Gazprom: Growing the Value of Gas Transportation Assets

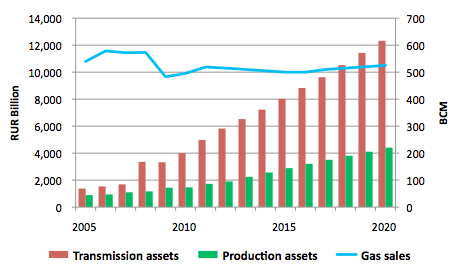

Tenfold Growth of the Value of Gas Transportation Assets of Gazprom in 2005-2020

Gazprom is rapidly overinvesting in the new gas pipelines. From 2005 to 2011, the book value of the company’s gas transportation assets has increased from RUR 1.4 Trillion to RUR 5.0 Trillion (RUR 1.5 Trillion was added by the reevaluation of assets in 2008). Remarkably, by 2020 the value of assets of the gas transportation segment is to be nearly ten times higher than in 2005. Naturally, this tremendous growth is to affect the depreciation cost and the overall profitability of the Russian gas giant.

Book Value of Gas Production and Transmission Assets and Gas Sales of Gazprom

(Sources: Gazprom and EEGA forecasts)

Note that the excessive pipeline construction was caused by the change of the Yamal development plan. The previous plan assumed the construction of a short link from Bovanenkovo to Yamburg (see the map) and a full utilization of the existing pipeline system. The existing pipelines are capable to evacuate all gas produced in West Siberia, including Yamal.

The current plan calls for the construction of a new pipeline corridor from Bovanenkovo to Ukhta. This corridor hits the fully loaded Northern Lights pipeline that starts in Punga (see the map). Gazprom needs to build new pipelines to evacuate gas from Ukhta to Gryazovets and Pochinki. Because of the gas production decline at Urengoy, Yamburg and other fields of West Siberia, by 2020 the “old” pipelines will have over 150 bcm/yr of spare capacity. The overall efficiency of the gas transmission segment will be much lower than now.

Mikhail Korchemkin

Dr. Mikhail Korchemkin is the founder of East European Gas Analysis (EEGA), an independent consulting firm based in Malvern, Pennsylvania, USA. EEGA specializes in cost-benefit and financial analysis of natural gas projects in the former Soviet Union and Eastern Europe