Administration data shows a rise in small-scale LNG exports to the Bahamas and Antigua and Barbuda, for example, since 2020.

However, with the two fields most likely to see development – Manatee and Calypso – being relatively small in size, T&T’s hopes of both rejuvenating its long-term gas supply and positioning itself as a Caribbean LNG hub appear to hinge on events in Caracas. If the Bolivarian revolution instituted by the deceased Hugo Chavez finally runs its course, T&T would be a prime beneficiary.