Saudi Arabia, UAE and Egypt pivot towards hydrogen exports [Gas In Transition]

The energy crisis that started in 2021 and the war in Ukraine are accelerating the energy transition, creating huge interest in hydrogen. Moreover, high natural gas prices have improved the economics of green hydrogen dramatically, spurring increased investment.

The European Commission (EC) published its Hydrogen strategy for a climate-neutral Europe in July 2020. It sets out a roadmap for establishing and scaling up value chains to produce green hydrogen, and envisages hydrogen providing as much as 14% of Europe’s energy mix by 2050.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Events in Ukraine have only increased the EU’s hydrogen aspirations, outlined in a new plan, REPowerEU, released on March 8. In this plan, the EU increased its target for hydrogen production from 5mn metric tons/year to 20mn mt/yr by 2030, which will require about 1,000 TWh of renewable energy – almost twice the amount generated in the EU today. An astonishing 10mn mt/yr will have to be imported. This is part of measures to reduce the EU's gas consumption by 30% by then.

However, some countries have expressed concern that the EU could end up replacing one external dependency, gas, with another, imported hydrogen.

The EU plans to use hydrogen not just to decarbonise Europe, but also to ensure energy security. The greatest demand for green hydrogen is expected to be in the industrial, aviation and heavy-duty transport sectors. But a massive scale-up is needed to make a difference. This will require public-private partnerships and economic incentives.

In order to kickstart the sector, mandates may be needed on the minimum hydrogen use in certain industries. Before the market can emerge, however, Europe first needs LNG to replace Russian gas in the nearer term. But many LNG suppliers are looking for long-term contracts and are reluctant to commit, given Europe’s insistence that decarbonisation means declining need for gas as the world approaches 2030, and beyond. To alleviate those concerns, Frans Timmermans, the EU’s climate chief, told the European Parliament on April 28 that the EC “is offering long-term partnerships that would start with a supply of LNG and end up in the hydrogen economy.” Without spelling out how this would work, and during what time frame, at this stage it is just a nebulous statement. As one MEP put it, “I have a feeling that we are fleeing into a daydream of what hydrogen can do for us.”

Timmermans also said that he envisions a hydrogen economy around the Mediterranean producing and exporting surplus hydrogen in ammonia form to Europe. Undoubtedly, if this works it will bring these countries and Europe closer together.

With only about 1% of the global hydrogen production being green, the challenge for production at this scale will be land availability to deploy renewables and abundant solar/wind renewable resources. That is where the Middle East – North Africa (MENA) and East Med regions come in. European Commission (EC) president Ursula von der Leyen outlined a plan to achieve this in November 2021. It involves “scaling up the technology, establishing international collaboration, and partnering with industry and researchers”, and investing in MENA’s hydrogen sector, thus “creating a new hydrogen market between the two shores of the Mediterranean.”

Gaseous fuels will contribute approximately 20% of Europe’s final energy consumption by 2050. But within this, unabated natural gas consumption will be reduced drastically and will be replaced by renewable and low-carbon gases, 40% of which will be hydrogen – and, increasingly, green hydrogen.

Even though this is a proven technology, it still requires further development for the safe storage and transportation of hydrogen. In order to accelerate this, the EU launched a €2bn ($2.1bn) partnership with the industry in November 2021 to promote the researching and development of green hydrogen. The EU’s Fit-for-55 package provides the basis to achieve transformational change, with the required regulatory framework now being put in place by the EC.

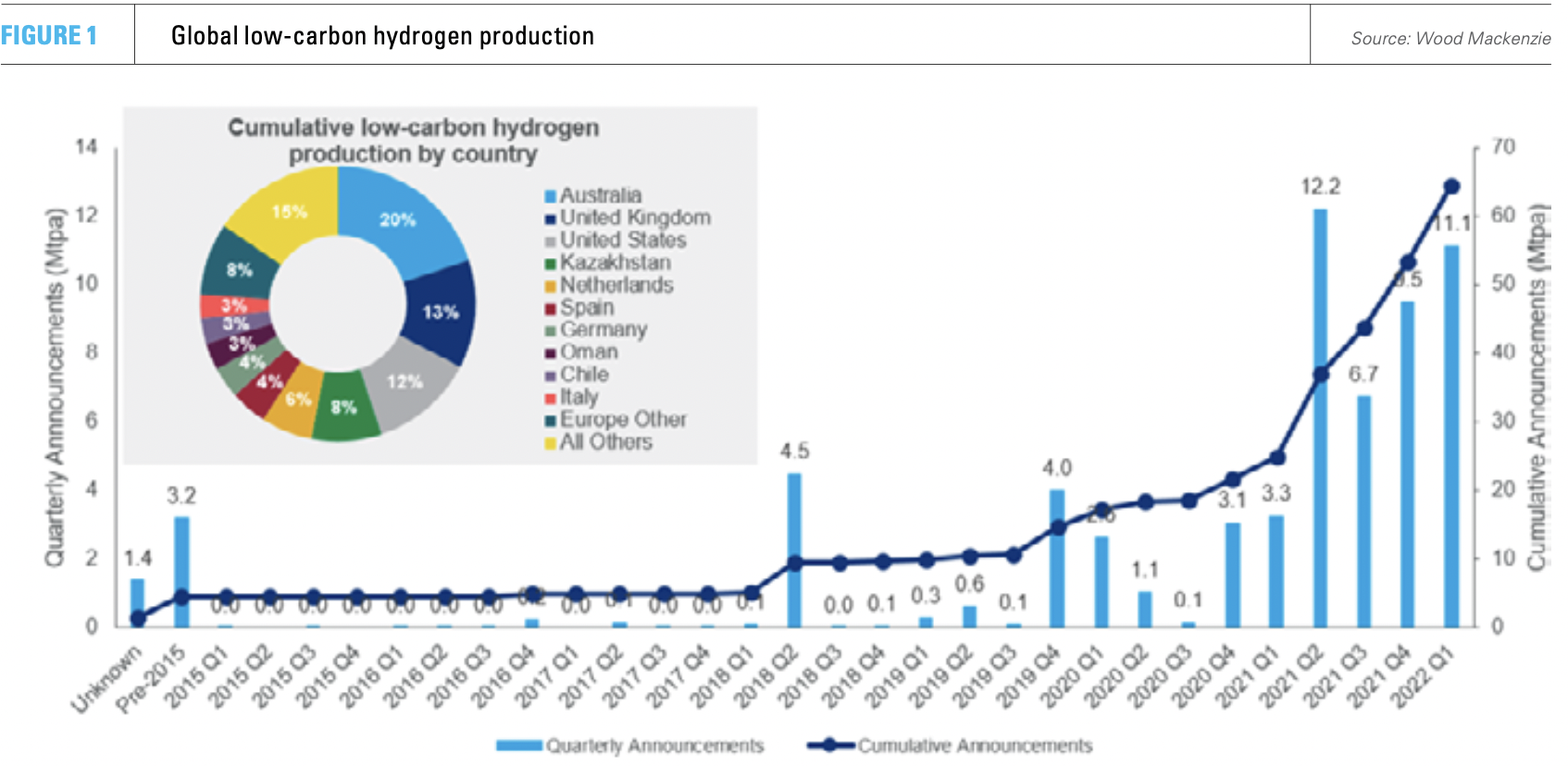

Worldwide, more than 75 countries have announced plans and strategies for hydrogen development. There were 75 new project announcements in Q1 2022 alone, totalling 11.1mn mt/yr of new capacity, with the lion’s share found in the US (see figure 1). By 2050, it is forecast that the global hydrogen market could be worth $600bn, providing as much as 12% of the world’s energy needs by then.

The EC is proposing preferential tax rates to promote the use of renewable and low-carbon hydrogen in a new Energy Taxation Directive. The EC published its revised Renewable Energies Directive (RED-II) proposals in July 2021. But it now proposes to update these to include an increase in the renewables target from 32% now to 40% by 2030. This would translate to 60-65% renewables in electricity production by 2030. In addition, a more ambitious binding target has been set to reduce final and primary energy consumption by 36% to 39% over the same period.

The EC expects that implementation of such policies will lead to demand for green electricity increasing dramatically, to the extent that it is unlikely that it can be supplied fully from within the EU. Similarly, it is not certain that the EU will be able to secure sufficient supplies internally to meet the forecast demand for hydrogen. Germany has recognised this and has taken the lead in securing hydrogen supply deals, including with MENA countries.

These are likely to require interconnectivity and imports from regions with high renewables potential – wind and solar – such as MENA and the East Med. They are well placed to produce very competitively both green and blue hydrogen. They also have large natural gas reserves and potential for CCS. These factors make these regions major hotspots for the developing hydrogen economy.

However, high gas prices now, and likely for the rest of the decade, are weakening the economics of blue hydrogen.

With energy transition away from oil and gas gaining momentum, these countries are prioritising development of a hydrogen production industry. There are already projects in place to produce green hydrogen in Saudi Arabia and the UAE, not just for export to Europe and Asia, but also for internal consumption. In fact Europe will have to compete with Asia to secure such exports.

Egypt

The country with the highest potential in the East Med region to respond to Europe’s hydrogen needs is Egypt. It is putting together a low-carbon hydrogen strategy with the help of the EBRD that includes assessing existing and potential hydrogen production. EBRD will also help conduct a regulatory analysis and assessment of the changes needed to support the development of hydrogen supply and export chains in Egypt.

The Egyptian government is expected to announce a $40bn hydrogen strategy this year, which will include a production capacity of 1,400 MW by 2030. With at least five known active green hydrogen projects under development, progress is already being made.

Egyptian foreign minister Sameh Shoukry and Frans Timmermans agreed on April 10 to reinforce cooperation on LNG and green hydrogen supplies between Europe, Africa and the Gulf by developing a Mediterranean Green Hydrogen Partnership.

In March Norwegian renewables firm Scatec announced agreement to build a 1mn mt/yr green ammonia facility, with a plan to increase it to 3mn mt/yr, at the Egyptian Red Sea port of Ain Sukhna

The UAE’s Abu Qir Fertilisers already produces about 1.2mn mt/yr of ammonia at plants near Alexandria. In March it said that it was studying a project to produce green hydrogen and green ammonia in collaboration with TotalEnergies.

Several other potential hydrogen projects have been announced in Egypt this year, including a 0.39mn mt/yr green ammonia plant in the Suez Canal Economic Zone (SCEZ) by EDF and UAE-based Zero Waste, another by the UAE’s AMEA Power, and a deal by the UAE’s Masdar and Egypt’s HAU to produce 0.48mn mt/yr of green hydrogen at SCEZ.

With its expanding renewable energy capacity – targeted to reach 42% by 2035 – Egypt considers this to be an opportunity to become a leader in the region for the production, use and export of green hydrogen and ammonia. It already has one of the largest photovoltaic parks in the world, the Benban solar complex, which has a total capacity of 1,800 MW.

Saudi Arabia

As part of its push to diversify from oil revenues, Saudi Arabia wants to become a leader in hydrogen production, primarily to ensure its future economic security, as envisioned in its Saudi Vision 2030. It has been very proactive in developing a hydrogen industry, both for internal use and for export. Its target is to attract more than $36bn investments under its National Hydrogen Strategy and produce about 4mn mt/yr of hydrogen by 2030.

Based on its hydrocarbon resources and CCS potential, Saudi Arabia is well placed to produce and export commercially competitive blue hydrogen, with the lead taken by Saudi Aramco. But the country also has a vast solar power capacity. In July 2020, it announced a $5bn green hydrogen/ammonia plant in Neom city with a capacity of 1.2mn mt/yr of green ammonia. This is expected to start operations in 2026. It will be powered by 4 GW of solar and wind energy. A final investment decision (FID) is expected in June, with completion in 2026.

This was followed by the first ever export of blue ammonia in September 2020 to Japan. A year later UAE followed this with its own first shipment of ammonia.

UAE

In support of its net-zero by 2050 commitments, UAE has embarked into the development of low-carbon business, including hydrogen. Like Saudi Arabia, it benefits from abundant hydrocarbons, competitive solar PV and large-scale CCS. In this context it intends to build its renewables company Masdar into one of the world's largest clean energy businesses.

UAE’s target, declared at COP26 in November 2021, is to capture 25% share of the global market for low-carbon hydrogen by 2030. This is embodied in the Emirates’ Hydrogen Leadership Roadmap established to support local industries to develop competitive hydrogen for export.

In May 2021, Siemens inaugurated the “first industrial-scale, solar-driven green hydrogen facility in the Middle East and North Africa” in Dubai in partnership with DEWA.

In December 2021, Engie and Masdar signed an agreement to “explore the co-development of a UAE-based green hydrogen hub” with an electrolyzer capacity of 2,000 MW, backed up by $5bn investment.

ADNOC is also designing a 1mn mt/yr ammonia plant in Ruwais that will feed on blue hydrogen, with a target start-up date of 2025. It is already producing over 0.3mn mt/yr of hydrogen and plans to increase this to 0.5mn mt/yr.

The UAE is also forming partnerships with other countries, such as Japan, South Korea and Germany, to support development of its hydrogen economy. In this context, German vice-chancellor Robert Habeck was in Abu Dhabi on March 20-21 to sign hydrogen cooperation agreements. As a result of these deals, the first blue hydrogen is expected to be shipped to Germany in 2022. ADNOC has also signed an agreement with the logistics operator of the port of Hamburg to create a transport chain for blue ammonia and agreements to explore transport of hydrogen using Liquid Organic Hydrogen Carrier (LOHC) technology.

Transporting hydrogen

Hydrogen faces not only big production challenges but it is also difficult to store and transport. It remains almost prohibitively expensive. The cheapest way to transport green hydrogen from the East Med to Europe is by subsea pipeline.

Cornelius Matthes, CEO of Dii Desert Energy, a Dubai-based public-private sector association that promotes renewable energy development, notes that to really launch a Middle East/East Med hydrogen economy, we need a pipeline connecting the eastern Mediterranean with Europe.

A large diameter pipeline capable of carrying hydrogen could be a breakthrough for the region that has huge production potential. Only pipelines will be able to meet the massive hydrogen demand foreseen in Europe.

This would be a €15+ bn project and putting it in place would require bold government/industry commitments, with European Investment Bank (EIB) involvement.

In the meanwhile, in March Italy’s SNAM committed to invest $250mn in ADNOC’s pipelines. They plan to have a system of hydrocarbons and hydrogen running in parallel, with the aim of enabling a seamless shift from the first to the latter.

Eni and SNAM also set up a partnership on gas pipelines from Algeria to Italy. The purpose of this is to ensure the security of natural gas supply between the two countries and enable potential development initiatives within the hydrogen value chain from North Africa.

With Eni and SNAM taking the lead, Italy is well placed to act as a hydrogen-bridge between Middle East/East Med countries and Europe.