EU Storage Stocks Limit Gazprom's Exports

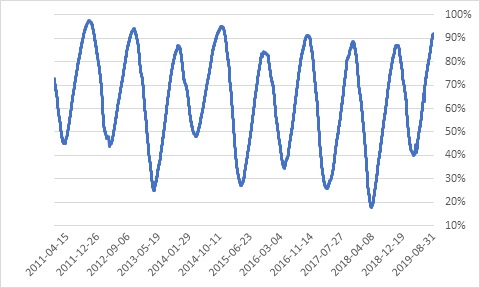

After Nord Stream 1's July maintenance, Gazprom’s exports to the European Union were again slightly down in August compared with July (-1.1%) and massively down compared with last year (-12.2%). With EU storage 92.2% full at the end of August (according to Gas Infrastructure Europe) compared with just 60.7% last year (ie 343 TWh more or 34bn m³), there was limited space for extra gas to be used in the EU, hence the drop in exports.

EU storage achieved an all-time record of 97% full in October 2011. That means the available technical space in EU storage is 59 TWh, after an injection of 207 TWh in August.

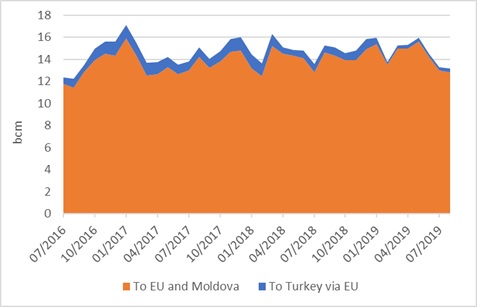

Gazprom Western Monthly Exports

Source: Gazprom, Entsog, thierrybros.com

The low transit to Turkey via EU is still on-going as, since 12 February, this line has seen very little gas flowing. This can be explained by a severe drop in gas demand in Turkey since last year. According to the latest BP Statistical Review, 2018 was a year of very high gas demand (+5.3%) with Turkey experiencing a major drop in consumption (-8.3%).

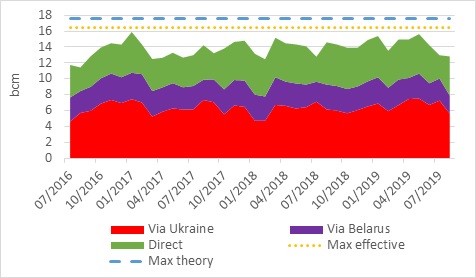

After Nord Stream 1 maintenance between 16 and 27 July, the direct volumes to Europe went up 68.8% vs July 2019 and as expected Ukraine and Belarus transit were down respectively 22.7% and 18.8%.

Split of Gazprom’s EU Monthly Exports

Source: Gazprom, Entsog, thierrybros.com

With very limited extra space in storage , the September shoulder month should force Gazprom to reduce further its exports to avoid a price crash…

EU storage (% full)

Source: GIE, thierrybros.com

Gazprom quarterly exports to the EU and its disclosed price

Source: Gazprom, Entsog, thierrybros.com

Thierry Bros

September 2, 2019

Advisory Board Member of Natural Gas World