Ithaca Expects 4Q UK Stella Startup (Update)

Update: Ithaca Energy said August 5 that its FPF-1 floating production facility has completed the final marine system trials as planned and has commenced sail-away to the UK North Sea Stella field. The anticipated period from sail-away to first hydrocarbons from Stella is roughly 3 months.

The original August 2 article follows:

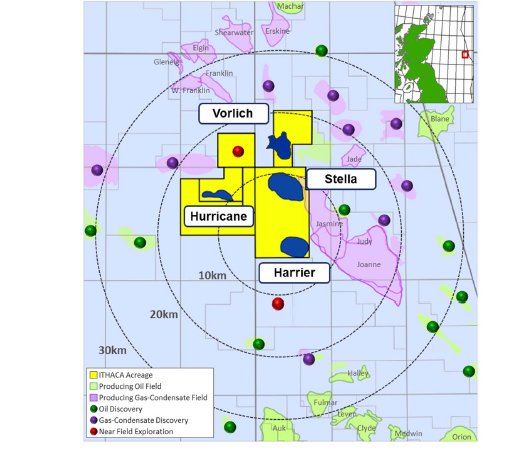

Canada and London-listed Ithaca Energy said August 2 it has expanded its core position in the UK central North Sea’s Greater Stella Area (GSA) oil and gas condensate fields, having reached four agreements to buy extra interests in the Vorlich discovery and an operated interest in the Austen discovery for an aggregate price of less than $6mn.

From Engie, Ineos and Maersk, Ithaca has acquired extra interests in Vorlich, taking its stake from about 17% to 33%, and adding roughly 4mn barrels of oil equivalent (boe). Upon completion, Ithaca will operate P1588 with 100%, and have 20% of BP-operated P363. The Vorlich discovery tested at a maximum of 5,350 boe/d, of which 80% was oil. It is 10km north of the GSA hub.

Ithaca has also acquired from Engie a 75% interest and operatorship of the Austen discovery, which lies approximately 30 kilometres from the GSA production hub. Engie’s most recent appraisal well there in 2012 tested at a maximum of 7,820 boepd, of which 50% oil. Premier retains 25%.

Greater Stella Area in the UK central North Sea (Map credit: Ithaca Energy)

Ithaca said it is gearing up for start-up of production from the Stella field this autumn.

The FPF-1 floating production facility recently departed from the Remontowa shipyard in Poland. Final remaining trials are expected to be completed in the coming days and an update will be provided once the FPF-1 commences sail-away to the Stella field, the company said. Five wells there are pre-drilled. Ithaca’s GSA operating interest is 54.66%, with Dutch Dyas 25.34% and the UK’s Petrofac 20%.

Mark Smedley