Famine Turns to Feast at UK LNG Port (Update)

(Update, adding analyst comment at end.)

Swiss-registered trading company Vitol expects to deliver a cargo of US LNG into the UK through the 15.6mn metric tons/yr South Hook terminal October 31, it said October 26. The Malta-registered vessel, Yari LNG, loaded at Cheniere Energy's Sabine Pass terminal and will offload its cargo into the UK grid, Vitol said.

The South Hook terminal is owned by Qatar Petroleum and ExxonMobil; its capacity, which has been in demand on and off since it was built, is available for third parties. Vitol has just such a contract there for third-party capacity use. (Photo of Yari LNG is courtesy of shipowner TMS Cardiff)

The final day of this month is expected to be a busy day for LNG cargo arrivals in the west Wales port of Milford Haven, with no fewer than three shipments due according to the port authority. In contrast none are scheduled between now and then.

Another US cargo from Sabine Pass is expected to arrive October 31 at the adjacent Dragon LNG terminal, aboard the Shell-chartered carrier Pan Europe shortly after midnight.

Finally an Egyptian cargo from Idku is due to arrive six hours later at the same Dragon terminal, aboard the carrier Maran Gas Spetses, also chartered by Shell. Shipments to the UK from Egypt were common ten years ago, but dried up around 2012 as the government in Cairo stopped exports for a number of years to redirect gas supplies to the domestic market. Now a surplus for export is available once more, and the Egyptian government called a halt to LNG imports, and negotiated the sailaway of at least one of its two chartered floating LNG import terminals.

Both Shell and Malaysian state Petronas have equity interests in both the Idku liquefaction and export terminal in Egypt, and the Dragon receiving terminal at Milford Haven.

More to come

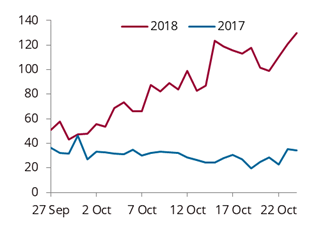

According to analysts at Energy Aspects (EA), LNG supply has been the surprise story of the last few weeks and should remain much stronger year on year, at least for the next two weeks. Before the October and November Japan-Korea Marker (JKM*) contracts expired, the TTF-JKM Oct-18 and Nov-18 spread had eased below the $3/mn Btu mark, the point at which reloads from Europe cease to be profitable. Additionally, forecasts point for NE Asia weather to remain mild for the next two weeks and some of the additional demand pull from that region is likely to be dented, making more cargoes available to Europe, EA told NGW.

LNG Sendout, NW Europe (mn m³/d)

Note: Includes sendout from Fos Tonkin and Fos Cavaou.

(Source: National Grid, GTS, Fluxys, Dunkerque LNG, Elengy, GIE, Energy Aspects)

The current surge in daily tanker rates will be most important to determine if Yamal LNG stays in Europe or goes to Asia, and which way US cargoes will sail this winter. The dynamics will not change the flow of all gas, as a lot of winter trade will have been fully physically hedged over the summer and freight will have been locked in at that time. Still, flows from new trains tend to go into the short-term markets, and while the winter JKM-TTF spread has narrowed to just $2.75/mn Btu for Jan-Feb contracts, Europe could see more LNG than expected, particularly from new US and Russian trains.

*JKM is the daily spot assessment for near-term physical delivery in northeast Asia and is owned by Platts, now part of S&P Global.