Vietnam on the cusp of LNG market entry [Gas in Transition]

Vietnam’s electricity system was initially based on hydropower, with most of the country served by small hydro plants operating in a number of separate grids. The size of the plants increased over time, and connections were made between the various grids, but energy use grew only slowly.

The tempo increased from the late 1980s as more energy was needed to implement the doi moi economic reforms. The emphasis remained on developing indigenous resources, reflecting a deeply-ingrained emphasis on self-reliance, with hydropower being joined by coal and natural gas.

Most of the gas was used for power generation, with a significant amount of gas-fired plants being developed from the 1990s.

However, by the mid-2000s, it was apparent that a radical shift in policy was needed -- the modest pace of development of indigenous resources was acting as a drag on economic growth. Although untapped hydropower resources remained substantial, the size, cost and location of many potential new facilities was not optimal. Coal resources were also affected by location, cost and quality issues.

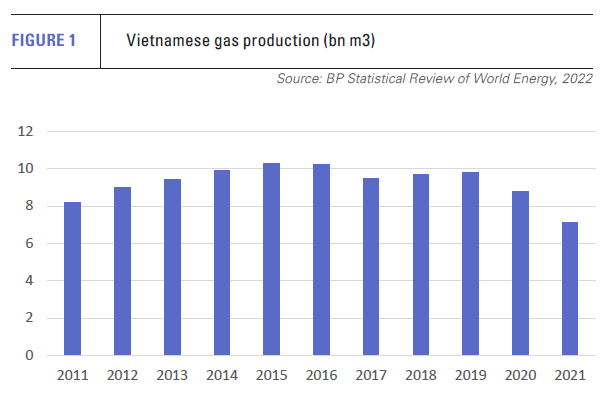

Above all, the expectation that domestic gas could supply a rapidly-growing share of total energy requirements came into question. Gas production grew from negligible levels in the early 1990s to almost 10bn m3/yr by the end of the 2000s. But, thereafter, growth stalled and by the end of the 2010s had gone into reverse. Output fell from a peak of 10.3bn m3 in 2015 to 7.1bn m3 in 2021, according to the BP Statistical Review of World Energy 2022.

The development of Vietnam’s gas resources has been hamstrung by a range of interconnected issues. These include pricing, ownership and the opaque legal and regulatory regime that has hindered access to international technology and capital. In the absence of clear investment rules, many projects have stalled or proceeded only slowly. These issues have been compounded by the problematic geopolitical location of some of the most prospective offshore resources.

The development of Vietnam’s gas resources has been hamstrung by a range of interconnected issues. These include pricing, ownership and the opaque legal and regulatory regime that has hindered access to international technology and capital. In the absence of clear investment rules, many projects have stalled or proceeded only slowly. These issues have been compounded by the problematic geopolitical location of some of the most prospective offshore resources.

Coal to the fore

These problems led to a shift towards coal-fired generation. While the emphasis remained on using indigenous coal wherever possible, many of the projects were predicated on the sole or partial use of imported coal. Traditional concerns about relying on imports were tempered by the availability of coal from a range of countries.

Collaboration with international agencies also resulted in the development of templates embodying clearer rules on project ownership, offtake and payment mechanisms.

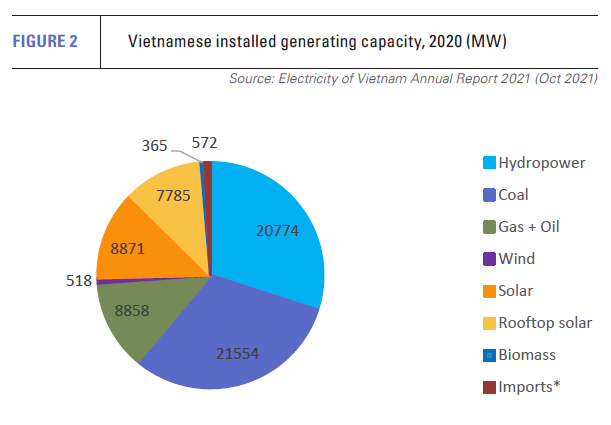

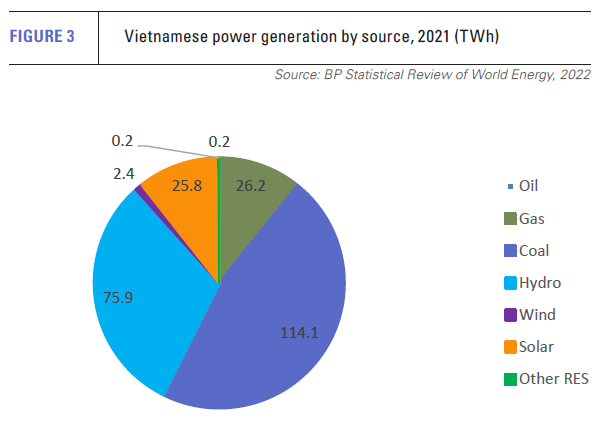

As a result, a significant number of coal-fired plants were built in the 2010s, many with international capital. Coal-fired generation increased from 63.9 TWh in 2016 to 114.8 TWh in 2020, according to the annual report of state-run electricity company Electricity of Vietnam (EVN). By 2020, 21,554 MW of coal-fired plants dwarfed the country’s 8,858 MW of gas and oil-fired plants. Coal underpinned the 9.2%/yr increase in electricity output from 2011 to 2021, and accounted for almost half of all power output in the latter year.

By comparison, gas and oil-fired generation fell from 46 TWh in 2016 to 35.2 TWh in 2020. The figure fell again in 2021 to 26.4 TWh, comprising 26.2 TWh generated from gas and 0.2 TWh from oil.

Policy shifts again

However, the second half of the 2010s saw another shift in government policy, with coal use to be pegged back and phased out in the long term. This partly reflected renewed concern about the cost and security of supply implications of relying on imports.

It also reflected the increasing difficulties Vietnam faced in securing finance for new coal-fired plants. Ten of the 12 coal-fired generators built between 2015 and 2021 relied on overseas funding from multilateral, bilateral and export credit agencies, with organisations from Japan, South Korea and China providing much of the capital.

Many of these lenders no longer finance coal-fired power plants.

But the key reason for the switch was the government’s adoption of environmentally-inspired energy policies, which culminated in the adoption of a net zero carbon emissions target by 2050. This is to be met by massive investment in renewable energy and much-increased gas use in the transition period. Given that indigenous gas production is expected to grow relatively slowly, this means importing a large amount of LNG.

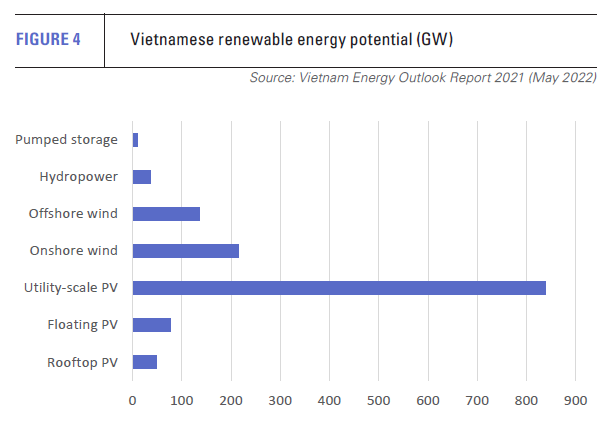

The renewable energy programme is already well under way, based on the country’s massive wind and solar resources. The Vietnam Energy Outlook Report 2021 estimates that overall solar potential is 963 GW, onshore wind 215 GW and offshore wind 137 GW.

The renewable energy programme is already well under way, based on the country’s massive wind and solar resources. The Vietnam Energy Outlook Report 2021 estimates that overall solar potential is 963 GW, onshore wind 215 GW and offshore wind 137 GW.

By 2020, there was 518 MW of operational wind capacity. But the main growth has been in solar power. Installed utility-scale solar capacity increased from 4,669 MW in 2019 to 8,871 MW in 2020, according to EVN, while rooftop PV capacity soared from 320 MW to 7,785 MW over the same period. The 16,656 MW of solar plant in 2020 accounted for 30% of Vietnam’s total generating capacity, and underpinned the rise in renewable output from 0.4 TWh in 2016 to 28.3 TWh in 2021.

LNG issues

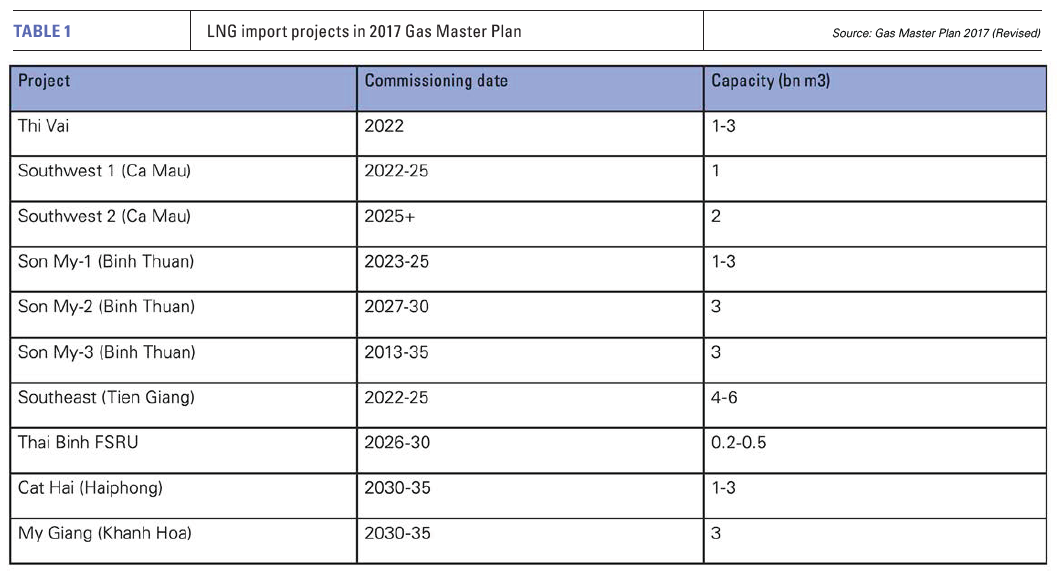

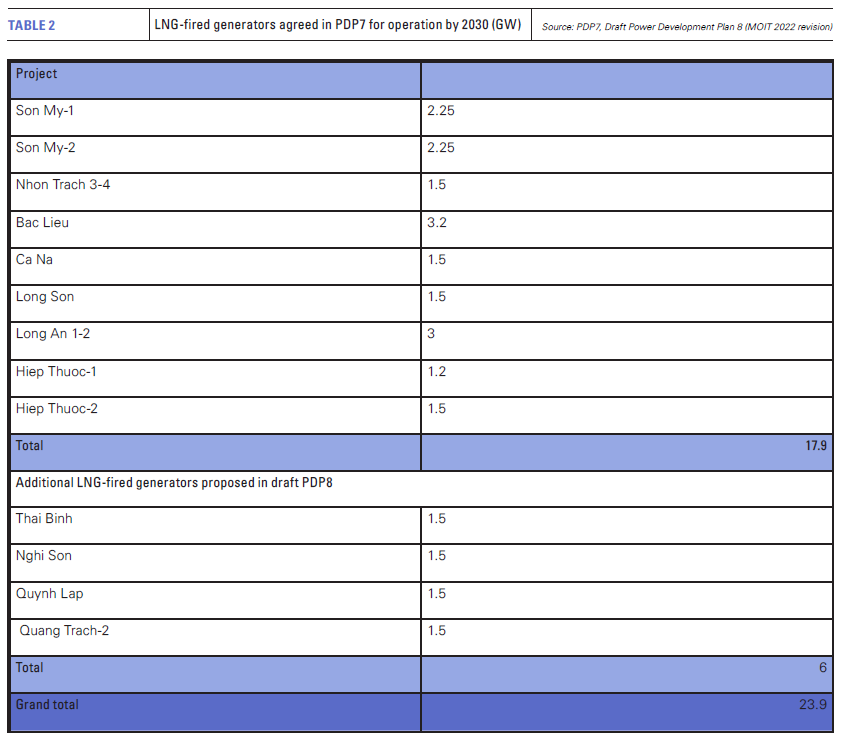

Despite the rise of renewable generation, LNG will be critical to the transition from a heavy reliance on coal. The 2016 revision of the Seventh Power Development Plan (PDP7) projected that 17.9 GW of LNG-fired generators would be needed by 2030, while the 2017 Gas Master Plan identified the location and size of the import terminals needed to fuel these plants.

Several of the projects are at an advanced stage of development. PV Gas, a subsidiary of the state energy company Petrovietnam, for example, is developing the Thi Vai terminal. The 1mn mt/year first phase is 97% complete and due for operation in the first half of 2023.

It will supply PV Power’s 1.5-GW Nhon Trach 3-4 project, for which South Korea’s Samsung C&T Corp and the local Lilama won the $940-million engineering, procurement and construction contract in March 2022. Nhon Trach 3-4 is slated to enter operation by 2025, as are the 1.2-GW Hiep Thuoc-1 and 0.8-GW Bac Lieu-1 LNG-fired generators.

From 2026 to 2030 much larger tranches of LNG-fired generators and import facilities are scheduled to enter operation in line with PDP7, with several of the projects having secured international investors.

But, for all the interest -- and the long period over which they have been under discussion -- none of the projects has secured final approval or completed financing. Disagreement over key issues such as power purchase arrangements and state guarantees for projects have delayed their implementation.

Battle over PDP8

The government has indicated that these issues will be resolved once it approves PDP8. The initial draft was drawn up by the Ministry of Industry and Trade (MOIT) in late 2020 and included all the PDP7 LNG facilities plus 17 GW of additional LNG-fired plants and associated import terminals.

The near-doubling of LNG capacity was intended to reduce coal use more quickly and ensure that rapid growth in renewable output did not destabilise the grid. Some of the proposed new LNG capacity could also replace, at least temporarily, domestic gas, if new projects were abandoned or delayed.

PDP8 was originally due to be approved by the prime minister in early 2021. However, the government batted it back to MOIT on several occasions over concerns including the scale of growth in LNG imports.

In September, the government observed that, in 2020, the Politburo – effectively the country’s supreme policy-making body -- had set targets for LNG imports of 8bn m3 in 2030 and 15bn m3 in 2045. It noted that MOIT’s proposals would entail importing 14-18bn m3 by 2030 and 13-16bn m3 by 2045, over-reaching the Politburo figures.

MOIT responded in October with revisions placing greater emphasis on domestic gas production and associated gas-fired plants. But it still argued that 23.9 GW of LNG-fired generators would be needed by 2030, with 6 GW of new capacity being added to the PDP7 list of named projects.

Policy developments

At the time of writing, it was not known whether the government had been persuaded by MOIT or stuck with its desire for a lower LNG import target. Even in the latter event, this would still imply a very substantial programme of investment. Approval of PDP8 with its up-to-date list of projects would be a milestone in the development process, since PDP8 projects and their investors should have priority over more speculative investments that could otherwise muddy the waters.

However, having a list of priority projects is a different matter to financing and building them. While PDP8 may assist the process by identifying the priority projects, this must go hand in hand with the changes to the regulatory environment and processes needed to implement projects.

Vietnam has always been a challenging market in these respects, and there are few signs that all the necessary changes will be made in the immediate future. But it is worth noting that the templates and changes needed to kickstart the coal-fired generation programme were eventually secured.

In addition, the fact that few terminal or power projects are likely to enter operation until 2025, when LNG price volatility is likely to have eased, is not necessarily a bad thing -- especially given the government’s concerns over reliance on energy imports. The arrival and growth of LNG imports may thus occur more slowly in Vietnam than in official plans, but the long-term potential is considerable.