Why COP26 has to succeed

What happens if COP26 doesn’t put the world on a 2 °C or lower pathway? We released WoodMac’s latest Energy Transition Outlook (ETO) last week. The analysis projects global energy demand and supply across all sectors through to 2050. It’s a bottom-up, integrated model: energy demand forecast by sector for every country; and the supply of energy, metals and bulk commodities to meet it sourced from our asset database.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

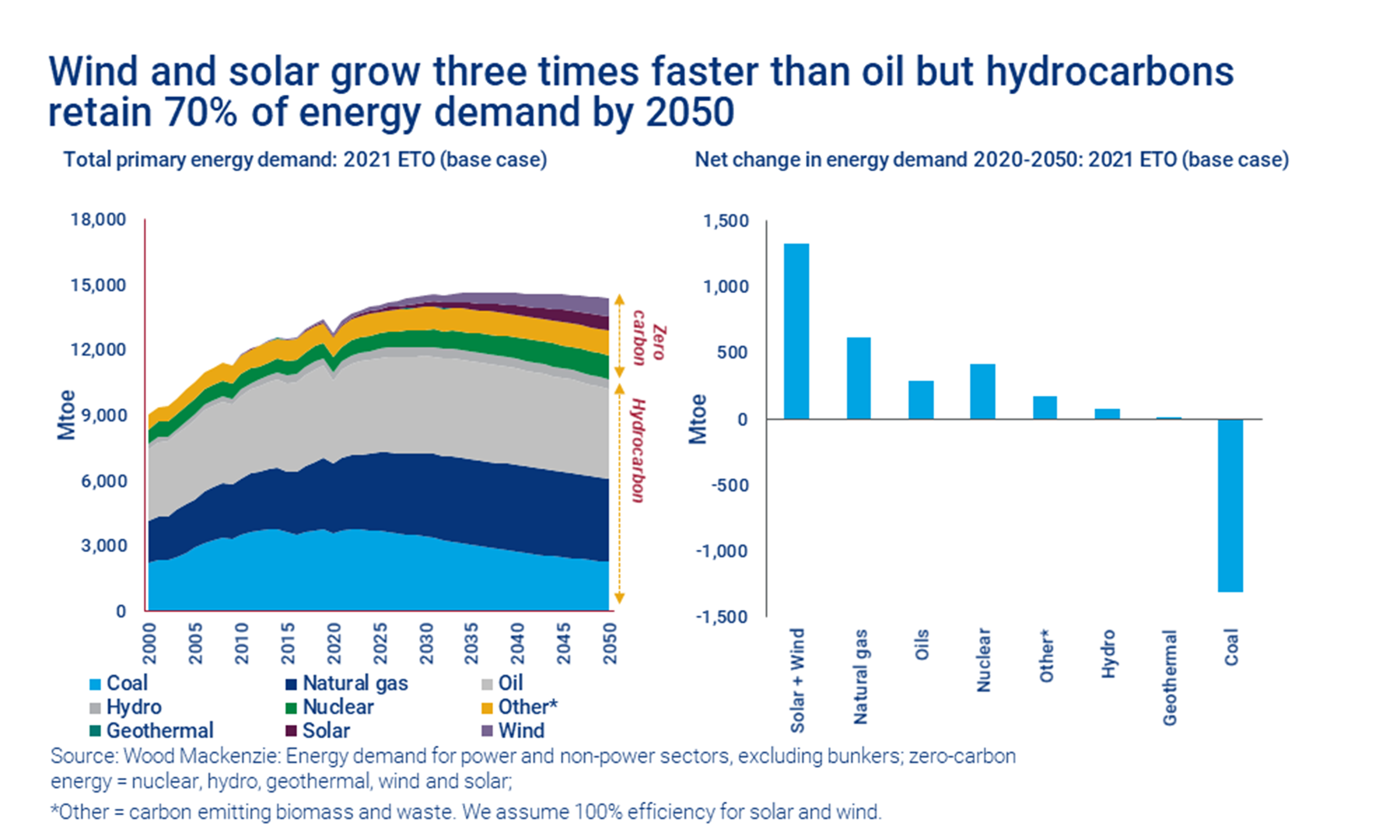

Chart shows wind and solar grow three times faster than oil but hydrocarbons retain 70% of energy demand by 2050

The ETO shows what happens if COP26 fails to lay down the law on collective goals and actions to tackle climate change. The ETO assumes that policy and technology continue to ‘evolve’ much as they are doing now. Nations, industries and people strive to reduce emissions and are successful up to a point. But it’s patchy – the easier gains are made, the tougher ones lag.

The result? Efforts to slow down global warming aren’t big enough or fast enough. Our Energy Transition team helped me pick out the ETO’s main insights and implications.

First, the outcome of the ETO is a 2.5 °C to 2.7 °C pathway. The global economic recovery will lead to energy-related CO2 emissions not falling but rising over the next five years to a new high of 34 Bt in 2026, just above the 2019 peak. Slow penetration by low-carbon fuels and new technologies means that emissions are still 25 Bt by 2050, a decline of just 9 Bt from the peak. It’s a far cry from the net zero 2050 ambition. Coincidentally, the ETO’s pathway is closely in line with the 2.7 °C prognosis in the UN Emissions Gap report released this week, albeit for different reasons.

The risks of failing to deliver the Paris Agreement’s goal of ‘well below 2 °C above pre-industrial levels and pursue efforts to limit the increase to 1.5 °C’ are well documented, as is the impact that our power generation, production methods, agriculture and consumption patterns have on the climate system.

Second, in the ETO, the world relies on fossil fuels for decades to come. Hydrocarbons are persistent – while their share of the global energy mix falls, it is still 70% in 2050, marginally down from 80% today. Oil demand plateaus and begins a slow decline in the mid-2030s; gas demand in contrast continues to increase into the 2040s fuelled by Asian economic growth. Investment in oil and gas will have to be sustained, with US$12 trillion spent on new supply through 2050.

In the ETO, the world relies on fossil fuels for decades to come.

Third, roll-out of the suite of low-carbon technologies is slow. There will be great successes as the world electrifies – solar and wind’s share of global power rises from 10% today to 48% by 2050. Yet the transition in power also brings major challenges, among them grid reliability and price volatility in renewables-dominated systems, and the cost of decarbonising the ‘final 30%’ of expensive generation that still relies on coal and gas.

Battery costs break through the magic US$100/kWh barrier in 2024, enabling electric vehicles (EVs) to be competitive. The global stock of EVs reaches 877 million by 2050, 50% of the total light vehicle stock. EVs, along with other low-carbon transport vehicles, displace 22 million b/d of oil demand by 2050 – assuming the required US$5 trillion of investment in EV charging happens.

The trajectory of green hydrogen costs mirrors that of renewables over the last decade, falling 75% by 2050; blue hydrogen, a more pedestrian 8%. Industrial-scale hydrogen capacity doesn’t arrive until the 2040s. It’s a similar story for carbon capture and storage capacity.

There is still plenty of growth in low-carbon technologies and much opportunity for investment. We estimate US$32 trillion of spend through 2050 on these technologies and the infrastructure to support them in the ETO. The opportunity, though, would be substantially bigger in a 2.0 °C or lower pathway.

The technologies of the transition, most of them at least, are already there awaiting development and commercialisation. An orderly energy transition therefore is essentially about investment. Mobilising the capital depends on setting clear policies and the right price signals.

Simon Flowers is the chairman and chief analyst at Wood Mackenzie.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.