Gazprom Ramps up Ukraine, Belarus Transit

Russian gas exports to Europe were up massively (+17.1%) compared with Januarh 2018 and a more modest 3.5% compared with December. Those extra volumes were needed as European storage stocks were down 22bn m3 in January, compared with only 16bn m3 in January 2018. With high storage level at the end of December 2018, we are now just 49% full, and back into the historical five-year range for the period (from 42% in 2017 to 60% in 2014).

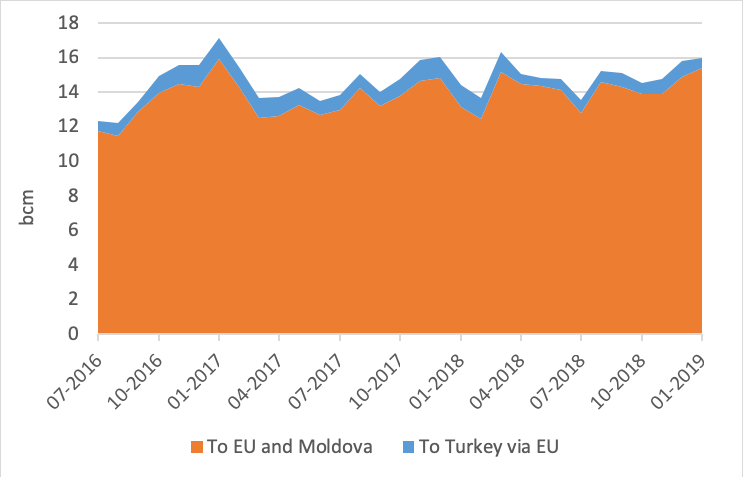

Gazprom Western Monthly Exports

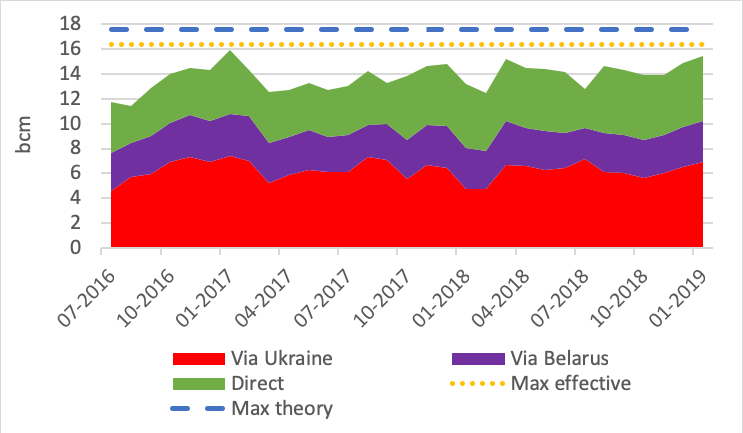

In January all routes witnessed an increase in flows (5.9% via Ukraine and 4.4% via Belarus) with the exception of Nord Stream (pictured), which was already at maximum.

Split of Gazprom’s EU monthly exports

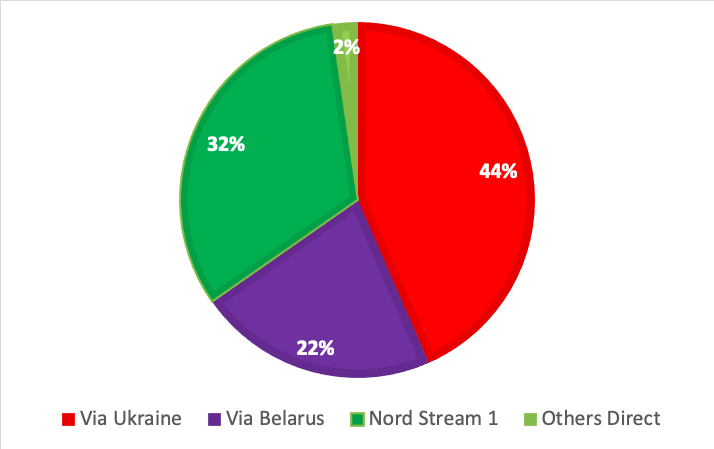

With a difference of 2.8bn m3/month between the maximum and minimum effective flows via Ukraine, this transit route is essential as it provides not only the highest share (44%) but also the most flexibility (in volume) to Gazprom’s exports.

Gazprom Western 2018 Exports: split by routes

On 21 January, a trilateral ministerial meeting between EU, Russia and Ukraine was held in Brussels[1] on the future of gas transit via Ukraine post 2020, with the next ministerial meeting scheduled in May. The EU proposal regarding the duration, volumes, and tariffs has not been made public. According to Naftogaz, “the new gas transit contract should be long-term, i.e. 10 or more years, and provide for transit volumes that would be economically viable for a high-profile European investor”.[2] Perhaps the likely outcome could look like a up to 100bn m3/yr, fixed €1bn ($1.1bn)/yr, 10-year contract with a revision in five years’ time… But with Gazprom more focused on Nord Stream 2 construction than the transit negotiations and vice-president for energy union Maros Sefcovic now on leave for campaigning at the Slovak presidential elections, the probability of a transit deal to be signed in 2019 has further decreased…

Thierry Bros

February 1, 2019

Advisory Board Member of Natural Gas World